Trading position (short-term; our opinion): Long positions (with the stop-loss order at $65.10 and the initial upside target at $70.37) are justified from the risk/reward perspective.

Before the Friday’s session closure oil bulls fell out of their strength and didn’t finish the day above the 50-day moving average. Although they “suffered a defeat”, they managed to do two other important things that will probably have a positive impact on the behavior of buyers in the coming days. What have they done?

Let’s examine the chart below (charts courtesy of http://stockcharts.com).

Technical Picture of Crude Oil

On Friday, we wrote the following:

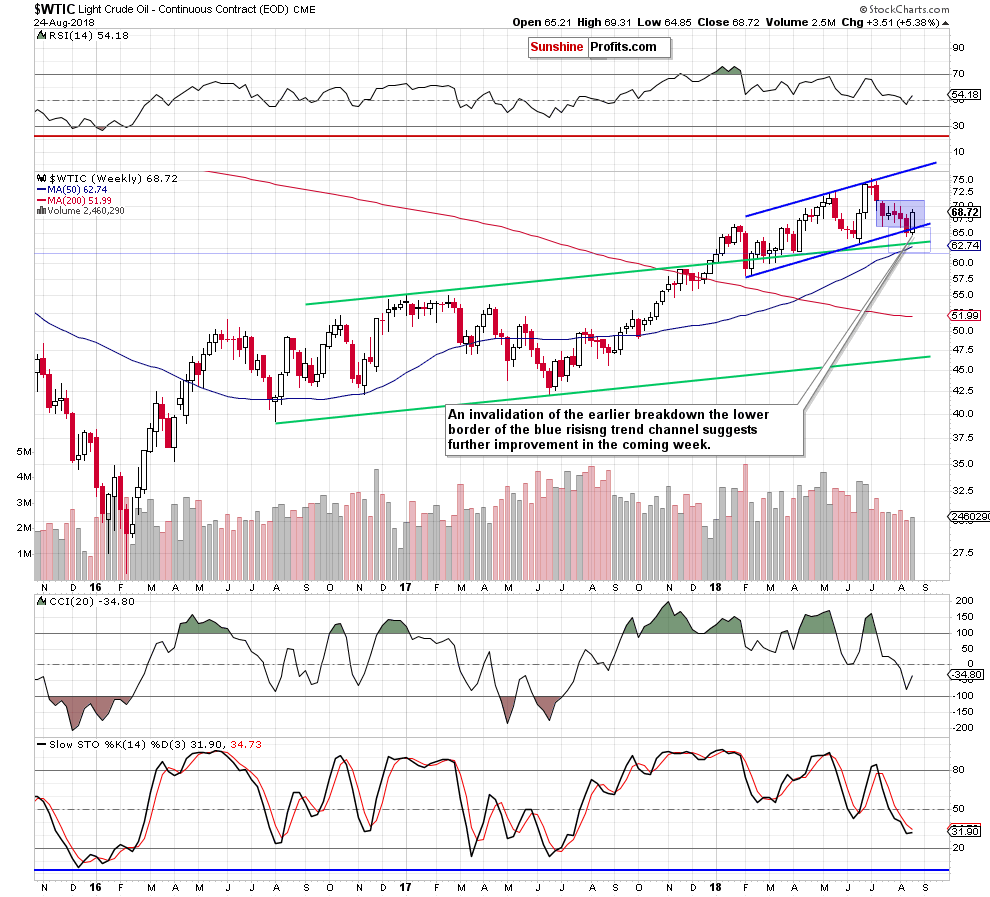

(…) if black gold closes this week at current levels (or higher), the commodity will invalidate the earlier breakdown under the lower border of the blue rising trend channel, which should trigger further improvement in the following days.

The first thing that catches the eye on the medium-term chart is the above-mentioned invalidation of the earlier breakdown under the lower border of the blue rising trend channel.

In our opinion, this is a bullish development, which suggests that higher prices of black gold in the coming week are very likely – especially when we facto in the volume, which accompanied the last week’s move to the upside.

As you see it was bigger than week earlier, which increases the probability that oil bulls recovered from earlier declines and began to grow in strength.

How did this price action affect the short-term perspective?

Before we answer this question, let’s recall the quotes from our last alert:

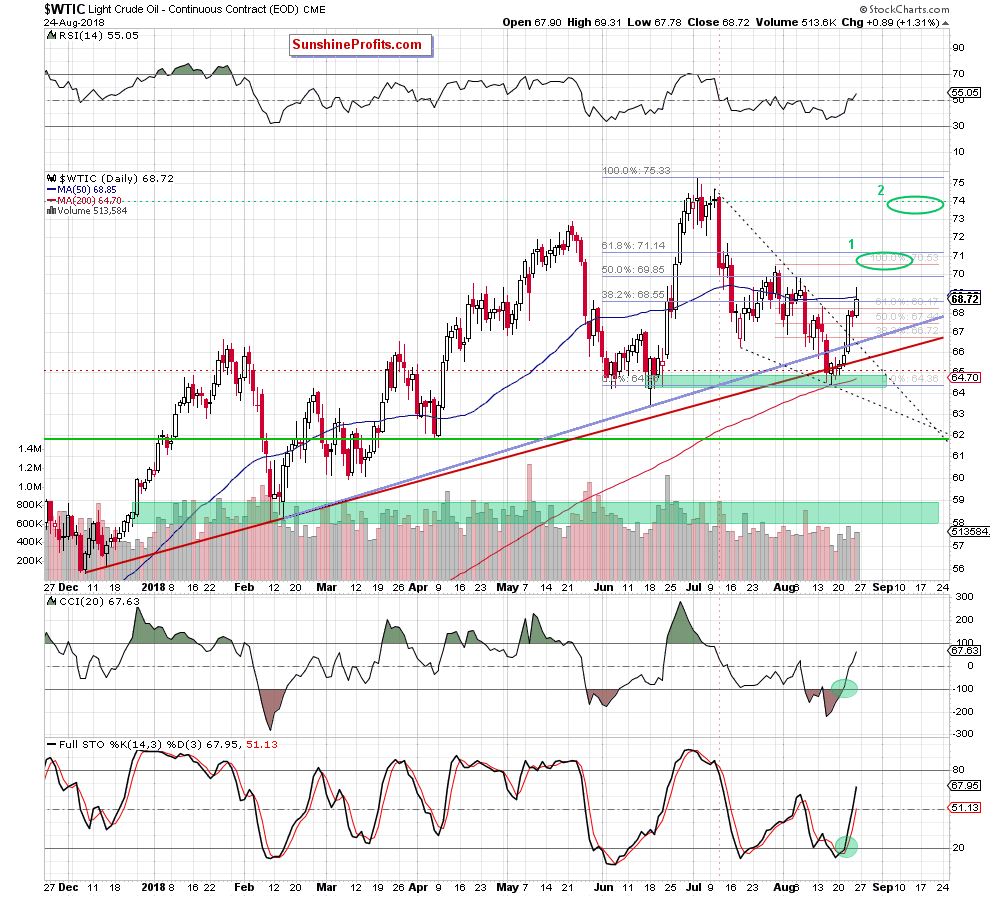

(…) the pullback was quite shallow and crude oil verified only the earlier breakout above the 50% Fibonacci retracement. After this drop, the commodity reversed and turned north once again, which suggests that oil bulls are vigilant and control the gained levels.

Additionally, yesterday’s move materialized on smaller volume than Wednesday’s upswing, which in combination with the buy signals generated by the daily indicators increases the probability that we’ll see another attempt to move higher in the very near future – maybe even later in the day or at the beginning of the coming week.

Looking at the daily chart, we see that oil bulls extended gains on Friday (just as we had expected), making our long positions profitable. Although black gold pulled back before the session’s closure, the commodity finished the day above the 61.8% Fibonacci retracement (based on the late-July-August drops), which suggest that will see further improvement in the following days.

How high could crude oil go if we see a realization of a pro-growth scenario? We believe that the best answer to this question will be the quote from our Friday’s alert:

In our opinion, the first upside target will be around $70.20-$70.40, where the late July highs are (we marked this area with the green ellipse on the daily chart). Slightly above them is also the 61.8% Fibonacci retracement, which will be the next target for the buyers.

Nevertheless, if this quite solid resistance zone is broken, oil bulls could extend gains even to around $74, where the price was very often at the turn of June and July (the upper green ellipse seen on the daily chart).

Summing up, long positions continue to be justified from the risk/reward perspective as crude oil invalidated the earlier breakdown below the lower border of the medium-term rising trend channel (a bullish development), which in combination with the buy signals generated by the daily indicators suggests further improvement and a test of our upside targets in the coming week.

Trading position (short-term; our opinion): Long positions (with the stop-loss order at $65.10 and the initial upside target at $70.37) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts