Briefly: In our opinion no speculative positions are justified.

Our intraday outlook remains neutral, and our short-term outlook is neutral, following recent move up:

Intraday

(next 24 hours) outlook: neutral

Short-term (next 1-2 weeks) outlook: neutral

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

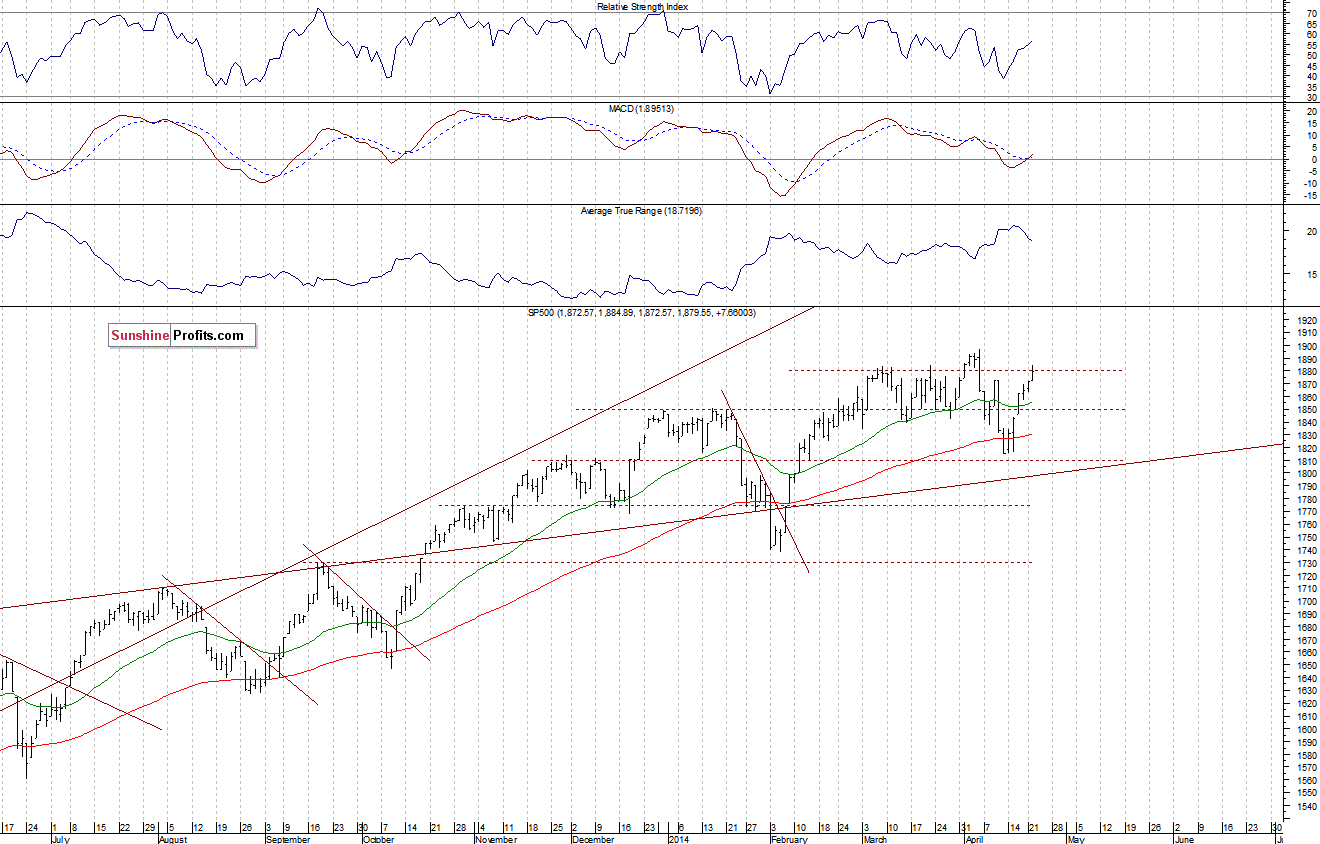

The U.S. stock market indexes gained 0.4-0.8% on Tuesday, extending their short-term uptrend, as investors awaited quarterly earnings releases, economic data announcements. The S&P 500 has got closer to its April 4 all-time high of 1,897.28 (yesterday’s session daily high at 1,884.89). The resistance is at 1,880-1,900, and the nearest important support level is at around 1,840-1,850, marked by previous local highs and lows. The next support remains at 1,800-1,810. For now , it looks like an extension of the medium-term consolidation, as the index continues to fluctuate above its December-January consolidation, as we can see on the daily chart:

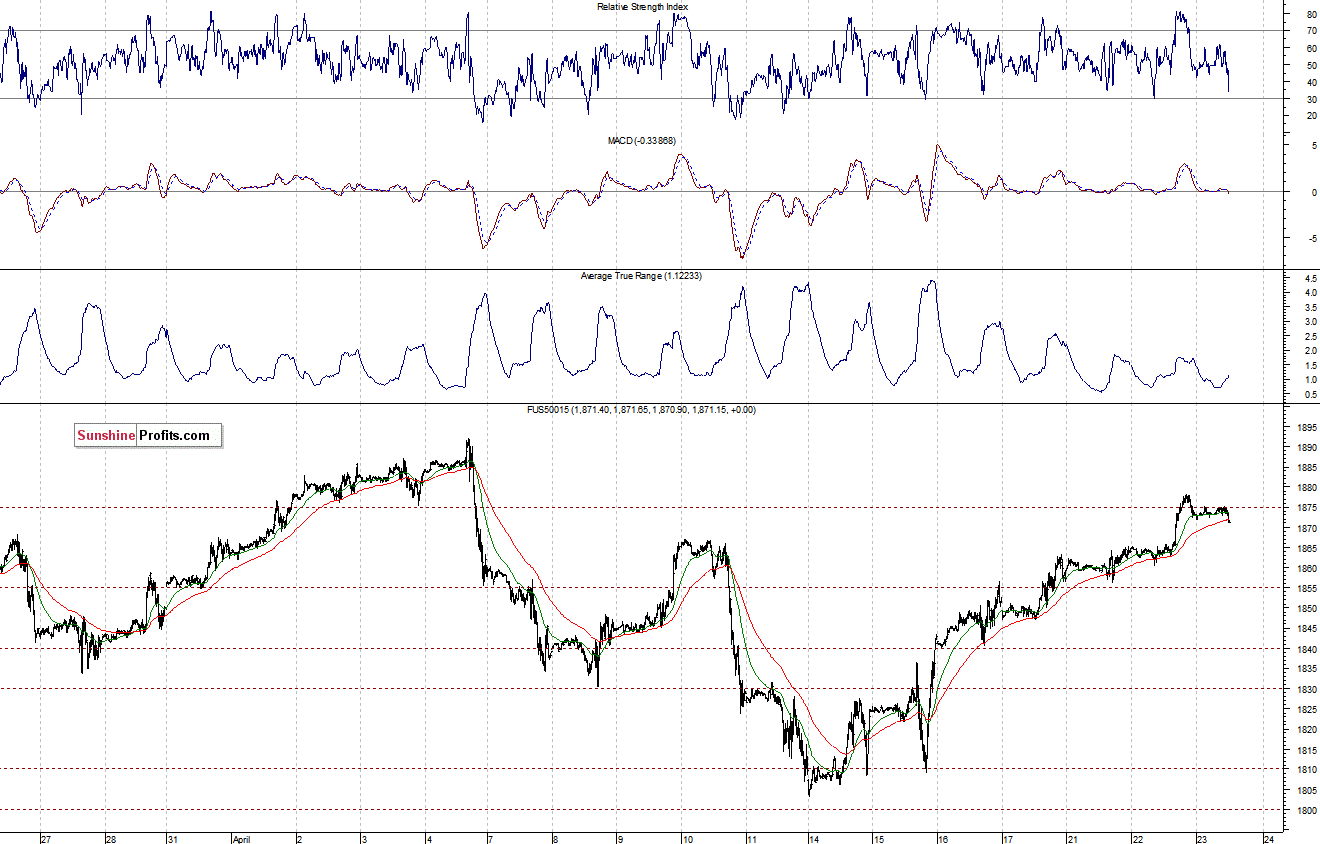

Expectations before the opening of today’s session are virtually flat, as the main European stock market indexes have lost between 0.2% and 0.4% so far. Investors will now wait for the New Home Sales number announcement at 10:00 a.m., and some further quarterly earnings reports, including Apple Inc.’s release (after session’s close), among others. The S&P 500 futures contract (CFD) trades near its local highs, testing the resistance at around 1,880-1,890. The support level is at 1,855-1,865. The market remains in a short-term uptrend, however, within its month-long consolidation:

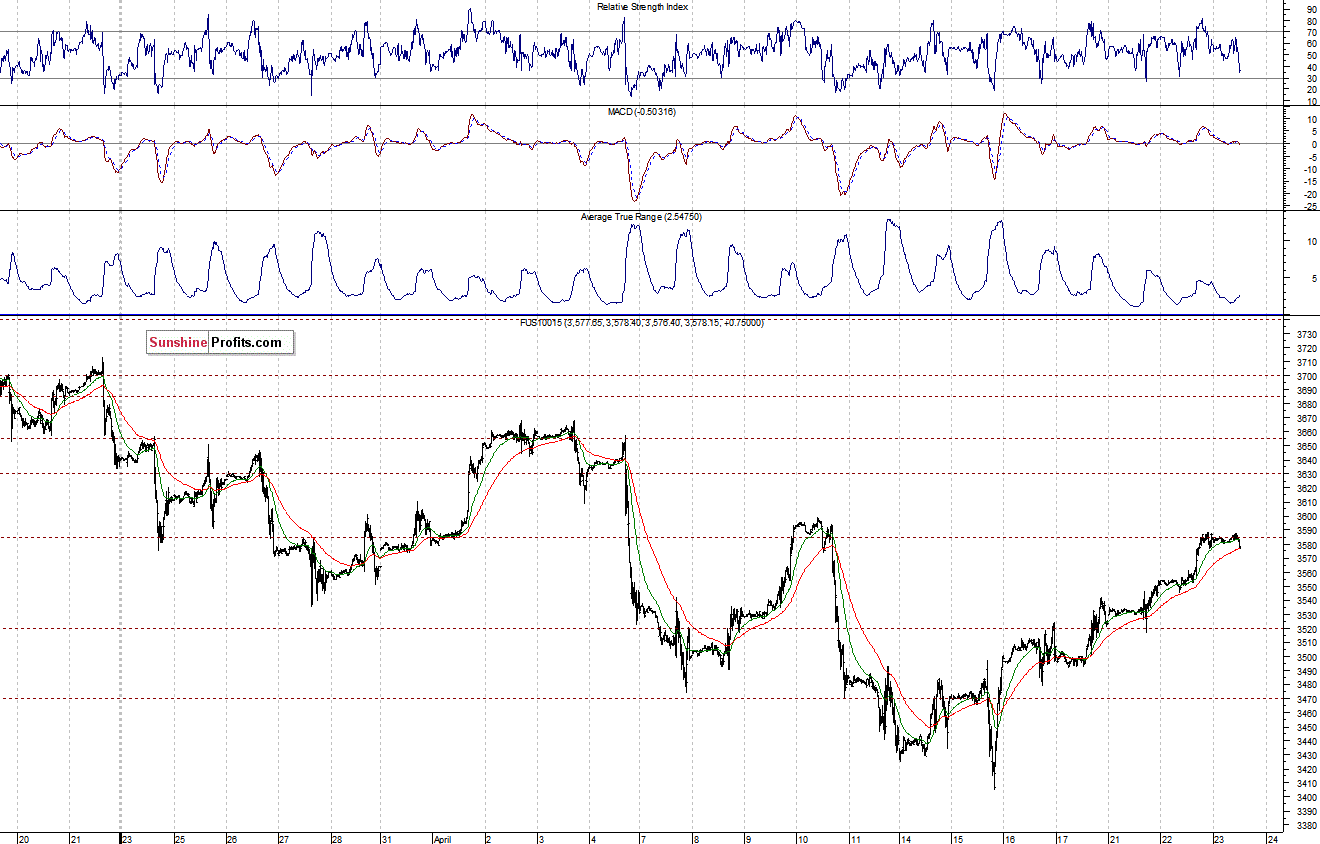

The technology Nasdaq 100 futures contract (CFD) trades in a relatively narrow intraday range, following recent move up. The resistance is at the psychological level of 3,600. There have been no confirmed negative signals so far, as the 15-minute chart shows:

Concluding, there is some short-term uncertainty as broad stock market S&P 500 index gets closer to its early March all-time high at around 1,900. We will wait for another opportunity to open a trading position - at this time opening one doesn't seem justified from the risk/reward point of view.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts