Trading position (short-term; our opinion): Short positions in crude oil (100% size of the regular trading position) are justified from the risk to reward point of view with $11.22 as the binding profit-take level, and with $30.23 as the stop-loss level.

Black gold didn't move much during yesterday's session and remains relatively far away from the late-March highs. There can be no talk of moving up and challenging them, can there?

Let's start today's analysis with the long-term chart examination (chart courtesy of www.stooq.com ).

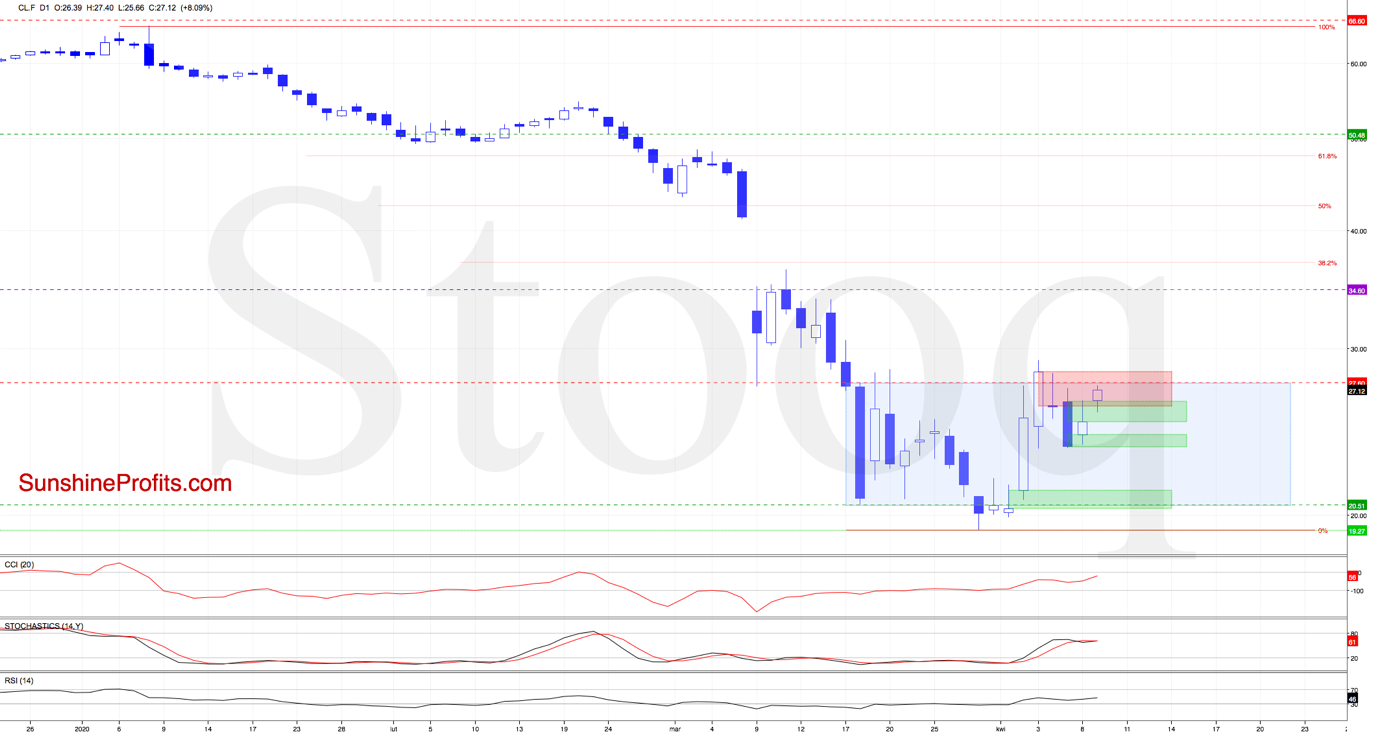

From today's point of view, we see that the overall situation in the short term remains almost unchanged as crude oil futures are still trading inside the blue consolidation.

Yesterday, the futures opened the day with a green gap, which encouraged the bulls to push prices higher. Earlier today, there was one more bullish gap, which suggests that we'll see a test of the upper border of the consolidation or even the upper line of the red resistance gap later in the day.

Nevertheless, as long as the red gap remains open, it continues to serve as the major short-term resistance, which could trigger another reversal in the very near future.

However, if the buyers receive external support such as an agreement between OPEC and Russia on record oil production cuts in a meeting later today, crude oil futures could extend gains and test the 61.8% Fibonacci retracement (at around $29.70) or even the lower border of the huge gap created on March 9 (at $32.87) before the end of today's session.

Summing up, it seems that crude oil's rally is already over, and lower crude oil prices are to be expected. If not, and today's news moves the market, we'll be taken out of the market exactly where it seems it would make sense to stop betting on lower crude oil prices.

Trading position (short-term; our opinion): Short positions in crude oil (100% size of the regular trading position) are justified from the risk to reward point of view with $11.22 as the binding profit-take level, and with $30.23 as the stop-loss level.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager