There’s not a rigid definition of what an emerging market is. For example, China is still the leading country in many emerging market ETFs and funds. But is it fair to consider China an emerging market any longer? It has nearly 1.4 billion people and was the only major economy globally to see GDP growth in 2020.

That’s like calling Giannis Antetokounmpo an up and coming superstar despite winning the last two NBA MVP awards.

But even if I did see China as an emerging market, it wouldn’t be my top choice for 2021.

If you’ve been reading my newsletters, you know that I love emerging market exposure this year. The dollar is weakening and should continue to weaken with trillions more in stimulus and rising commodity prices.

Meanwhile, emerging markets are perfectly positioned to exploit this and grow as a result.

You also know that I’ve been talking about specific emerging markets like Taiwan, Thailand, and Russia.

But in this special emerging markets newsletter, I will aim to further talk about what to look for when investing in a country, what other emerging markets to consider, and why I think they are set to outperform the US markets this year, after many years of underperformance.

Why emerging markets?

For several reasons!

For one, did you know these facts about emerging markets? They have:

-85% of the world population

-77% of the land mass

-63% of global commodities

-59% of global GDP (using PPP)

-12.5% of world’s market cap

Consider this for long-term investing too. Advanced economies are aging rapidly while emerging economies have youthful demographics.

That’s why PWC believes that emerging markets (E7) could grow around twice as fast as advanced economies (G7) on average.

For emerging markets, this could be very advantageous in the coming decades.

With American debt building up at an alarming rate, and the U.S. Dollar set for broader declines, this trend could begin sooner than we realize.

U.S. investors also usually have >5% exposure to emerging markets, making this an even more untapped opportunity.

Aren’t emerging markets risky?

Of course, you have to consider political risk, credit risk, and economic risk for emerging markets.

But did you see the U.S. Capitol two weeks ago? Have you noticed how its currency has performed since March?

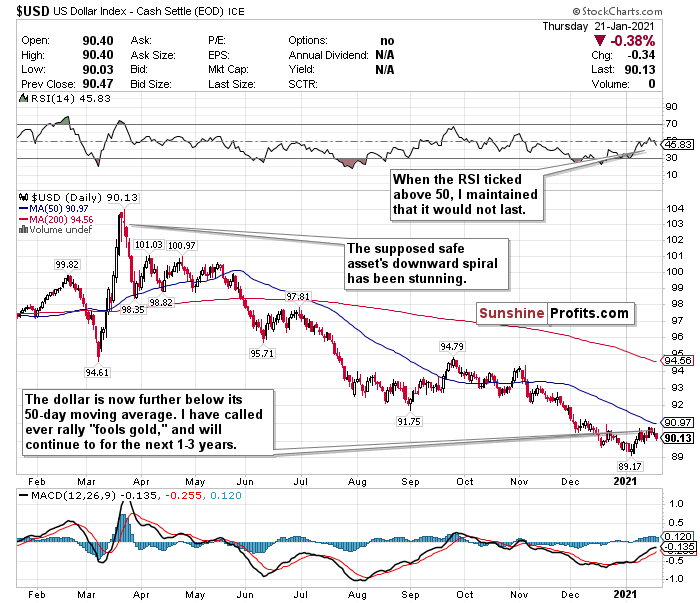

Figure 1- U.S. Dollar $USD

Have you also seen the Fed’s balance sheet? Have you seen the S&P’s valuation and the tech IPO market?

I would even argue that emerging markets could hedge against America’s political, economic, and currency risks right now. The pandemic only exacerbated this.

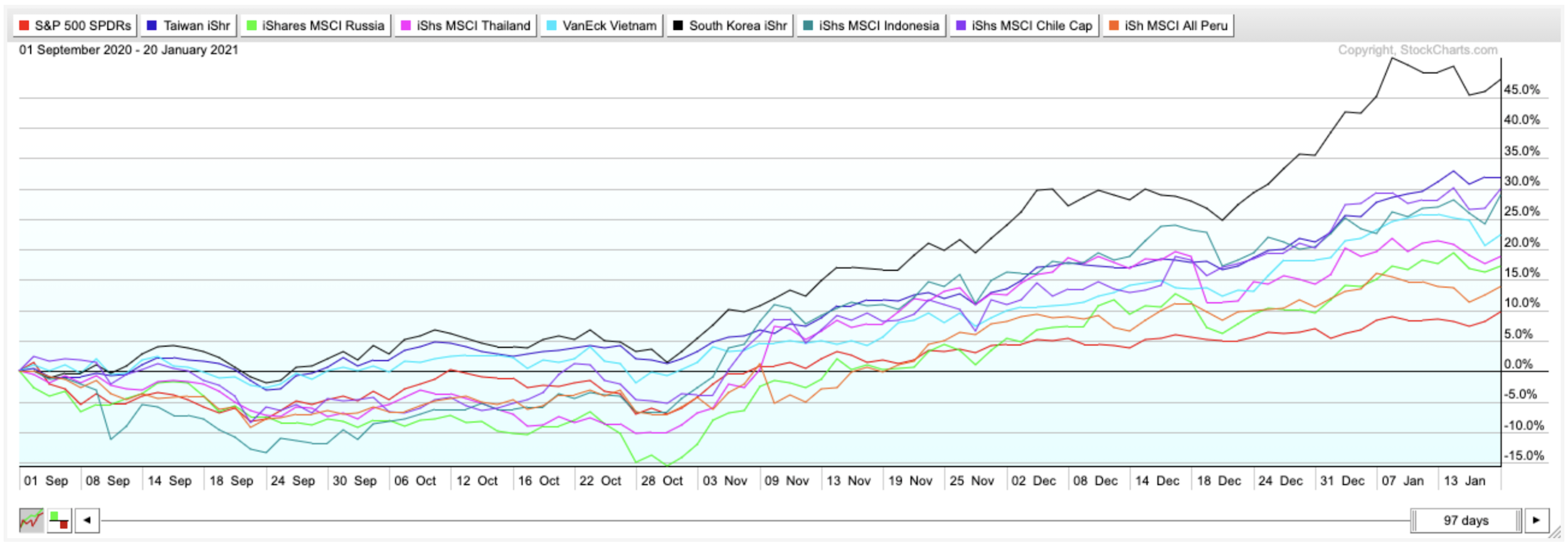

Furthermore, if you look at the returns of the emerging markets I will discuss today: Taiwan (EWT), Thailand (THD), Russia (ERUS), Vietnam (VNM), South Korea (EWY), Indonesia (EIDO), Chile (ECH), and Peru (EPU), you will see that all have outperformed the S&P 500 (SPY) since September.

Figure 2-SPY, EWT, ERUS, THD, VNM, EWY, EIDO, ECH, EPU comparison chart- Sep. 1, 2020-Present

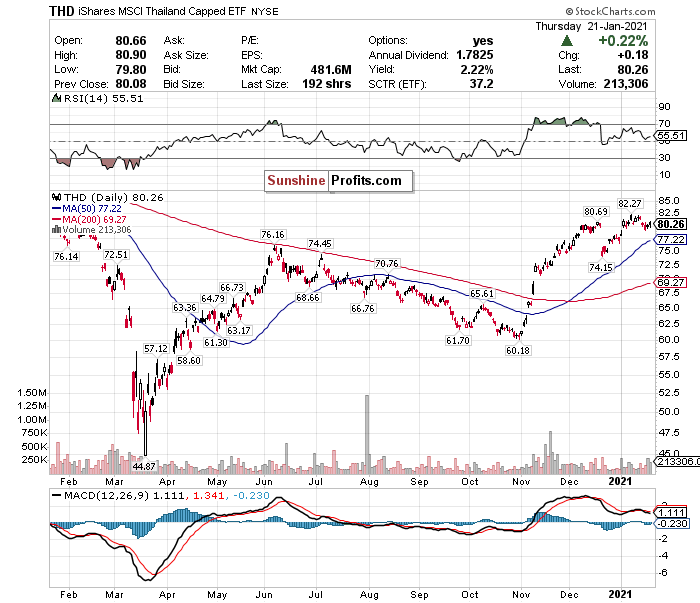

iShares MSCI Thailand ETF (THD)

Figure 3-iShares MSCI Taiwan ETF (EWT)

The iShares MSCI Thailand ETF (THD) is an undervalued opportunity to add exposure to a fledgling economy in the fastest-growing region in the world.

I have been consistently citing a Bloomberg study from December 16th that projected Thailand to be the top performing emerging market in 2021. Thailand topped the list due to abundant reserves and a high potential for portfolio inflows.

Thailand's ETF, compared to the other ETFs I will discuss, has performed relatively middle of the pack since September. But this is an undervalued opportunity with tremendous upside. Thailand is a newly industrialized economy with strong growth potential thanks to a rapidly expanding population and growing worldwide exports.

Thailand's economy is also the second-largest in Southeast Asia (behind Indonesia). It has an average long-term GDP growth of around 4-5% per year that has been primarily driven by its strong auto industry and exports of rice and other agricultural commodities.

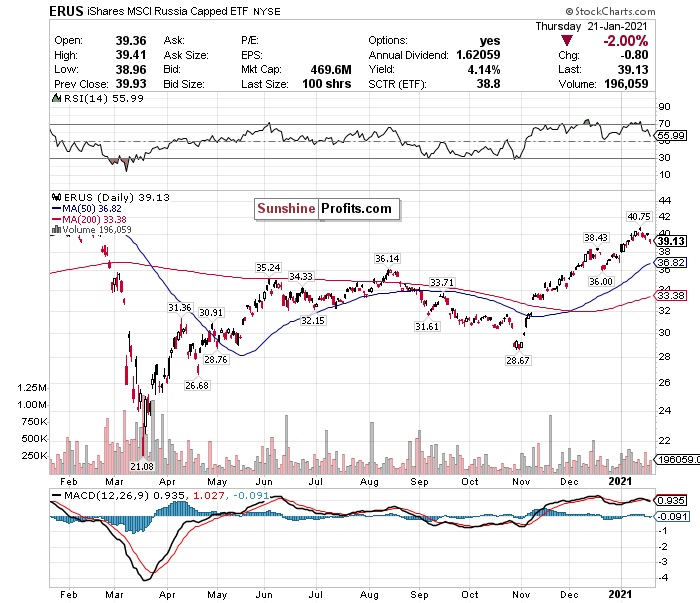

iShares MSCI Russia ETF (ERUS)

Figure 4-iShares MSCI Russia Capped ETF (ERUS)

Russia came in second in that same Bloomberg study due to robust external accounts, a robust fiscal profile, and an undervalued currency.

Russia gets stigmatized because, well, it’s Russia. I get it. It’s cold; it’s dreary, it’s corrupt, and it has a checkered past. But I challenge you as an investor to take perceptions out of the equation and see why Russia could be an excellent opportunity for 2021.

For one, Russia has a scorching hot growth rate as one of the fastest-growing emerging markets globally.

It also has one of the hottest commodity markets in the world. With the dollar set to plummet and commodity prices set to soar, do not overlook this. Russia is also the world's largest exporter of natural gas, one of the world’s largest oil producers, and one of the world’s largest steel producers.

Russia's information technology (IT) and telecom sectors are also noticeably growing. The country’s software industry is primarily one of the fastest-growing markets in the world (see Yandex).

Furthermore, while the U.S. and other developed markets continue to struggle with growing income inequality, Russia’s population of 142 million is seeing personal incomes grow at an estimated 10% to 15% per year.

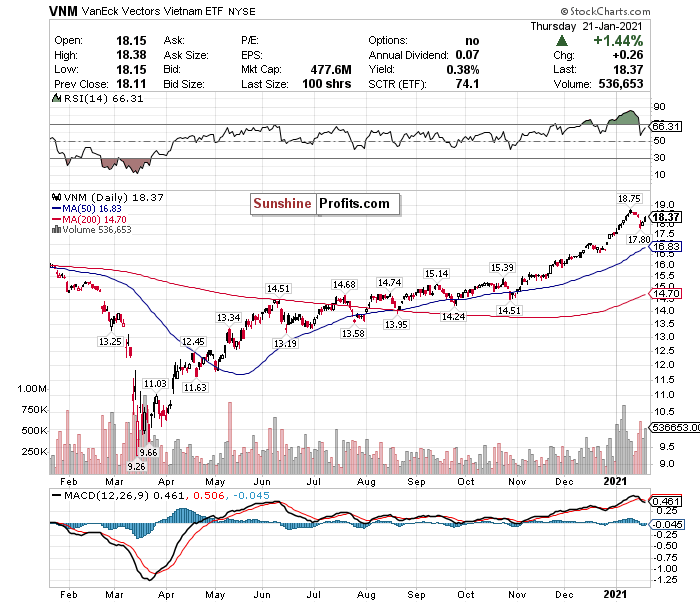

VanEck Vectors Vietnam ETF Vietnam (VNM)

Figure 5-VanEck Vectors Vietnam ETF Vietnam (VNM)

Since the Asia financial crisis in 1997, Vietnam has turned itself into an economy with a stable credit rating, strong exports to the U.S., and modest public debt relative to its growth rates. It has grown at an average rate of 4% and 8% per year since 1997.

According to PWC, Vietnam could also be the fastest-growing economy globally, with a potential annual GDP growth rate of 5.2%. This could possibly make it the 20th largest economy in the world by 2050.

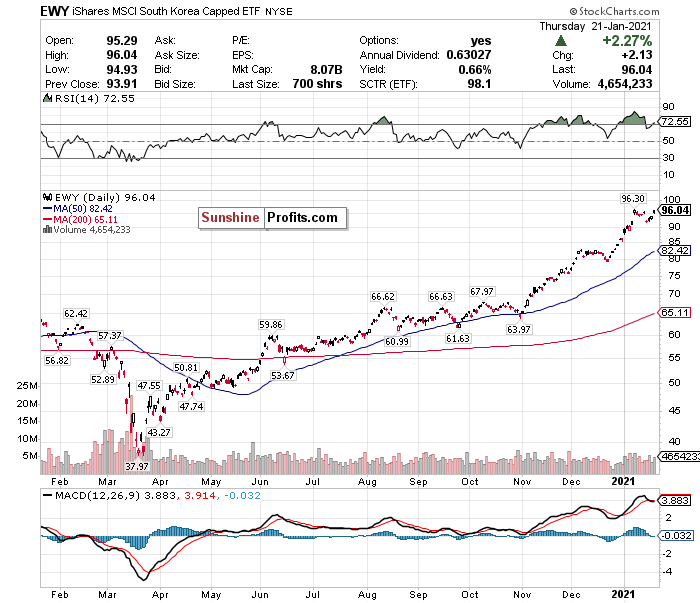

iShares MSCI South Korea ETF (EWY)

Figure 6-iShares MSCI South Korea ETF (EWY)

South Korea is booming. The Korean economy is another economy that’s hard to consider an emerging market any longer. The country’s GDP has surged in the last decade and now represents 2.47% of the global economy. It currently ranks 11th in the world by nominal GDP and 12th by PPP. South Korea's economy could also grow at 3.9-4.2% through 2030.

Out of all today’s country-specific ETFs, the iShares MSCI South Korea ETF (EWY) has performed the best. Since the start of the year, the EWY has surged by nearly 8.75%, 50% since September, and by a whopping 148.35% since the market bottomed on March 23rd.

South Korea is a rare international opportunity with both a stable economy and high growth potential. Despite not having natural resources and experiencing overpopulation, South Korea has consistently been a rapidly growing economy thanks to its exports in both the automotive industry and in consumer electronics- ie. Hyundai Kia and Samsung.

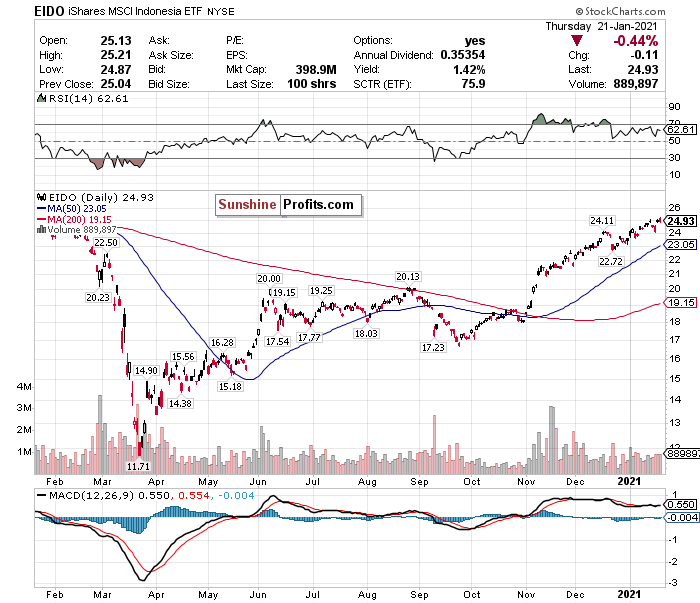

iShares MSCI Indonesia ETF (EIDO)

Figure 7-iShares MSCI Indonesia ETF (EIDO)

Indonesia is the largest economy in Southeast Asia and also has one of the youngest populations. A little known fact is that it’s also the fourth most populated country in the world. Because its population is so young and its economy has been growing so fast, many economists believe it should be considered one of the top emerging markets.

Ever since the 2008 financial crisis, Indonesia has been one of the world's top-performing economies. According to a study by MSCI and Bloomberg, Indonesia may also be less risky than other emerging markets due to its annual rate of return and beta of less than 0.8.

Most importantly, because Indonesia is so populous yet has a lower market cap than other emerging markets, it has more room to grow than comparable countries. Currently, Indonesia’s GDP ranks 15th (nominal) and 7th (PPP). By 2050, it could rank Top 5 in both.

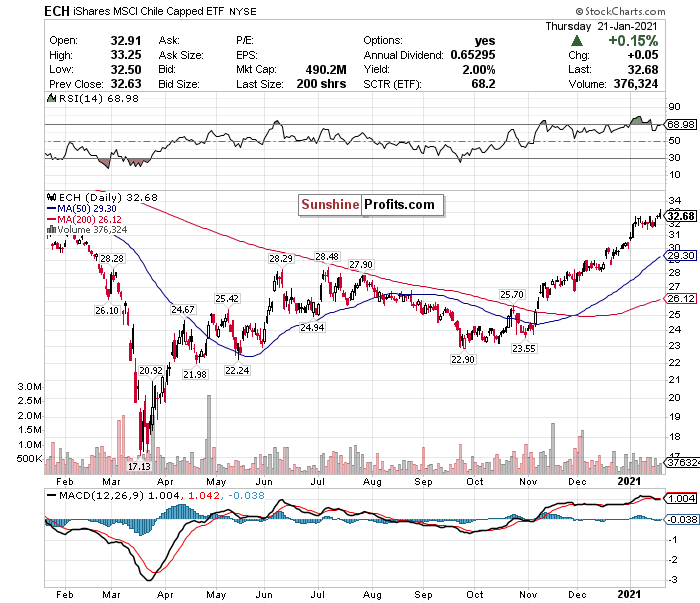

iShares MSCI Chile ETF (ECH)

Figure 8-iShares MSCI Chile ETF (ECH)

Chile is one of South America's largest and most prosperous economies. One of the reasons it could have a healthy 2021 is its abundance of natural resources and minerals.

Chile, for one, is the world's largest exporter of copper.

More importantly, it is the largest exporter of lithium in the world. With electric vehicles looking like the wave of the future, along with next-generation batteries, demand for lithium could send Chile's economy skyrocketing.

Some estimates also believe that Chile has about a quarter of the world's lithium reserves.

Chile's government is also one of the wealthiest governments in Latin America and is known for its business-friendly economic policies promoting growth and long-term sustainability.

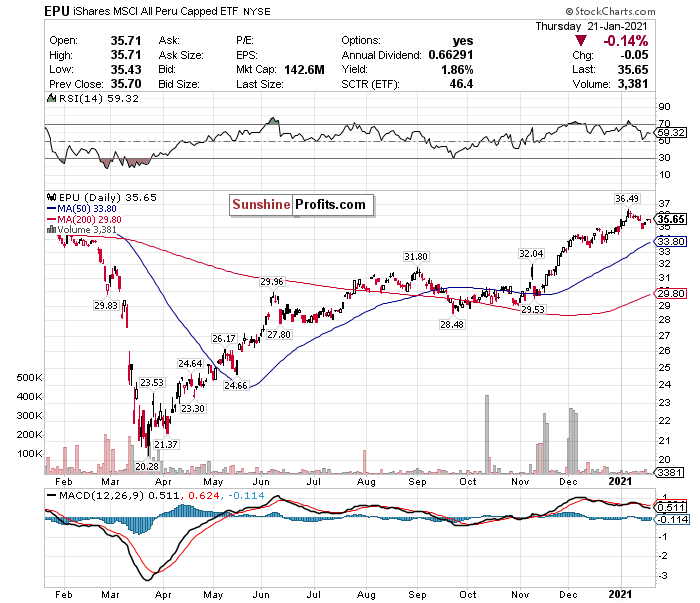

iShares MSCI Peru ETF (EPU)

Figure 9-iShares MSCI Peru ETF (EPU)

Peru is a smaller and more developing economy than Chile. But it may have even more upside, especially with soaring commodity prices.

Peru's economy, first and foremost, has significantly evolved since the 1990s. Despite its recent political issues, it has maintained an investment-grade credit rating.

Its heavy exposure to commodities could send it skyrocketing in 2021 as well. Peru is best known for its gold and copper reserves and could benefit from a declining dollar. Because this is a smaller economy than Chile, it may outperform in the coming year with similar mineral reserves.

While the surging spread of COVID-19 and resulting economic shutdowns may drive some short-term concerns, it is becoming apparent that emerging economies have handled this crisis better than developed economies.

With trillions of dollars of stimulus expected to be pumped into developed economies, this could only mean good things for emerging economies. It almost seems as if we are having a reckoning of the global financial system.

I encourage you to think outside the box in 2021 and understand that this is a big world we live in. There is always a bull market somewhere. Emerging markets may be the best bet for that.

Thank you.

Matthew Levy, CFA

Stock Trading Strategist