So the theme of last week was primarily the same as the previous few weeks- rising bond yields and inflation fears.

Look, it's not the fact that bond yields are rising that are freaking out investors. Bond yields are still at a historically low level, and the Fed Funds Rate remains 0%. But it's the speed at which they've risen that are terrifying people. So far this year, the 10-year yield has soared 72%

Fed Chair Jay Powell's statement that inflation could "temporarily return" did not help matters much last week either. However, despite the fears, the indices really did not perform all that badly the previous week after a Friday (Mar. 5) reversal. The Dow Jones managed to gain 1.8%, the S&P eked out a 0.8% gain, and after briefly touching correction territory and giving up its gains for the year, the Nasdaq managed to decline only -2.1%.

So what's on tap for this week? Is the downturn overblown and already over?

This is a massive week for market sentiment. The Senate, first and foremost, passed President Biden's $1.9 trillion stimulus plan over the weekend. On the one hand, stocks could pop from this. On the other hand, this makes inflation a foregone conclusion. Remember this, too- when the market gets what it expects, it's usually a sell signal rather than a buy signal. Markets look forward. Not to the past, and not to the present.

Important data being released this week also includes inflation data, initial claims, and consumer sentiment.

Time will tell where we go from here. While I still do not foresee a crash like we saw last March and feel that the wheels remain in motion for a healthy 2021, inflation is a genuine concern and could be here already.

According to Bloomberg, the price of gas and food already appear to be getting a head start on inflation. For January, Consumer Price Index data also found that the cost of food eaten at home rose 3.7 percent from a year ago — more than double the 1.4 percent year-over-year increase in all goods included in the CPI.

This could only be the start too. In its 2021 outlook report, the Economic Research Service for the U.S. Department of Agriculture forecast the food cost from grocery stores to rise 1 to 2% this year.

Moody's Analytics chief economist Mark Zandi also believes that Wall Street is significantly underestimating inflation's seriousness and warns it could affect every sector in the market — from growth to cyclicals.

"Inflationary pressures will develop very quickly," he said. "I don't think there's any shelter here."

I'm not trying to sound the alarm- but be very aware. These are just the early warning signs.

I still feel that a correction of some sort is imminent. The Nasdaq touched it briefly last week and is still about 2% away from one. Other indices could possibly follow. But don't fret. Corrections are healthy and normal market behavior, and we have been long overdue for one. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017).

Most importantly, this correction could be an excellent buying opportunity.

It can be a very tricky time for investors right now. But never, ever, trade with emotion. Buy low, sell high, and be a little bit contrarian. There could be some more short-term pain, yes. But if you sat out last March when others bought, you are probably very disappointed in yourself. Be cautious, but be a little bold too.

There's always a bull market somewhere, and valuations, while still somewhat frothy, are at much more buyable levels now.

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one to help people who needed help instead of the ultra-high net worth.

With that said, to sum it up:

There is optimism but signs of concern. A further downturn by the end of the month is very possible, but I don't think that a decline above ~20%, leading to a bear market, will happen.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

When Will the Russell Be Buyable?

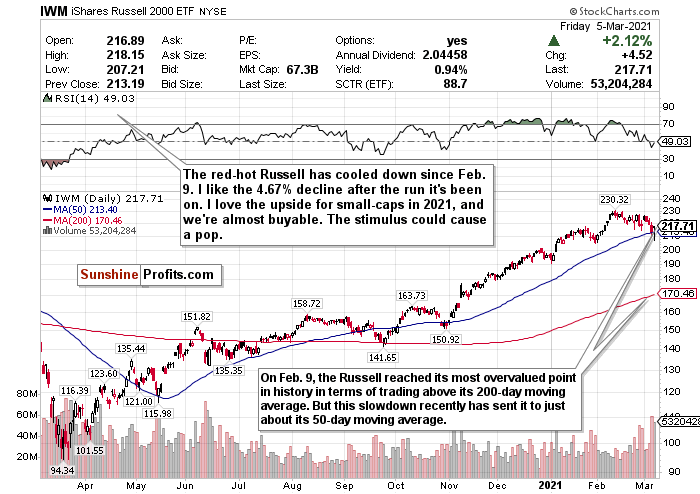

Figure 1- iShares Russell 2000 ETF (IWM)

I want to buy the Russell 2000 so badly, especially now that the $1.9 trillion stimulus bill passed the Senate.

I think we’re just about there. For now, I’m keeping this a HOLD. However, if the Russell 2000 declines on Monday (Mar. 8) BUY THE DIP.

It pains me not to unequivocally recommend a BUY call for the small-cap Russell 2000. I love this index’s outlook for 2021- aggressive stimulus, friendly policies, and a reopening world.

Consumer spending, especially for small-caps, already appears to be very pent-up as well.

So why can’t I say with conviction to 100% BUY just yet? It’s pretty simple. As tracked by the iShares Russell 2000 ETF (IWM), small-cap stocks have been on a rampage since November.

Since the market’s close on October 30, the IWM has gained about 42.65% and more than doubled ETFs’ returns tracking the larger indices.

If you thought that the Nasdaq was red hot and frothy, you have no idea about the Russell 2000.

Not to mention, year-to-date, it’s already up approximately 12.5%. That’s not quite buyable to me.

I wouldn’t fault you at all if you started initiating positions before the opening bell on Monday (Mar. 8). The RSI is below 50, and closer to oversold than overbought. But I personally will be waiting to see what happens on Monday, and to see if we can get in at a better entry point.

I feel the Russell 2000’s slowdown has been long overdue, but that’s all it is- a slowdown. The Nasdaq’s downturn is probably more buyable than the Russell’s right now, even though I feel the current climate favors the Russell more.

HOLD, but if it dips enough on Monday (Mar. 8), start BUYING on account of the stimulus package and what it should do for small-cap stocks.

Where Could the Streaky S&P Go?

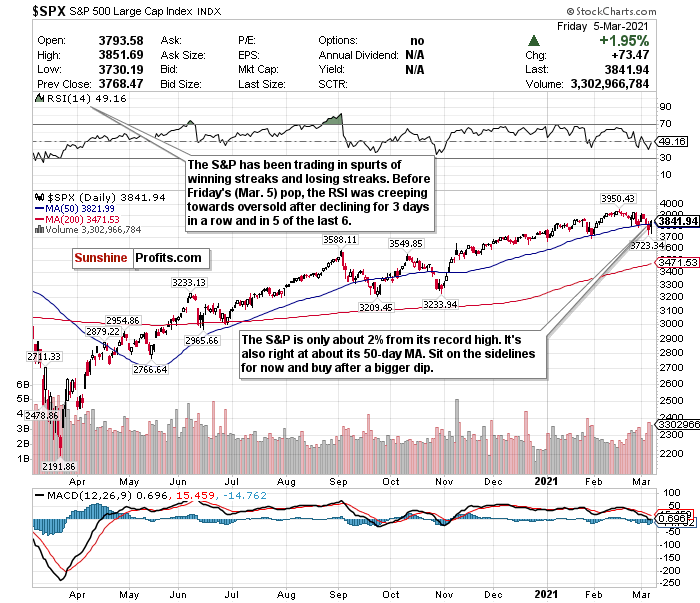

Figure 2- S&P 500 Large Cap Index $SPX

The S&P 500 is a complex index to call. It’s incredibly streaky and is between a rock and a hard place right now.

From the end of February through now, the S&P has been trading like a slumping team. Think of the Lakers, who still have Lebron James but have looked ordinary without Anthony Davis. Well, think of bond yields/inflation as an Achilles injury and Tesla (TSLA) as Anthony Davis. It was apparent this was going to eventually happen once the volatile Tesla joined the index.

Before Friday’s (Mar. 5) reversal upwards, the large-cap benchmark declined for 3 days in a row and in 5 of the last 6 sessions. But it’s only 2% below its all-time highs, managed to eke out a 0.8% gain last week, and is still up about 2.3%for the year.

That’s not quite buyable.

For now, it’s best to sit and wait this out. The first week of March has started off with headwinds, but don’t forget. March 1st also saw the S&P’s best one-day gain since June.

Unless I see some sort of buy or sell signal for the S&P 500, I just think we’ll keep playing this streaky sideways game.

HOLD for now, but be prepared to either BUY or SELL depending on its moves. For an ETF that attempts to directly correlate with the performance of the S&P 500, the S&P 500 SPDR ETF (SPY) is a great option.

The Dow Jones Is Not Buyable at This Time

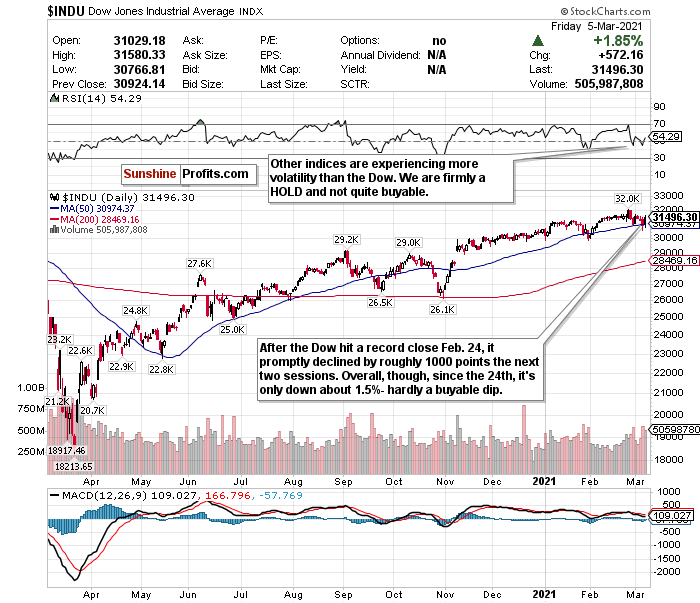

Figure 3- Dow Jones Industrial Average $INDU

The Dow Jones has been behaving more stable than the other indices. However, we’re not quite as buyable.

The Dow is only about 1.5% off its February 24th record close, rose 1.8% last week, and is up about 2.9% year-to-date. It could also benefit from this stimulus package due to all of the cyclical stocks in its index.

Where do we go from here?

Like the S&P, the Dow is between a rock and a hard place right now. But the Dow is not as close to buyable. It’s trading comparatively dull, we’re above the 50-day moving average, and the RSI indicates that the index is a strong HOLD.

Yes, there are underlying concerns, and the market is more of a house of cards than anyone realizes. But the Dow is still comparatively stable to the others, and I can appreciate that.

Many analysts believe the index could end the year at 35,000, and the wheels are in motion for a furious rally for the second part of the year. But you could do better for a buyable entry point.

There are some Dow stocks at a decent entry point right now. But as an index, I would like the Dow to see a deeper pullback.

From my end, I’d prefer to assess the situation.

My call on the Dow stays a HOLD, but this could change soon.

For an ETF that aims to correlate with the Dow’s performance, the SPDR Dow Jones ETF (DIA) is a reliable option.

Beware of Inflation

I cannot stress this enough. We are already experiencing inflation, and soon it will permeate our entire society. I think we're genuinely underestimating this.

As I said in the intro, Bloomberg claims that food prices are soaring faster than inflation and incomes. The January Consumer Price Index data also found that the cost of food eaten at home rose 3.7 percent from a year ago — more than double the 1.4 percent year-over-year increase in all goods included in the CPI.

The Economic Research Service for the U.S. Department of Agriculture also believes that the food cost from grocery stores will rise 1 to 2% this year.

Plus, Moody's Analytics chief economist Mark Zandi feels that investors have not fully grasped that inflation is "dead ahead" and are grossly underestimating its seriousness and effect on every sector in the market.

I have been calling out Jay Powell for weeks on this. I feel he is being cavalier in his inflation thoughts, and I did not buy what he was selling two weeks ago. Good for him that inflation hasn't hit his magic 2% target yet. But he essentially admitted last Thursday (Mar. 4) what the worst kept secret in the book was- that we could see "temporary inflation."

"Temporary inflation"? We weren't born yesterday. Inflation isn't "temporary" unless you drastically hike rates. Once that happens, then all bets are off for stocks.

How long will the Fed do this song and dance? Who knows. They said they'd keep rates at 0% through 2023, but if inflation gets really bad, there's no way this can be sustainable.

Pent-up consumer demand is great. Retail sales crushing expectations reflect this. However, bond yields rising as fast as they have coupled with a Fed showing no signs of hiking interest rates is as strong a sign of inflation as you can get.

Bond yields are rising because investors expect inflation to return and almost desire higher interest rates sooner rather than later.

Five-year inflation expectations have also more than doubled from last year's low and are now at around their highest levels since 2013.

"The rich world has come to take low inflation for granted. Perhaps it shouldn't." -The Economist.

As hedges against inflation, consider BUYING the SPDR TIPS ETF (SPIP), the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC), and the iShares Cohen & Steers REIT ETF (ICF).

Mid-Term/Long-Term

Add Emerging Market Exposure- Period

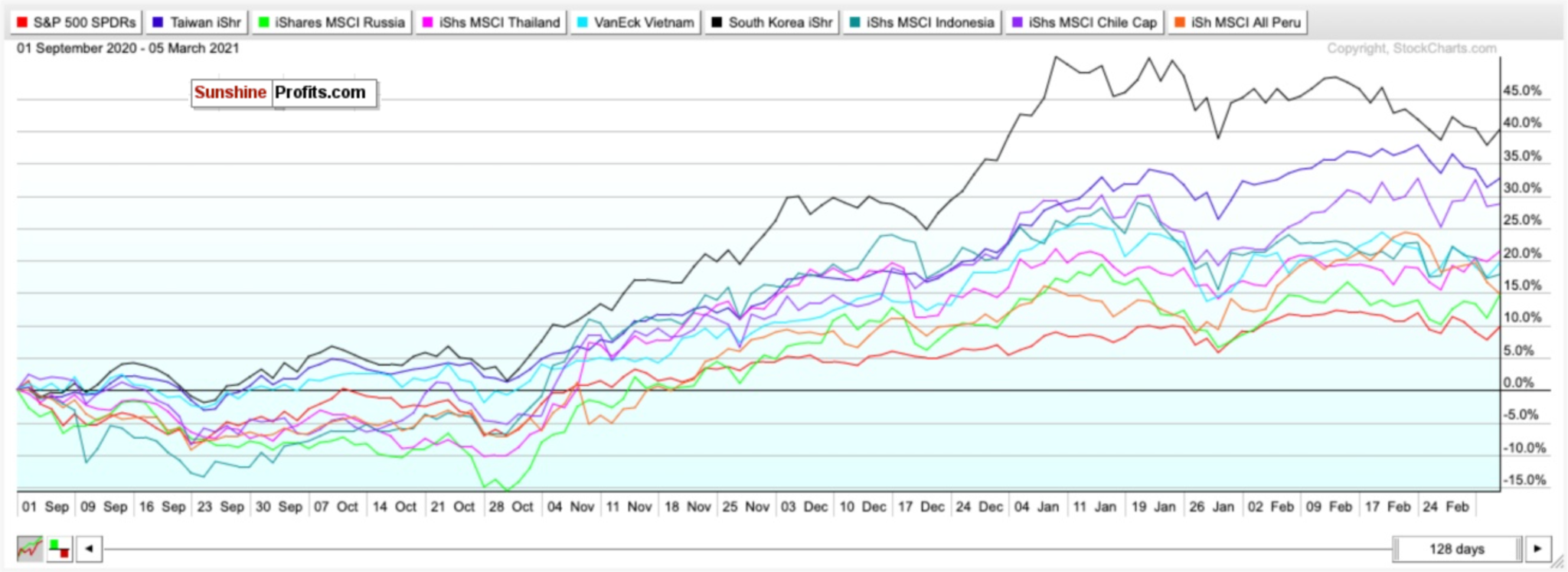

Figure 4- SPY, EWT, ERUS, THD, VNM, EWY, EIDO, ECH, EPU comparison chart- Sep. 1, 2020-Present

Since September, the SPDR S&P 500 ETF (SPY) has gained around 9.7%.

But if you compare that yield to that of my top emerging market picks for 2021, it has underperformed.

Only the iShares MSCI Russia ETF (ERUS) and the iShares MSCI Peru ETF (EPU) come close with returns of 14.68% and 14.87%, respectively, in that same timeframe.

The difference? Russia may be undervalued and have more than a 35% upside for its equities in the long-term, while Peru sits on some of the most robust and in-demand mineral reserves in the world.

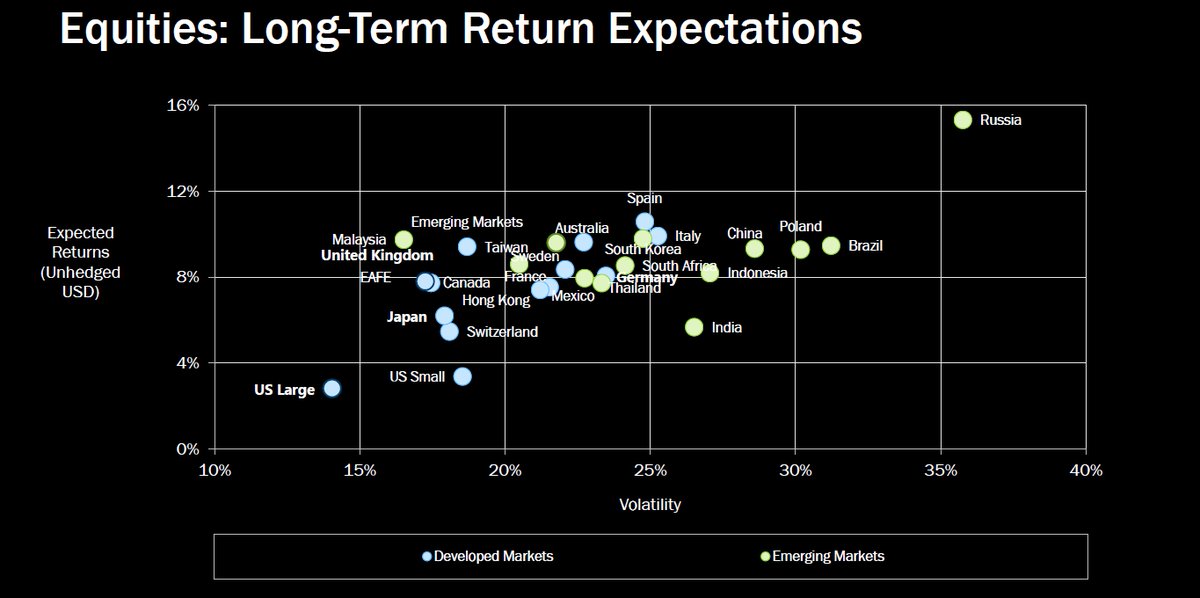

Figure 5- Equities: Long-Term Return Expectations Developed Markets/Emerging Markets

But these are only two examples of emerging markets with strong potential.

Consider this too.

With inflation on the horizon, a surge in commodity prices combined with shifting demographics could send other emerging markets upwards long-term. Plus, with birth rates plummeting during the pandemic in developed markets, it could mean long-term upside for emerging markets.

PWC echoes this sentiment and believes that emerging markets (E7) could grow around twice as fast as advanced economies (G7) on average in the coming decades.

For 2021, the following are my BUYs for emerging markets and why:

iShares MSCI Taiwan ETF (EWT)- Developing country, with stable fundamentals, diverse and modern hi-tech economy, regional upside without China’s same geopolitical risks.

iShares MSCI Thailand ETF (THD)- Bloomberg’s top emerging market pick for 2021 thanks to abundant reserves and a high potential for portfolio inflows. Undervalued compared to other ETFs.

iShares MSCI Russia Capped ETF (ERUS)- Bloomberg’s second choice for the top emerging market in 2021 thanks to robust external accounts, a robust fiscal profile, and an undervalued currency. Red-hot commodity market, growing hi-tech and software market, increasing personal incomes. Compared to many other developed and emerging markets,

VanEck Vectors Vietnam ETF Vietnam (VNM)-Turned itself into an economy with a stable credit rating, strong exports, and modest public debt relative to growth rates. PWC believes Vietnam could also be the fastest-growing economy globally. It could be a Top 20 economy by 2050.

iShares MSCI South Korea ETF (EWY)- South Korea has a booming economy, robust exports, and stable yet high growth potential. The ETF has been the top-performing emerging market ETF since March 23.

iShares MSCI Indonesia ETF (EIDO)- Largest economy in Southeast Asia with young demographics. The fourth most populous country in the world. It could be less risky than other emerging markets while simultaneously growing fast. It could also be a Top 5 economy by 2050.

iShares MSCI Chile ETF (ECH)- One of South America’s largest and most prosperous economies. An abundance of natural resources and minerals. World’s largest exporter of copper. Could boom thanks to electric vehicles and batteries because of lithium demand. It is the world’s largest lithium exporter and could have 25% of the world’s reserves.

iShares MSCI Peru ETF (EPU)- A smaller developing economy but has robust gold and copper reserves and rich mineral resources.

Let’s take a look at how these emerging markets have performed over the last 7 trading sessions

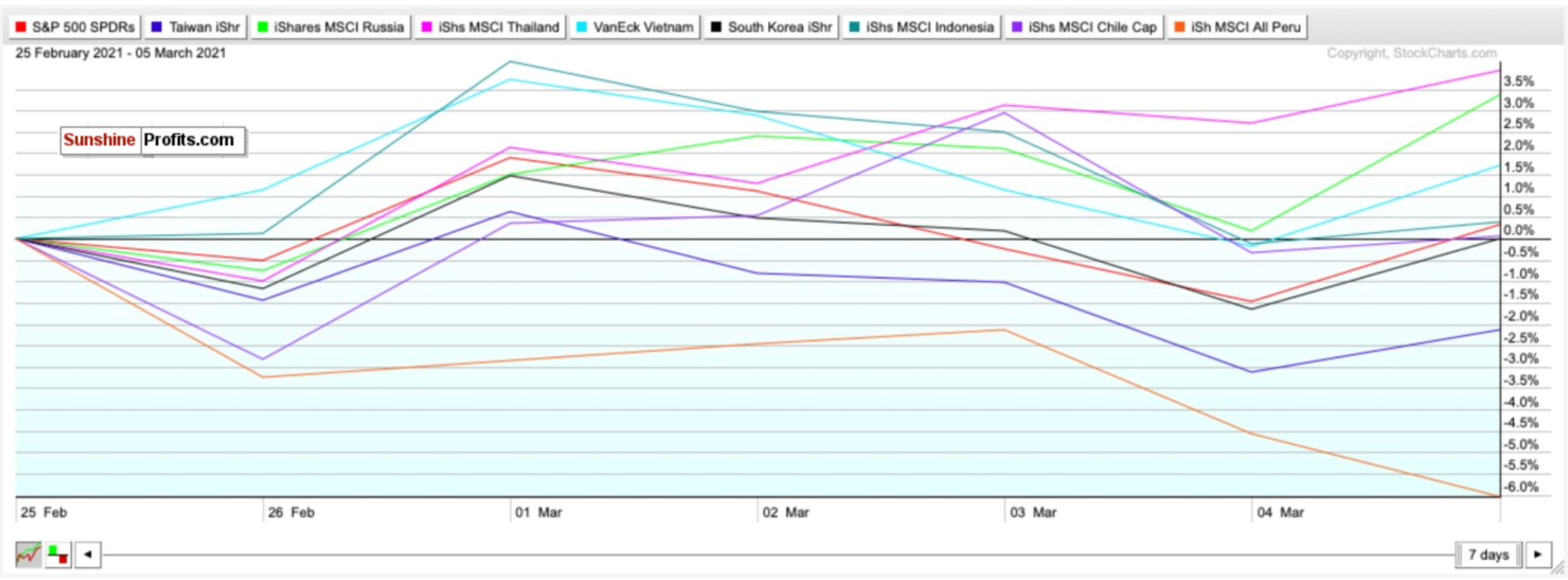

Figure 6- SPY, EWT, ERUS, THD, VNM, EWY, EIDO, ECH, EPU comparison chart- Feb. 25-Present

What a difference a week can make. Peru was the leading emerging market in February, thanks to surging copper prices. “Clean metals” and “battery metals” like copper surged in February, and Peru, because of its extensive copper reserves, outperformed. Copper saw its best month in 5 years in February and popped by more than 19%.

But in just the last 7 sessions, copper has declined by almost 4.4%, and the Peru ETF (EPU) has responded accordingly as the biggest laggard since February 25th, declining by about 6%.

The best performing ETFs since the 25th have been Thailand ETF (THD) and Russia (ERUS). Both are 3.93% and 3.36%, respectively.

Outside of the aforementioned country-specific ETFs, you can also BUY the iShares MSCI Emerging Index Fund (EEM) for broad exposure to Emerging Markets.

Long-Term

I remain convinced that the economic recovery is going better than expected as the progress in administering the vaccines improves. But it’s a blessing and a curse if it goes “too well.”

Continue to pay attention to complacency, overvaluation, bond yields, and especially inflation.

Time will tell what happens with the market. There could be more short-term pain. But slowly but surely, we are seeing more and more long-term buying opportunities. I will have a much better feeling for even more stocks and sectors for the second half of the year if they cool down even more, as I hope.

I think another down week or two could come before entering a powerful buying opportunity for the second half of the year. I’ve been calling for this buyable correction for weeks now, and the Nasdaq is already there. We may be at the beginning of the end of the pandemic, and despite the choppy waters right now, 2021 should be a big year for stocks.

Summary

Is it possible to become increasingly optimistic while at the same type becoming increasingly cautious?

That’s how I feel right now.

I was hoping that as the vaccines became more widespread and COVID numbers improved, the tug-of-war between optimism and pessimism would subside.

But I was wrong. We’re just battling bond yields and inflation now.

The crash and subsequent record-setting recovery we saw in 2020 is a generational occurrence. I can’t see it happening again in 2021. But as I said in the intro, I think a correction is inevitable. The Nasdaq, after all, briefly touched a correction last week, and remains on teh edge.

If you have heavy equity exposure, especially in struggling sectors like tech, take a breath, stay cool, and use it as a time to find buying opportunities.

How do you think many investors feel today who bought energy stocks at dirt-cheap valuations feel today? While energy lagged in 2020, it’s leading 2021.

Do not get caught up in fear and most of all:

NEVER TRADE WITH EMOTIONS.

Consider this too. You can sit out and be scared and wait for the perfect buying opportunity. But since markets bottomed on March 23rd, ETFs tracking the indices have seen returns like this: Russell 2000 (IWM) up 121.04%. Nasdaq (QQQ) up 82%. S&P 500 (SPY) up 74.26%. Dow Jones (DIA) up 72%.

Nobody knows “where” the actual bottom is for stocks, and what’s happening right now is far from a crash. This is just a slowdown and a rotation.

In the long-term, markets always move higher and focus on the future rather than the present.

To sum up all our calls, I have a BUY call for

- the Invesco QQQ ETF (QQQ)- but buy selectively.

I have HOLD calls for:

- The iShares Russell 2000 ETF (IWM)- but buy if it sees a nice dip Monday (Mar. 8)

- the SPDR S&P ETF (SPY), and

- the SPDR Dow Jones ETF (DIA)

I am more bullish for all of these ETFs for the second half of 2021 and the long-term.

I also recommend selling or hedging the US Dollar and gaining exposure into emerging markets for the mid-term and long-term.

I have BUY calls on:

- The iShares MSCI Emerging Index Fund (EEM),

- the iShares MSCI Taiwan ETF (EWT),

- the iShares MSCI Thailand ETF (THD),

- the iShares MSCI Russia ETF (ERUS),

- the VanEck Vectors Vietnam ETF (VNM),

- the iShares MSCI South Korea ETF (EWY),

- the iShares MSCI Indonesia ETF (EIDO),

- the iShares MSCI Chile ETF (ECH),

- and the iShares MSCI Peru ETF (EPU)

Additionally, because I foresee inflation returning as early as mid to late 2021…

I also have BUY calls on:

- The SPDR TIPS ETF (SPIP),

- the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC), and

- the iShares Cohen & Steers REIT ETF (ICF)

Thank you.

Matthew Levy, CFA

Stock Trading Strategist