Trading position (short-term, our opinion; levels for crude oil’s continuous futures contract): No positions are currently justified from the risk/reward point of view.

Crude oil extended its uptrend on Friday, as it traded above the $74 price level. The market followed a decline in the U.S. dollar after last Wednesday’s FOMC Statement release. On Wednesday we also got a bigger than expected Crude Oil Inventories draw – -4.1M barrels vs. -2.6M expected. The decrease in Crude Oil Inventories implies stronger demand, and it’s bullish for crude prices.

Investors will wait for tomorrow’s American Petroleum Institute Weekly Crude Oil Stock release. It will show how much oil and product is available in storage. Overall, it gives an overview of U.S. petroleum demand.

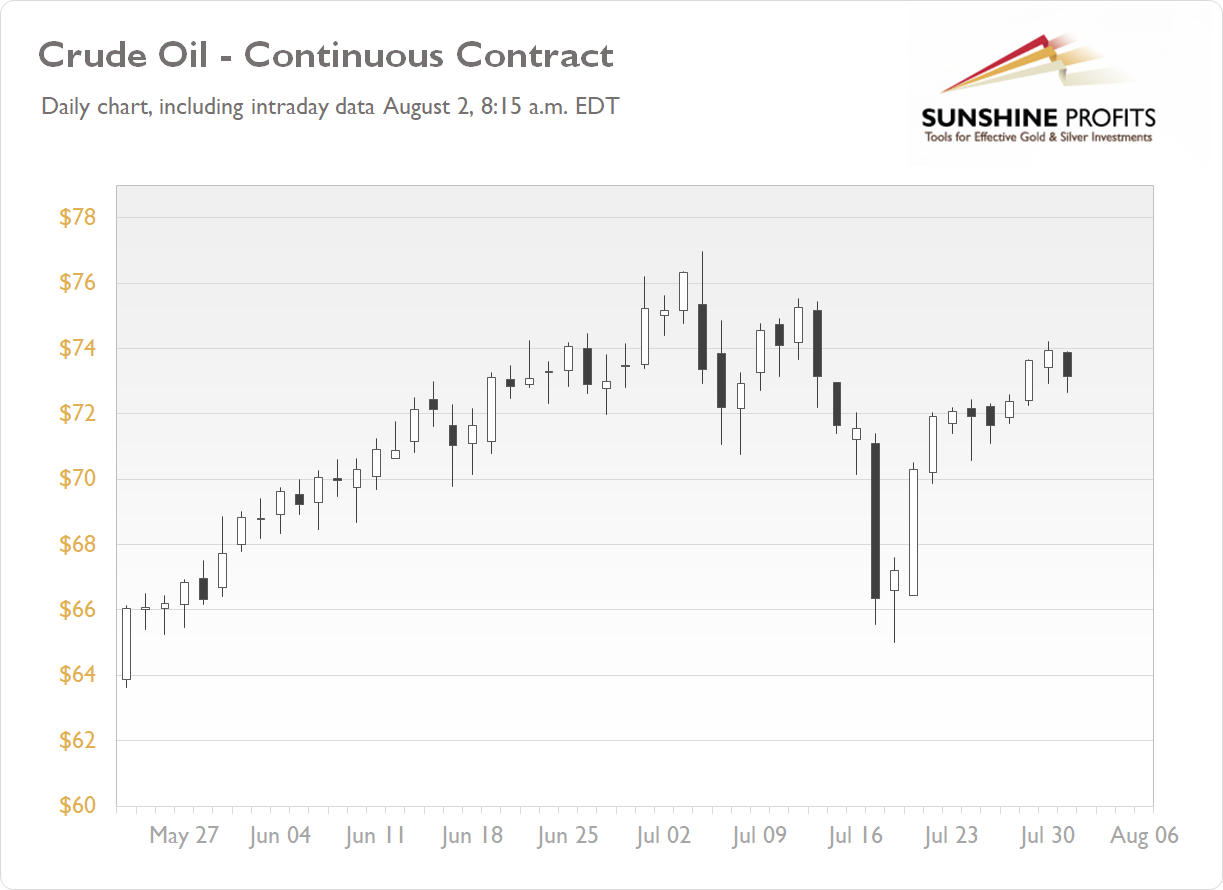

Crude oil price is back within its mid-June – mid-July consolidation, marked by local lows at $71-72 and local highs at $76-77. The market has quickly rebounded from the July 20 local low of $65.01. However, we may see more uncertainty in the near future, as $76-77 remains an important resistance level.

Oil Above $72 Again

The market is fluctuating after breaking above the recent consolidation level at $72. As long as crude oil is trading above that level, we may see an attempt to reach the medium-term high of $76.98 again.

(the graph includes today’s intraday data)

New Uptrend or Still a Correction?

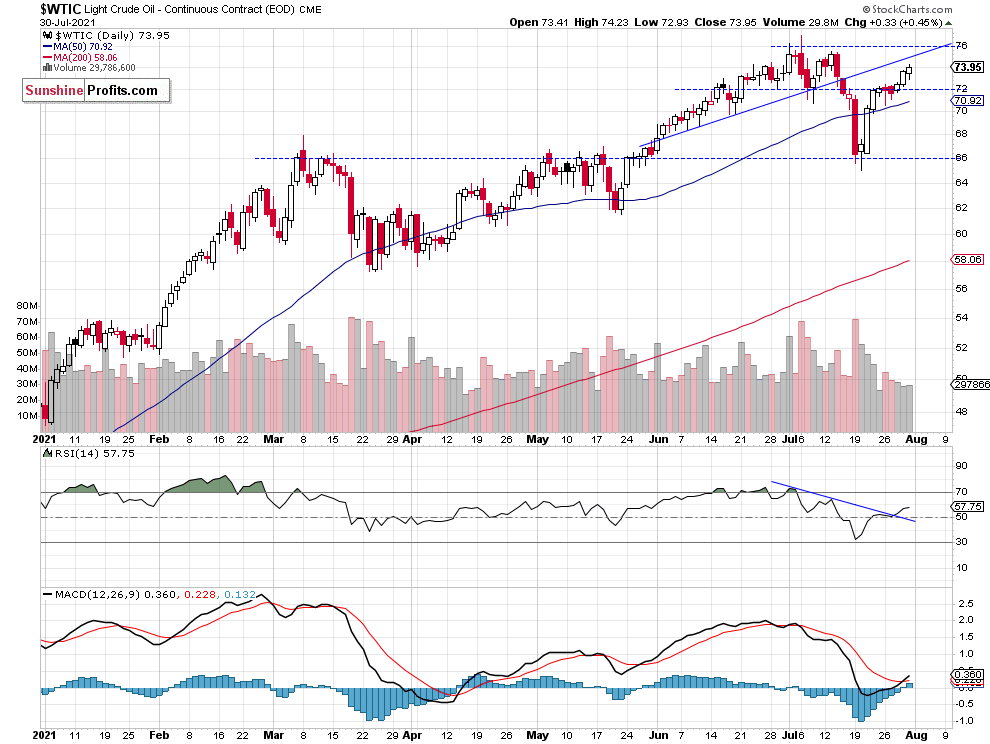

The market gets closer to its over month-long upward trend line after bouncing back from the support level at $65-66. The previous local highs and the above-mentioned broken trend line are acting as resistance levels, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

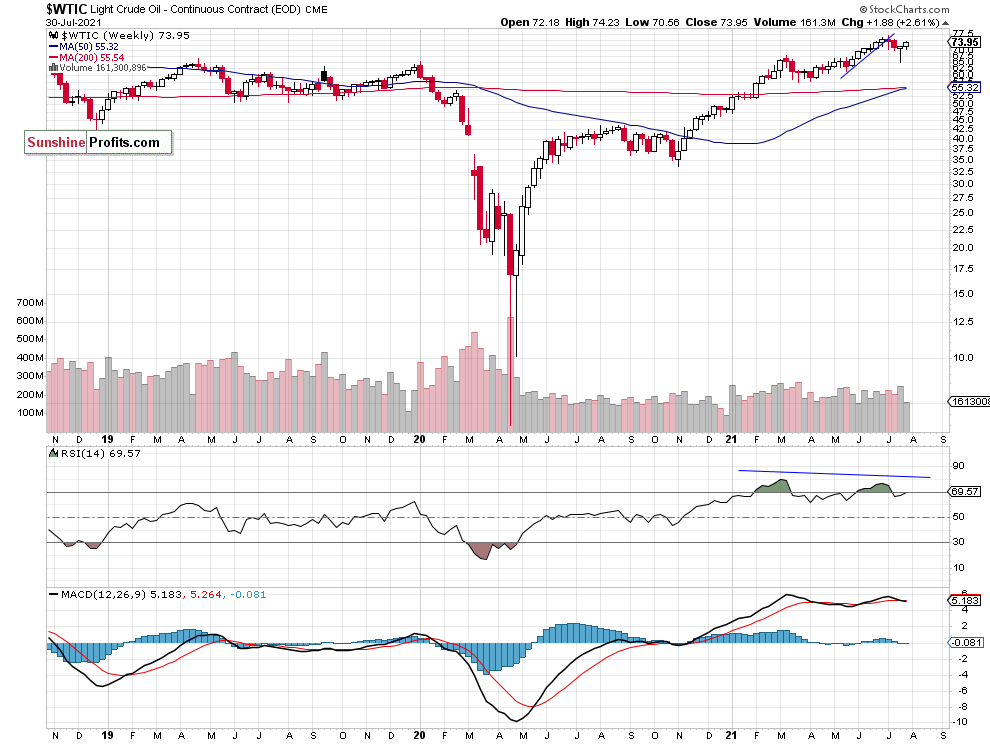

The weekly chart of the Light Crude Oil Continuous Contract is still showing clearly negative technical divergences between the price and the indicators. But there have been no confirmed negative signals so far. The market remains close to the medium-term highs:

Conclusion

Oil has been trading near the resistance level of $72 recently, but on Thursday it broke higher following a weakening of the U.S. dollar and Crude Oil Inventories draw data release. It’s likely that the market will reach the next resistance level of around $76-77. We may open a speculative short position there. No positions are justified from the risk/reward point of view at this moment.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for crude oil’s continuous futures contract): No positions are currently justified from the risk/reward point of view.

Thank you.

Paul Rejczak,

Oil Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care