Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Although crude oil moved lower after the market’s open, the EIA weekly report encouraged oil bulls to act, which resulted in a fresh July peak. How high could the black gold go in the coming days?

Yesterday, the Energy Information Administration report showed that crude oil inventories fell by 7.2 million barrels in the week ended July 14, beating expectations of a draw of 2.6 million barrels. Additionally, gasoline inventories fell by 1 million barrels, beating expectations of a draw of 614,000 barrels. On top of that, distillate stockpiles fell by 1.9 million barrels, compared to expectations of a decline of 453,000 barrels. These bigger-than-expected declines in crude and gasoline stockpiles encouraged oil bulls to act, which resulted in a fresh July peak. How high could the black gold go in the coming days?

Crude Oil’s Technical Picture

Let’s take a closer look at the charts and find out (charts courtesy of http://stockcharts.com).

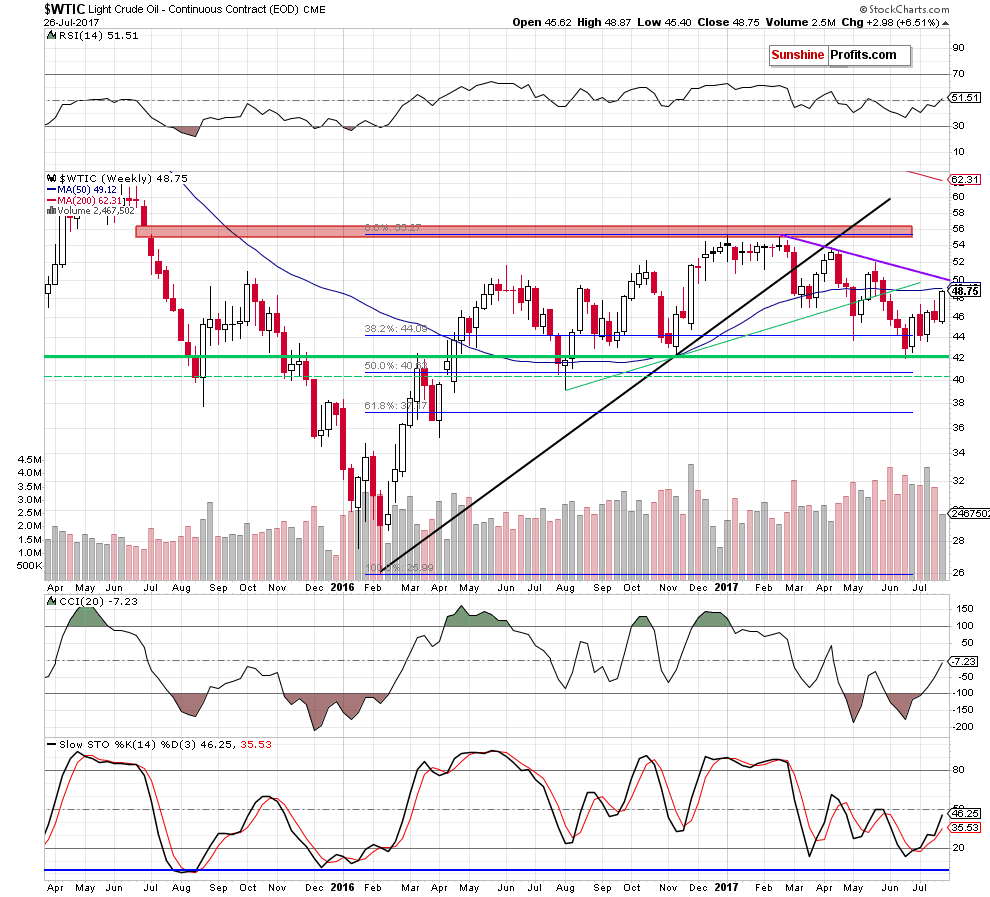

On the weekly chart, we see that crude oil extended gains and approached the 50-week moving average, but will we see further rally? Let’s examine the very short-term picture and find out what can we infer from it.

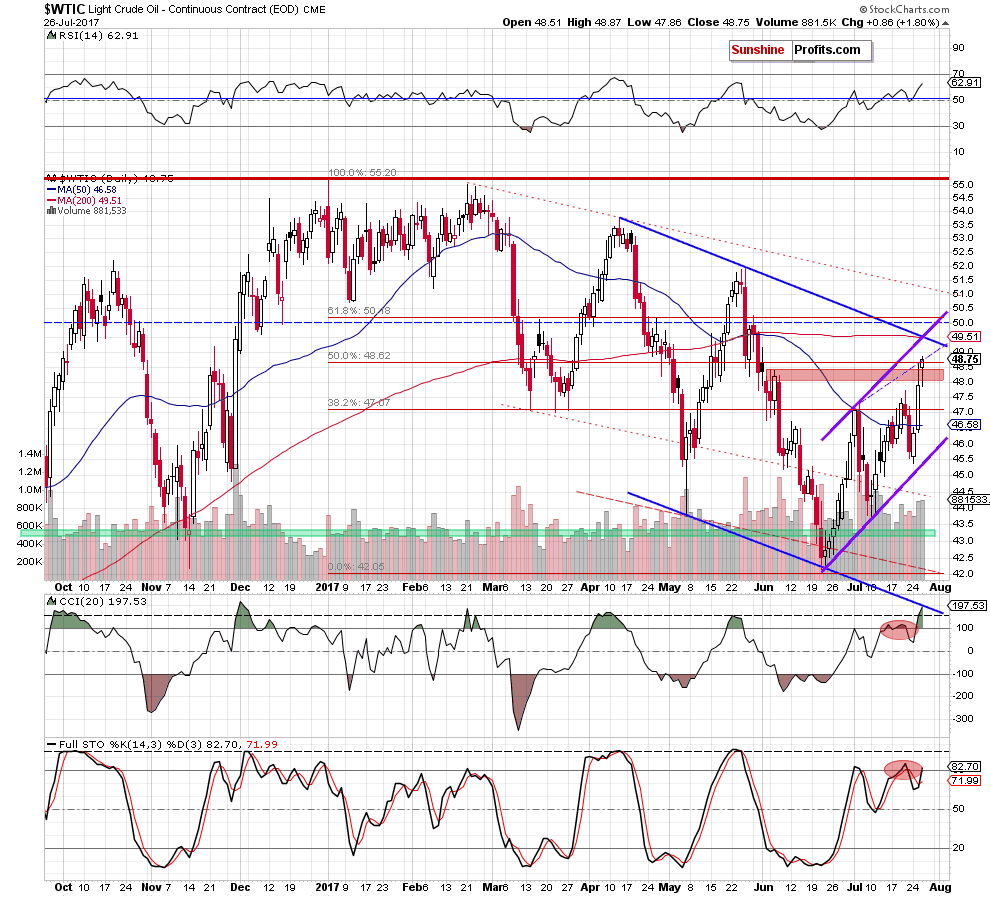

From this perspective, we see that although crude oil moved lower after the market’s open, oil bulls stopped further deterioration, triggering a rebound. As a result, light crude not only climbed above Tuesday’s high, but also broke above the red resistance zone and the 50% Fibonacci retracement (based on the entire 2017 downward move), opening the way to higher levels.

How high could the black gold go in the coming days?

We believe that the best answer to this question will be the quote from our last Oil Trading Alert:

(…) the space for gains seems limited as the upper border of the purple rising trend channel, the upper border of the blue declining trend channel and the 50-week moving average are not far from yesterday’s levels. Therefore, we think that even if light crude increases slightly later in the day, the combination of these resistances will be strong enough to stop oil bulls and trigger reversal and declines in the coming days.

Summing up, crude oil invalidated the earlier breakdown under the red resistance zone and the 50% Fibonacci retracement, which is a positive development and suggests a test of the resistance zone created by the upper border of the purple rising trend channel and the upper border of the blue declining trend channel in the coming day(s).

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts