Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): long positions with entry at 4,340 price level, with 4,020 as a stop-loss and 4,640 as an initial price target.

The stock market trades within a consolidation, as geopolitics is still dominating headlines. Is this a medium-term bottoming pattern?

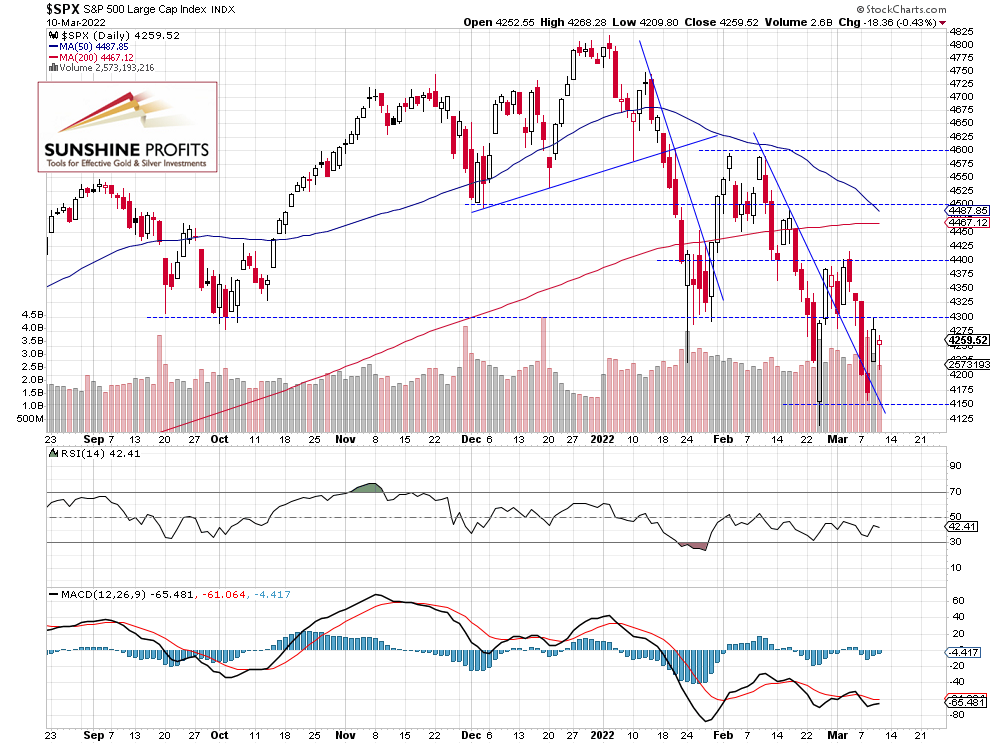

The S&P 500 index lost 0.43% on Thursday, Mar. 10 following its Wednesday’s gain of 2.6%, as investors hesitated on more Ukraine conflict news. The broad stock market’s gauge remained below the 4,300 level after bouncing from the Tuesday’s low of 4,157.87. On Feb. 24 the index fell to the local low of 4,114.65 and it was 704 points or 14.6% below the January 4 record high of 4,818.62. There’s still a lot of uncertainty concerning the ongoing Ukraine conflict. This morning the S&P 500 index is expected to open 0.9% higher and we may see further consolidation.

The nearest important resistance level is at 4,300, and the next resistance level is at 4,350-4,400, among others. On the other hand, the support level remains at 4,150-4,200. The S&P 500 index continues to trade above the recently broken downward trend line, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Futures Contract’s Bounce

Let’s take a look at the hourly chart of the S&P 500 futures contract. Recently it broke below the short-term consolidation. On Tuesday it fell to around 4,150, before bouncing back to the 4,200-4,250 level. Today it went the highest since Monday’s morning.

We are still maintaining our long position from the 4,340 level, as we are expecting an upward correction from the current levels (chart by courtesy of http://tradingview.com):

Conclusion

Yesterday the S&P 500 index fluctuated following its Wednesday’s rally. This morning the global markets jumped higher on Putin’s comments. And we will likely see more news-driven volatility. For now, it looks like an upward correction but it may also be a more meaningful upward reversal.

Here’s the breakdown:

- The S&P 500 index will likely open higher, but we may see more consolidation along the 4,300 level.

- We are maintaining our long position (opened on Feb. 22 at 4,340).

- We are expecting an upward correction from the current levels.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): long positions with entry at 4,340 price level, with 4,020 as a stop-loss and 4,640 as an initial price target.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care