In the last five trading days (December 23 – December 29) the broad stock market has extended its record-breaking run-up. The S&P 500 index reached new record high of 3,756.12 on Tuesday following the recent stimulus news.

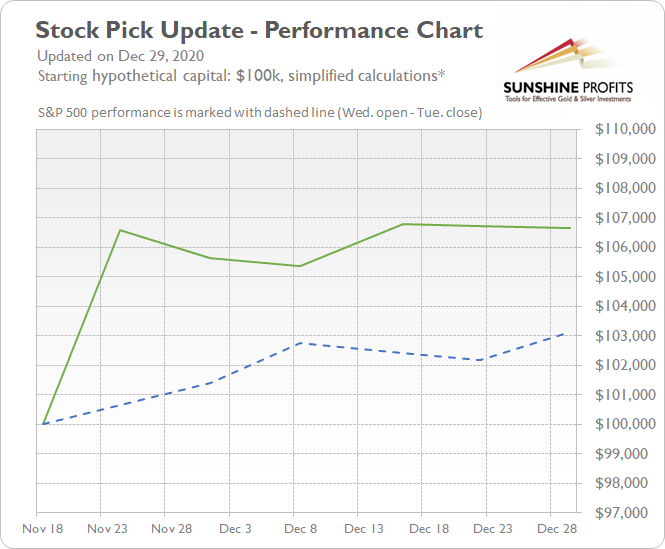

The S&P 500 has gained 0.91% between December 23 open and December 29 close. In the same period of time our five long and five short stock picks have lost 0.07%. Stock picks were relatively weaker than the broad stock market last week. Our long stock picks have lost 0.30% and short stock picks have resulted in a gain of 0.16%.

There are risks that couldn’t be avoided in trading. Hence the need for proper money management and a relatively diversified stock portfolio. This is especially important if trading on a time basis – without using stop-loss/ profit target levels. We are just buying or selling stocks at open on Wednesday and selling or buying them back at close on the next Tuesday.

If stocks were in a prolonged downtrend, being able to profit anyway, would be extremely valuable. Of course, it’s not the point of our Stock Pick Updates to forecast where the general stock market is likely to move, but rather to provide you with stocks that are likely to generate profits regardless of what the S&P does.

Our last week’s portfolio result:

Long Picks (December 23 open – December 29 close % change): CRM (-4.32%), NVDA (-2.36%), PSX (0.00%), FANG (+4.72%), SPGI (+0.47%)

Short Picks (December 23 open – December 29 close % change): SO (+0.10%), AES (+0.73%), WY (-1.27%), ARE (-0.88%), CL (+0.52%)

Average long result: -0.30%, average short result: +0.16%

Total profit (average): -0.07%

Stock Pick Update performance chart since Nov 18, 2020:

Let’s check which stocks could magnify S&P’s gains in case it rallies, and which stocks would be likely to decline the most if S&P plunges. Here are our stock picks for the Wednesday, December 30 – Tuesday, January 5 period.

We will assume the following: the stocks will be bought or sold short on the opening of today’s trading session (December 30) and sold or bought back on the closing of the next Tuesday’s trading session (January 5).

We will provide stock trading ideas based on our in-depth technical and fundamental analysis, but since the main point of this publication is to provide the top 5 long and top 5 short candidates (our opinion, not an investment advice) for this week, we will focus solely on the technicals. The latter are simply more useful in case of short-term trades.

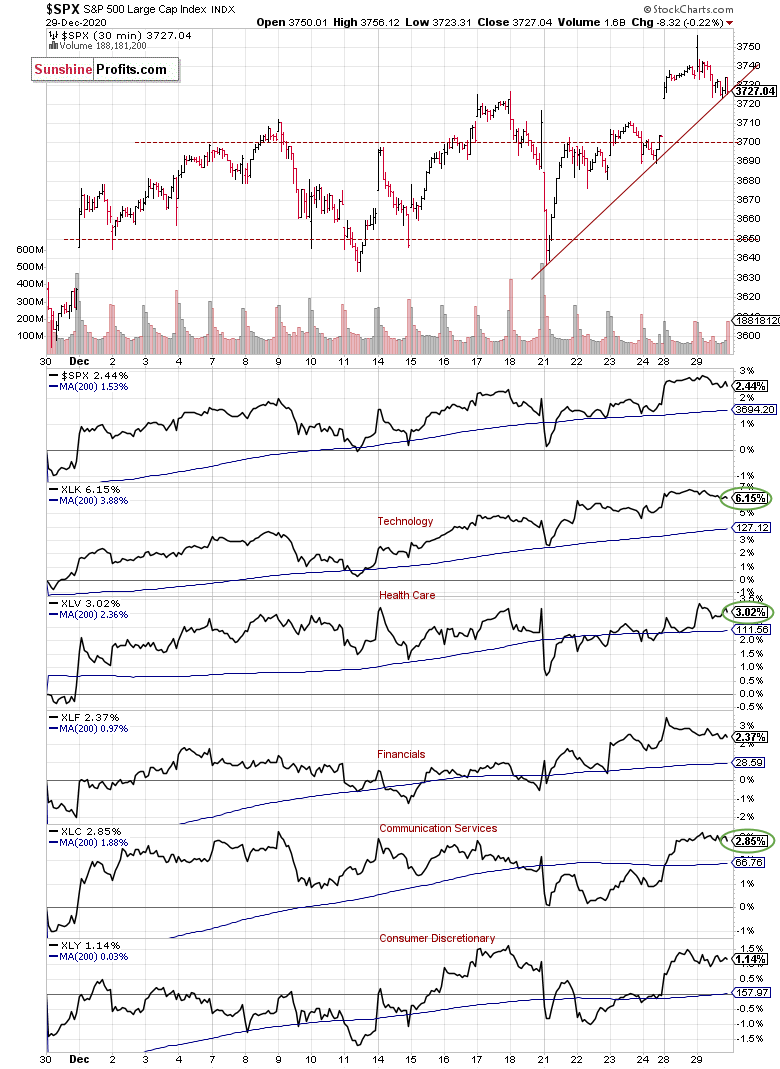

First, we will take a look at the recent performance by sector. It may show us which sector is likely to perform best in the near future and which sector is likely to lag. Then, we will select our buy and sell stock picks.

There are eleven stock market sectors: Energy, Materials, Industrials, Consumer Discretionary, Consumer Staples, Health Care, Financials, Technology, Communications Services, Utilities and Real Estate. They are further divided into industries, but we will just stick with these main sectors of the stock market.

We will analyze them and their relative performance by looking at the Select Sector SPDR ETF’s.

Let’s start with our first charts (charts courtesy of www.stockcharts.com).

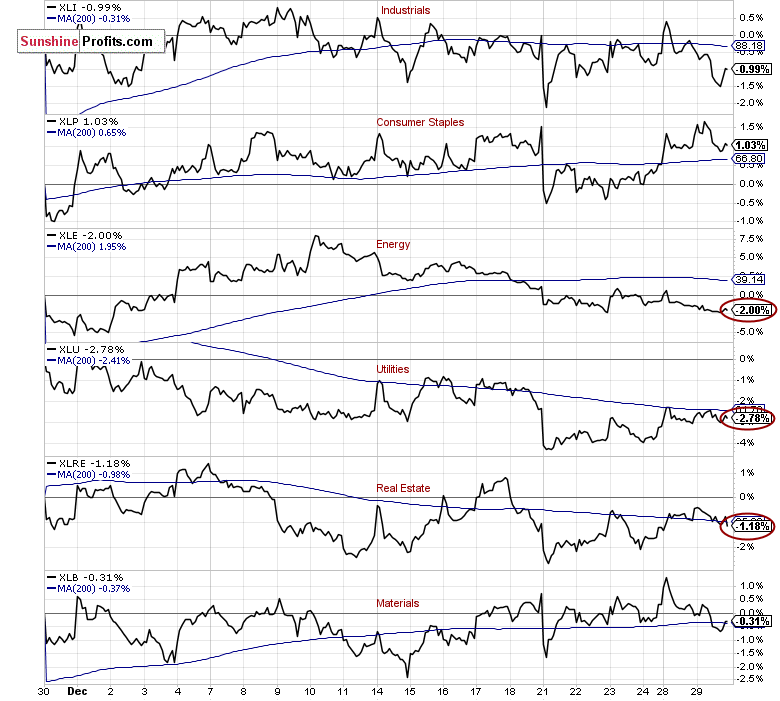

There’s S&P 500’s 30-minute chart along with market sector indicators for the past month. The S&P 500 index has gained 2.44% from the closing price on November 27. The strongest sector was Technology XLK once again, as it gained 6.15%. The Health Care XLV gained 3.02% and Communication Services XLC gained 2.85%.

On the other hand, the weakest sector was Utilities XLU, as it lost 2.78% in a month. The Energy XLE lost 2.00% and Real Estate XLRE lost 1.18%.

Based on the above, we decided to choose our stock picks for the next week. We will choose our 5 long and 5 short candidates using trend-following approach:

- buys: 2 x Technology, 2 x Health Care, 1 x Communication Services

- sells: 2 x Utilities, 2 x Energy, 1 x Real Estate

Buy Candidates

NVDA NVIDIA Corp. - Technology

- Stock trades along medium-term upward trend line

- Possible breakout above short-term consolidation

- The support level is at $490-500 and resistance level is at $550, among others

INTC Intel Corp. – Technology

- Stock retraced most of its recent declines

- Possible breakout above medium-term downward trend line

- The support level is at $47 and the nearest important resistance level is at $52

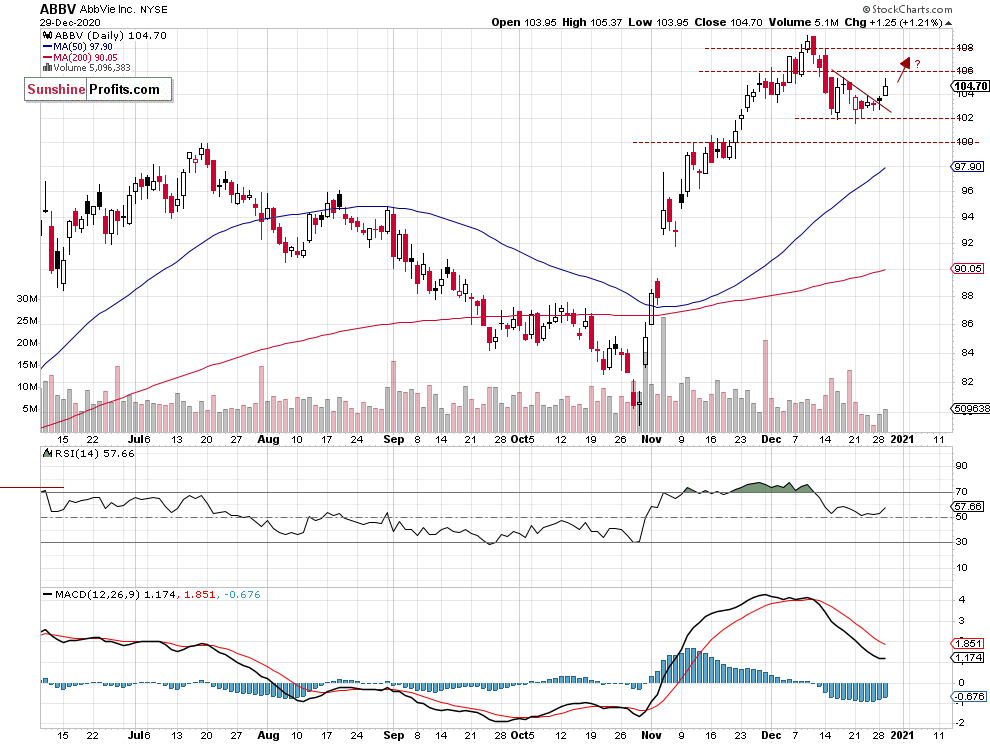

ABBV AbbVie Inc. – Health Care

- Stock broke above short-term downward trend line – uptrend continuation play

- The support level is at $100-102 and resistance level is at $106-108

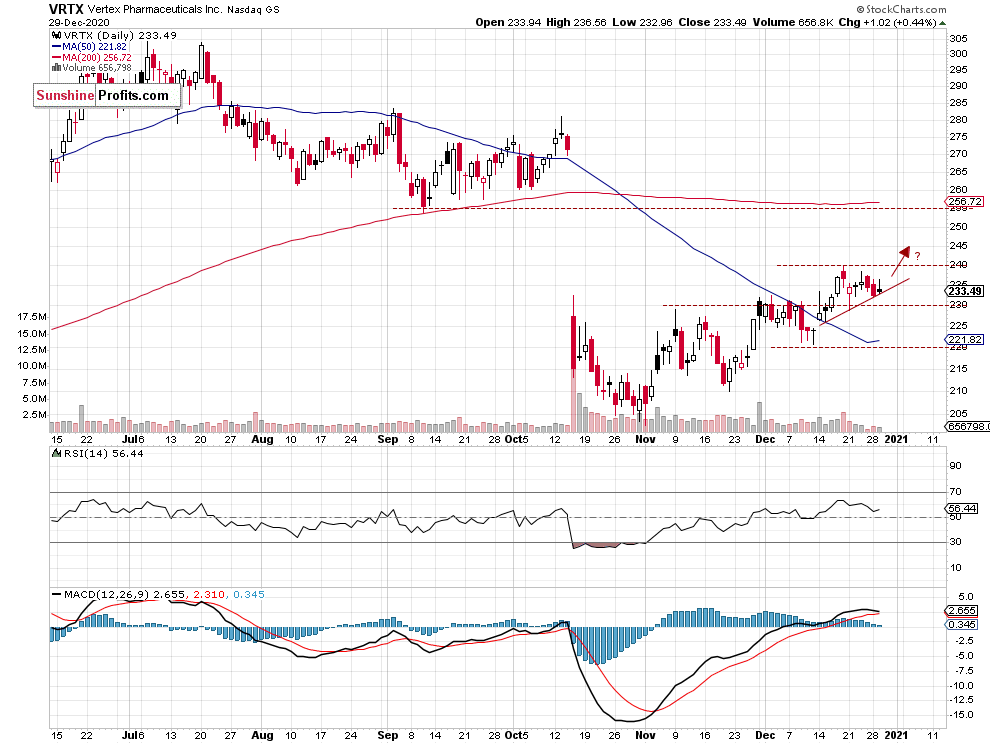

VRTX Vertex Pharmaceuticals Inc. – Health Care

- Stock remains above short-term upward trend line - uptrend continuation play

- The resistance level is at $240 and support level is at $230

FB Facebook, Inc. – Communication Services

- Stock broke above its month-long downward trend line

- The support level is at $265-270 and resistance level is at $290-300

Sell Candidates

DUK Duke Energy Corp. – Utilities

- Possible breakdown below short-term bear flag pattern

- The support level is at $86 – downside profit target level

SO Southern Co. – Utilities

- Possible breakdown below short-term consolidation

- Stock continues to trade along medium-term upward trend line

- The resistance level is at $62 and support level is at $59 – short-term downside profit target level

MPC Marathon Petroleum Corp. - Energy

- Possible medium-term topping pattern – breakdown below over month-long upward trend line

- The resistance level is at $42

- The support level is at $38 – short-term target profit level

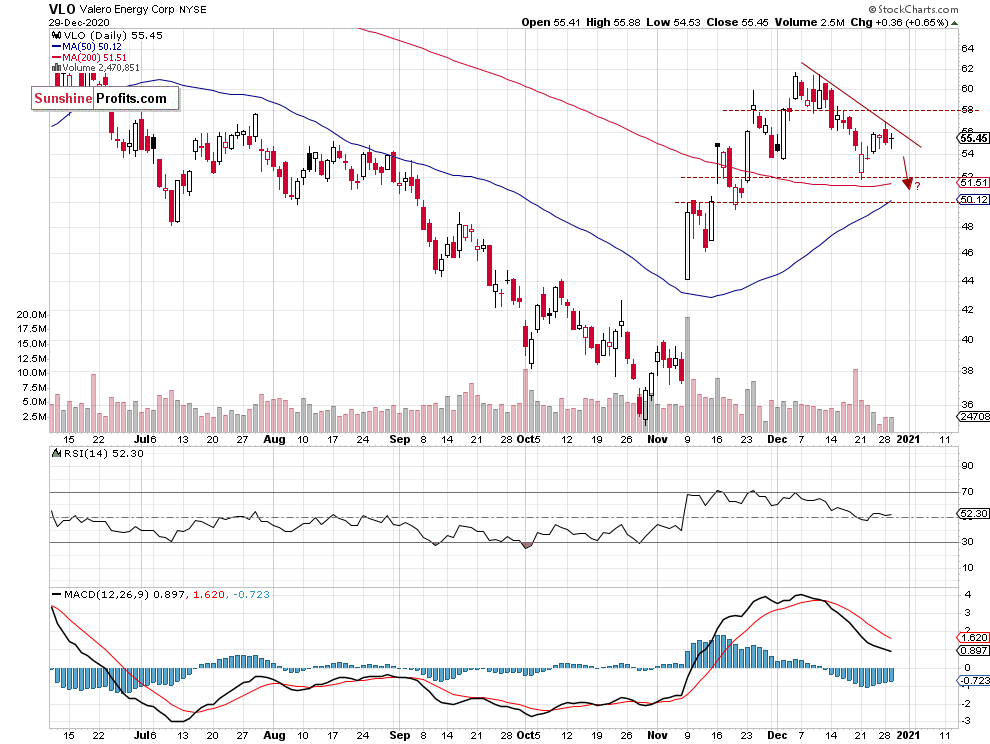

VLO Valero Energy Corp. - Energy

- Stock trades below month-long downward trend line

- The support level is at $50-52 – short-term downside target profit level

SPG Simon Property Group, Inc. - Real Estate

- Possible month-long downtrend continuation

- The support level is at $80

- The resistance level remains at $88-90

Conclusion

In our opinion, the following stock trades are justified from the risk/reward point of view between December 30 and January 5:

Long: NVDA, INTC, ABBV, VRTX, FB

Short: DUK, SO, MPC, VLO, SPG

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care