Starting this moment, we will be publishing the weekly Stock Pick Updates. It will be released each Wednesday and the top 5 long and top 5 short candidates for a week-long stock trading will be included (our opinion regarding their risk to reward potential). Without further ado, let's check which stock could magnify S&P's gains in case it rallies, and which stocks would be likely to decline the most if S&P plunges.

The broad stock market has reached historically high levels recently. Last year's breathtaking December correction was followed by the record-breaking comeback rally. The late October - early November breakout led to another leg higher, as the S&P 500 index got close to the 3,200 mark. But will the rally continue? If the market goes higher, which stocks are going to beat the index? And if it reverses down from here, which stocks are about to outperform on the short side?

We will provide stock trading ideas based on our in-depth technical and fundamental analysis, but since the main point of this publication is to provide the top 5 long and top 5 short candidates (our opinion, not investment advice) for this week, we will focus solely on the technicals. The latter are simply more useful in case of short-term trades.

We will assume the following: the stocks will be bought or sold short on the opening of today's trading session (December 18th) and sold or bought back on the closing of the next Tuesday's trading session (December 24th).

First, we will take a look at the recent performance by sector. It may show us which sector is likely to perform best in the near future and which sector is likely to lag. Then, we will select our buy and sell stock picks.

There are eleven stock market sectors: Energy, Materials, Industrials, Consumer Discretionary, Consumer Staples, Health Care, Financials, Technology, Communications Services, Utilities and Real Estate. They are further divided into industries, but we will just stick with these main sectors of the stock market.

We will analyze them and their relative performance by looking at the Select Sector SPDR ETF's.

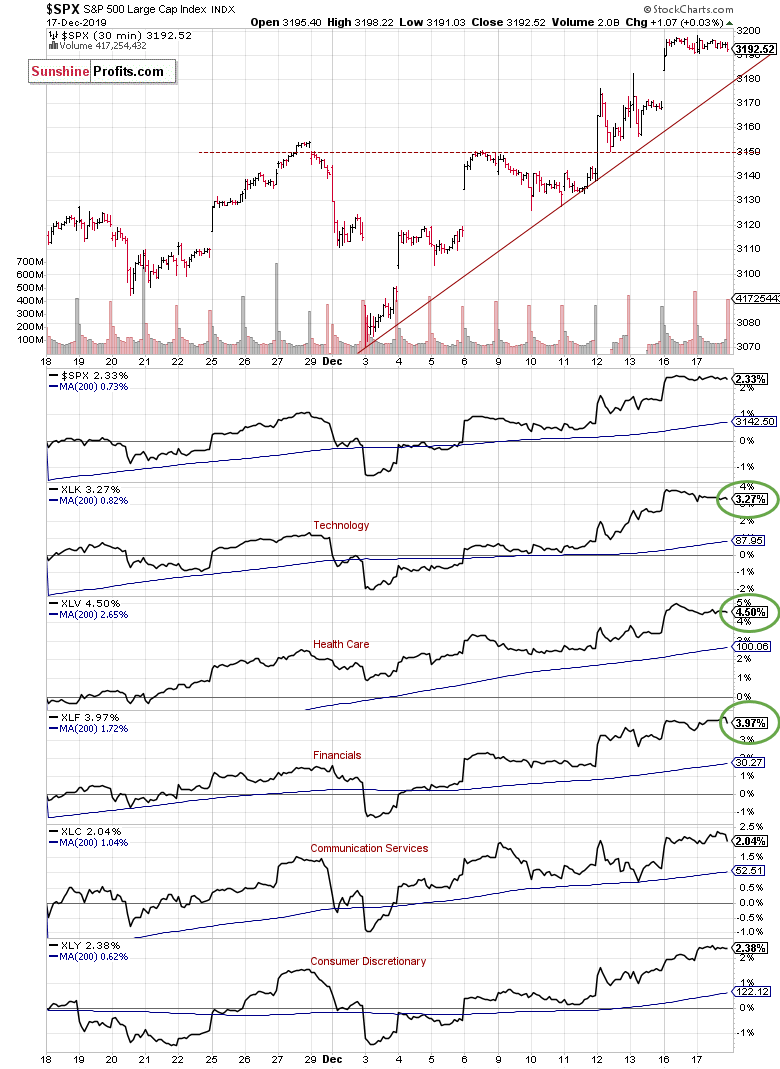

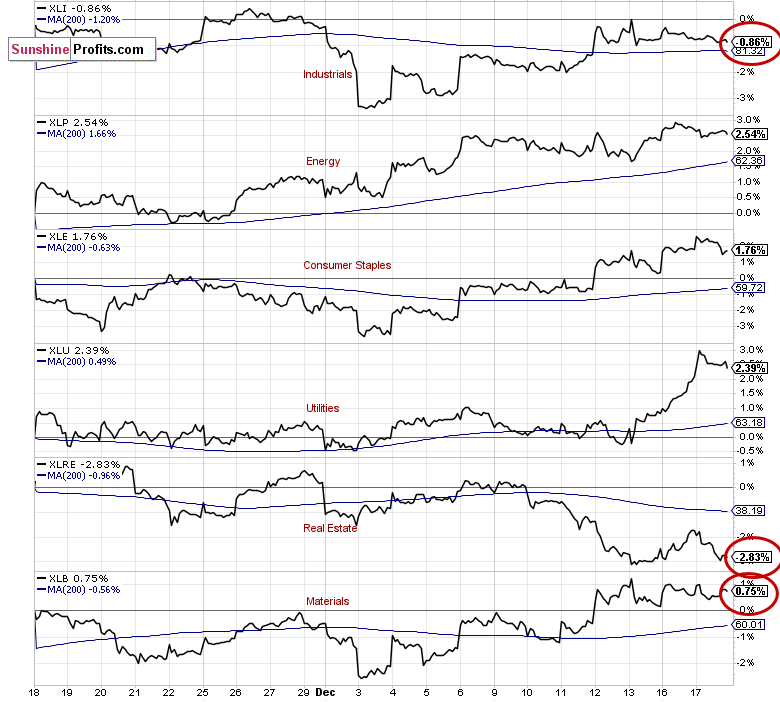

Let's start with our first charts (charts courtesy of www.stockcharts.com).

There's the S&P 500's 30-minute chart along with market sector indicators for the past month. The strongest sector was Health Care XLV index, as it gained 4.50% since November 18th. The Financials XLF gained 3.97% and Technology XLK gained 3.27%.

On the other hand, the weakest sector was Real Estate XLRE, as it lost 2.83%. The Industrials XLI lost 0.86%, and Materials XLB gained just 0.75% in the last 30 days.

Furthermore, the Utilities XLU index remains within a strongest short-term uptrend.

Based on the above, we decided to choose our stock picks for the next week. We will choose our top 3 long and top 3 short candidates using a contrarian approach, and top 2 long and top 2 short candidates using the trend-following approach:

Contrarian approach (betting against the recent trend):

- buys: 1 x Real Estate, 1 x Industrials, 1 x Materials

- sells: 1 x Health Care, 1 x Financials, 1 x Utilities

Trend-following approach:

- buys: 1 x Health Care, 1 x Financials

- sells: 1 x Real Estate, 1 x Industrials

Contrarian approach

Top 3 Buy Candidates

Ventas, Inc. - Real Estate

The VTR stock accelerated its over one-month-long downtrend last week, as it broke below the recent local low of around $57. But we can see a potential bottoming pattern along with positive technical divergences. The short-term support level remains at $55.

C. H. Robinson Worldwide, Inc. - Industrials

Here we can see the C. H. Robinson Worldwide Inc. stock breaking above the month-long downward trend line. The market may retrace some of its late October sell-off. It makes a pretty good contrarian buy.

CF Industries Holdings, Inc. - Materials

CF is another stock that broke above an over one-month-long downward trend line. Will it extend its short-term uptrend and gain from today's open to the next Tuesday's close? It could break above the nearest important resistance level of around $47.

Top 3 Sell Candidates

Eli Lilly & Co. - Health Care

The LLY stock accelerated its uptrend this week following breaking above the resistance level of around $120-122. However, the market may retrace some of that rally. We can see technical overbought conditions that may lead to a short-term downward correction.

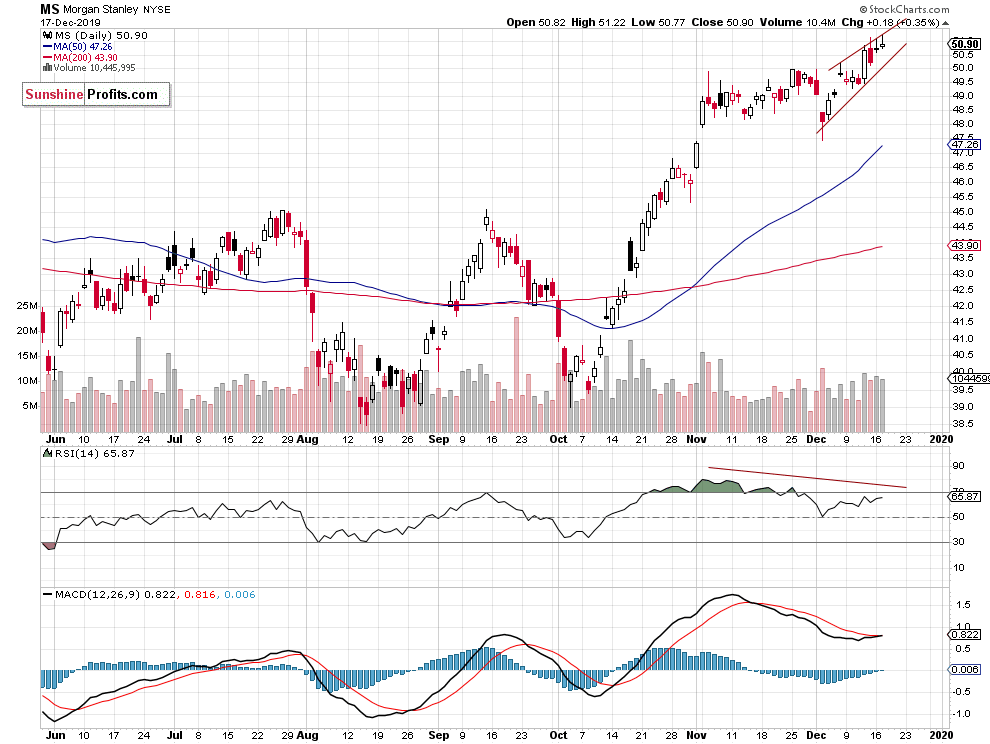

Morgan Stanley - Financials

The MS chart shows a potential rising wedge topping pattern. There are also some clear negative technical divergences. The stock may retrace some of its recent advance and give a profit on the short side in the coming week.

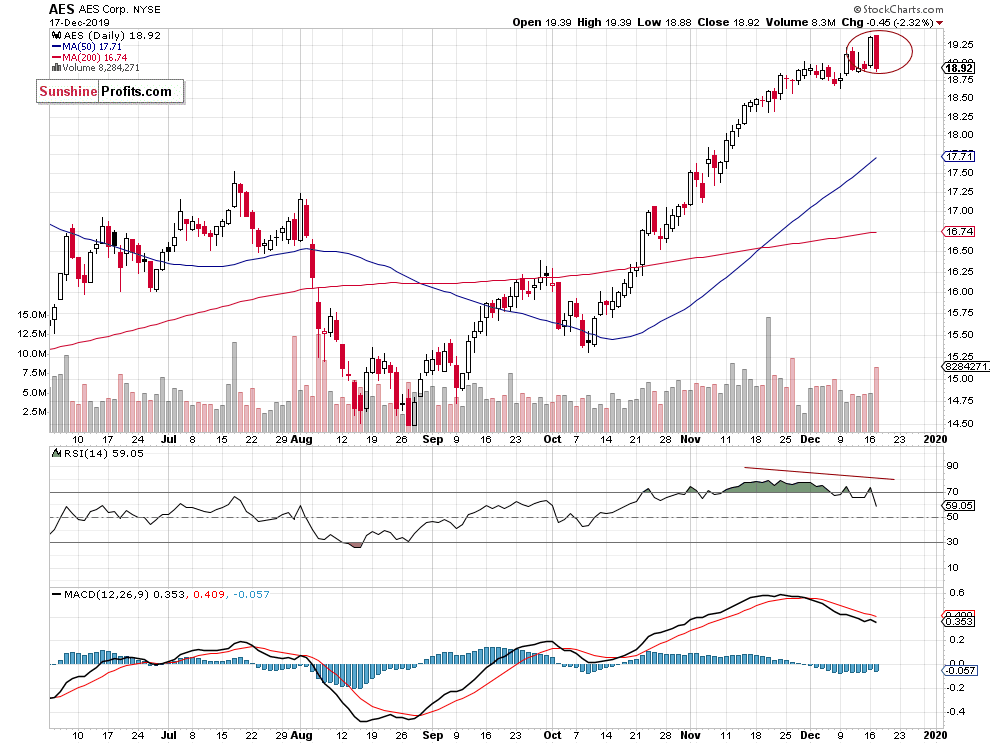

AES Corp. - Utilities

And here is another potential topping pattern. The AES Corp. stock keeps bouncing off the $19 resistance level recently. First, it formed a dark cloud cover candlestick pattern, then a bearish engulfing. We can also see negative technical divergences.

Trend-following approach

Top 2 Buy Candidates

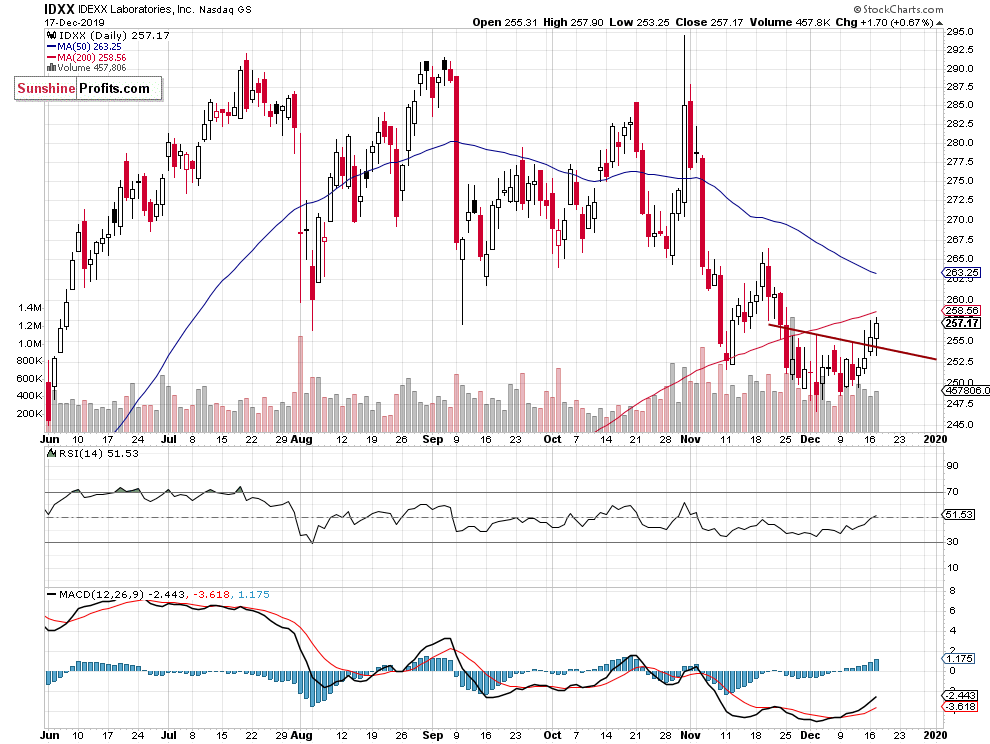

IDEXX Laboratories, Inc. - Health Care

The IDXX stock broke above its weeks-long downward trend line. It may extend its short-term uptrend and retrace more of the late November decline. Will it reach a potential resistance level of around $265? We still can see some short-term bullish momentum.

Cincinnati Financial Corp. - Financials

Here, we can see a breakout attempt above an over one-month-long downward trend line. The Cincinnati Financial Corp. stock may retrace some of its October-November decline. The nearest important resistance level is at $109-110.

Top 2 Sell Candidates

Duke Realty Corp. - Real Estate

The DRE stock broke below its one-month-long upward trend line last week. For now, it keeps bouncing off a short-term support level at around $33.80-34.00, but it will likely extend the downtrend and give a profit on the short-side.

Ametek, Inc. - Industrials

The AME stock trades within a potential rising wedge topping pattern. We can also see negative technical divergences. There have been no confirmed negative signals so far. However, it seems that the stock may bounce off the $100 resistance level and retrace some of its recent advances.

Conclusion

In our opinion, the following stock trades are justified from the risk/reward point of view between December 18 and December 24th:

Long: VTR, CHRW, CF, IDXX, CINF

Short: LLY, MS, AES, DRE, AME

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

Disclaimer

All essays, research and information found above represent analyses and opinions of Paul Rejczak and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Paul Rejczak and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Rejczak is not a Registered Securities Advisor. By reading Paul Rejczak's reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Paul Rejczak, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.