Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): long positions with entry at 4,335 price level, with 4,180 as a stop-loss and 4,550 as an initial price target.

Stocks extended their volatile consolidation yesterday – is this a bottoming pattern or just a flat correction within a downtrend?

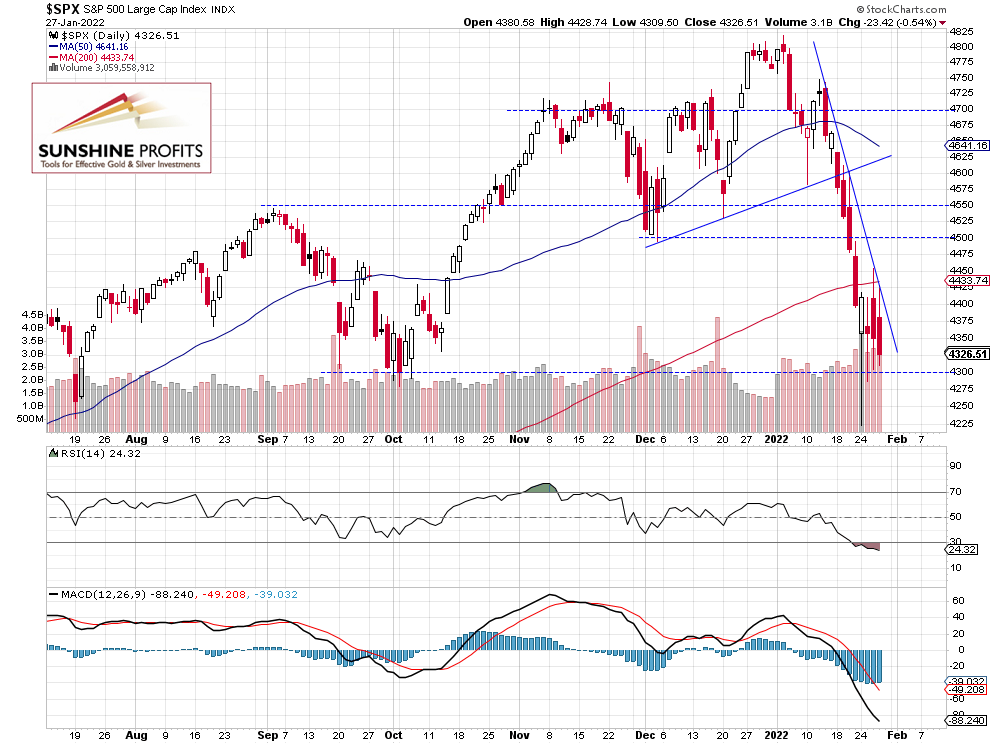

The S&P 500 index lost 0.54% on Thursday, as it continued to fluctuate following Monday’s intraday rebound from the low of 4,222.62. On Monday the market was 596 points or 12.4% below the Jan. 4 record high of 4,818.62. And on Wednesday it reached the local high of 4,453.23, before going back lower and nearing the 4,300 level again. For now, it looks like a consolidation within a downtrend. However, we still may see some more profound upward correction following a few-week-long sell-off.

Late December – early January consolidation along the 4,800 level was a topping pattern and the index retraced all of its December’s record-breaking advance. This morning it is expected to open 0.4% lower despite yesterday’s better-than-expected quarterly earnings release from Apple.

The nearest important resistance level remains at 4,400-4,450, marked by the recent local highs. The resistance level is also at 4,500-4,550. On the other hand, the support level is at 4,300-4,350. The next support level is at 4,220-4,250. The S&P 500 continues to trade below a steep short-term downward trend line, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Futures Contract Remains Below the Downward Trend Line

The S&P 500 futures contract continues to trade below the 4,400 price level and below its short-term downward trend line. For now, it looks like a consolidation within a downtrend.

We decided to open a speculative long position on Tuesday before the opening of the cash market (4,335 price level). (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index continues to trade within a volatile consolidation following its Monday’s sell-off and an intraday rebound. This morning the index is expected to open 0.4% lower and we may see more fluctuations above the support level of 4,300. There is still an uncertainty concerning Russia-Ukraine tensions.

Here’s the breakdown:

- The S&P 500 will likely extend its short-term consolidation.

- We are maintaining our Tuesday’s speculative long position (4,335 price level), as we expect an upward correction from the current levels (around +5% from the 4.335 level – futures contract).

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): long positions with entry at 4,335 price level, with 4,180 as a stop-loss and 4,550 as an initial price target.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care