Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

During Friday’s session the price of crude oil wavered between gains and small losses, but finally closed the day exactly at the level of Thursday closing. Can such a session give us tips on the direction of the next move in the coming week?

Let’s examine the charts below (charts courtesy of http://stockcharts.com).

In our last commentary, we wrote the following:

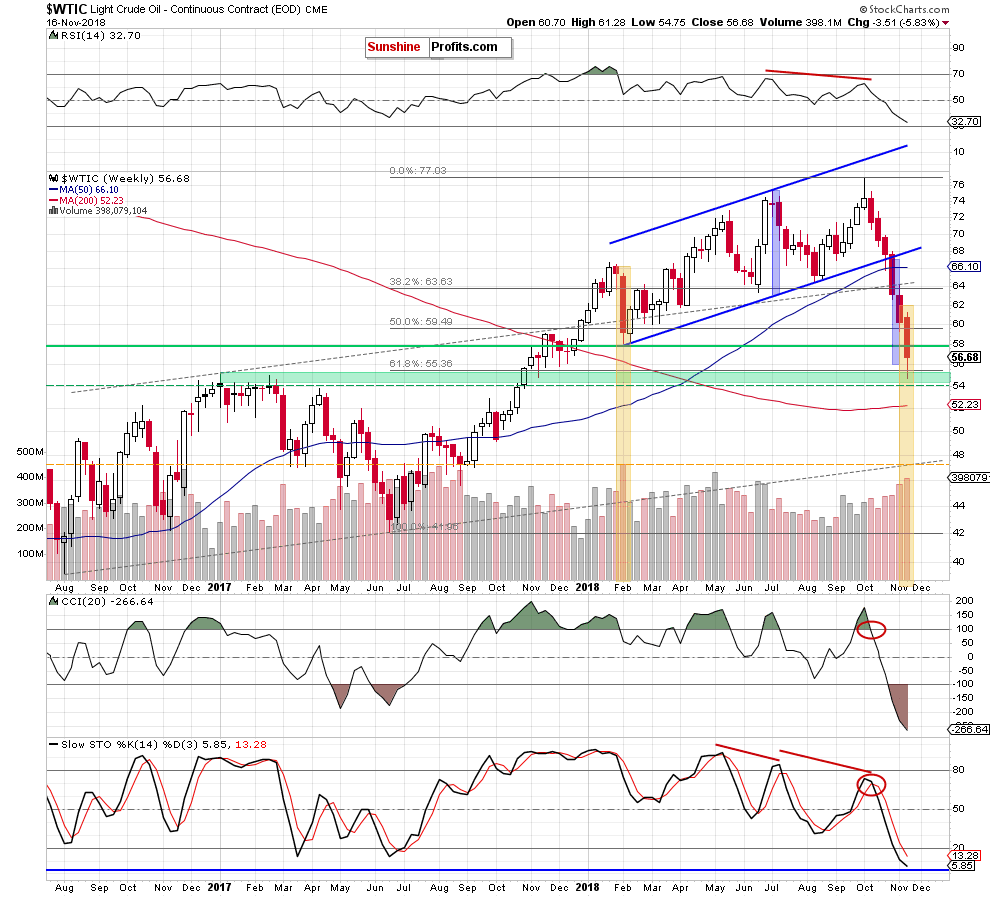

(…) the overall situation hasn’t changed much as the commodity is still trading above the previously-broken 61.8% Fibonacci retracement and the green support zone.

Therefore, if the bulls manage to hold these levels and close the week above them, the probability of further improvement will increase a bit more.

From today’s point of view, we see that black god closed the previous week above the 61.8% Fibonacci retracement and the green support zone, which may look quite inviting. But is this upswing as positive as it looks at the first glance?

Let's analyze the volume. Looking at it, we can clearly see that the last week's drop materialized on a massive volume, which shows that the involvement of the sellers not only grows from week to week, but also was the biggest since February 2018. What were the consequences of that event? When we look at the chart, we see that the big red candle created at the beginning of the month preceded a re-test of the February low (we marked it with a yellow rectangle), which started a move to the upside in the following weeks.

Can the situation recur in the coming week? In our opinion, this is quite likely. Why? Let's look at the daily chart below.

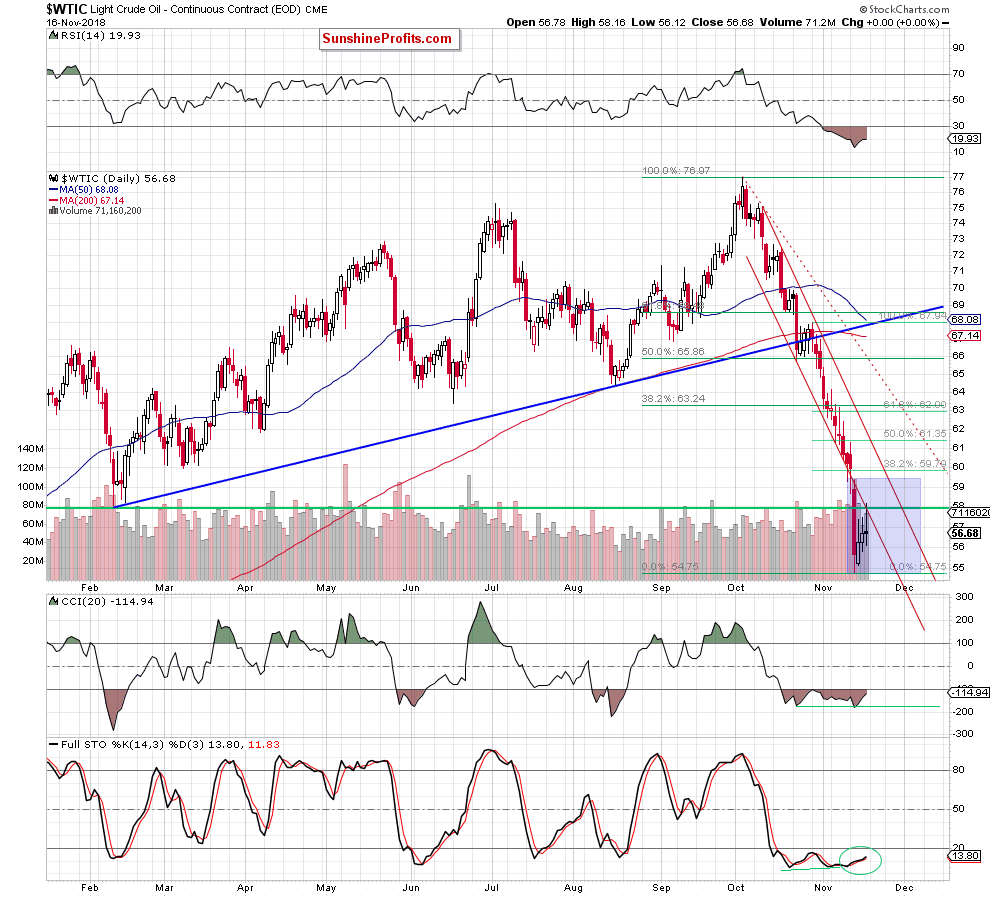

From this perspective, we see that oil bulls pushed the price of black gold higher on Friday, which resulted not only in an upswing above $58, but also in a test of the previously-broken support levels, which serve now as the resistances.

As you see, despite the attempts of the buyers to go even further to the north, the combination of the above-mentioned levels stopped them effectively, causing the correction of the earlier move.

What such price action means for the commodity?

In our opinion, the best answer to this question will be the quotes from our last alert:

(…) we think that as long as there is no comeback above these lines all upswings will be nothing more than a verification of the earlier breakdowns. In other words, one more attempt to move lower can’t be ruled out – especially when we factor in the size of volume, which didn’t increase despite oil bulls’ upswings during recent sessions.

Earlier today, the commodity increased once again, suggesting that we’ll see a test of the above-mentioned resistances later in the day. In our opinion, the attitude of the buyers in this area will be very significant for the price of black gold next week.

Why? Because if (…) the bulls fail, we can see a test of the strength of the recent lows and the supports marked on the weekly chart.

Connecting the dots, we continue to believe that waiting at the sidelines is justified from the risk/reward perspective at the moment.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective, but if we see a confirmation of oil bulls’ strength, we’ll consider opening long positions. On the other hand, if the bears manage to push the price of black gold under this week’s lows, we’ll consider going short. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Administrative Note Regarding This and Next Week’s Publication Schedule

The long Thanksgiving weekend is approaching. There will be no / limited trading in the final part of this week and we will be taking this opportunity to take some time off from our regular analyses. Tomorrow’s Alert will be published normally, and Wednesday’s Alert will likely be very brief. There will be no regular Alerts on Thursday and Friday. The Monday’s (November 26th) and Tuesday’s (November 27th) Alerts will most likely be very short as well.

However, the above does not mean that we will stop monitoring the market entirely. Conversely, the time is quite critical, so despite taking time off from regular tasks, we will be monitoring the market and if anything urgent happens, we will let you know through a quick intraday Alert.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts