Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Friday, the black gold tested important resistance, but then pulled back and closed the day below it. Is this the first sign of oil bulls’ weakness?

Crude Oil’s Technical Picture

Let’s take a closer look at the charts and find out (charts courtesy of http://stockcharts.com).

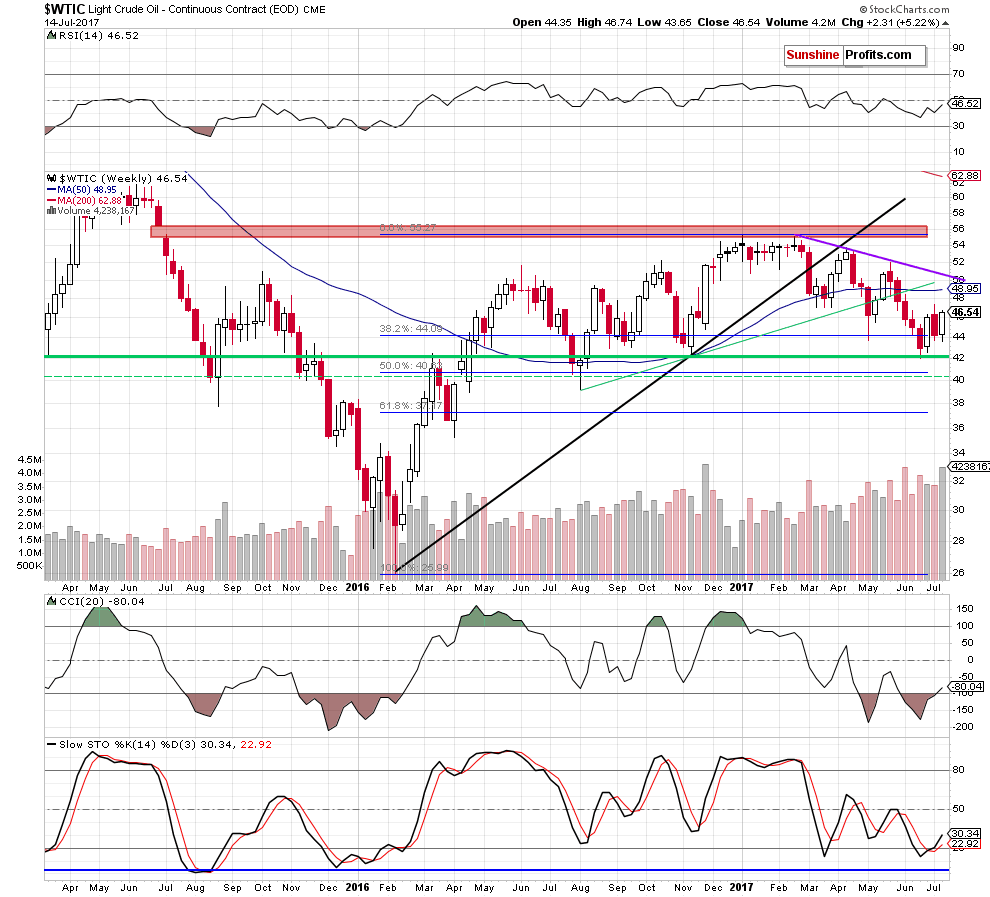

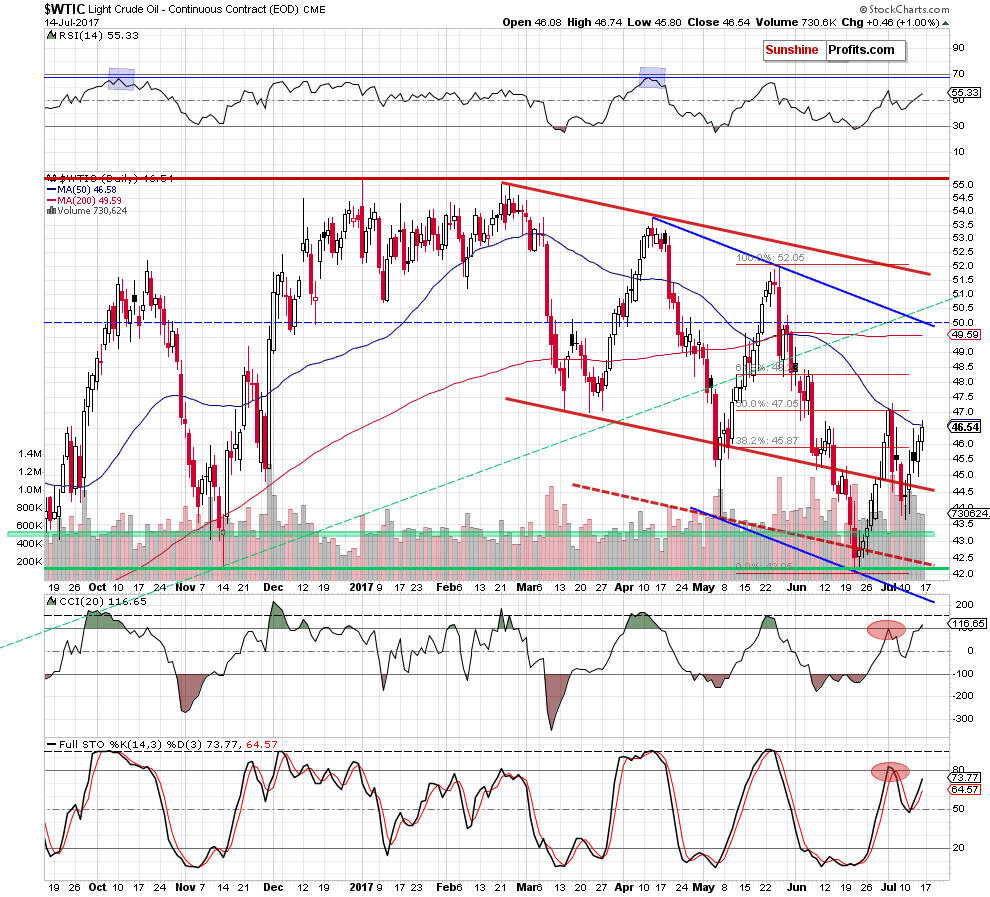

On the daily chart, we see that the black gold extended gains and tested the 50-day moving average. Despite this improvement, oil bulls didn’t manage to hold gained levels, which resulted in a pullback and a daily closure below this resistance.

What’s next for Light Crude?

We think that the best answer to this question will be the quotes from our Friday’s Oil Trading Alert:

(…) this resistance together with the 50% Fibonacci retracement, successfully stopped oil bulls at the beginning of the month, which suggests that we may see a similar price action in the coming days. Additionally, the size of volume during recent increases is getting smaller, which doesn’t confirm oil bulls’ strength and suggests that they may be out of power in the near future. Nevertheless, taking into account the buy signal generated by the daily indicators, we think that the commodity could test the July high before the next move to the downside.

(…) if we see more bearish factors on the horizon (for example another increase on smaller volume), we’ll consider opening short positions.

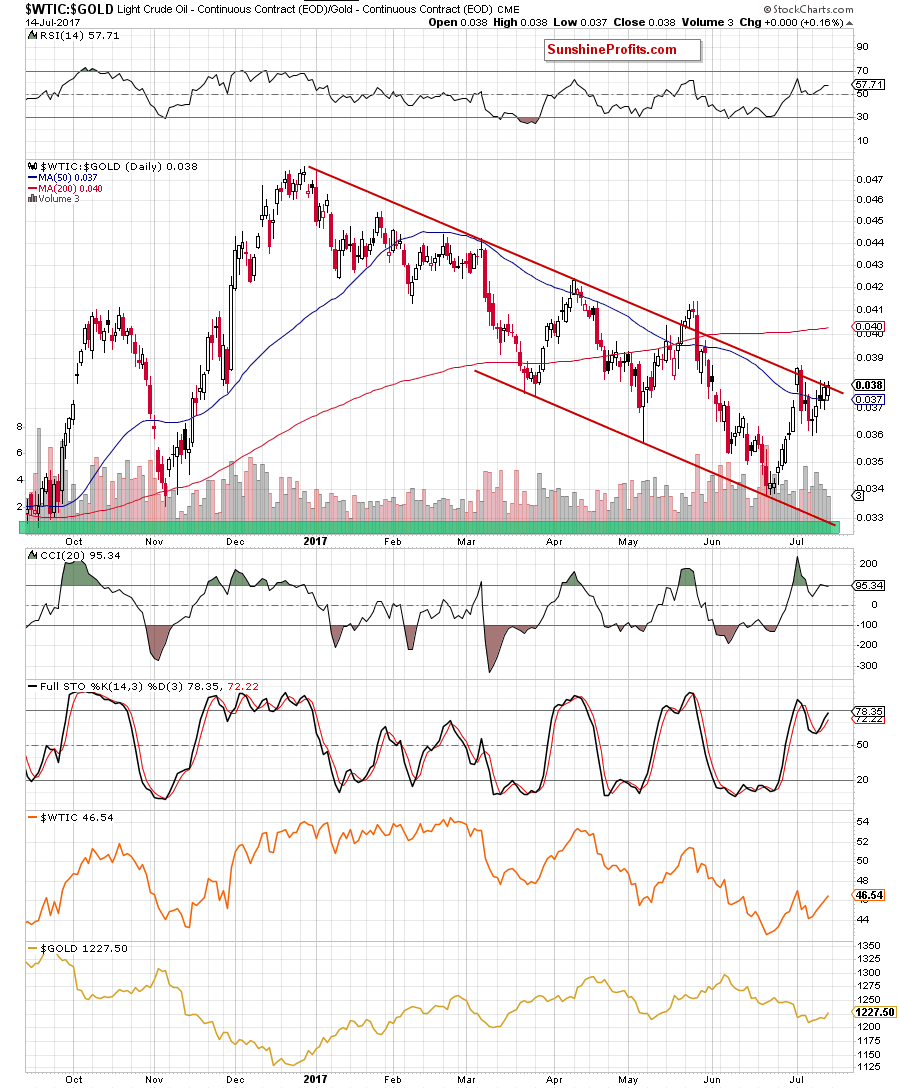

Finishing today’s Oil Trading Alert, let’s take a closer look at the oil-to-gold ratio.

Looking at the above chart, we see that although crude oil moved higher, the ratio didn’t follow this increase and remains in the consolidation under the upper border of the red declining trend channel. Such price action suggests that oil bulls may not be as strong as it seems at the first sight and increases the probability of reversal in near future.

What does it mean for the price of crude oil? Taking into account the fact that positive correlation between the ratio and the commodity is still in cards, we believe that declines in the ratio will likely translate into lower prices of crude oil in the coming week(s) – similarly to what we saw in the past.

Summing up, crude oil moved a bit higher, but the 50-day moving average continues to keep gains in check. Taking this fact into account and combining it with the current situation in the oil-to-gold ratio, we think that another bigger move to the downside is just around the corner.

Very short-term outlook: mixed

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts