Trading position (short-term, our opinion; S&P 500 futures contract): In my opinion, the short-term outlook is bullish and long positions are still justified from the risk/reward point of view (since Feb. 27).

Stock prices extend their consolidation – is this a topping pattern?

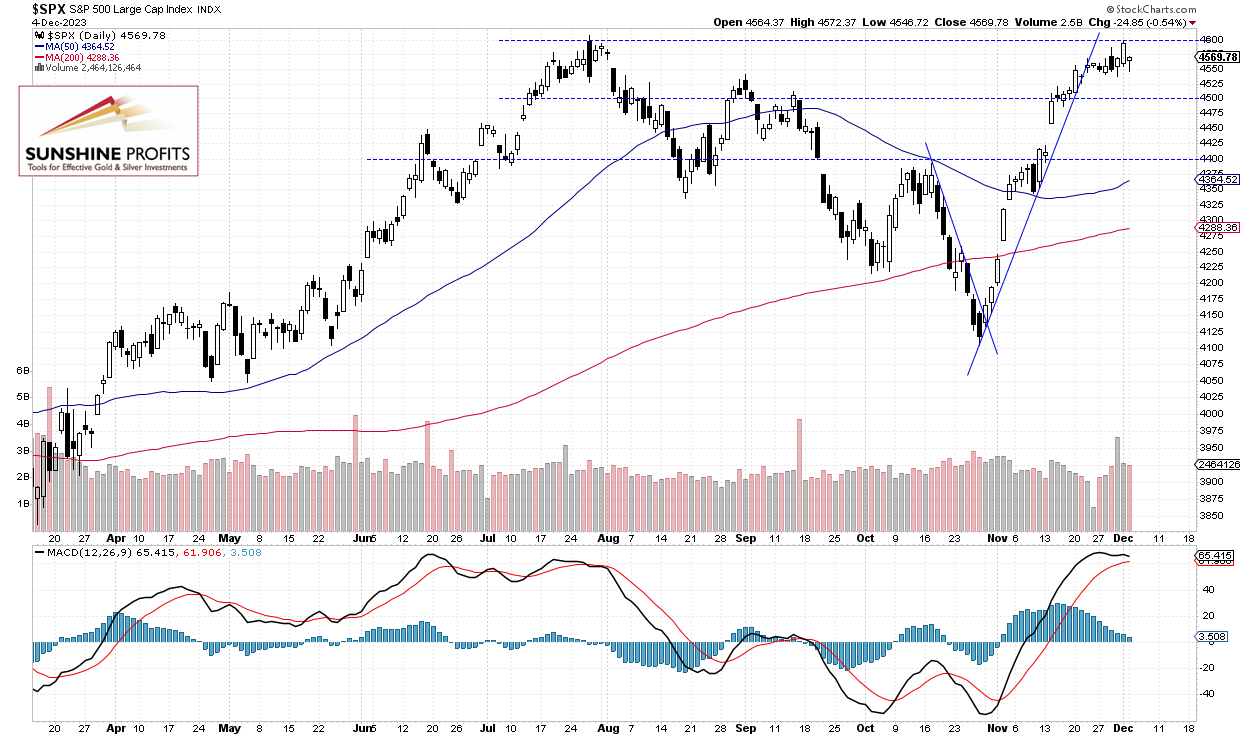

The S&P 500 index lost 0.54% on Monday as it retraced most of its Friday’s advance of 0.6%. The index bounced from the important 4,600 level. On Friday the daily high was at 4,599.39, so the S&P 500 went close to its July 27 medium-term high of 4,607.07. Investors’ sentiment remains bullish despite interest rates uncertainty, mixed economic data.

Recently the S&P 500 broke above the resistance level marked by the technically important August 2 daily gap down of 4,551-4,568. The market resumed its rally from October 27 local low of 4,103.78. On Friday it went to yet another important resistance level marked by the mentioned July top.

The S&P 500 will likely open 0.3% lower this morning. So it may continue trading along the 4,550 level. The nearest important resistance level remains at 4,600 as we can see on the daily chart:

Futures Contract Trades Sideways

Let’s take a look at the hourly chart of the S&P 500 futures contract. It bounced from the 4,600 resistance level and yesterday it traded along the support level of 4,550 again.

Conclusion

Stocks will likely extend their short-term consolidation this morning. The S&P 500 continues to trade within its July consolidation range. For now it looks like a relatively flat correction following mid-November rally.

There have been no confirmed negative signals so far. However, the market may see a downward correction at some point.

Here’s the breakdown:

- The S&P 500 bounced from the important 4,600 level; it’s likely to extend a consolidation.

- There may be a downward correction at some point.

- In my opinion, the short-term outlook is still bullish and long positions are still justified from the risk/reward point of view.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; S&P 500 futures contract): In my opinion, the short-term outlook is bullish and long positions are still justified from the risk/reward point of view (since Feb. 27).

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care