Trading position (short-term; our opinion): Short positions (with a stop-loss order at $52.52 and the initial downside target at $45.80) are justified from the risk/reward perspective.

Although crude oil moved a bit higher after yesterday market open, the previously-broken lower border of the trend channel stopped oil bulls, triggering a pullback. As a result, light crude lost 0.89% and invalidated the earlier breakout above the barrier of $50 and two other resistances. Will oil bears show their strength in the coming days?

Crude Oil’s Technical Picture

Let’s take a closer look at the chart below (charts courtesy of http://stockcharts.com).

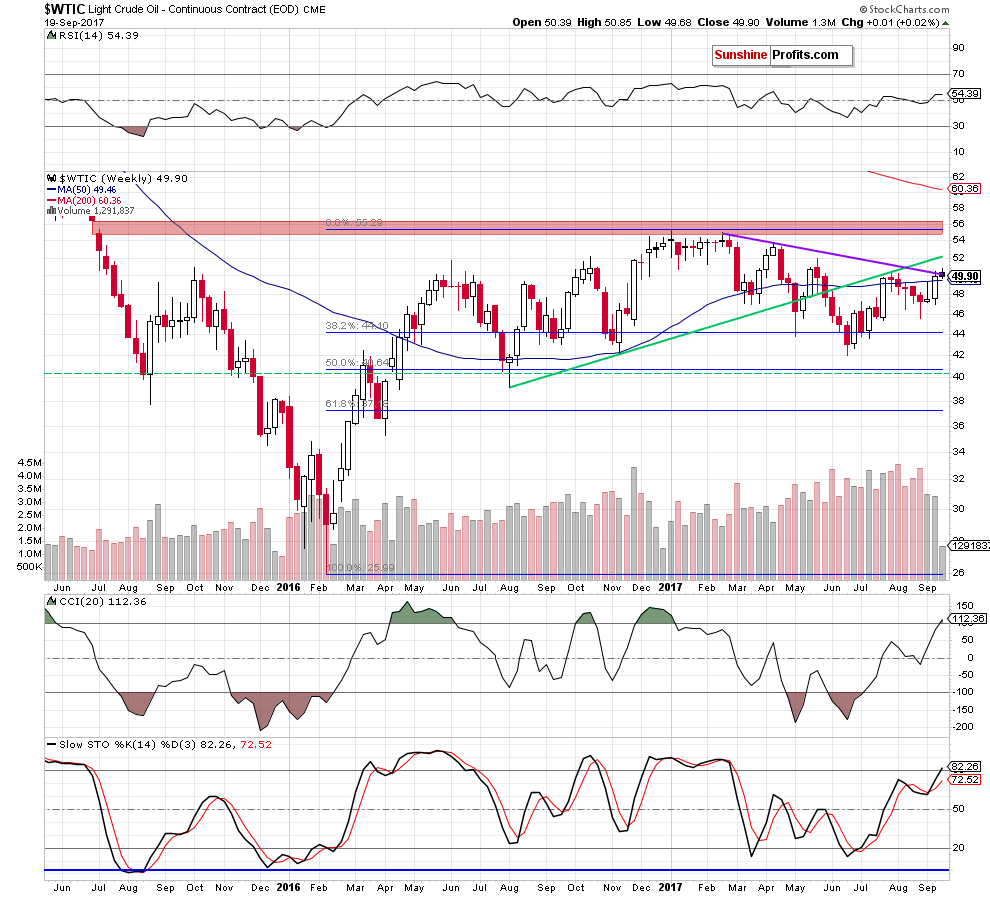

The first thing that catches the eye on the weekly chart is a drop under the purple declining support/resistance line. Thanks to this decline light crude invalidated the earlier tiny breakout above this line, which is a negative development. Nevertheless, it will turn into bearish if the commodity closes the whole week below it. In this case, oil bears will receive a very important reason to push black gold lower.

But are there any negative factors at the moment? Let’s examine the very short-term chart and find out.

Yesterday, we wrote the following:

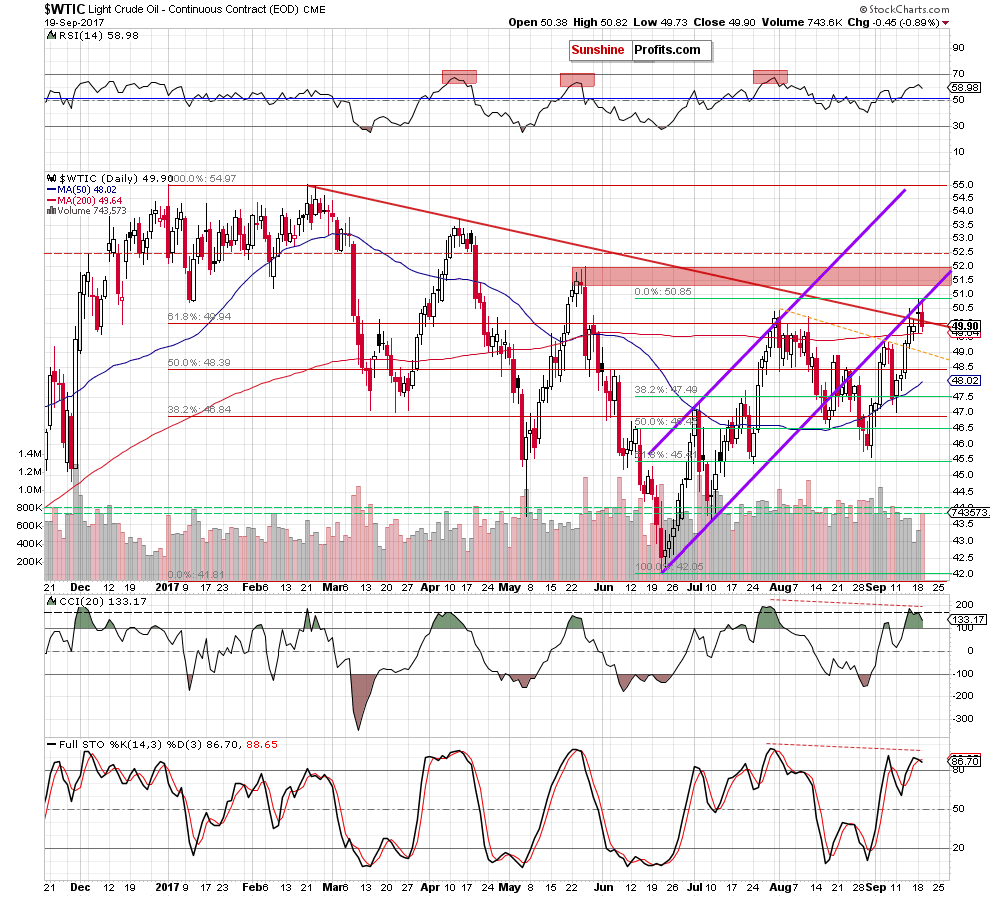

(…) crude oil extended gains (…) which resulted in another climb to the lower border of the purple rising trend channel. (…) Despite the above-mentioned improvement, light crude pulled back and closed the day under this important resistance line and the August highs, invalidating the earlier tiny breakout above these levels. Such price action looks like another verification of the breakdown below the trend channel (similar to what we saw earlier this month), which is a negative development.

(…) recent increases materialized on smaller volume than earlier declines, which increases the probability of reversal and lower prices of black gold in the very near future.This scenario is also reinforced by the current position of the daily indicators – they are overbought and close to generating sell signals, which suggest that the space for gains is limited and the return of the oil bear is only a matter of time.

Looking at the daily chart, we see that the situation developed in line with our yesterday assumptions and crude oil pulled back after another increase to the lower border of the purple rising trend channel. In this way, the commodity verified the breakdown under this line, which triggered further deterioration. As a result, light crude slipped under the red declining line, the barrier of $50 and the 61.8% Fibonacci retracement, invalidating the earlier breakouts. Additionally, the size of volume, which accompanied yesterday decline, was visibly bigger (compared to what we saw during recent increases), which suggests that another bigger move to the downside may be just around the corner.

On top of that, there are negative divergences between the CCI, the Stochastic Oscillator and the price, which increases the probability of reversal – especially when we factor in the sell signal generated by the Stochastic Oscillator and the current position of the CCI (the indicator is very close to generating a sell signal).

Where will light crude head next?

In our opinion, if crude oil moves lower from current levels, the initial downside target for oil bears will be around $47.49, where the 38.2% Fibonacci retracement (based on the entire June-September upward move is.

Summing up, short positions continue to be justified from the risk/reward perspective as crude oil verified the earlier breakdown under the lower border of the purple rising trend channel once again and invalidated the earlier breakouts above the red declining line, the barrier of $50 and the 61.8% Fibonacci retracement, suggesting that lower prices of black gold are just around the corner.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $52.52 and the initial downside target at $45.80) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts