Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Although oil bulls pushed the price of light crude higher after yesterday’s market’s open, their march to the north turned out to be very short-lived. The combination of two resistances stopped them, triggering a pullback and causing a bearish development. What can be the consequences of this price action in the coming days?

Let’s analyze the charts below and try to answer to this question (charts courtesy of http://stockcharts.com).

In our last Oil Trading Alert, we wrote the following:

(…) the price of black gold hit an intraday high of $54.22 and climbed to the major very short-term resistances seen on the chart below. Unfortunately (for the bulls) this is the place where doubts begin to appear. Why?

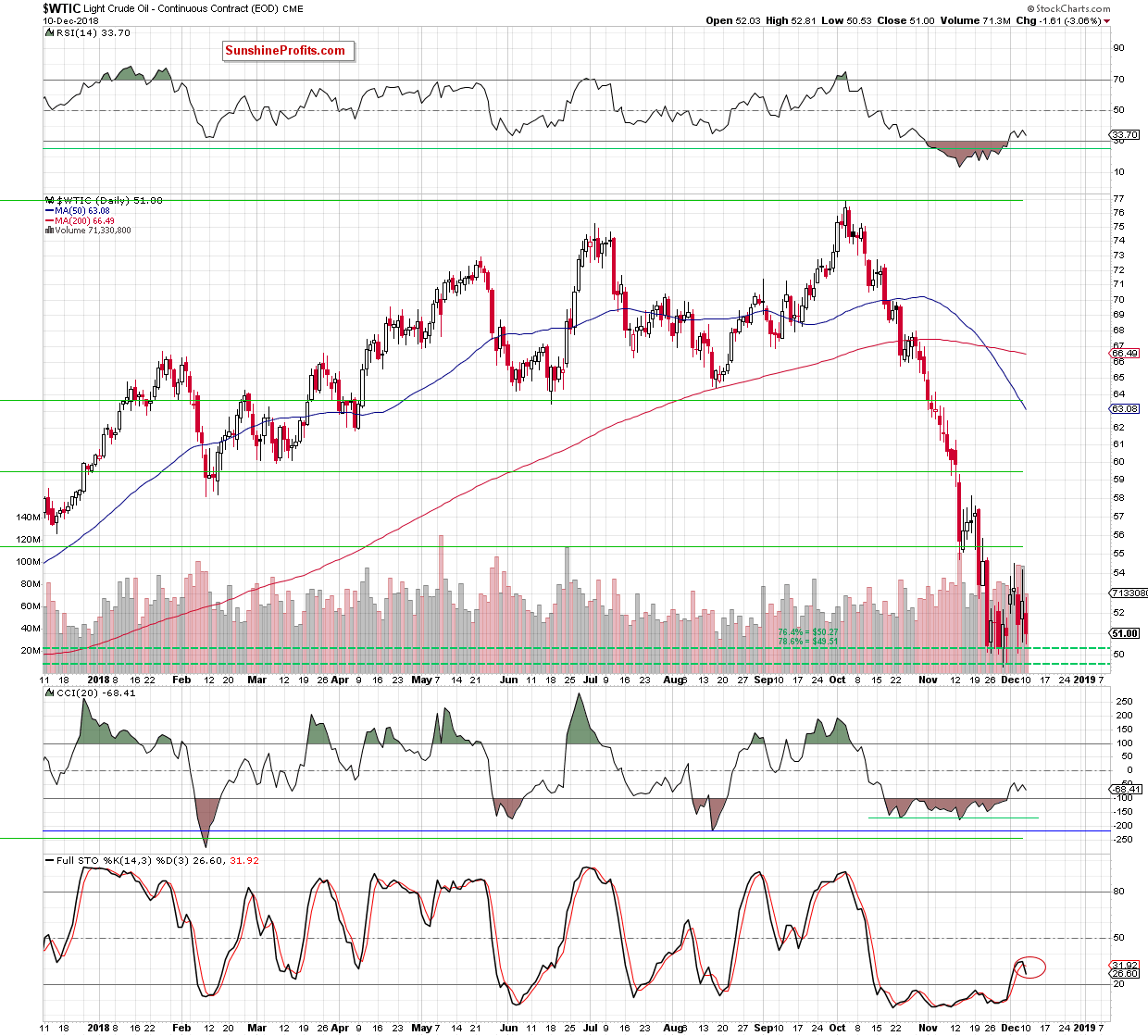

Because despite Friday’s upswing, oil bulls didn’t manage to hold gained levels for the second time in a row (as a reminder, we saw a very similar price action during Tuesday’s session), which resulted in a correction of the earlier move and another invalidation of the small breakout above the blue resistance line based on the previous highs and the 50% Fibonacci retracement.

A similar price action at the beginning of the previous week caused a sharp decline and a re-test of the major short-term supports on the following session. Therefore, taking all the above into account, we think that one more downswing (to the above-mentioned support area created by the Fibonacci retracements or even to the barrier of $50) from current levels should not surprise us in the very near future.

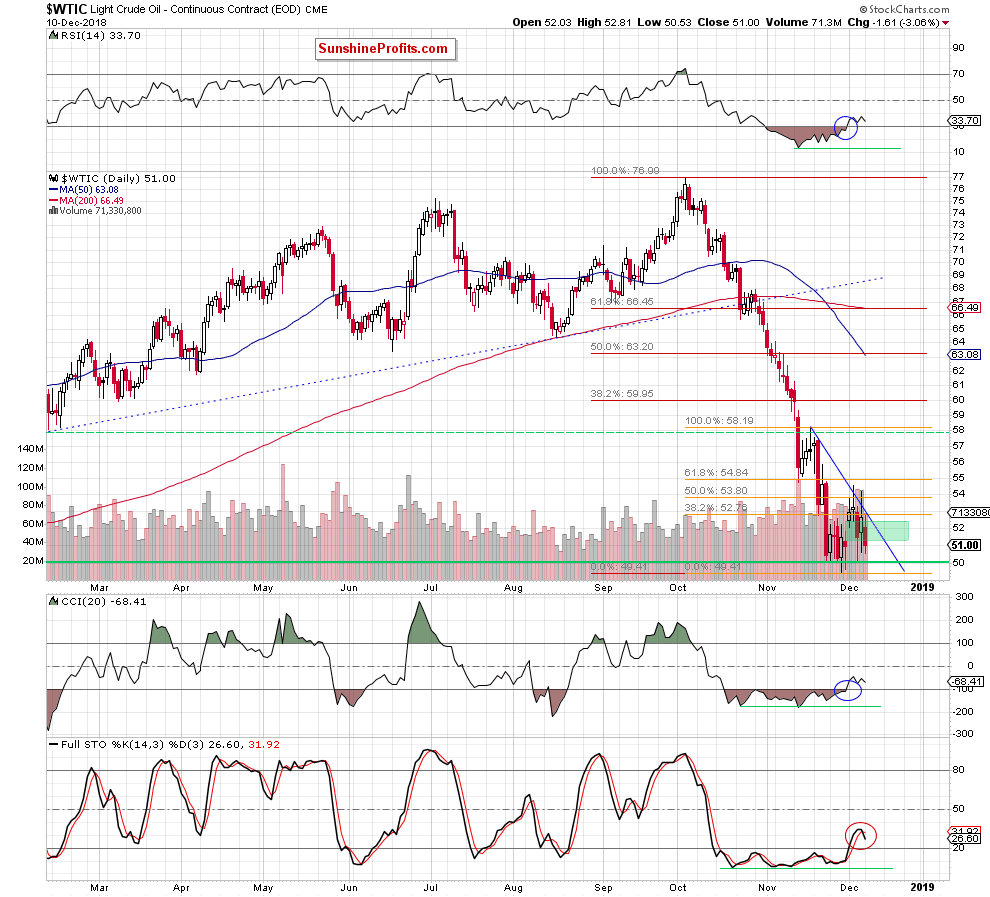

From today’s point of view, we see that the situation developed in line with the above scenario and crude oil extended losses during yesterday’s session. As you see on the daily chart, although the commodity increased after the Monday’s market’s open, the combination of the 38.2% Fibonacci retracement and the above-mentioned very short-term blue resistance line based on the previous highs was enough to stop the buyers and trigger a move to the downside in the following hours.

Thanks to this price action, light crude closed the day below $51.27, which resulted in the closing of the green gap. Additionally, the Stochastic Oscillator generated a sell signal, suggesting that another move to the downside might be just around the corner.

If this is the case and black gold moves lower from current levels, we’ll see (at least) a re-test of the barrier of $50, the support area created by the 76.4% and the 78.6% Fibonacci retracements (marked with the green horizontal dashed lines on the char below) or even the last week lows in the very near future.

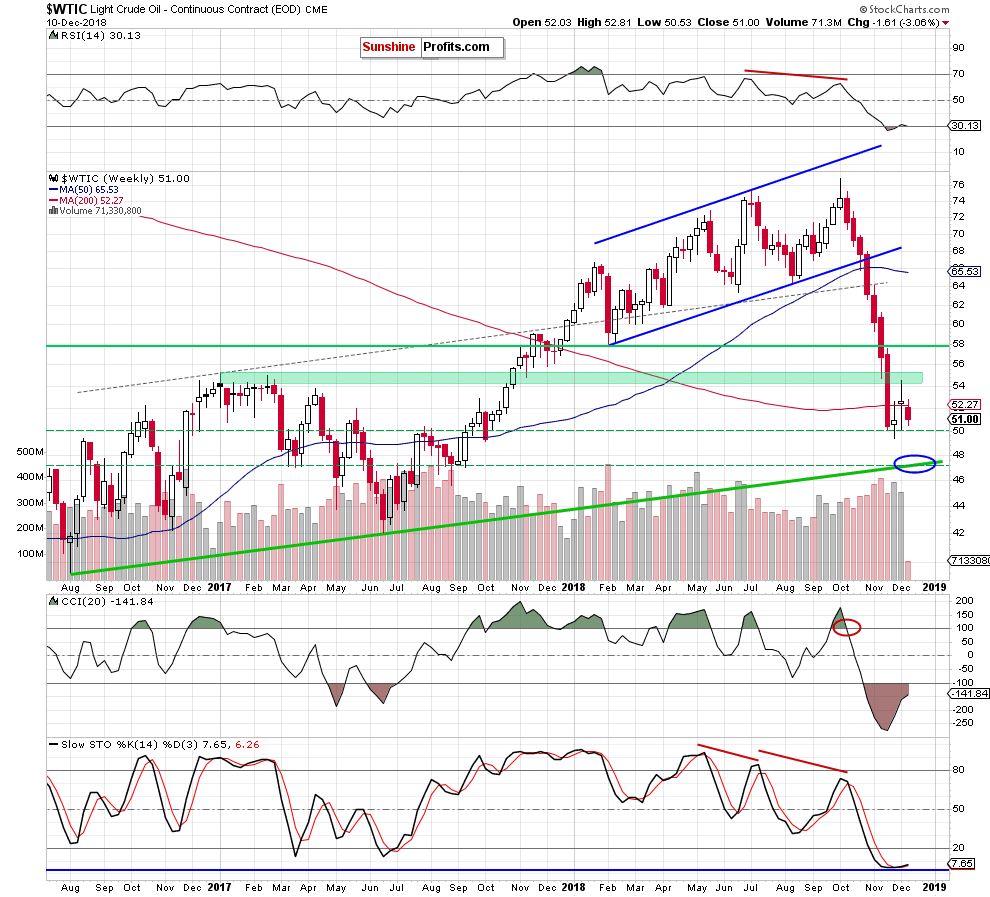

Finishing today’s commentary on crude oil, please keep in mind that if oil bulls fail in this area and allow their opponents to push the price of black gold to a fresh low, we can see a decline even to around $47.20, where the long-term green rising support line (marked on the weekly chart below) based on the August 2016 and the June 2017 lows currently is.

Summing up, the overall situation in the very short term deteriorated slightly after oil bulls failed to move above the blue declining resistance line for a third time in a row. Their weakness also resulted in a closure of the green gap, which in combination with the sell signal generated by the Stochastic Oscillator suggests that one more downswing and a re-test of the nearest supports might be just around the corner.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts