Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Hold long positions with entry at $59-61 with $51.50 as a stop-loss and $68.10 as the initial price target.

As of Wednesday morning, a couple of pieces of bearish news trickled in. The first one being that U.S. crude oil inventories rose by 3.91MMbbls over the last week and the second is the lower demand forecast by OPEC. The market reacted by falling slightly but still finding support at $60 levels. There is also anticipation ahead of the OPEC meeting on April 1, which will decide on the extension of the upcoming month’s production cuts.

All signals like lower demand forecast by OPEC, and stronger dividends expectations by Saudi Aramco point towards a higher likelihood of production extension which will provide a solid support for prices to remain at current levels.

In spite of a U.S. warning, China continues to buy oil from Iran at cheaper prices with levels expected to reach 1 mbpd, which is almost half of what China buys from Saudi Arabia. Now, even India (the third largest oil importer), is planning to purchase Iranian oil.

The key reason for oil’s restraint and a lack of a rally this week is because of the continuous strengthening of the U.S. dollar in the past days. The reason for this week’s rise is attributed to the U.S. hedge fund’s default on margin calls, which may negatively impact some global banks. Opinions are divided on future movements and we will be watching closely over the next few weeks.

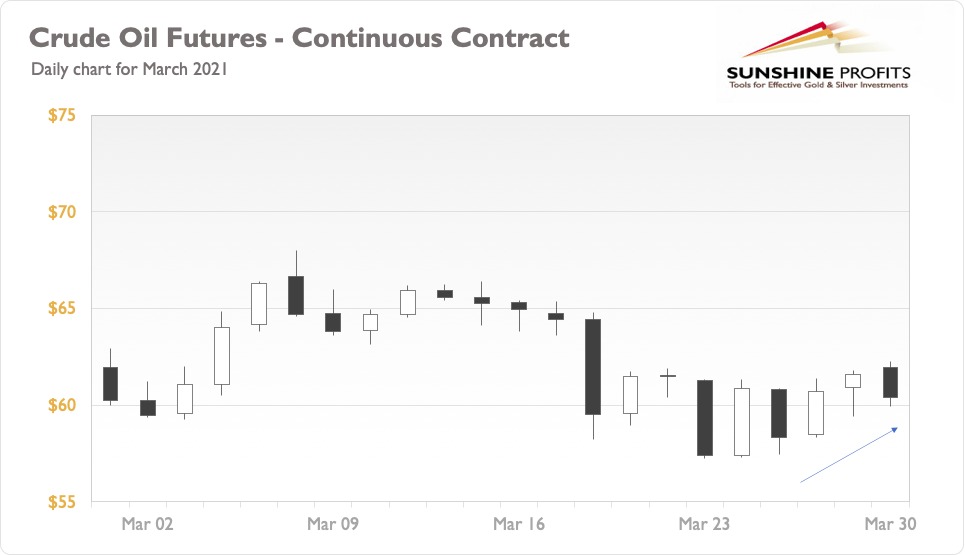

A look at the crude oil candle chart below reveals that daily volatility has been on a slow decline during the past five trading sessions. While the direction of the market is still flip-flopping, the daily median of prices is showing an increasing trend. In the last session, there was clear support at $60, which means that the unblocking of the Suez Canal has not prompted prices to be in the 50s range.

To summarize, there are chances of oil finding upward direction post the OPEC meeting on April 1, on production quotas for May. There is strong support at $60 levels – in spite of the bearish news – indicating that the market may be ready for the next big rally.

As always, we’ll keep you, our subscribers well informed.

Letters to the Editor

Q: Your trading position specifies a decreased probability of big dips, but you’re still keeping the stop loss farther away? Shouldn’t the stop loss not be nearer if big dips are less probable?

A: Thank you very much for your question. My logic is as follows: The market remains volatile, hence momentary big dips may happen, however, there is a decreased probability of a price reduction for a sustained period. Therefore, keeping the stop loss farther away to prevent an accidental trigger (and unnecessary sell) remains prudent.

Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Hold long positions with entry at $59-61 with $51.50 as a stop-loss and $68.10 as the initial price target.

Thank you.

Nishant Jain, MBA, CPSM

Oil Trading Strategist