Trading position (short-term; our opinion): Short positions (with a stop-loss order at $54 and the initial downside target at $45.80) are justified from the risk/reward perspective.

On Monday, crude oil lost 2.11% after investors digested Friday’s news (the Baker Hughes report and higher OPEC output). Thanks to these circumstances, light crude slipped to the barrier of $50 and tested August peaks. Will we see a verification of the earlier breakout above them or further declines in the coming week?

Crude Oil’s Technical Picture

Let’s take a closer look at the charts below and find out (charts courtesy of http://stockcharts.com).

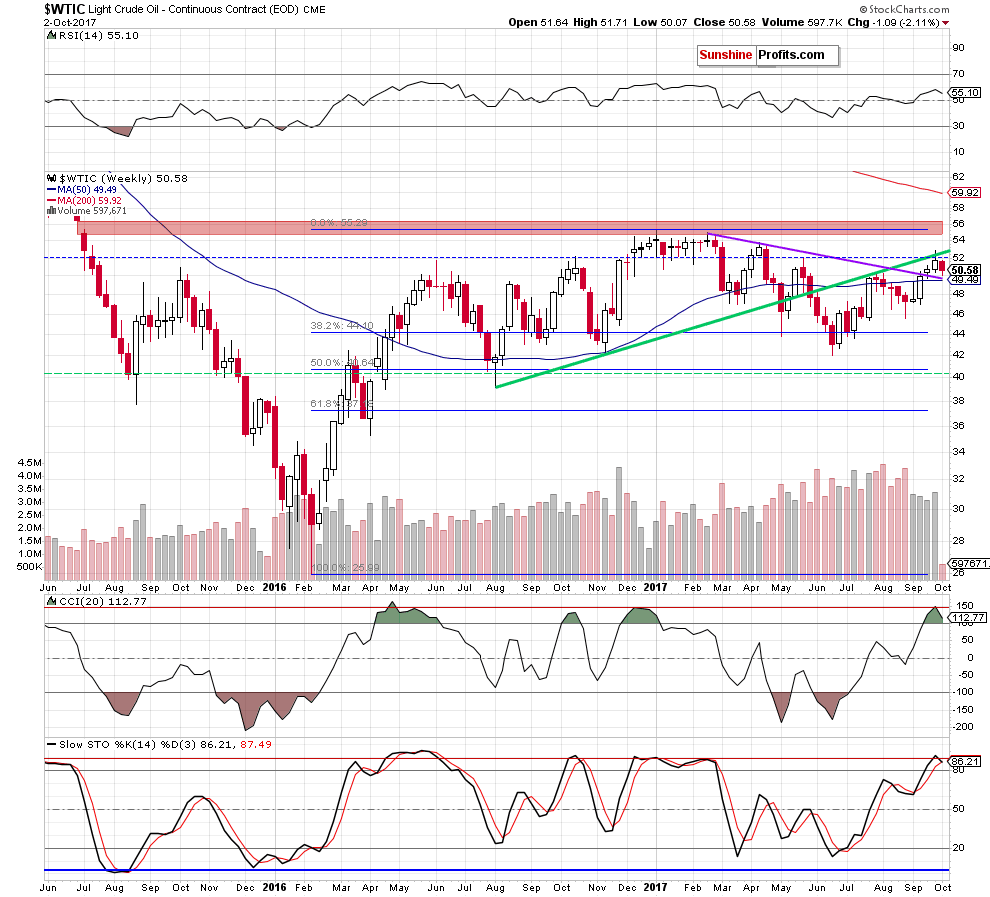

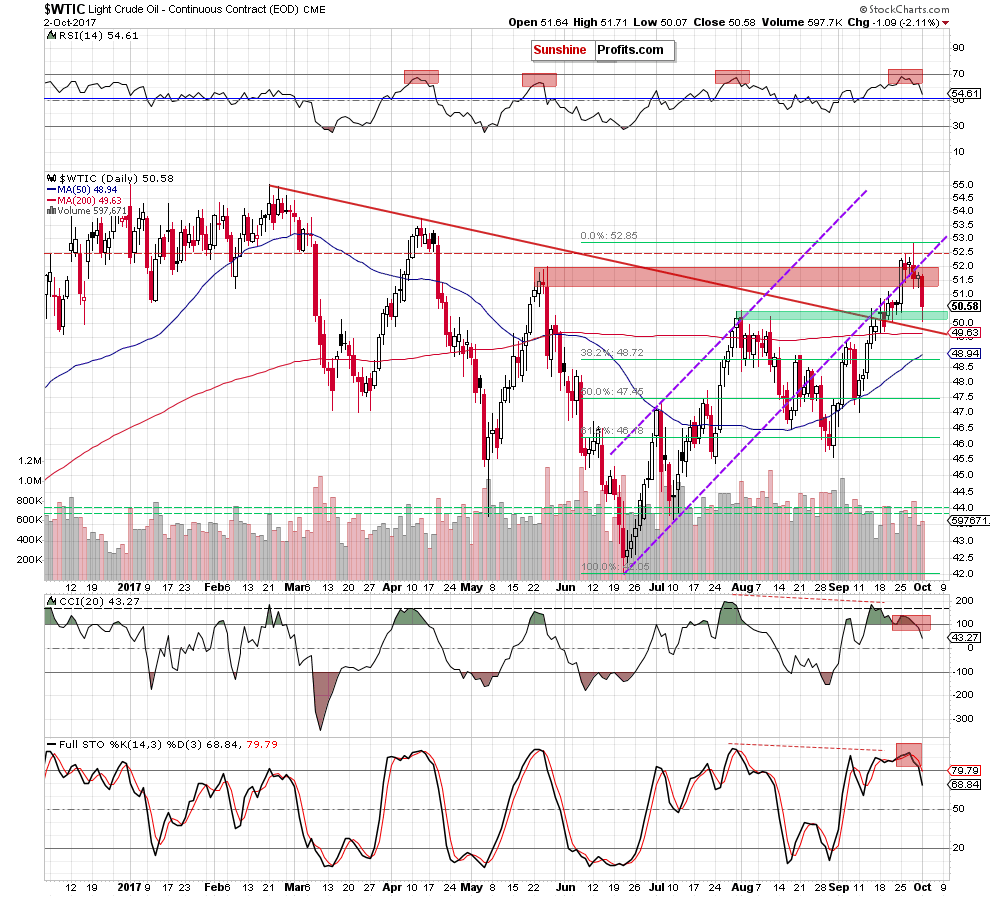

Looking at the charts, we see that crude oil extended losses, which together with the sell signals generated by the daily indicators and the weekly Stochastic Oscillator suggest lower prices in the coming days – even if the green support zone (created by the August peaks) triggers a small rebound later in the day.

Taking the above into account, we believe that what we wrote yesterday remains up-to-date also today:

(…) the commodity closed the previous week under the long-term green resistance line, invalidating earlier breakouts and giving oil bears an important reason to act in the coming week.

(…) On the daily chart, we see that although crude oil moved a bit higher on Friday, the size of rebound was small compared to Thursday pullback. Additionally it materialized on visibly lower volume than earlier decline, which increases doubts about oil bulls’ strength and further rally.

On top of that, crude oil closed another session and the whole week below the recent highs and the previously-broken lower border of the purple rising trend channel, which together with the sell signals generated by the CCI and the Stochastic Oscillator suggests further deterioration in the coming week.

How low could crude oil go?

If (…) crude oil declines from current levels, the initial downside target for oil bears will be around $49.85, where the previously-broken red declining line (which serves as the nearest support) is. If it’s broken, we’ll likely see a drop to the 38.2% Fibonacci retracement based on the June-September upward move (around $48.72) in the following days.

Summing up, short positions continue to be justified from the risk/reward perspective as the combination of the technical (invalidation of breakouts, higher volume during declines, sell signals generated by the indicators) and the fundamental pictures (an increase in the number of oil rig, higher production from Iraq and Libya) of the commodity suggest that further deterioration is just around the corner.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $54 and the initial downside target at $45.80) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts