Trading position (short-term; our opinion): no positions are justified from the risk-reward perspective.

The S&P 500 upswing didn't materialize on Friday, and our decision to go short has paid off handsomely. Taking stocks to new 2020 lows on both intraday and closing basis, the bears clearly had a field day. As the S&P 500 closed the week near its lows, which way next for the badly battered stocks?

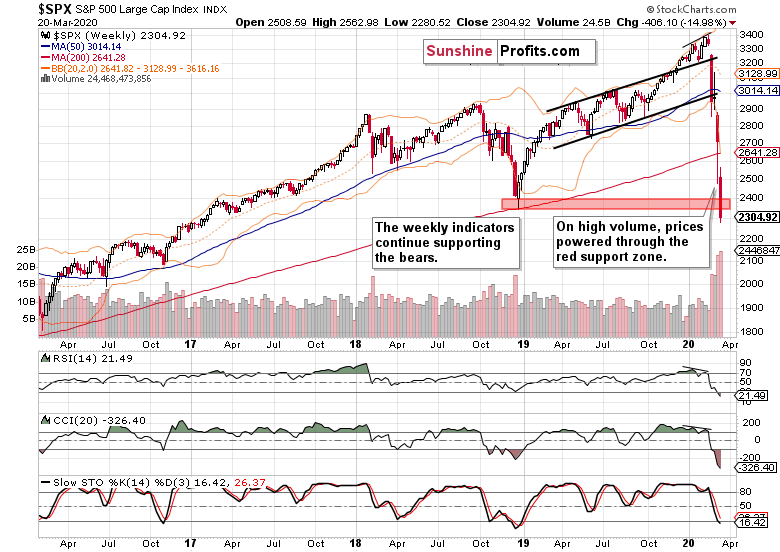

Let's start our analysis with the weekly chart examination (charts courtesy of http://stockcharts.com).

Prices broke down below the red support zone marked by the December 2018 lows. This is an important technical development that attests to the bears' strength just as much as the sizable weekly volume. As the weekly indicators continue to heavily favor the bears, it might seem that we're in for a one-way move lower in the coming days.

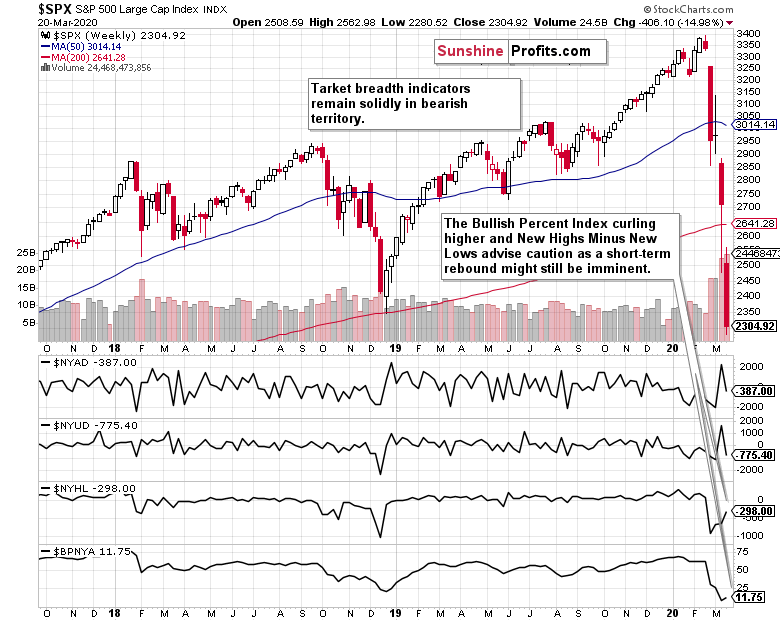

Not so fast. Consider the below weekly chart that takes a detailed look at the market breadth indicators.

While they all confirm the bears as being in the driving seat, new highs minus new lows reveals that the sellers aren't as strong as they appear to be when one looks at price action only. The bullish percent index has also curled higher despite new 2020 lows being hit.

As a result, the market breadth indicators indicate a high likelihood of pause in the trend of continuously lower prices. Be it in the form of a sharp rally that runs out of steam relatively fast, or a somewhat more prolonged sideways trading with a bullish bias, it nonetheless justifies our decision earlier today to take the 168-point profit on our short positions off the table.

As a reminder, we opened the wildly profitable short just as the upswing attempt was fizzling out on Friday when stocks were trading at 2385, and today's decision to cash in profits went out as the futures were trading at 2217. Since then, the upswing indeed materialized and reached almost 2240 before pulling back and spurting over 2270 as we speak.

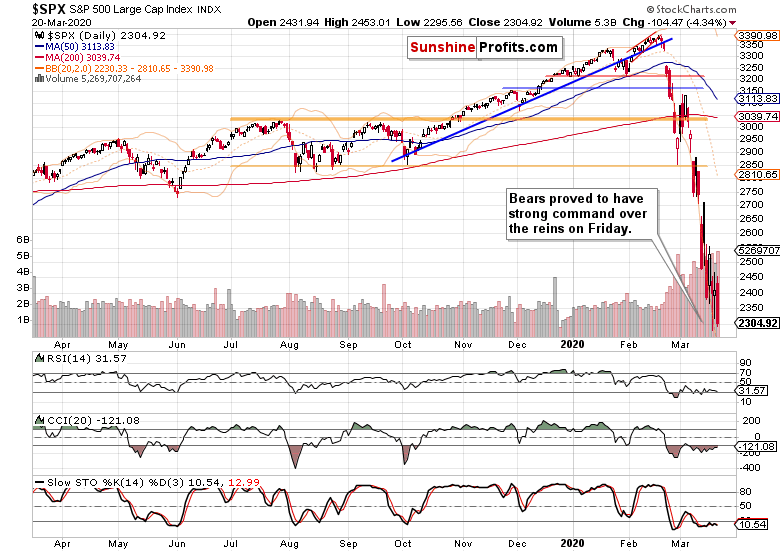

Let's check the daily chart's closing prices for more insights.

While the volume of Friday's downswing hasn't been outrageously high, it has still been elevated. Coupled with the price action, it doesn't scream that a lasting reversal higher is imminent. On one hand, the CCI points to gradually decreasing selling pressure. On the other hand though, both RSI and Stochastics keep flashing their extended readings to the downside.

Summing up, whilethe bears have the upper hand, the potential for a temporary upswing hasn't decreased despite Friday's slide. Quite to the contrary, and we plan to take advantage of it and position ourselves accordingly for the next big trade. At this moment though, the right course of action is to stay on the sidelines. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): no positions are justified from the risk-reward perspective.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care