Trading position (short-term; our opinion): None positions are justified from the risk/reward perspective.

On Thursday, crude oil extended losses and broke below the mid-August lows. How low could the price of black gold go in the coming week?

Let’s take a look at the charts below (charts courtesy of http://stockcharts.com).

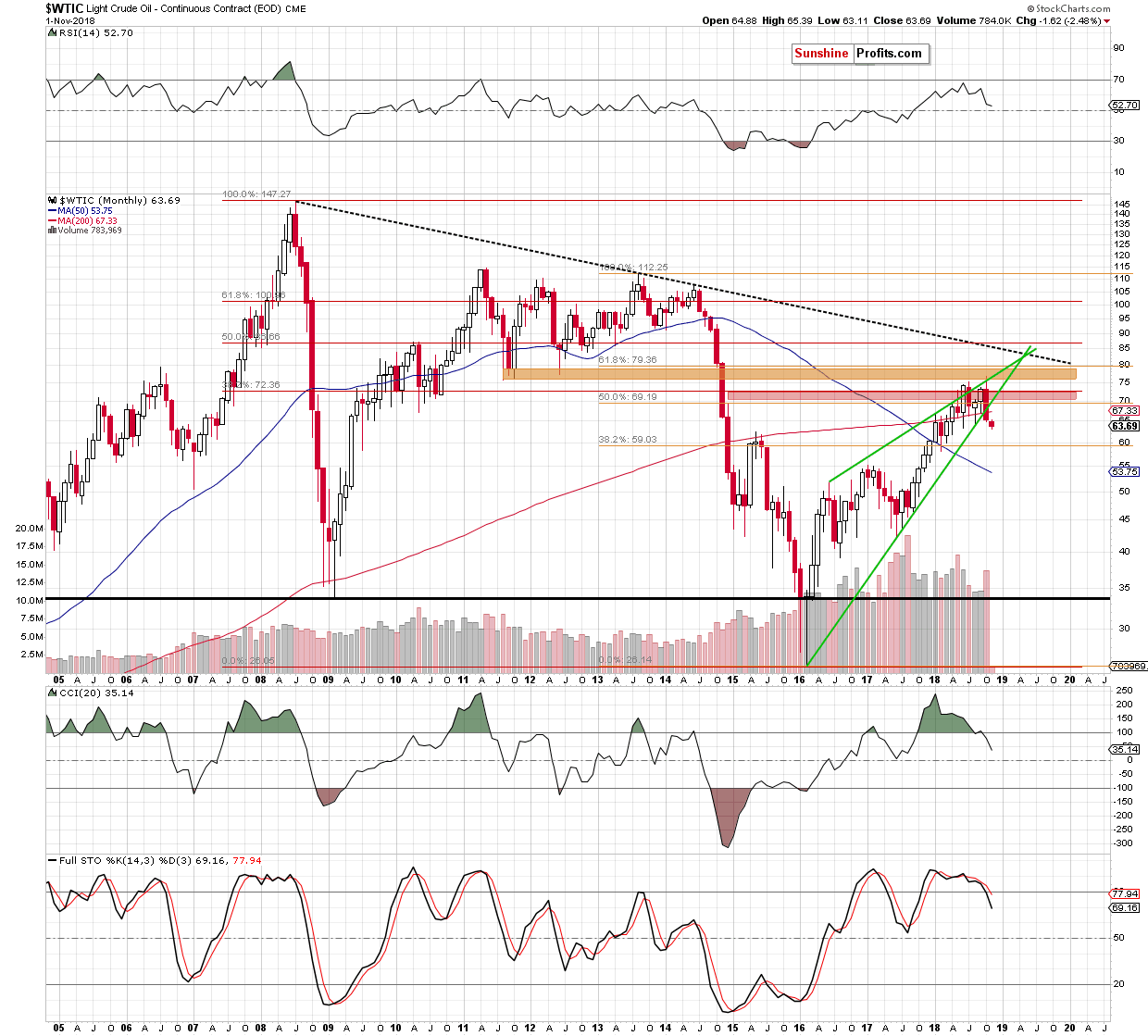

Looking at the long-term chart, we see that crude oil moved lower during the first session of the month, which together with the sell signals generated by the indicators suggests further deterioration in the coming week(s).

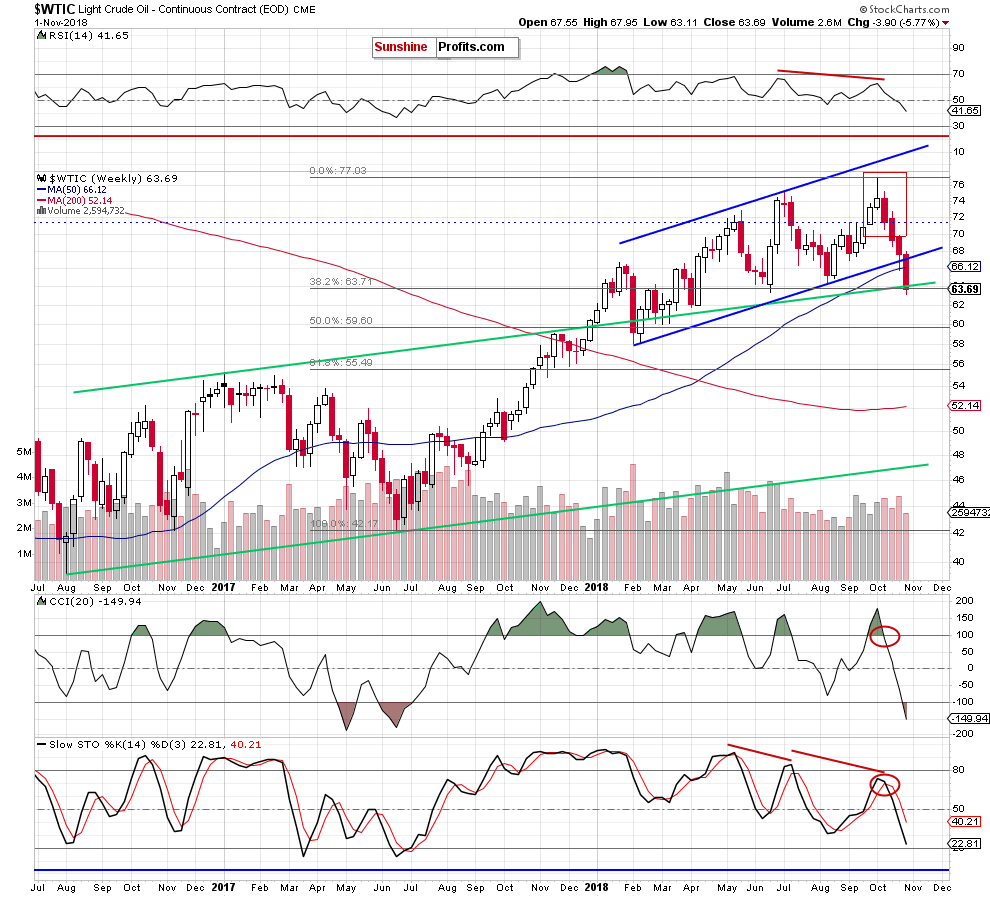

Thanks to yesterday’s decline black gold also slipped under the previously-broken upper line of the green rising trend channel and the 38.2% Fibonacci retracement, which suggests that the way to the next retracement and the barrier of $60 may be open.

Nevertheless, in our opinion, this scenario will be more likely and reliable if the commodity closes this week under these supports. If we see such price action, we’ll likely open short positions. We will keep you informed should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): None positions are justified from the risk/reward perspective. As always, we’ll keep you - our subscribers - informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts