Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): long positions with entry at 4,225 price level, with 4,090 as a stop-loss and 4,470 as an initial price target.

The S&P 500 index slightly extended its downtrend yesterday, but at the end of the day it was higher. So was it a reversal or just another short-term bounce?

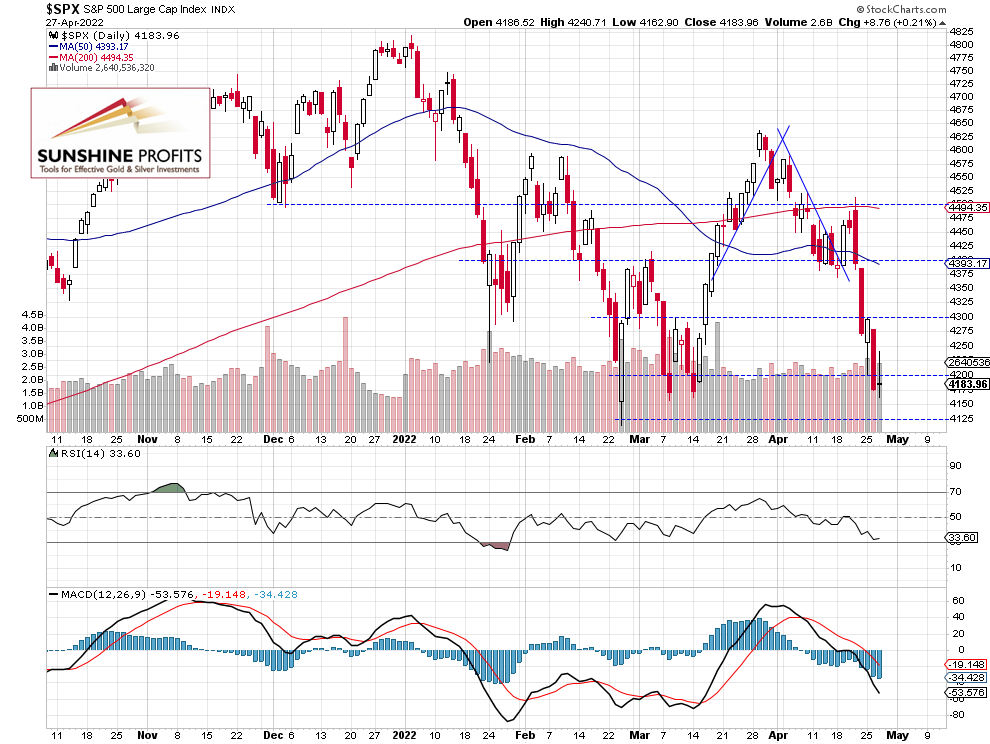

The broad stock market index gained 0.21% on Wednesday, after bouncing from the new local low of 4,162.90. The S&P 500 fell to its March local lows of around 4,160. It extended the downtrend despite quarterly corporate earnings releases. There’s still a lot of uncertainty concerning the Fed’s monetary policy tightening fears and Ukraine conflict. This morning the S&P 500 index is expected to open 1.1% higher following yesterday’s FB quarterly earnings release. However, the market retraced some of its overnight advance after much worse than expected quarterly Advance GDP data release (-1.4% vs. expectations of +1.1%).

The nearest important resistance level is now at around 4,200-4,250. On the other hand, the support level is at 4,100-4,150, marked by the previous lows. The S&P 500 index retraced the whole March advance, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Futures Contract Above 4,200 Again

Let’s take a look at the hourly chart of the S&P 500 futures contract. On Tuesday the market fell to its previous local lows of around 4,140, and yesterday it bounced back above the 4,200 level again.

The market is technically oversold and there are some positive trend exhaustion signals, therefore we decided to open a speculative long position (the current futures contract level of 4,225) with the stop-loss level of 4,090 and the initial target profit level of 4,470. We are expecting an upward correction from the current levels. (chart by courtesy of http://tradingview.com):

Conclusion

On Wednesday, the S&P 500 index fluctuated following its recent declines. The market closed higher, but it was still below the 4,200 level. Today, the important Advance GDP release was much worse than expected. However, we may see a “sell the rumor, buy the news” action here. Investors will also wait for today’s important quarterly earnings releases from AAPL and AMZN.

Here’s the breakdown:

- The S&P 500 index remained below the 4,200 level yesterday; it may be counterintuitive, but today’s worse than expected Advance GDP release may trigger an upward reversal.

- Opening a speculative long position (4,225 price level) is justified from the risk/reward perspective.

- We are expecting an upward correction from the current levels.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): long positions with entry at 4,225 price level, with 4,090 as a stop-loss and 4,470 as an initial price target.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care