So how about GameStop (GME) and AMC (AMC)? That Silver short-squeeze? Fighting the man?

That was fun while it lasted.

I don't want to lecture anyone or say that I told you so. During one of my newsletters last week, I even said that I tip my hat to anyone who profited from this—all the respect in the world.

Me personally, though, I would never trade like this. Monday (Feb. 1) and Tuesday's market (Feb. 2) was nothing more than a reality check. GameStop's stock has lost nearly half of its value, and other Reddit darlings like AMC, Blackberry (BB), Koss (KOSS), and Silver (SLV) tanked.

Stocks don't go up forever.

Stonks especially don’t.

Who knows, maybe the party's not over. But I think the plummet in the Reddit stocks was bound to happen. Bubbles always eventually pop.

The market seems happy that the earth is back on its axis in stockland. The indices have recovered nearly all of last week's losses already.

I didn't call the GameStop short-squeeze, but I had called last week's downturn for a while. The recovery so far this week wasn't entirely surprising either.

Be that as it may, I remain concerned about complacency in the markets and overstretched valuations, plus the potential return of inflation. But the breather last week was needed and brought the indices to less overbought levels.

Generally, investors and analysts are bullish these days. According to a recent Bank of America survey of 194 money managers, bullishness on stocks is at a three-year high, and the average share of cash in portfolios, which is usually a sign of protection from market turmoil, is at the lowest level since May 2013.

We have still not declined 10% from the record highs- the minimum needed for a correction. Although the market needed last week's downturn, we're once again mostly right where we were several days ago.

I know what you’re thinking. Amazon (AMZN) and Alphabet (GOOGL) are the latest companies to crush their earnings estimates, how could we possibly have a correction?

For one, there are still things to be concerned about from a public health and economic perspective.

We are also long overdue for one. We haven't seen one since last March. Corrections are healthy for markets and more common than most realize. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017).

A correction could also be an excellent buying opportunity for what should be a great second half of the year.

We're no longer as close to those same BUY levels as we were after market close on Friday. But we're not quite at SELL again, and I still think we're a few pullbacks away from making more BUY calls with conviction. In other words, welcome to no man's land.

In my last newsletter, I cautioned against making manic moves and trading with emotions. We saw our worst week since October last week and declined in two of the previous three. Much of that was due to the GameStops and AMCs freaking out Wall Streeters. But I reminded you then, and I'll remind you again. Shares of Eastman Kodak surged by 1,481% in three days last July, and the broader market seems to have done just fine since then.

Do not let the noise deter you from your goals. My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one where I could help people who needed help, instead of the ultra-high net worth.

With that said, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction between now and the end of Q1 2021 is possible. I don't think that a decline above ~20%, leading to a bear market will happen.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

We're all in this together!

What’s Next for Small-Caps?

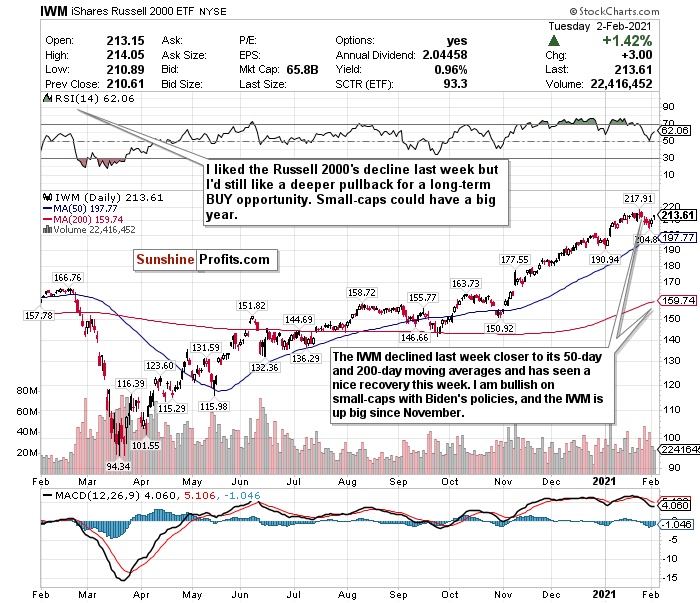

Figure 1- iShares Russell 2000 ETF (IWM)

The Russell 2000 small-cap index, as tracked by the iShares Russell 2000 ETF (IWM), declined over 4.3% last week. However, in only the first two days of the week, the index has recovered almost all of these losses. It’s also up over 10.3% year-to-date and is outperforming the larger indices.

Small-caps are funny. They either outperform and underperform and are easily swayed by the news. While I foresaw last week’s decline coming for over a month now, I remain bullish due to aggressive stimulus and President Biden’s policies.

Although it is no longer technically overbought, I still think that it could use another pullback just because of how much it’s overheated since October 30. It’s up nearly 40% since then!

I love small-cap stocks for the long-term, especially as the world reopens and the Biden agenda eventually passes an aggressive stimulus package.

I’d like to see another sharp decline, though, before calling this a BUY. It could potentially happen this month.

HOLD, but if there is a deeper pullback, BUY for the long-term recovery.

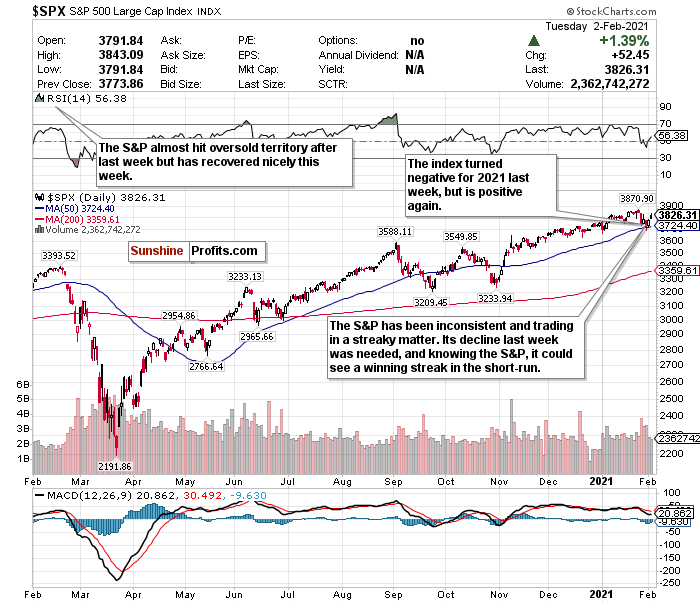

The S&P 500 is Very Streaky and Trading Like a HOLD

Figure 2- S&P 500 Large Cap Index $SPX

The S&P 500 is trading like an inconsistent team trying to find its identity. It seems like it rips off multiple-day winning streaks and losing streaks every week.

Before the start of last week, the S&P was hovering around a record-high. Its forward P/E ratio was the highest it’s been since the dot-com bust, and the RSI consistently approached overbought levels.

By the end of last week, it was nearly oversold.

Now, this week? Its RSI is back in the mid-50s, it’s back over 3800, and on a two-day winning streak. Last week’s losses have practically gone bye-bye.

I said before that once the S&P approaches a 3600-level, we can start talking about it as a BUY. Well, the index came pretty darn close to it last week, but it wasn’t enough for me. Despite this week’s rally, short-term concerns remain, with long-term optimism.

To me, because of the RSI and how the index has traded, it remains a HOLD. We’re another down week and maybe another few pullbacks away from a potential BUY.

A short-term correction could inevitably occur by the end of Q1 2021, but for now, I am sticking with the S&P as a HOLD.

For an ETF that attempts to directly correlate with the performance of the S&P, the SPDR S&P ETF (SPY) is a good option.

The Dow Has Momentum on Its Side Again

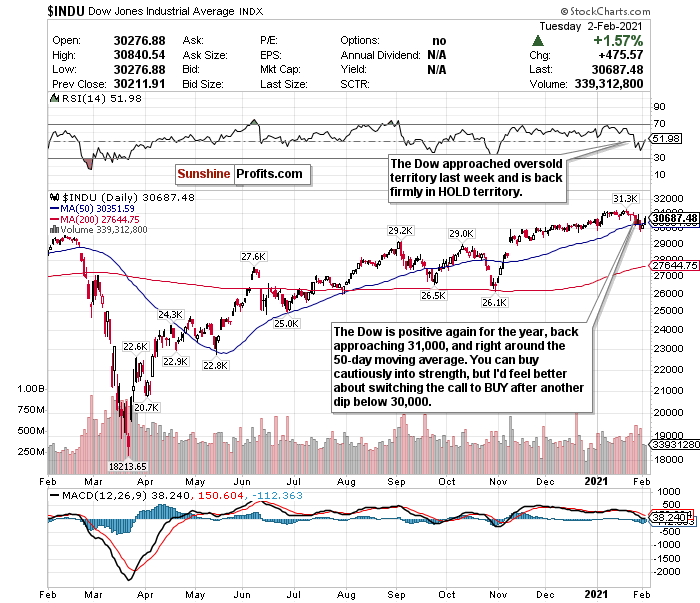

Figure 3- Dow Jones Industrial Average $INDU

The Dow has lagged behind the other indices thus far in 2021, and before recovering this week, was firmly negative for the year.

After its downturn last week, the Dow was by far the index closest to oversold and BUY territory. It saw a decline in 6 of 7 days and briefly saw its RSI plummet to a sub-40 level.

It has seen significantly more momentum this week, however. So far, it’s recovered many of its losses from the last two weeks and is back in positive territory for the year.

I love the Dow for its value compared to the other indices. It’s more relatively undervalued than the Nasdaq and the Russell, with arguably a similar type of long-term upside for 2021.

If you want to start initiating positions, go ahead. It’s at a solid entry point, especially considering that many analysts call for it to end the year at 35,000.

From my end, though, I still have some short-term questions and concerns and feel like the Dow could see another pullback.

My call on the Dow stays a HOLD, but this could change soon.

For an ETF that looks to directly correlate with the Dow's performance, the SPDR Dow Jones ETF (DIA) is a strong option.

Mid-Term/Long-Term

Taiwan, South Korea, and More for Best Emerging Market Exposure

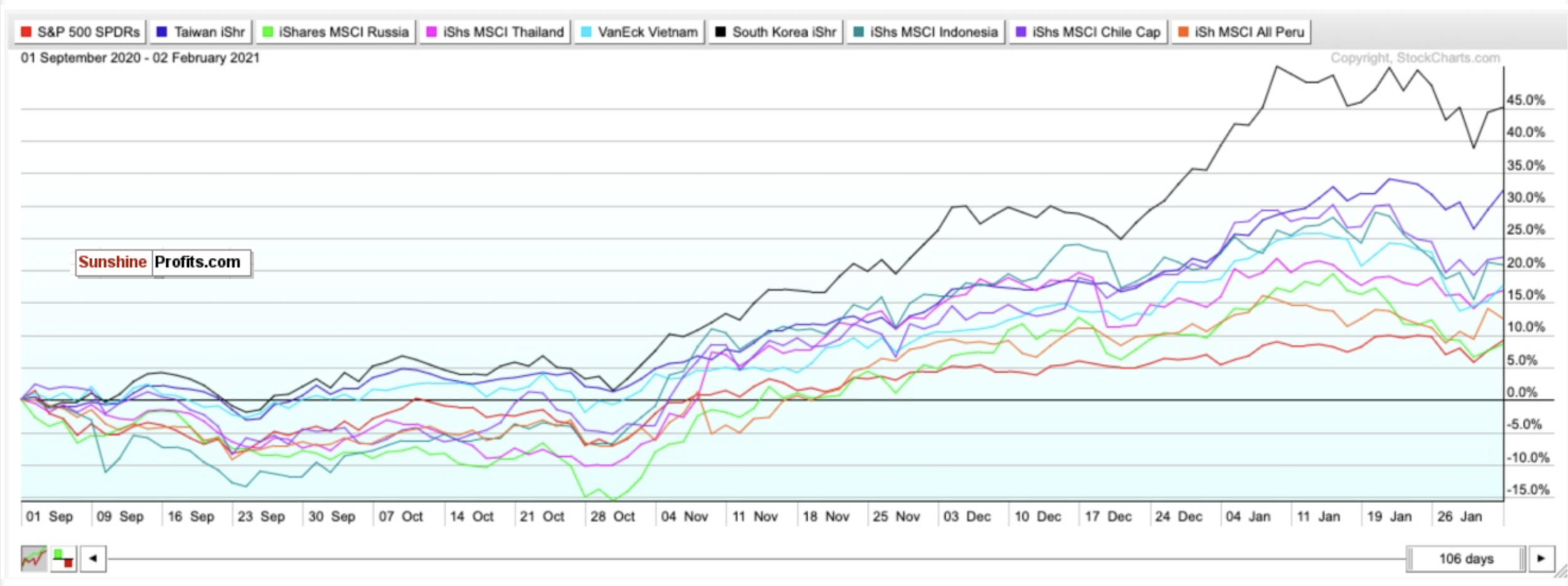

Figure 4- SPY, EWT, ERUS, THD, VNM, EWY, EIDO, ECH, EPU comparison chart- Sep. 1, 2020-Present

Emerging markets got clobbered last week, just like the broader markets. I saw it as an opportunity to strengthen my BUY calls on some specific emerging markets. Despite seeing its highest level in months, the dollar could inevitably decline due to imminent stimulus and low-interest rates. A surge in commodities and shifting demographics could send emerging markets upwards too.

PWC also believes that emerging markets (E7) could grow around twice as fast as advanced economies (G7) on average in the coming decades.

For 2021, the following are my BUYs for emerging markets and why:

iShares MSCI Taiwan ETF (EWT)- Developing country, with stable fundamentals, diverse and modern hi-tech economy, regional upside without China’s same geopolitical risks.

iShares MSCI Thailand ETF (THD)- Bloomberg’s top emerging market pick for 2021 thanks to abundant reserves and a high potential for portfolio inflows. Undervalued compared to other ETFs.

iShares MSCI Russia Capped ETF (ERUS)- Bloomberg’s second choice for the top emerging market in 2021 thanks to robust external accounts, a robust fiscal profile, and an undervalued currency. Red-hot commodity market (a big deal for a declining dollar), growing hi-tech and software market, increasing personal incomes.

VanEck Vectors Vietnam ETF Vietnam (VNM)-Turned itself into an economy with a stable credit rating, strong exports, and modest public debt relative to growth rates. PWC believes Vietnam could also be the fastest-growing economy globally. It could be a Top 20 economy by 2050.

iShares MSCI South Korea ETF (EWY)- South Korea has a booming economy, robust exports, and stable yet high growth potential. The ETF has been the top-performing emerging market ETF since March 23.

iShares MSCI Indonesia ETF (EIDO)- Largest economy in Southeast Asia with young demographics. The fourth most populous country in the world. It could be less risky than other emerging markets while simultaneously growing fast. It could also be a Top 5 economy by 2050.

iShares MSCI Chile ETF (ECH)- One of South America’s largest and most prosperous economies. An abundance of natural resources and minerals. World’s largest exporter of copper. Could boom thanks to electric vehicles and batteries because of lithium demand. It is the world’s largest lithium exporter and could have 25% of the world’s reserves.

iShares MSCI Peru ETF (EPU)- A smaller developing economy but has robust gold and copper reserves and rich mineral resources.

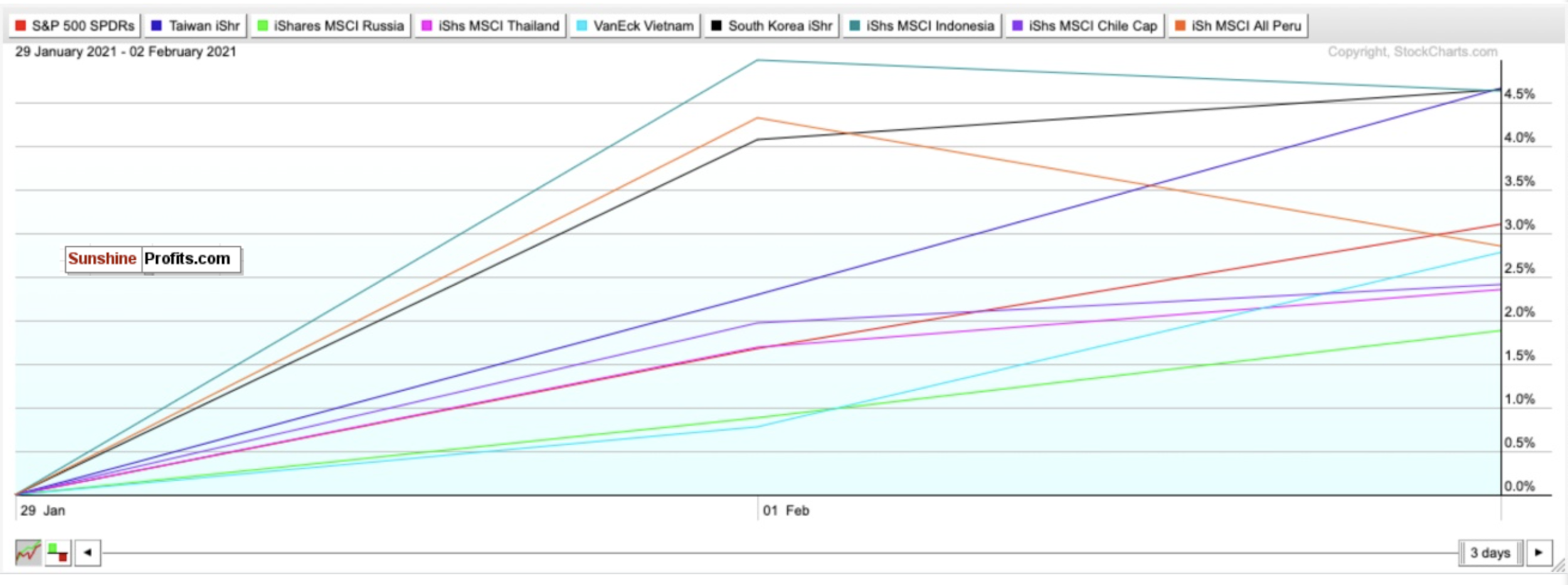

Since the close on January 29, Indonesia, Taiwan, and South Korea are the top performers. I specifically foresaw this happening with these ETFs.

Indonesia has been the laggard in 2021 of all my emerging market calls, but a reversal was inevitable. It’s such a robust economy with a young and sizable population, it’s growth potential is inevitable. It’s up over 4.6% this week after it declined over 5.7% for the month of January.

Taiwan’s rally is also not shocking, simply because it has China’s upside without the same type of geopolitical risks. It also is a very hi-tech and modern economy, and has mostly eradicated the coronavirus from its society.

Last week, South Korea was also the worst-performing emerging market, which is to be expected when you’ve surged over 138% since March 23. This week’s recovery is not shocking in the least. It needed a breather.

Monitor Vietnam this week too. It declined by nearly 7.15% last week as well, primarily due to reimposed lockdown restrictions. It’s not up as much as my other emerging market calls this week, but don’t let this deter you.

The VNM is as good a BUY opportunity as there is for emerging markets. A recent CNBC report showed that Vietnam was likely the top-performing Asian economy in 2020- including China.

Vietnam shockingly did not see a single quarter of economic contraction, and government estimates showed that the Vietnamese economy grew 2.9% last year from a year ago, topping China’s forecast-beating 2.3% growth during the same period.

Outside of the aforementioned country-specific ETFs, you can also BUY the iShares MSCI Emerging Index Fund (EEM) for broad exposure to Emerging Markets.

Pay Very Close Attention to Inflation

Pay very close attention to the possible return of inflation by mid-Q2 or Q3. An aggressive stimulus could be imminent, and the Fed has not been shy in its plans to allow the GDP to heat up. It may overshoot in the medium-term as a result. GDP growth could stutter in Q1 2021 but pay close attention to what happens in Q2 and Q3 once vaccines begin to roll out on a massive scale. Inflation will inevitably return with the Fed’s policy and projected economic recovery by mid-2021.

The 10-year yield’s recent rally, as well as the 10-year breakeven rate, reflects this as well.

If you are looking to the future to hedge against inflation, look into TIPS, commodities, gold, and potentially some REITs.

In the mid-term, I have BUY calls on the SPDR TIPS ETF (SPIP), the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC), and the iShares Cohen & Steers REIT ETF (ICF).

Long-Term

There are some things to worry about in the short-term. But I’m convinced that economic stimulus and the progress made with administering the vaccines bodes well for stocks in the second half of 2021. We may be at the beginning of the end of the pandemic-but over the next 1-3 months, this could be a very bumpy ride back.

There does seem to be one consensus though: 2021 could be a big year for stocks.

Small-caps, value stocks, and cyclicals, could especially surge. I just have a much better feeling for them in the second half of the year. I think we could be another down week or two before entering a very strong buying opportunity for the second half of the year.

Summary

The current headwinds are very concerning. But I remain optimistic for the second half of 2021 despite the bumpy road there. Until we eradicate COVID-19, a battle between optimism and pessimism is inevitable.

Despite the strong earnings we are seeing so far, a short-term correction is possible. But do not let this scare you.

Corrections are NORMAL. What happened last March is ABNORMAL.

The crash and subsequent record-setting recovery we saw in 2020 is a generational occurrence. I can’t see it happening again in 2021. If there is a short-term downturn, take a breath, stay cool, and use it as a time to find buying opportunities. Do not get caught up in fear and most of all:

NEVER TRADE WITH EMOTIONS.

If you cautiously bought a little bit last week, you’re probably delighted this week. Even though it wasn’t a full-blown correction, it was indeed an excellent opportunity to rebalance and add exposure. That’s why I love down weeks—especially overdue ones.

Consider this too. Since markets bottomed on March 23rd, ETFs tracking the indices have seen returns like this: Russell 2000 (IWM) up 116.87%. Nasdaq (QQQ) up 93.20%. S&P 500 (SPY) up 73.31%. Dow Jones (DIA) up 67.08%.

In the long-term, markets always move higher and focus on the future rather than the present.

To sum up all our calls, I have a HOLD calls for:

- The iShares Russell 2000 ETF (IWM)

- the Invesco QQQ ETF (QQQ)

- the SPDR S&P ETF (SPY), and

- the SPDR Dow Jones ETF (DIA)

For all these ETFs, I am more bullish in the long-term for the second half of 2021 but I liked last week’s pullback.

For the mid-term and long-term, I recommend selling or hedging the US Dollar, and gaining exposure into emerging markets.

I have BUY calls on:

- The iShares MSCI Emerging Index Fund (EEM),

- the iShares MSCI Taiwan ETF (EWT),

- the iShares MSCI Thailand ETF (THD),

- the iShares MSCI Russia ETF (ERUS),

- the VanEck Vectors Vietnam ETF Vietnam (VNM),

- the iShares MSCI South Korea ETF (EWY),

- the iShares MSCI Indonesia ETF (EIDO),

- the iShares MSCI Chile ETF (ECH),

- and the iShares MSCI Peru ETF (EPU)

Additionally, because I foresee inflation returning as early as mid to late 2021…

I also have BUY calls on:

- The SPDR TIPS ETF (SPIP),

- the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC), and

- the iShares Cohen & Steers REIT ETF (ICF)

Thank you.

Matthew Levy, CFA

Stock Trading Strategist