Trading position (short-term; our opinion): Short positions (with a stop-loss order at $54 and the initial downside target at $45.80) are justified from the risk/reward perspective.

On Tuesday, light crude lost 0.32% as Friday news and uncertainty ahead of inventories reports pushed the price of black gold lower. In this environment the commodity re-tested the barrier of $50 and August peaks, but will they withstand the selling pressure in the coming days?

Crude Oil’s Technical Picture

Let’s take a closer look at the charts below and find out (charts courtesy of http://stockcharts.com).

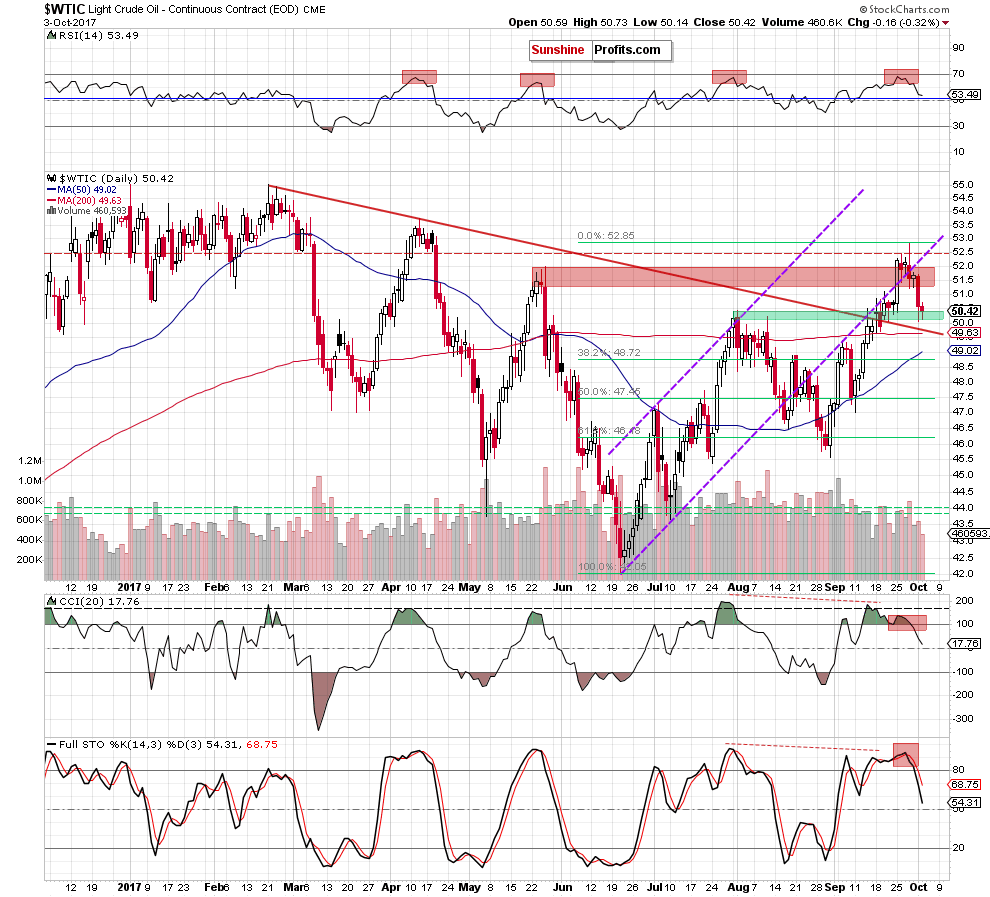

Today’s alert is going to be quite short, because crude oil didn’t do anything that would change the outlook on Tuesday and the same applies to today’s session so far. The only thing that light crude did yesterday is that it moved a bit lower and re-tested the barrier of $50 and August peaks.

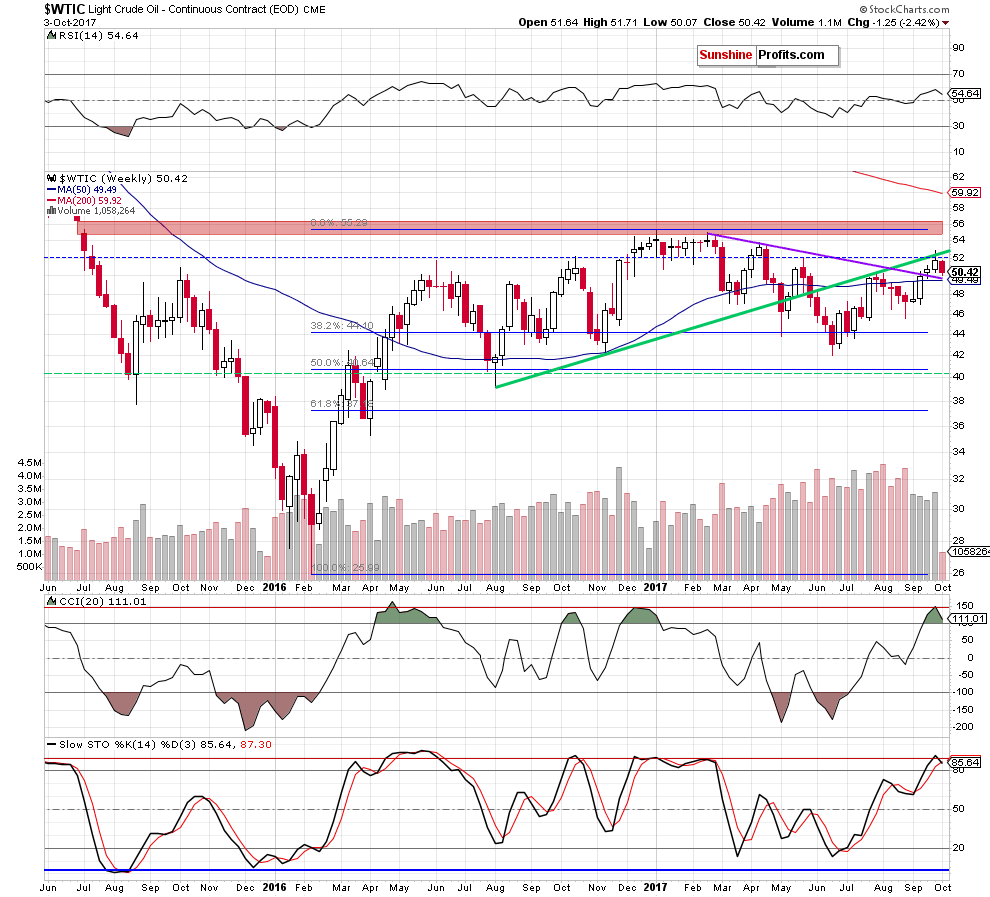

Although this area withstood the selling pressure and triggered a tiny rebound, we should keep in mind that crude oil is trading under the long-term green resistance line based on August and November 2016 lows (marked on the weekly chart), the lower border of the purple rising trend channel and May peaks, which means that the last week’s invalidation of the breakout above these levels and its negative impact on the price are still in effect, supporting oil bears. Additionally, the sell signals generated by the daily indicators and the weekly Stochastic Oscillator remain in place, suggesting lower prices in the coming days.

The pro-bearish scenario is also reinforced by the fundamental picture of the oil market. Why? Yesterday, after the session closure the American Petroleum Institute reported that although crude oil supplies fell by 4.08 million barrels (beating analysts’ forecasts), gasoline inventories gained 4.91 million barrels and supplies in Cushing, Oklahoma, rose by 2.084 million barrels, which could increase worries over rebalancing between supply and demand. Therefore, if today’s government data confirms these increases oil bears will receive one more important reason to act and we’ll likely see a decline to one of our next downside targets from Monday Oil Trading Alert:

How low could crude oil go?

If (…) crude oil declines from current levels, the initial downside target for oil bears will be around $49.85, where the previously-broken red declining line (which serves as the nearest support) is. If it’s broken, we’ll likely see a drop to the 38.2% Fibonacci retracement based on the June-September upward move (around $48.72) in the following days.

Summing up, short positions continue to be justified from the risk/reward perspective as the combination of the technical (invalidation of breakouts, higher volume during declines, sell signals generated by the indicators) and the fundamental pictures (an increase in the number of oil rig, higher production from Iraq and Libya) of the commodity suggest that further deterioration is just around the corner.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $54 and the initial downside target at $45.80) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts