-

Stocks Seem Unfazed By the Stimulus Promise, So Far

March 11, 2020, 9:20 AMAfter Monday's plunge, stocks staged a rebound on Trump's stimulus promises. While the bulls closed higher than the market opened on Monday, was it a resounding show of their strength?

Let's jump right into the daily chart to find out (chart courtesy of http://stockcharts.com).

In short, we doubt that it revealed buyers' strength. As the traders say, even dead cats bounce. The bulls didn't even manage to challenge the sizable Monday's gap. Also the volume on the upswing was lower than that of the preceding downswing, raising further doubts about the bulls' strength.

In light of the above, we're of the opinion that the daily indicators' divergencies can't be trusted and that the indicators will head to new lows instead. As a result, our open short and around 60 points in the black position remains justfied. New 2020 lows are very likely ahead of us - that's a pretty safe bet to make as the S&P 500 futures are trading at around 2770 currently.

Due to the sizable volatility, we have to work with wide enough stop-losses and initial downside targets. In these times, we'll be better off managing the open position accordingly. As we have written yesterday, remember that you can adjust your position sizing if the short position would mean risking a higher trading account percentage than you're comfortable with.

Summing up, yesterday'supswing fueled by the contemplated stimulus, isn't really convincing, and both the weekly and daily charts keep sending bearish messages. The downswing appears likely to have further to go on the downside before the market regains confidence in a lasting turnaround. Therefore, keeping open the profitable short positions is justified.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, we encourage you to sign up for our Stock Trading Alerts to also benefit from the trading action we describe - the moment it happens. The full analysis includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care -

Will Trump's Stimulus Hint Turn Stocks Around?

March 10, 2020, 9:25 AMAfter Thursday's rise, stocks went ever deeper into red since. Driven by incoming bad coronavirus news both in the US and abroad, not even Friday's strong employment data stopped the selling. Monday's bloodbath even caused trading to be halted for quite some time. This hasn't happened since September 2008. Stocks continued lower, yet made a comeback in today's overnight session. Will it fizzle out again?

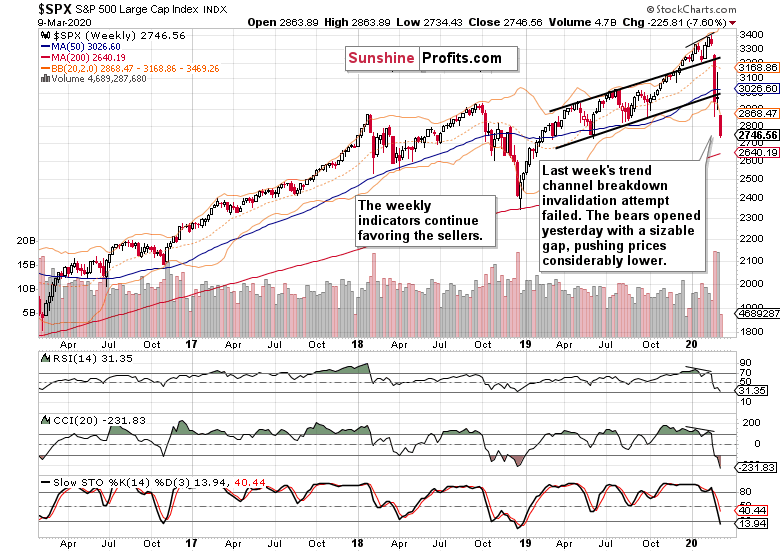

Let's jump right into the weekly chart (charts courtesy of http://stockcharts.com).

Last week's upswing attempt has failed, and the bulls couldn't invalidate the breakdown below the rising black trend channel's lower border. Yesterday, the index has shaved off 7.5%, closing at the March and June 2019 lows. Will this support be strong enough to stop further selling?

We doubt that. The emergency 0.5% rate cut didn't instill confidence in the market, and bad coronavirus news kept coming in. Maybe today's lockdown of Italy is being cheered but the US infections rate just keeps going up while all the existing coronavirus mutations are presumably doing fine in the US. South Korea's rigorous testing approach hasn't been replicated yet in the States either. Neither has the Singapore's contact tracing approach.

In other words, there's no turnaround on the immediate US horizon, and the current monetary and fiscal response is being perceived as inadequate. But Trump has just hinted at possible stimulus measures on the way. Tax relief is being considered for his upcoming meeting with the House and Senate Republicans.

This news has sent S&P 500 futures around 4% higher, as they reached 2879. With the weekly indicators solidly in the bearish territory, let's check the daily chart's closing prices first, and elaborate on our action plan thereafter.

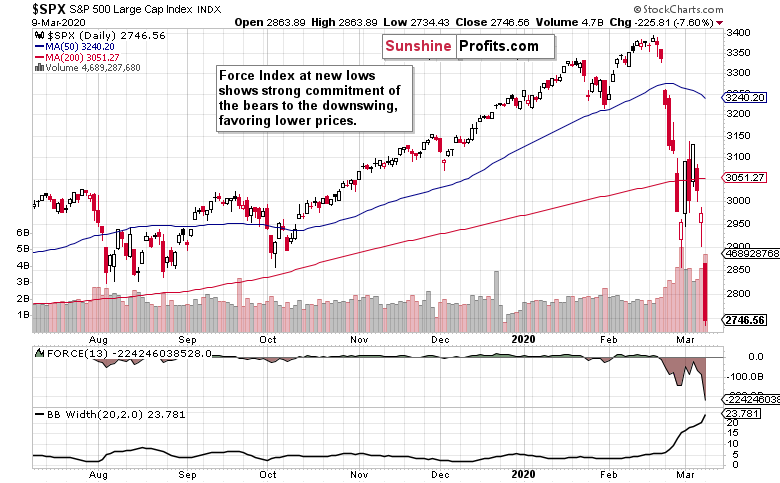

Monday's downswing took stocks below the lower orange support. The volume was elevated, but not of the outrageously high kind typically associated with a washout bottom. Daily indicators have predictably turned lower, and the question for bottom fishers is whether they will flash reliable divergencies any time soon.

Today's premarket upswing would favor the daily indicators to turn higher. But will the upswing stick? The bulls have already been at 2879 earlier today, which is above the lower orange zone. Yet, they have given up their gains as stocks change hands at around 2845 currently. This price action appears to be no more than verification of the breakdown below the orange support.

Let's check the message of the Force Index.

Force Index is a unique type of oscillator, because it's not built just around prices. It takes into account volume, and that's its key advantage. Designed by Alexander Elder, the indicator has much to say about the current setup.

Yesterday, it has made a new low, beating the late-Feb bottom. Bears are putting their money where their mouth is, and that means that selling isn't likely over just yet. Or have we seen a positively breaking coronavirus development or an overwhelming monetary or fiscal policy response that has the power to turn the market truly around?

In a word, not yet. Unless the contemplated stimulus achieves that, prices are more likely to go down that to go up. Despite all the volatility, a true panic hasn't apparently yet set in.

Taking all the above into account, opening short positions is justified at the moment of writing these words. Due to the sizable volatility, we have to work with wide enough stop-losses and initial downside targets to avoid being narrowly taken out of the market when we get the prevailing directional move right. In such times, we'll be better off managing the open position accordingly. Remember that you can adjust your position sizing if the short position would mean risking a higher trading account percentage than you're comfortable with. Position details are reserved for our subscribers.

Summing up, last week'supswing attempthas predictably fizzled out, and both the weekly and daily charts are sending bearish messages. Despite the considered stimulus, the downswing appears likely to have further to go on the downside before the market regains confidence in a lasting turnaround. Therefore, opening short-positions is justified.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, we encourage you to sign up for our Stock Trading Alerts to also benefit from the trading action we describe - the moment it happens. The full analysis includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care -

Stocks Seem Not Convinced by Yesterday's Surprise Cut

March 4, 2020, 9:58 AMStocks opened up on a bullish note yesterday, but the bulls gave up all of their gains and then some. This has happened despite the Fed's surprise rate cut that intended to calm the markets. As stocks closed the day back below the key support, where does that leave them exactly?

Let's jump right into the daily chart (charts courtesy of http://stockcharts.com).

Yesterday's early gains have evaporated, and stocks broke back below the upper orange support zone. But if it were a lasting reversal lower, the volume could have been higher. As it was in line with the preceding upswing's one, we can't read too much into this metric alone.

The daily indicators though, are starting to turn positive. Stochastics with its buy signal left the oversold zone, and so did the RSI despite yesterday's downswing. And the CCI is on the verge of leaving its extreme territory as well.

It would still seem premature though to declare an end to the sharp correction. It's because yesterday's session shows that the Fed move failed to calm the markets. Stocks were questioning the reason to rally further, and the decision's aftermath smacked of buy the rumor, sell the news.

With the S&P 500 futures trading at around 3060 as we speak, stocks pared over half of their yesterday's losses. However, they're still consolidating around the orange support zone, and the rebound from Friday's lows looks to have stalled despite the supportive Fed announcement. This doesn't bode well for the bulls in the short-term.

Let's quote these yesterday's observations:

(...) it appears quite likely that the bears will at some point test the bulls' resolve. As a result, there would be more short-term risk to the downside rather than to the upside.

Coupled with the scenario of the daily indicators working out their oversold readings while prices goes sideways to marginally higher, it would favor more downside in the coming sessions.

Let's check how the risk-off trade is doing. Do the Treasuries and Japanese yen support the bearish analysis?

The long end of the curve is represented by the 30-year Treasury note. As the Fed controls the short-term interest rates, this bond represents the long-term views of the market. And despite the partial recovery from yesterday's plunge, the sliding yields keep flashing red. That is dangerous to the stock market bulls.

Okay, long-dated bonds aren't impressed yet. Perhaps the yen would show that a turnaround is approaching?

Nope. Fresh 2020 lows have been made yesterday. The risk-off trade is still doing fine.

Taking all the above into account, opening short positions appears to be justified at the moment of writing these words. The probable downswing offers us a favorable setup from the risk reward point of view regardless of the positively-leaning daily indicators. We expect the market to question yesterday's remedy offered in short order. Remember, the Fed can't by fiat cause the supply chains to return to the pre-coronavirus state, or repair the shaken confidence in consumers' minds. As it's quite likely that the situation on the ground will still get worse before it gets better, the short position in the currently high volatility is justified. The position details are reserved for our subscribers.

Summing up, it's true thatthe medium-term S&P 500 outlook has improved with yesterday's price action and that the daily chart is starting to send some bullish signals. It's however the reaction to the Fed's accommodation that has us on guard and of the opinion that there remains some more work to do on the downside before a lasting recovery takes place. The very short-term balance of forces thus appears to slightly favor the bears, and is favored also by the risk-off trade performance. Therefore, opening short-positions with a reasonably close take-profit target is justified.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, we encourage you to sign up for our Stock Trading Alerts to also benefit from the trading action we describe - the moment it happens. The full analysis includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care

Free Gold &

Stock Market Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM