Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): long positions with entry at 4,340 price level, with 4,020 as a stop-loss and 4,640 as an initial price target.

The S&P 500 went sideways yesterday, as investors hesitated following the recent rally. Will the short-term uptrend resume?

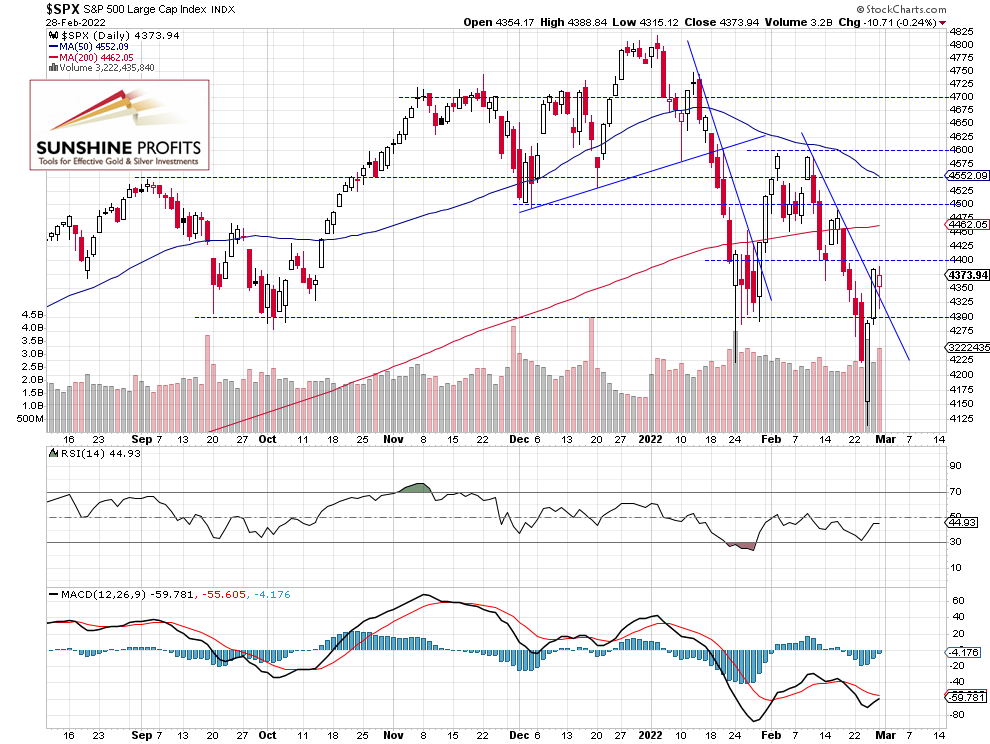

The broad stock market index lost 0.24% on Monday, after gaining 2.2% on Friday and 1.5% on Thursday. The sentiment improved following the Thursday’s rebound, but there’s still a lot of uncertainty following the ongoing Russia-Ukraine conflict news. On Thursday, the broad stock market reached the low of 4,114.65 and it was 704 points or 14.6% below the January 4 record high of 4,818.62. And yesterday it went closer to the 4,400 level. For now, it looks like an upward correction. However, it may also be a more meaningful reversal following a deep 15% correction from the early January record high.

The market sharply reversed its short-term downtrend, but will it continue the advance? This morning the S&P 500 index is expected to open 0.2% lower and we may see some more volatility.

The nearest important resistance level remains at 4,400 and the next resistance level is at 4,450-4,500. On the other hand, the support level is at 4,300-4,350, among others. The S&P 500 index broke slightly above the downward trend line, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Futures Contract Remains Above the 4,300 Level

Let’s take a look at the hourly chart of the S&P 500 futures contract. On Thursday it sold off after breaking below the 4,200 level. Since Friday it is trading along the 4,300 mark.

We are still expecting an upward correction from the current levels (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index fluctuated following the recent rally yesterday. This morning it is expected to open 0.2% lower and we may see some further volatility. Obviously, the markets will continue to react to the Russia-Ukraine conflict news.

Here’s the breakdown:

- The S&P 500 index bounced from the new low on Thursday after falling almost 15% from the early January record high.

- We are maintaining our speculative long position (opened on last Tuesday at 4,340)

- We are expecting an upward correction from the current levels.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): long positions with entry at 4,340 price level, with 4,020 as a stop-loss and 4,640 as an initial price target.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care