Trading position (short-term; our opinion): Small (half of the regular size) short positions (with a stop-loss order at $61.13 and the initial downside target at $52) are justified from the risk/reward perspective.

On Thursday, crude oil moved little higher and erased some of Wednesday decline, but did it change anything in the short-term picture of black gold?

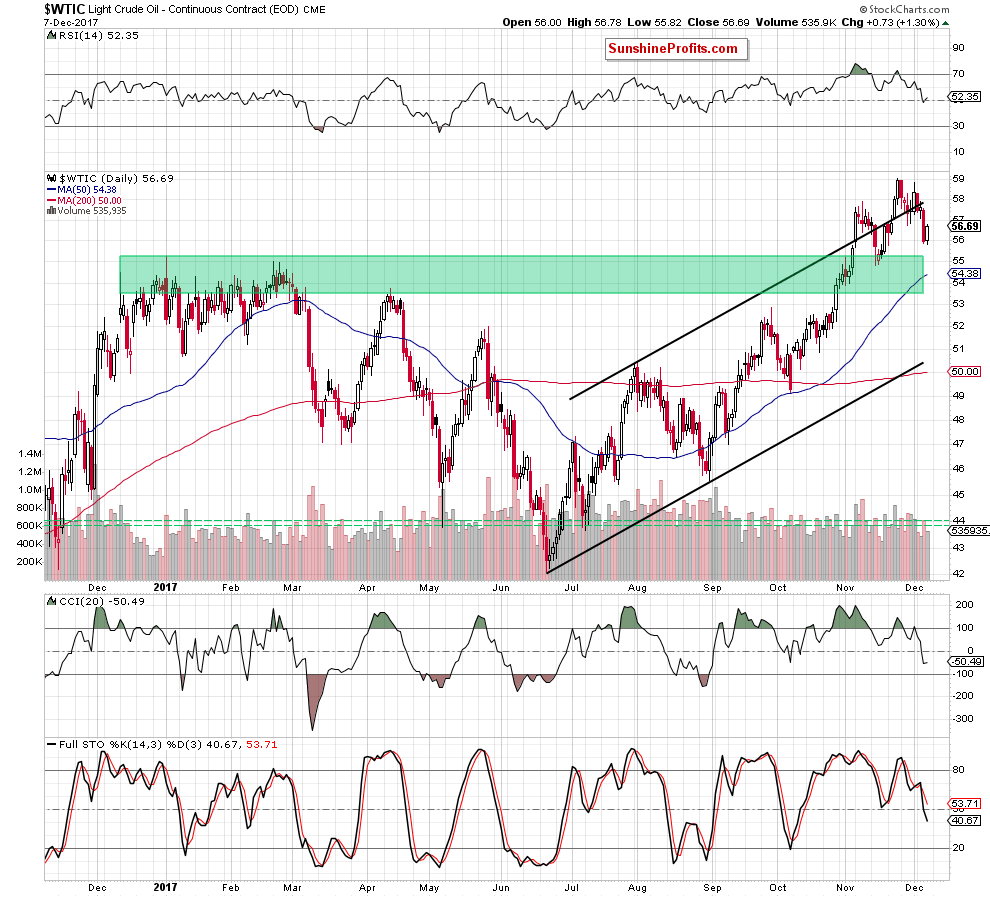

Crude Oil’s Technical Picture

Before we answer this question, let’s examine the very short-term picture of crude oil (charts courtesy of http://stockcharts.com).

Today’s alert is going to be quite short, because although crude oil increased slightly yesterday, the overall situation in the short term (not to mention the long- or medium-term perspective) hasn’t changed much as the commodity remains under the previously-broken upper border of the black rising trend channel.

Earlier today, in the pre-market trading, crude oil futures extended yesterday’s gains, which suggests that crude oil will likely follow them later in the day (similarly to what we saw many times in the past). Therefore, if oil bulls push the price of light crude higher, we can see an increase even to around $58, where the above-mentioned upper line of the trend channel currently is.

Will such price action change anything? In our opinion, it won’t, because as long as black gold is trading under the upper line of the above-mentioned formation all upswings should be considered as nothing more than verifications of the Monday breakout. In other words, short positions continue to be justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts