-

Stocks Will Open Lower Again – Temporary Bottom?

January 24, 2022, 8:59 AMAvailable to premium subscribers only.

-

S&P 500 – Should We Buy the Dip?

January 21, 2022, 9:12 AMThe S&P 500 index broke below its early December low. Are we in a new bear market or is this still just a downward correction?

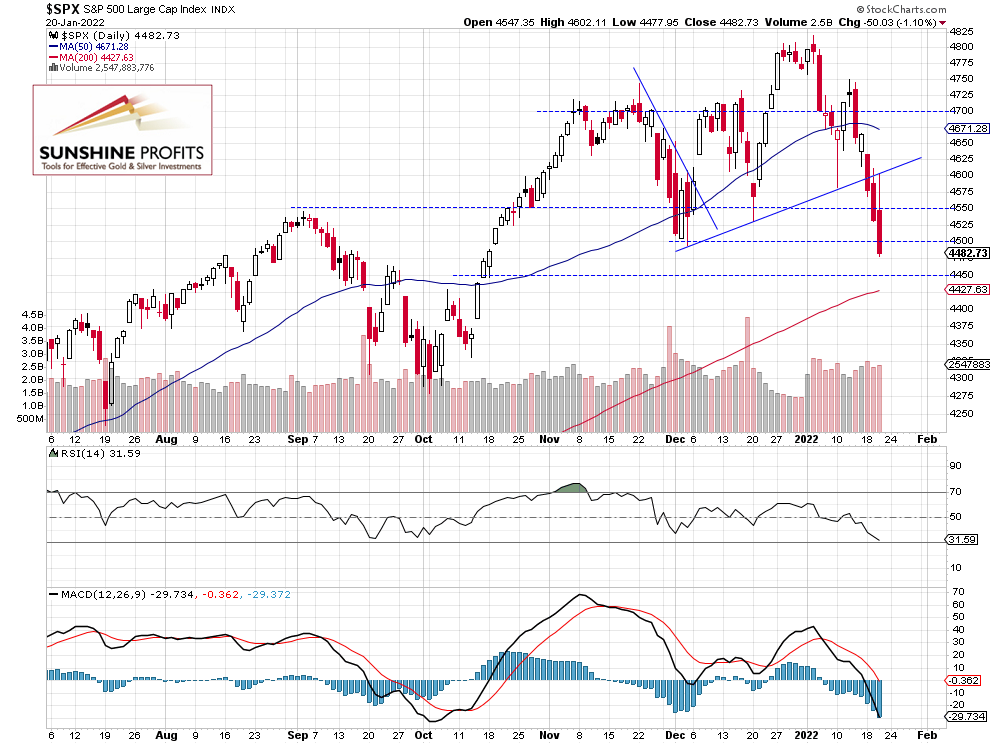

The broad stock market index lost 1.10% on Thursday following its Wednesday’s decline of around 1%. The S&P 500 index fell below the 4,500 level and it was the lowest since mid-October. Investors reacted to quarterly earnings releases and further Russia-Ukraine tensions. Late December – early January consolidation along the 4,800 level was a topping pattern and the index retraced all of its December’s record-breaking advance. This morning the market is expected to open 0.4% lower and it will most likely extend the downtrend.

The nearest important resistance level is now at around 4,500-4,525, marked by the recent support level. On the other hand, the support level is now at around 4,450. The S&P 500 broke below an over month-long upward trend line this week, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Futures Contract Broke Below its Previous Lows

Let’s take a look at the hourly chart of the S&P 500 futures contract. The market broke below its previous local lows along the 4,520 level. There was a chance that entering a long position would be justified here, but any short-term bullish scenario seems invalidated now. On the other hand, it may be too late to enter a short position right now, because of some clear technical oversold conditions. (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index is expected to open 0.4% lower this morning, so it will likely extend a short-term downtrend. We may see another intraday rebound, but there have been no confirmed positive signals so far. Yesterday we’ve seen a convincing rally, but it failed and the market sold off to new lows. The coming quarterly earnings releases (next week we’ll have MSFT, AAPL, TSLA among others) remain a bullish factor for stocks, but there is still a lot of uncertainty concerning Russia-Ukraine tensions.

Here’s the breakdown:

- The S&P 500 reached yet another new low yesterday and it was the lowest since mid-October.

- Stocks will most likely bounce at some point, but any rally may be short-lived.

- In our opinion no positions are currently justified from the risk/reward point of view.

Today's premium Stock Trading Alert includes details of our trading position. Interested in more exclusive updates? Join our premium Stock Trading Alerts newsletter and read all the details today.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care -

Will Stocks Break Below the Early December Low?

January 20, 2022, 9:21 AMAvailable to premium subscribers only.

-

S&P 500 – Mixed Signals, More Uncertainty Expected

January 19, 2022, 9:25 AMAvailable to premium subscribers only.

-

Stocks Will Open Lower, but Bulls May Regain the Ground

January 18, 2022, 9:21 AMStocks remained above their previous low on Friday, and today they are expected to open much lower. Will the downtrend continue?

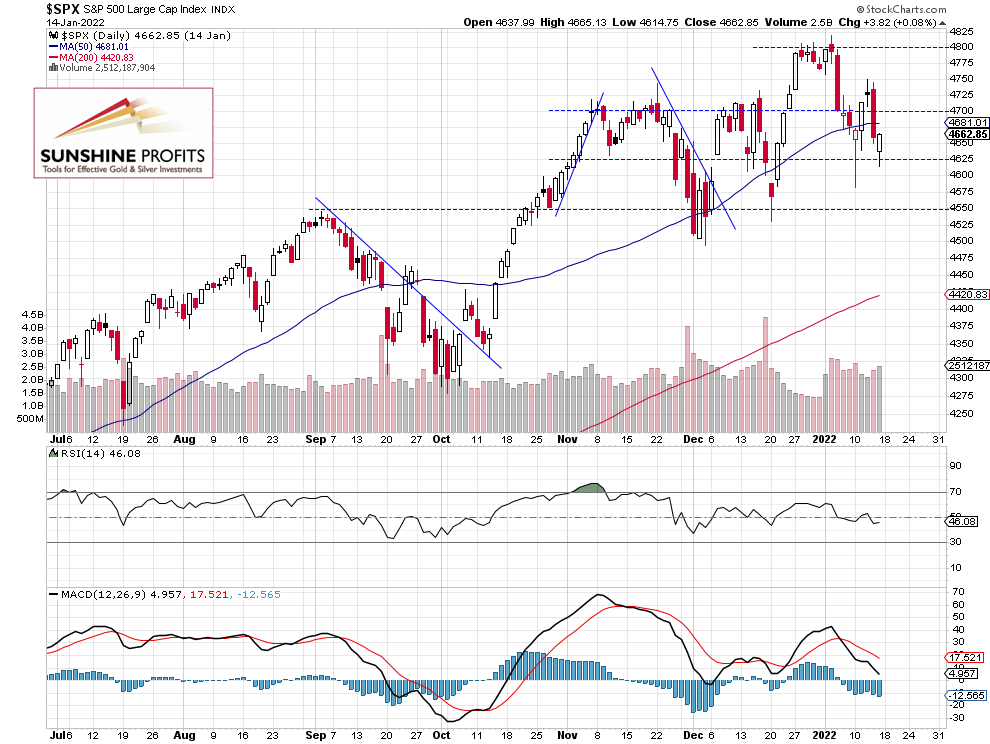

The S&P 500 index gained 0.08% and it closed at 4,662.85 on Friday after bouncing from the daily low of 4,614.75. The broad stock market’s gauge remained above its Jan. 10 local low of 4,582.24. It continues to trade within an over two-month long consolidation. Late December – early January consolidation along the 4,800 level was a topping pattern and the index fell to its previous trading range. This morning the market is expected to open 0.9% lower so we may see an attempt at breaking below the 4,600 level.

The nearest important resistance level is at around 4,680-4,700. On the other hand, the support level is at 4,580-4,600, marked by the recent local low. The S&P 500 is still trading within a medium-term consolidation, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

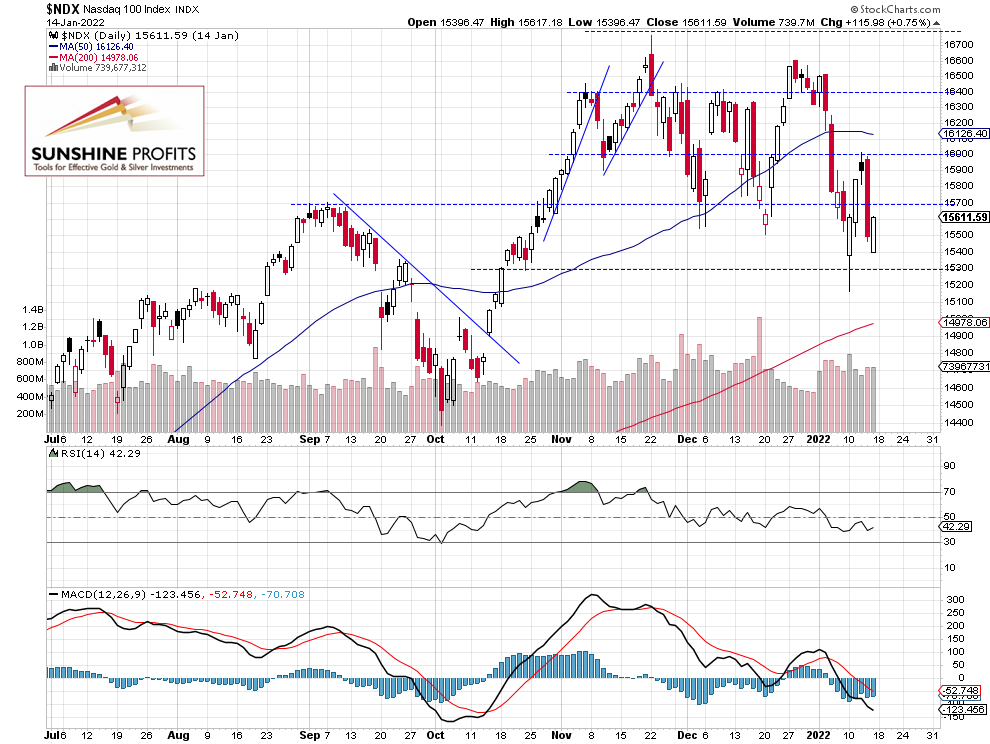

Nasdaq 100 Bounced from 16,000 Resistance Level

The technology Nasdaq 100 index remains relatively weaker than the broad stock market. On Jan. 10 it fell to the local low of 15,165.53. The Nasdaq 100 was almost 1600 points or 9.5% below the Nov. 22 record high of 16,764.85. Last week it bounced from the 16,000 level and it went closer to the local low again. It still trades along the September’s local high, as we can see on the daily chart:

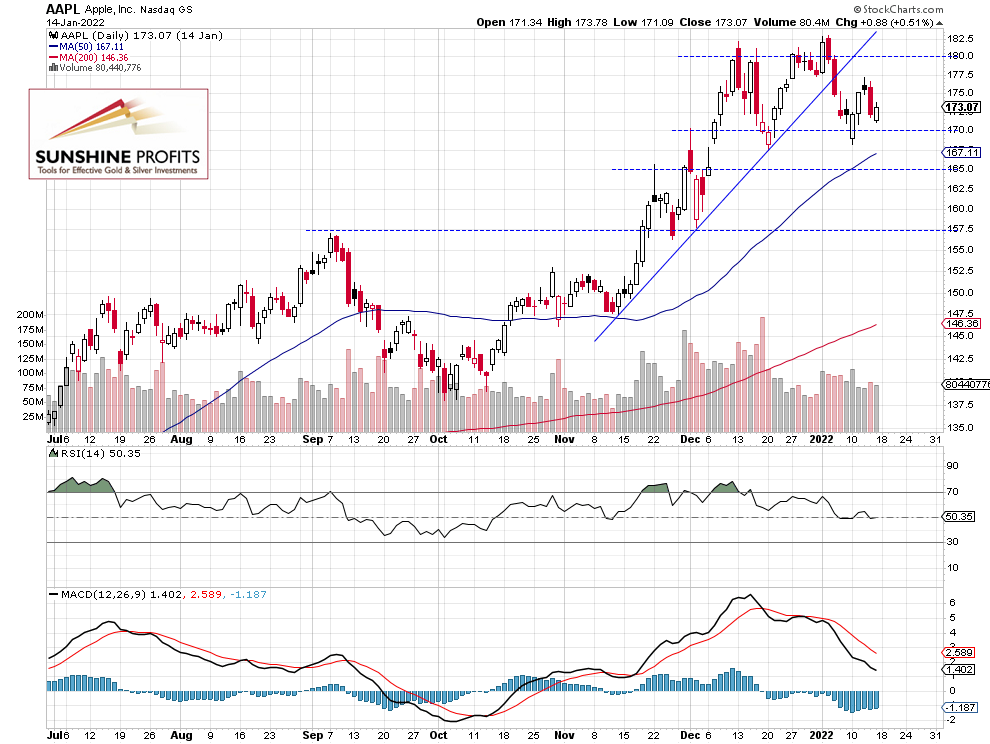

Apple Extends its Consolidation

Recently, Apple stock broke below its two-month long upward trend line after reaching the new record high of $182.94. So far, it looks like a downward correction and the nearest important support level is at $165-170, marked by the previous highs and lows. The stock trades within an over month-long consolidation of around $170-180.

Is this a medium-term topping pattern? It’s getting very hard to fundamentally justify the Apple’s current market capitalization of around $3 trillion.

Conclusion

The S&P 500 index is expected to open 0.9% lower this morning following global stock markets’ weakness amid Russia-Ukraine tensions and worse-than-expected economic data releases. So the market will get close to the recent local lows and the support level of around 4,580-4,600 again. There have been no confirmed short-term positive signals so far. However, we may see another intraday rebound later in the day. The quarterly earnings releases remain a bullish factor for stocks.

Here’s the breakdown:

- The S&P 500 will likely get back to the 4,600 level this morning; later we may see another intraday rebound.

- In our opinion no positions are currently justified from the risk/reward point of view.

Today's premium Stock Trading Alert includes details of our trading position. Interested in more exclusive updates? Join our premium Stock Trading Alerts newsletter and read all the details today.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care

Free Gold &

Stock Market Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM