Trading position (short-term; our opinion): profitable short position with a stop-loss order at $58.87 and the initial downside target at $53.85 is justified from the risk/reward perspective.

The oil bulls haven't exactly succeeded in repairing Friday's damage yesterday. But they've been trying hard earlier today. Will their efforts be enough to change the technical outlook materially? Let's get down to answering that pressing question.

Let's take a closer look at the charts below (charts courtesy of http://stockcharts.com and www.stooq.com ).

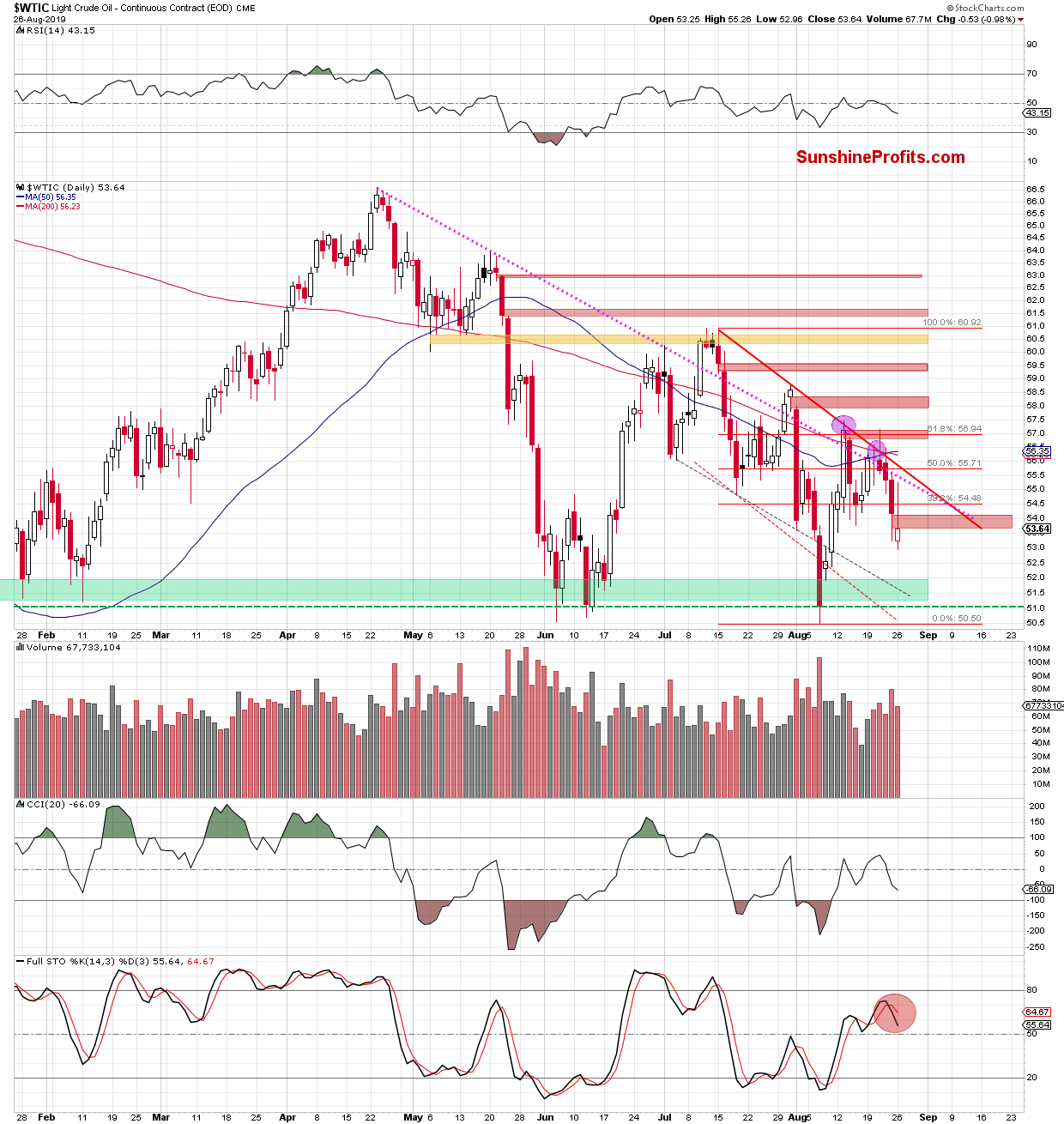

Crude oil opened yesterday's session with the bearish red gap. Although the buyers tried to close it, they failed, and it translated into quite a sharp pullback before the session's close.

As a result, the commodity closed the day below the red gap, which increases the likelihood of further deterioration in the following days. Additionally, the Stochastic Oscillator generated its sell signal, giving the sellers another reason to act.

Let's see how yesterday's price action affected investors earlier today.

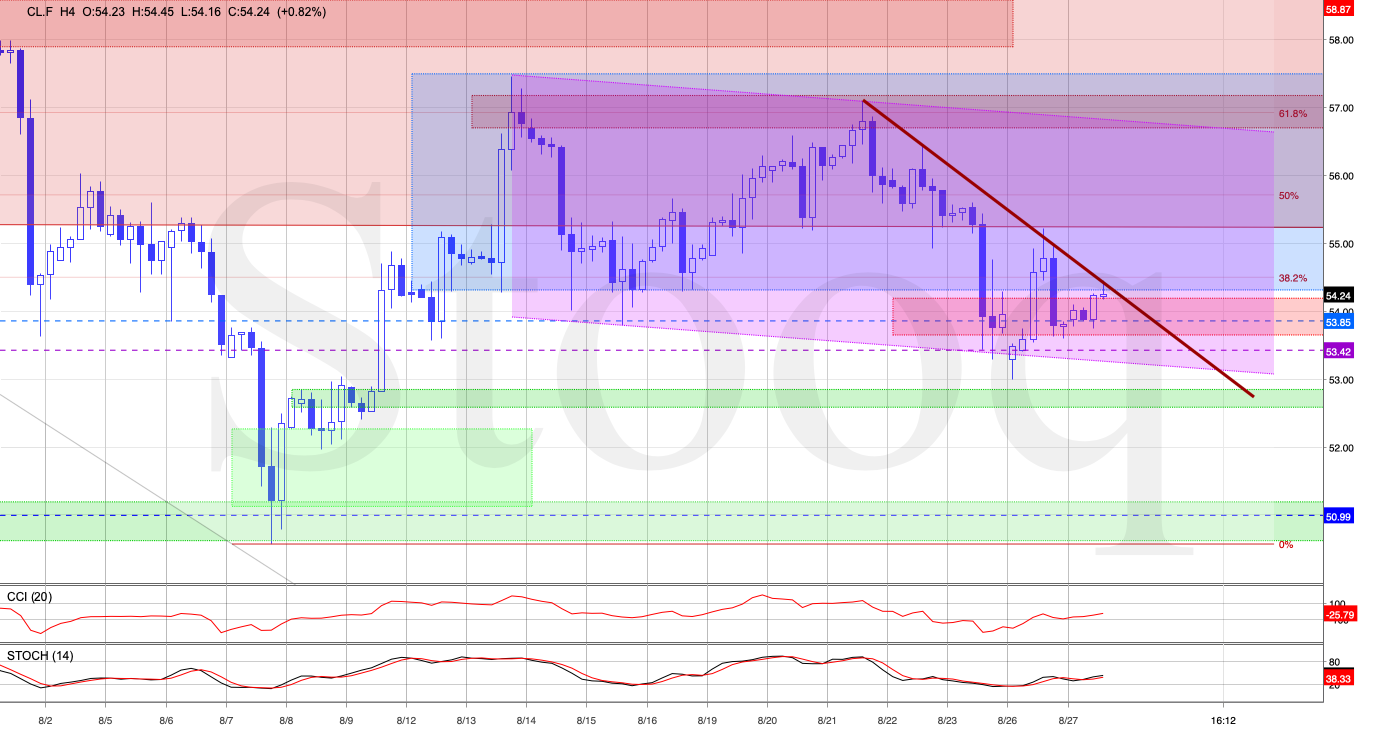

Crude oil futures opened today with a bullish gap, which triggered further improvement in the following hours. The futures moved to the upper border of yesterday's gap, and that can translate into closing the gap later today.

But let's keep in mind that not far from current levels, there is also the lower border of the blue consolidation, which could stop the buyers later today. The sellers are however active inside the consolidation (as they have clearly shown yesterday when they managed to stop the upswing slightly above $55).

This suggests that as long as there is no invalidation of the breakdown below this formation together with a daily close above its lower line, another move to the downside remains very likely. This is especially the case when we factor in the position of the daily indicators and the very short-term situation on the 4-hour chart.

The short-term chart shows that although the futures moved higher earlier today, they are still trading below the declining brown resistance line. This resistance has stopped the bulls during yesterday's session.

Therefore, as long as there is no successful breakout above it, lower values of the oil futures and crude oil commodity are very likely. If this is the case and they move lower from current levels, we'll see at least a test of the lower border of the declining purple trend channel and the recent low.

Summing up, yesterday's oil upswing has mostly fizzled out, yet the bulls showed up in strength earlier today. While they managed to take oil up to several resistances yet the daily indicators support a downside move. The profitable short position remains justified.

Trading position (short-term; our opinion): profitable short position with a stop-loss order at $58.87 and the initial downside target at $53.85 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist