Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): No positions in crude oil are currently justified from the risk to reward point of view.

Oil prices climbed overnight, continuing Tuesday’s (Jan. 12) rally. Oil has largely gained support from the news that Saudi Arabia will cut supplies, thus curbing the worries about rising coronavirus cases decreasing fued demand. But how long can this rally last?

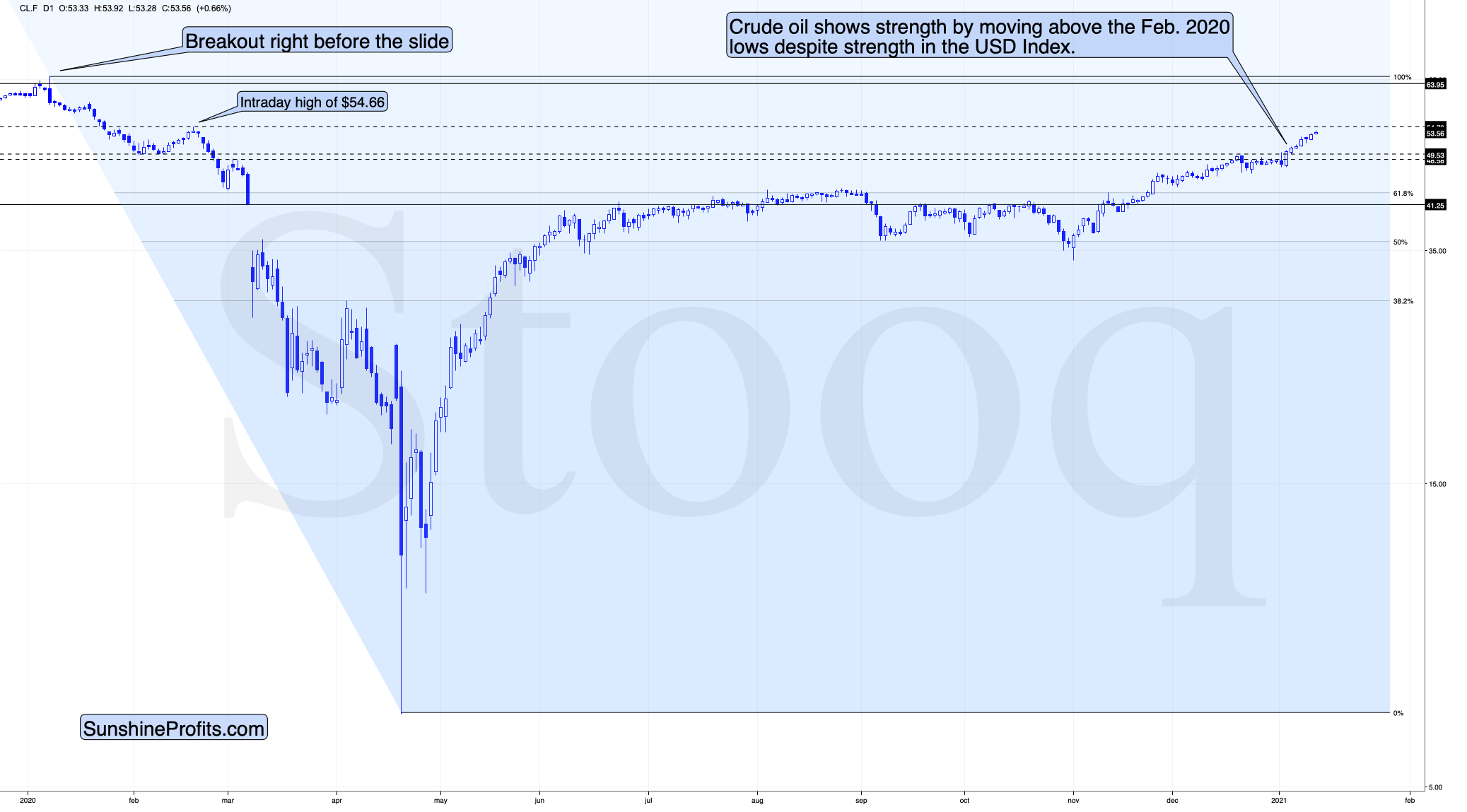

When crude oil broke above its late-2020 highs, I wrote that it could rally further in the short term, and that’s exactly what’s been taking place.

The crude oil price has moved higher steadily, almost without a pause. However, based on the resistance that is about to be hit, this might not be the case for long.

As you can see on the above chart, the next resistance is provided by the March 2020 high – at $54.66.

Will crude oil decline from that price? We’ll have to wait and see at least a convincing (on high volume) reversal to say that. The resistance being reached is one thing, but whether it triggers a reversal or a pause, is another thing altogether.

Based on crude oil’s recent ability to rally despite strength in the USD Index, it seems that the black gold (unlike the price of “regular” gold) might rally even higher before reversing. Depending on how crude oil handles the breakout above the March 2020 highs, we might even consider going temporarily long.

Still, given how ugly the situation might become in the stock market, and how bullish the situation might turn out in case of the USD Index, I don’t see a prolonged uptrend in crude oil prices from here. The biggest opportunity is likely to be in catching the next wave down, but if crude oil proves that it can really be strong in the short run, we might want to catch this short-term move to.

It’s all based on the risk to reward relation – if enough factors point to the same direction, opening a trade might be a good idea, even if it is against the bigger trend. The “don’t fight the trend” rule is useful, but one needs to keep in mind that there are multiple trends in place at the same time – the short-term trend can be different than the medium-term one, and the same goes with the long-term one (or immediate-term one).

To summarize, it seems that crude oil might move temporarily higher before turning south again. Consequently, it seems that staying on the sidelines for now is justified from the risk to reward point of view.

As always, we’ll keep you, our subscribers well informed.

Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): No positions in crude oil are currently justified from the risk to reward point of view.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief