Trading position (short-term; our opinion): Small (half of the regular size) short positions (with a stop-loss order at $61.13 and the initial downside target at $52) are justified from the risk/reward perspective.

On Wednesday, crude oil moved a bit lower and closed the day below the barrier of $60. Will oil bulls manage to push the commodity higher and finish the year above this level?

Crude Oil’s Technical Picture

Let’s examine the charts below and try to find out where will black gold head next (charts courtesy of http://stockcharts.com).

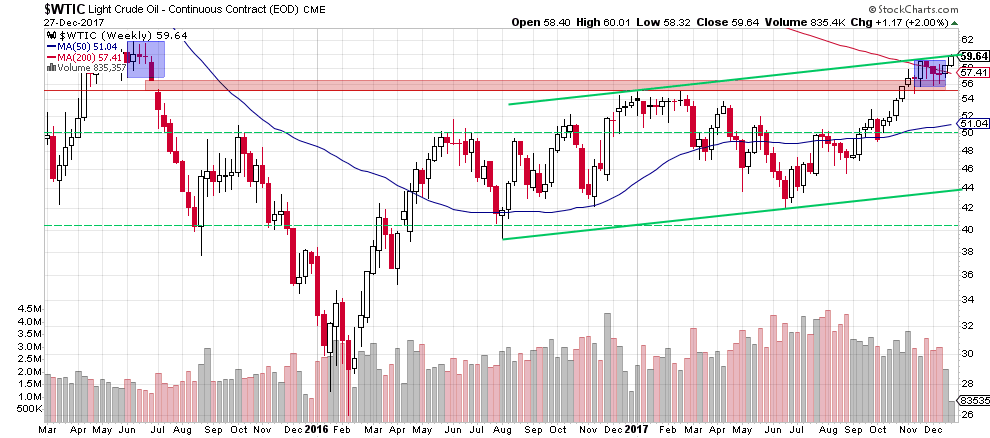

Looking at the weekly chart, we see that although crude oil increased to the barrier of $60 earlier this week, oil bulls didn’t manage to push the commodity higher, which resulted in a pullback. As a result, black gold came back below the previously-broken upper border of the rising trend channel, which suggests an invalidation of the breakout. Nevertheless, we should keep in mind that this signal will be more reliable if we see weekly closure under this resistance line.

Will we see such price action? Analyzing the long-term chart of light crude, we think that lower prices are very likely. Why? Let’s take a closer look at the monthly chart below.

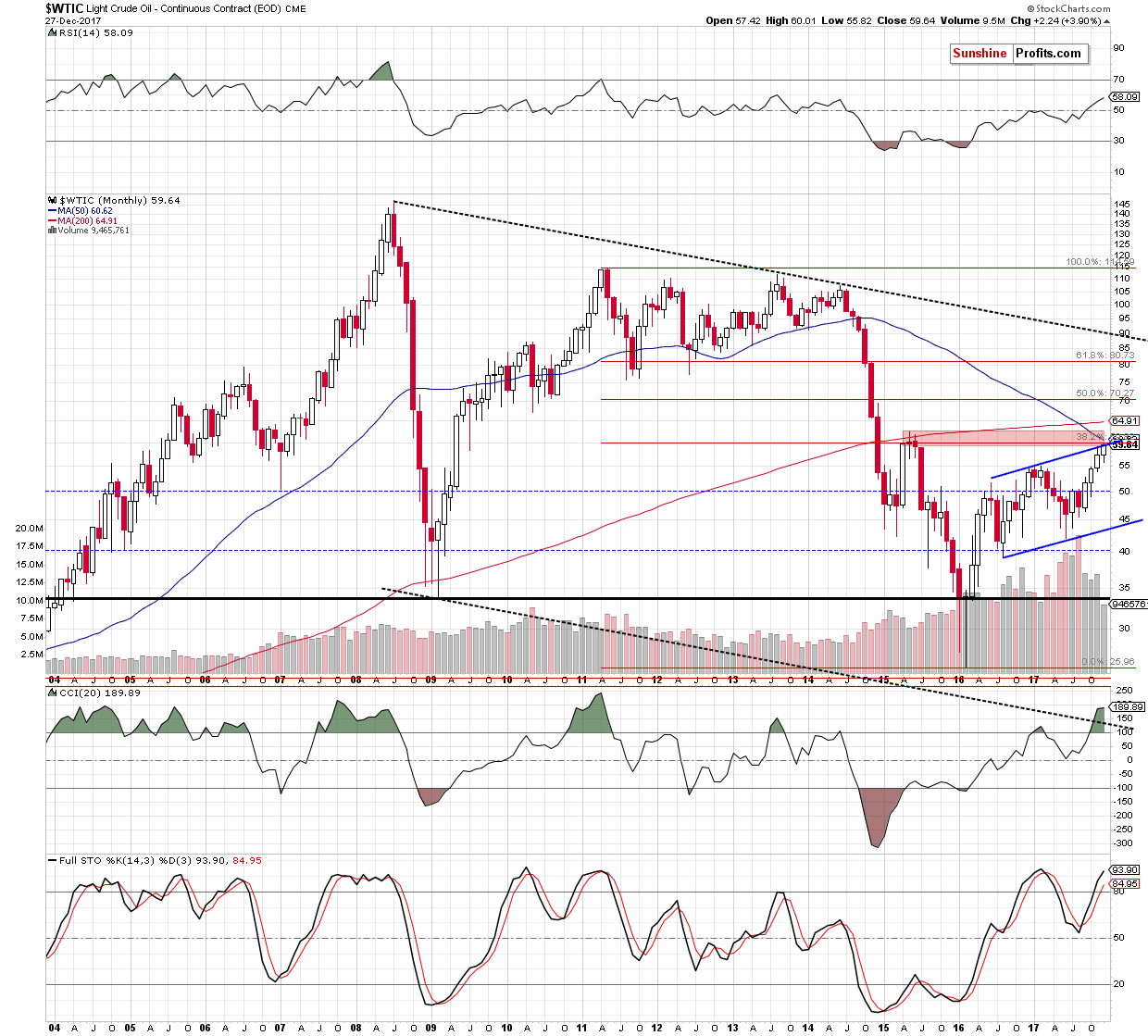

From today’s point of view, we see that although crude oil increased this month, the key resistance zone (created by the 2015 peaks and reinforced by the 50-month moving average and the 38.2% Fibonacci retracement based on the entire 2011-2016 downward move) remains in cards.

What does it mean for crude oil and the bulls? In our opinion, as long as there is in breakout above this key resistance area, the way to higher prices is blocked. This scenario is also reinforced by the similarity to the past, which we commented more widely in yesterday's alert:

The crude oil moved to new highs (…) we saw exactly the same thing at the end of 2016. In the final days of the previous year, crude oil broke above the previous highs on relatively low volume. The volume that we saw yesterday wasn't as extremely low as the late-2016 one, but compared to the size of yesterday's move, it was indeed small. Consequently, the 2 cases appear analogous and we doubt that yesterday's rally is black gold's true move.

Moreover, let's keep in mind that crude oil topped also in the final days of 2015. There was no major top in the final days of 2014, but crude oil declined in the early part of 2015 anyway. Additionally, there was a top in the final days of 2013.

All in all, in 4 out of the past 4 years the price of crude oil fell in the first part of the year and the last part of the previous year was a great time to enter short positions - not to exit them. Consequently, since history tends to repeat itself, keeping the short positions intact seems to be justified at this time.

Summing up, short positions continue to be justified from the risk/reward perspective as crude oil remains under the key resistance zone marked on the monthly chart.

Trading position (short-term; our opinion): Small (half of the regular size) short positions (with a stop-loss order at $61.13 and the initial downside target at $52) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts