Stocks closed largely down on Monday (Dec. 14) as fears of stricter lockdowns outweighed vaccine optimism.

News Recap

- The Dow Jones closed lower by 185 points, or 0.5% after earlier rising by as much as 200 points and hitting a record intraday high. The S&P 500 also declined by 0.4%, while the Nasdaq outperformed and gained 0.5%. The small-cap Russell 2000 once again rose, gaining 0.26%.

- Although the day started with optimism as Pfizer began the rollout of its vaccine, comments from New York City Mayor Bill De Blasio put pressure on the Dow and S&P, and spooked investors about further lockdowns. De Blasio warned earlier in the day that New York could experience a “full shutdown” soon, due to infection levels not seen since May.

- There is some cautious optimism that some sort of stimulus could be passed before the end of the year, however, congress remains deeply divided on several fronts. Namely, these partisan divides stem from liability protections for businesses, the scope of state and local aid, and weekly unemployment benefits.

- We have reached the deadliest weeks of the COVID-19 pandemic. More than 300,000 total COVID-related deaths have now been confirmed in the U.S., with over 16 million confirmed cases.

- After the U.S. FDA. officially cleared Pfizer (PFE) and BioNTech’s (BNTX) vaccine last Friday (Dec. 11), the roll-out officially began on Monday (Dec. 14). The first doses were administered to healthcare workers and nursing home staffers. Approximately 2.9 million doses were shipped to 636 sites across the country. Pfizer also said it would roll out a second batch of 2.9 million doses shortly after this initial batch. The FDA is also slated to publish its assessment on Moderna’s vaccine this week, before mass deployment.

- Despite the start of the vaccine roll-out, shares of Pfizer and BioNTech both sharply fell 4.65 and 14.95%, respectively.

- Companies dependent on an economic reopening lagged the “stay-at-home” and tech winners from early on in the pandemic. United Airlines (UAL) dropped 3.4% and Chevron (CVX) fell 3.26% compared to Netflix (NFLX) which gained over 3.8%, and Amazon (AMZN) which popped more than 1%.

- Tesla (TSLA) also surged 4.90% as investors anticipate its inclusion into the S&P 500 after this week.

While the short-term may see some pain and/or mixed sentiment, the mid-term and long-term optimism is certainly very real. Overall, the general consensus between market strategists is to look past short-term painful realities and focus more on the longer-term - a world where COVID-19 is expected to be a thing of the past and we are back to normal.

According to Robert Dye, Comerica Bank Chief Economist: “I am pretty bullish on the second half of next year, but the trouble is we have to get there...As we all know, we’re facing a lot of near-term risks. But I think when we get into the second half of next year, we get the vaccine behind us, we’ve got a lot of consumer optimism, business optimism coming up and a huge amount of pent-up demand to spend out with very low interest rates.”

Other Wall Street strategists are bullish about 2021 as well. According to a JPMorgan note to clients released on Wednesday (Dec. 9), a widely available vaccine will lift stocks to new highs in 2021: “Equities are facing one of the best backdrops for sustained gains next year,” JPMorgan said. “We expect markets to be driven by recovery from the COVID-19 crisis at the back of highly effective vaccines and continued extraordinary monetary and fiscal support.”

JPMorgan’s S&P 500 target for 2021 is 4,400. This implies a nearly 20% gain.

On the other hand, for the rest of 2020, and maybe early on into 2021, markets will wrestle with the negative reality on the ground and optimism for an economic rebound.

Additionally, the rally since election week invokes concerns of overheating with bad fundamentals. Commerce Street Capital CEO Dory Wiley advised caution in this overheated market. He pointed to 90% of stocks on the NYSE trading above their 200-day moving average as an indication that valuations might be stretched: “Timing the market is not always well-advised and paring back can miss out on some gains the next two months, but after such good returns in clearly a terrible fundamentals year, I think taking some profits and moving to cash, not bonds, makes some sense here,” he said.

In the short-term, there will be some optimistic and pessimistic days. Some days, like Monday (Dec. 14), will reflect what the broader “pandemic” trend has been - cyclical and recovery stocks lagging, and tech and “stay-at-home” stocks leading. On other days (and in my opinion this will be most trading days), markets will trade largely mixed, sideways, and reflect the uncertainty. However, if a stimulus deal passes before the end of the year, it could mean very good things for short-term market gains. It is possible that there could be a minor compromise reached before the end of the year, however, a more large-scale comprehensive package may not be agreed to until 2021.

In the mid-term and long-term, there is certainly a light at the end of the tunnel. Once this pandemic is finally brought under control and vaccines are mass deployed, volatility will stabilize, and optimism and relief will permeate the markets. Stocks especially dependent on a rapid recovery and reopening, such as small-caps, should thrive.

Due to this tug of war between sentiments, it is truly hard to say with conviction whether another crash or bear market will come.

Therefore, to sum it up:

While there is long-term optimism, there is short-term pessimism. A short-term correction is very possible. But it is hard to say with conviction that a big correction will happen.

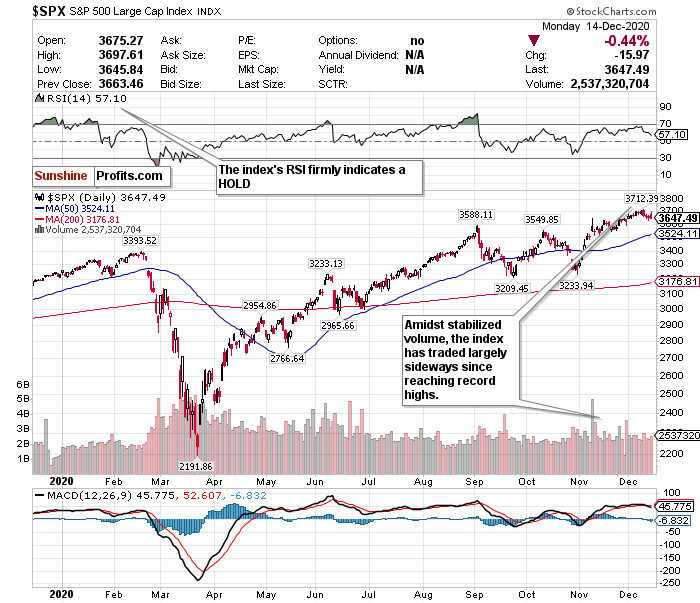

The S&P Has Long-term Upside Mixed with Uncertainty

I will say this. I like that the S&P has slightly pulled back. I like that its RSI is back under 60 again, and I like that it is back below the 3700 level. However, it is difficult to say with certainty if there will be a major downturn or whether we will surge back over 3700. There is simply too much near-term uncertainty.

However, many analysts and strategists believe this short-term uncertainty is worth it for long-term potential. I tend to agree with them, but I would prefer a sharper correction before making a conviction BUY call.

Some analysts believe the S&P could have up to a 20% upside in 2021, while others caution against an overheating index. According to another survey of market strategists conducted by CNBC, a narrow majority believe that U.S. stocks will continue to rally into 2021, with the S&P 500 rising between 8% and 22% next year from these current levels. This very well could be the case, but I personally believe most of this will happen in the next 6-12 months rather than 1-3 months.

Although the volume has largely stayed stable since Thanksgiving, I would prefer a drop closer to below 3600 before feeling more confident in initiating a BUY call. For now, I keep the S&P 500 in a HOLD category.

For an ETF that attempts to directly correlate with the performance of the S&P, the SPDR S&P ETF (SPY) is a good option.

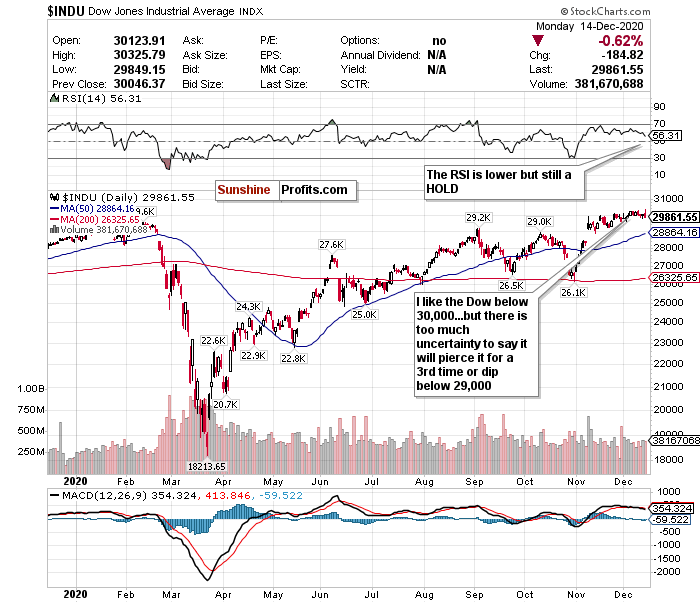

The Dow is Back Below 30,000...What Does it Mean?

I like that the Dow is back below 30,000. It is a healthy drop, and it is no longer overheating in the short-term in my opinion. Since piercing the 30,000 level for a second time two weeks ago, and reaching record highs, the Dow Jones has largely traded sideways and hovered around the 30,000 level. The drop below 30,000 is encouraging for me, however, there are too many short-term questions as to whether or not the Dow can return to that level and stay. In my view, in the short-term, the Dow is just as likely to drop below 29,000 as it is to return to record highs above 30,000. Outside of the Russell 2000, the Dow may be the index most vulnerable to news and sentiment. On pessimistic “sell the news” kinds of days, the Dow may have more downside pressure than other indices - like Monday (Dec. 14). There are so many cyclical stocks that depend on a strong economic recovery trade on this index, and any change in sentiment can adversely affect their performances.

Volume has remained relatively stable, however, it has declined since the start of December. This is something to take note of. While this could be a simple byproduct of reaching the end of the year, it would be ideal to see the Dow have a little more volume.

With so much uncertainty and the RSI still firmly in hold territory, the call on the Dow stays a HOLD.

This is a very challenging time to make any concrete predictions, but one thing I do believe is that IF there is a drop in the index, it will not be strong and sharp relative to the gains since March, let alone November. I believe that we could be in a sideways holding pattern as investors digest all the news being thrown at them on a daily basis. For an ETF that attempts to directly correlate with the performance of the Dow, the SPDR Dow Jones ETF (DIA) is a strong option.

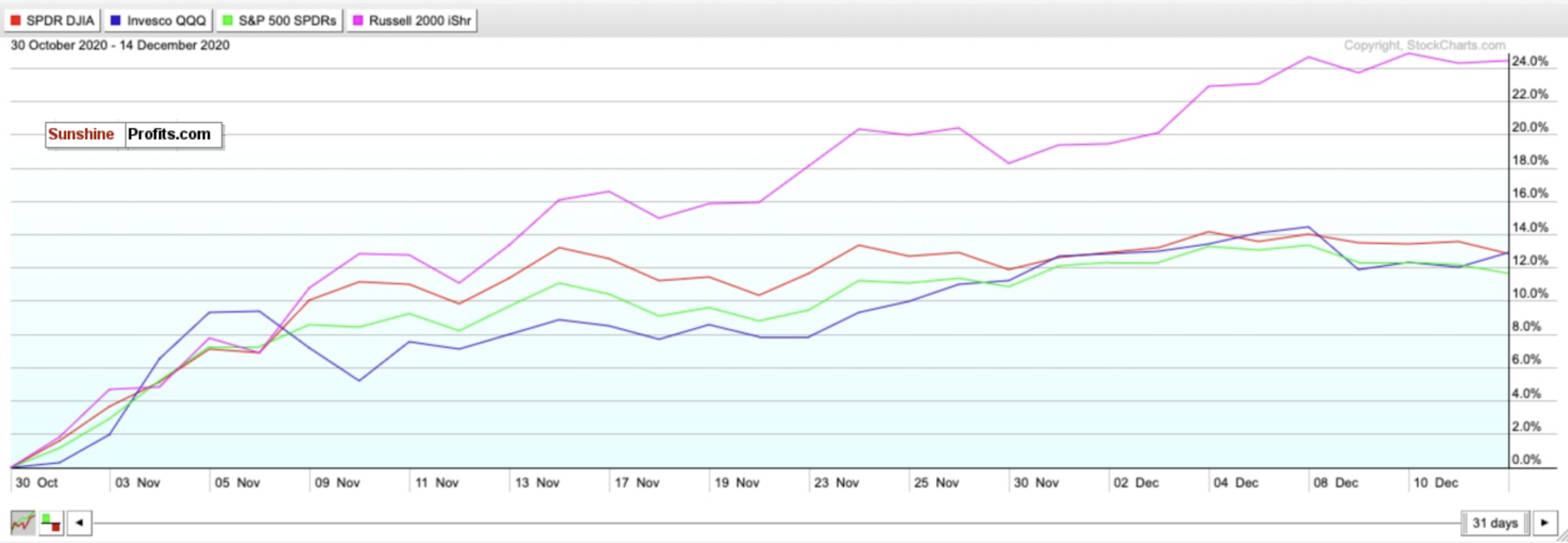

Can Small-caps Own December Too?

The Russell 2000 continues to surprise and amaze. Although Monday (Dec. 14) was a pessimistic kind of day, the Russell still managed to gain 0.11%! It is truly mind blowing. This is an index that is especially dependent on news and sentiment and can experience greater volatility than larger-cap stock indices. Much of this can be attributed to the amount of cyclical stocks in the index that are dependent on the recovery of the broader economy. Therefore, the fact that it managed a mile gain on Monday (Dev. 14), while the Dow and S&P declined, truly bucks the trend and reflects the unpredictable waters we are currently in.

Even for the week ended December 11 - an overall down week - the Russell 2000 STILL managed to outperform the larger indices. While the major indices ended the week negative, the Russell actually managed to eek out yet another weekly gain of 1.02%.

Since the start of November, the Russell 2000 has skyrocketed and considerably outperformed the other major indices. Just look how the iShares Russell 2000 ETF (IWM) compares to the ETFs tracking the Dow, S&P, and Nasdaq in that time frame. Since November, the IWM has risen over 24%. This is at least 12% higher than all of the other major indices.

If the last 9 months have shown us anything, it’s that Russell stocks will surge on optimistic days, and drop more on pessimistic days. Clearly Monday (Dec. 14) did not get the memo though. In the long-term, small-caps may be the best opportunity to bet on an economic recovery in 2021. But, in the short-term, small-cap stocks may be the most volatile of them, may have overheated, all and are a HOLD. If there is a pullback, though, consider initiating a position.

Mid-Term

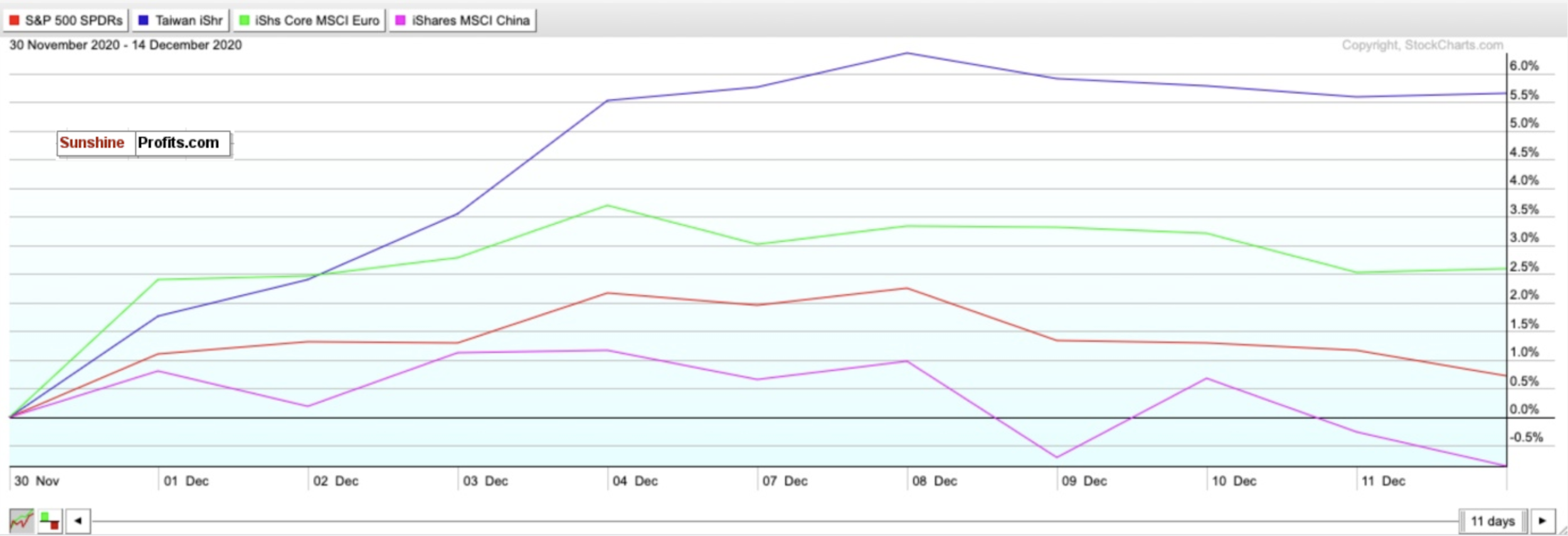

Taiwan Continues Distancing from China as Top Performing Emerging Market

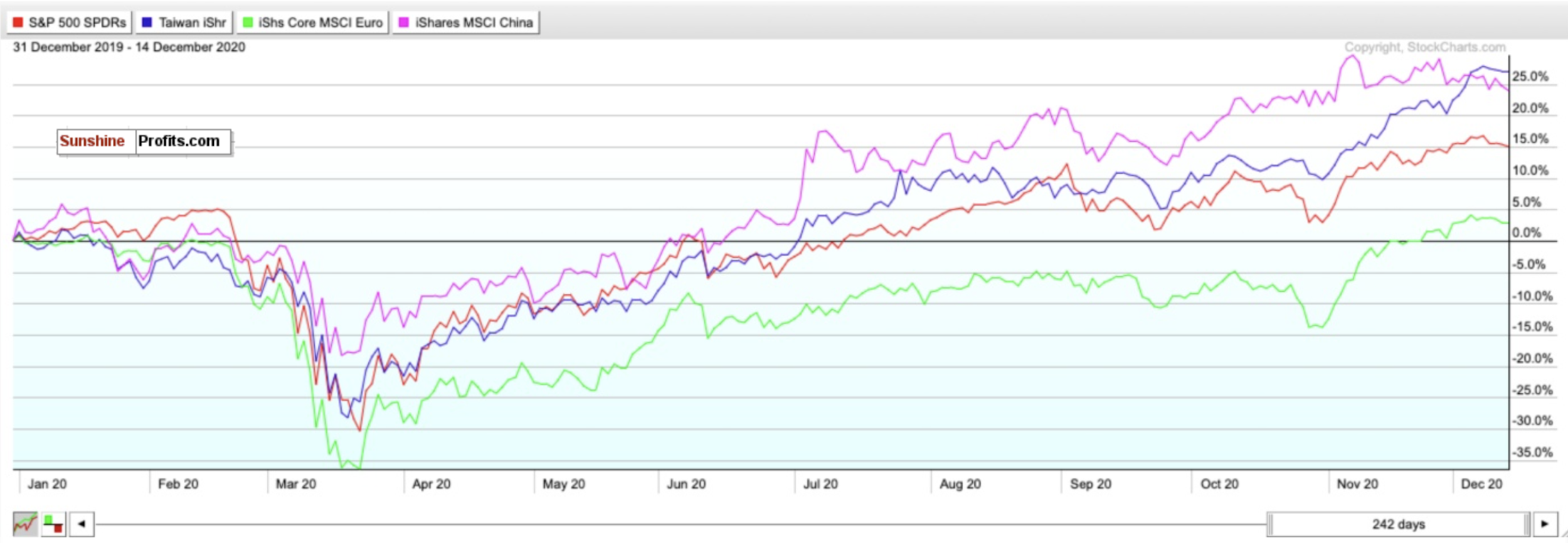

Investors remain bullish on emerging markets in both the short-term and medium-term. However, in the short-term it really depends on the region. China, for example, is by far the largest presence in emerging market indices. But Taiwan continues to distance from China as the top performing emerging market of 2020- and by a lot.

As seen in the chart above, since the start of December, the MSCI China ETF (MCHI) has underperformed compared to the SPDR S&P ETF (SPY), iShares Core Europe ETF (IEUR), and iShares Taiwan ETF (EWT) amidst renewed geopolitical tensions. Meanwhile, the Taiwan ETF has been the best performer, and has gained nearly 5.5%. This is more than quadruple what the SPDR S&P ETF has done in that time frame, and more than double what the iShares Core Europe ETF has done. All while the MSCI China ETF has managed to decline in that same time period. This continues to reflect what I have been saying - Taiwan adds a strong opportunity for emerging market exposure, without the same type of geopolitical risks as China.

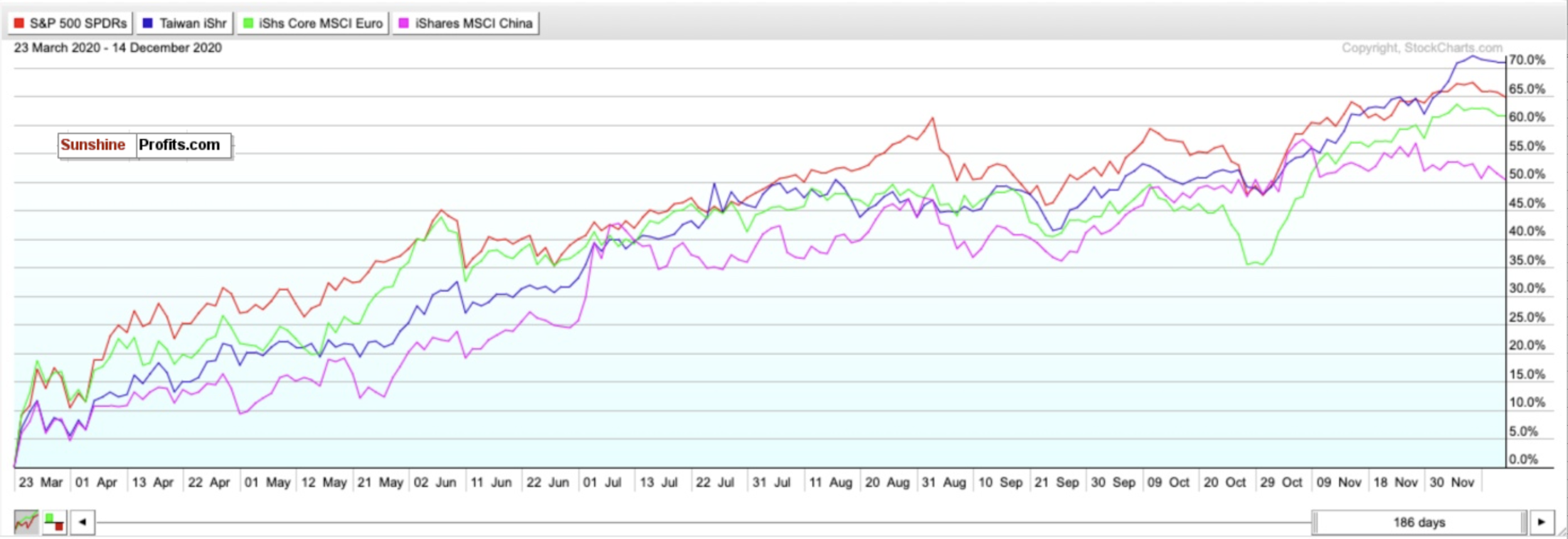

If you look at returns from December 31, 2019 to Monday’s (Dec. 14) close, and another chart showing returns from the market bottoms of March 23rd, 2020 to Monday’s (Dec. 14) close, the Taiwan ETF outperforms every single time.

The comparisons are stunning. After the China ETF outperformed the others for most of the 2020, the iShares Taiwan ETF has now firmly overtaken the China ETF’s 2020 returns. The Taiwan ETF has also outperformed the SPDR S&P ETF by over 10% while the Europe ETF has barely gained 3%.

Additionally, since March 23rd, the China ETF has been the biggest laggard and underperformed the Taiwan ETF by nearly 20%. It has also underperformed the S&P ETF and Europe ETF by nearly 15% and 10%, respectively.

China may have handled the pandemic better than other countries and continues to demonstrate its ability to handle COVID-19’s economic shocks. However, keep in mind that this is a regional victory, not just China. Although I am bullish on China in the mid-term and long-term, I feel that Taiwan may arguably pose an even stronger opportunity.

For broad exposure to Emerging Markets, you will want to BUY the iShares MSCI Emerging Index Fund (EEM), for exposure to China you will want to BUY the iShares MCHI ETF (MCHI), and for exposure to a regional economic power without the geopolitical risks of China, you will want to BUY the iShares MSCI Taiwan ETF (EWT). Consider the iShares MSCI Indonesia ETF (EIDO) as well for another growing regional economy.

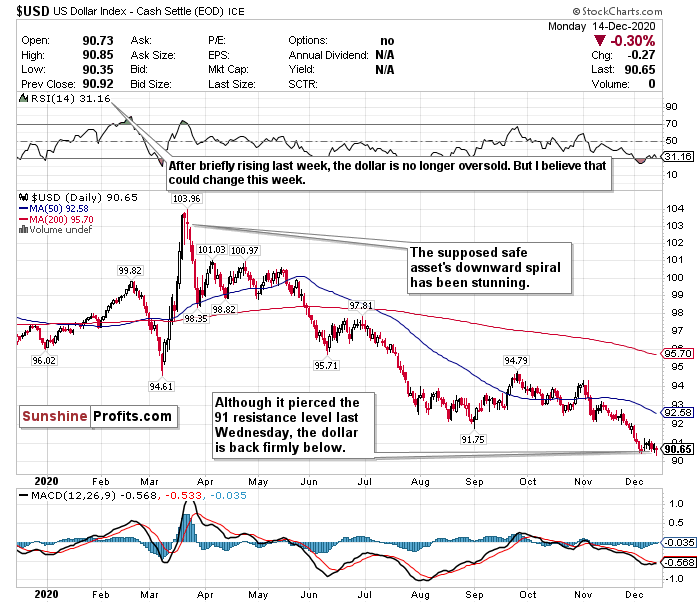

The Dollar Last Week Briefly Pierced Key Resistance...But I Have Doubts

Any time the dollar briefly pierces a key resistance level, I believe it’s fool's gold. Such was the case last week. Although the US Dollar had a decent week last week and is no longer oversold after it pierced the critical 91 resistance level last Wednesday (Dec. 9), the currency is pretty much back to where it started. The dollar has declined every day since piercing 91 and remains hovering around its 2-year low. It is also still trading way below both its 50-day and 200-day moving averages and continues to underperform both emerging market indices and foreign currencies. I have been calling the dollar’s weakness for weeks despite its low level, and expect the decline to continue due to a multitude of headwinds.

If the world returns to relative normalcy within the next year, investors may be more “risk-on” and less “risk-off,” which means that the dollar’s value will decline further.

Additionally, because of all of the economic stimulus combined with record low-interest rates, the dollar’s value has been hurt and could be further hurt. Remember, the Fed does not plan on raising interest rates at least until 2023. Now, this could of course change if the economy overheats, however, this is still an eternity for the value of the dollar.

The US Dollar’s position as the world’s reserve currency has never been as threatened as it is today. This plunge in value is concerning both in the short-term and mid-term for the US economy.

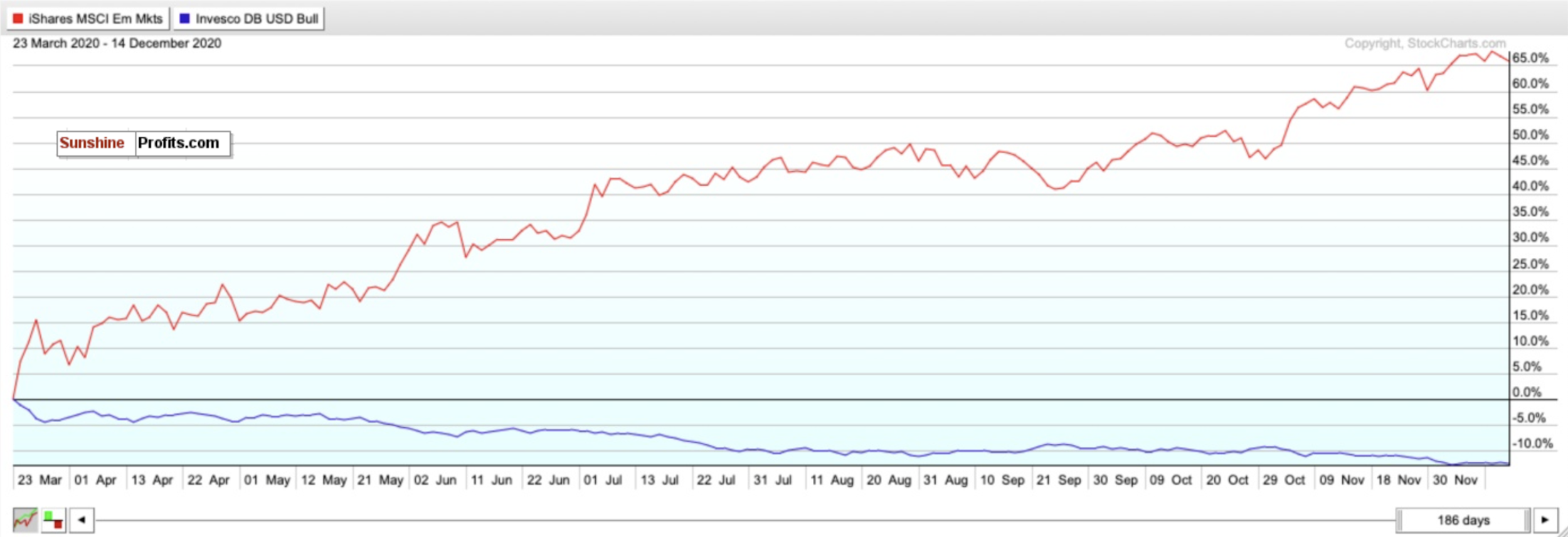

Further illustrating the dollar’s decline relative to emerging markets has been the performance of the iShares MSCI Emerging Market ETF (EEM) compared to the Invesco DB USD IDX Bullish ETF (UUP) since March 23rd.

While the UUP has declined around 12.50%, the EEM has surged by over 65%!

While the dollar may have more room to fall, this MAY be a good opportunity to buy the world’s reserve currency at a discount. However, the RSI is still not quite oversold, and I have too many doubts on the effect of interest rates this low for this long, government stimulus, strengthening of emerging markets, and inflation to be remotely bullish on the dollar’s prospects over the next 1-3 years.

For now, where possible, HEDGE OR SELL USD exposure.

Pay Very Close Attention to Inflation

Pay very close attention to the possible return of inflation within the next 6-12 months. The Fed has said it will allow the GDP to heat up, and it may overshoot in the medium-term as a result. Although JP Morgan and Goldman Sachs have cut their GDP growth estimates for Q1 2021, pay close attention to what happens in Q2 and Q3 once vaccines begin to be rolled out on a massive scale. It is only inevitable that inflation will return with the Fed’s policy and projected economic recovery by mid-2021.

If you are looking to the future to hedge against inflation, look into TIPS, commodities, gold, and potentially some REITS.

In the mid-term, I have BUY calls on the SPDR TIPS ETF (SPIP), the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC), the SPDR Gold Shares ETF (GLD), and the iShares Cohen & Steers REIT ETF (ICF).

Long-Term

While all of these headwinds may drive some short-term concerns, the progress made on the vaccine/treatment front cannot be ignored. With the vaccine rollout about to finally begin in the U.S., this may be the beginning of the end of the pandemic. There is certainly significant optimism for 2021 and beyond however, over the next 1-3 months, this could be a bumpy ride back to normalcy. Projections and predictions for the economy, the markets, and the pandemic are so all over the place right now, that the only real certainty is that nobody knows a thing, and nobody can predict the future. Meanwhile, the long-term outlook for equities, namely value stocks, and cyclicals, could be very positive. If there is a short-term pullback, it should be seen as an excellent buying opportunity.

Summary

While there is still some short-term tumult to close off this “interesting” year, we can officially enter 2021 with some glimmer of hope. Bear in mind that COVID-19 is still here and has not been eradicated. Until that happens, there will inevitably be a tug of war between vaccine optimism and health/economic pessimism.

Please keep in mind that markets are forward looking instruments and are investment vehicles that look 6-12 months down the road. However, it is very plausible that there could be some short-term uncertainty and volatility mixed in. But also remember how sharp and swift the rally was after the crashes in March.

Since markets bottomed on March 23rd, here is how the ETFs tracking the indices have performed: Russell 2000 (IWM) up 92.83%. Nasdaq (QQQ) up 78.94%. S&P 500 (SPY) up 64.94%. Dow Jones (DIA) up 62.50%.

In the long-term, markets always end up moving higher and are focused on the future rather than the present.

If everything goes well with distributing the vaccines, and the virus can be contained, the short-term volatility may be worth monitoring for opportunities before the eventual mid-term and long-term reality turns positive and stable in 2021.

To sum up all our calls, in the short-term I have a HOLD call for:

- the SPDR S&P ETF (SPY),

- Invesco QQQ ETF (QQQ)

- SPDR Dow Jones ETF (DIA), and

- iShares Russell 2000 ETF (IWM) (but consider buying on a pullback),

However, I am more bullish for these ETFs in the long-term.

For the mid-term, I recommend selling or hedging the US Dollar, and gaining exposure to emerging markets.

I have BUY calls on:

- The iShares MSCI Emerging Index Fund (EEM),

- the iShares MSCI China ETF (MCHI),

- the iShares MSCI Taiwan ETF (EWT), and

- the iShares MSCI Indonesia ETF (EIDO)

Additionally, because I foresee inflation returning as early as mid to late 2021…

I also have BUY calls on:

- The SPDR TIPS ETF (SPIP),

- the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC)

- the SPDR Gold Shares ETF (GLD), and

- the iShares Cohen & Steers REIT ETF (ICF)

Thank you.

Matthew Levy, CFA

Stock Trading Strategist