Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

Our Friday's Alert remains valid also today, as the oil outlook still hasn't changed. Please see below:

(...) How fitting were our Tuesday's words - crude oil is once again trying to move higher, and it's again likely to fail in its attempt. The price of black gold is moving close to its 61.8% Fibonacci retracement, but it's not there yet. Just recall our yesterday's observations below:

(...) Until crude oil confirms a breakout above this retracement and above the early-2020 low, it's unlikely to move higher without correcting (significantly) first.

Therefore, our previous comments remain up-to-date:

Crude oil formed a bearish reversal ("shooting star") candlestick, and at the same time it invalidated the intraday breakout above the 38.2% Fibonacci retracement level.

This unsuccessful attempt is by itself a sell signal - it shows that the market was driven by something (the temporary decline in the USDX seems to be the likely candidate), but it didn't really want to move higher. The rally didn't last long and instead of a powerful breakdown, we saw a bearish confirmation.

Consequently, the points that we made previously remain up-to-date:

Our stop-loss level is slightly above $45, which means that it's above the early-March levels. If this level - and the 61.8% Fibonacci retracement based on the entire 2020 decline - is broken in a meaningful manner, the SL order would take you us of the market - and correctly so, as it would imply that the outlook is no longer nearly as bearish as it is right now. This hasn't happened yet. In fact, based on the most recent invalidation, the bearish outlook just got a fresh bearish confirmation.

The trigger for crude oil's decline might be the rally in the USD Index. USD's quick rally in the first half of March was accompanied by a substantial slide in crude oil prices.

Another market that's worth keeping in mind, is the general stock market. After all, both: stocks and crude oil tend to move together. Increased economic activity usually translates into greater demand for crude oil, so crude oil should be rallying since stocks are moving to their previous highs... But it's not. It's moving back to the 61.8% Fibonacci retracement without a signs of real strength.

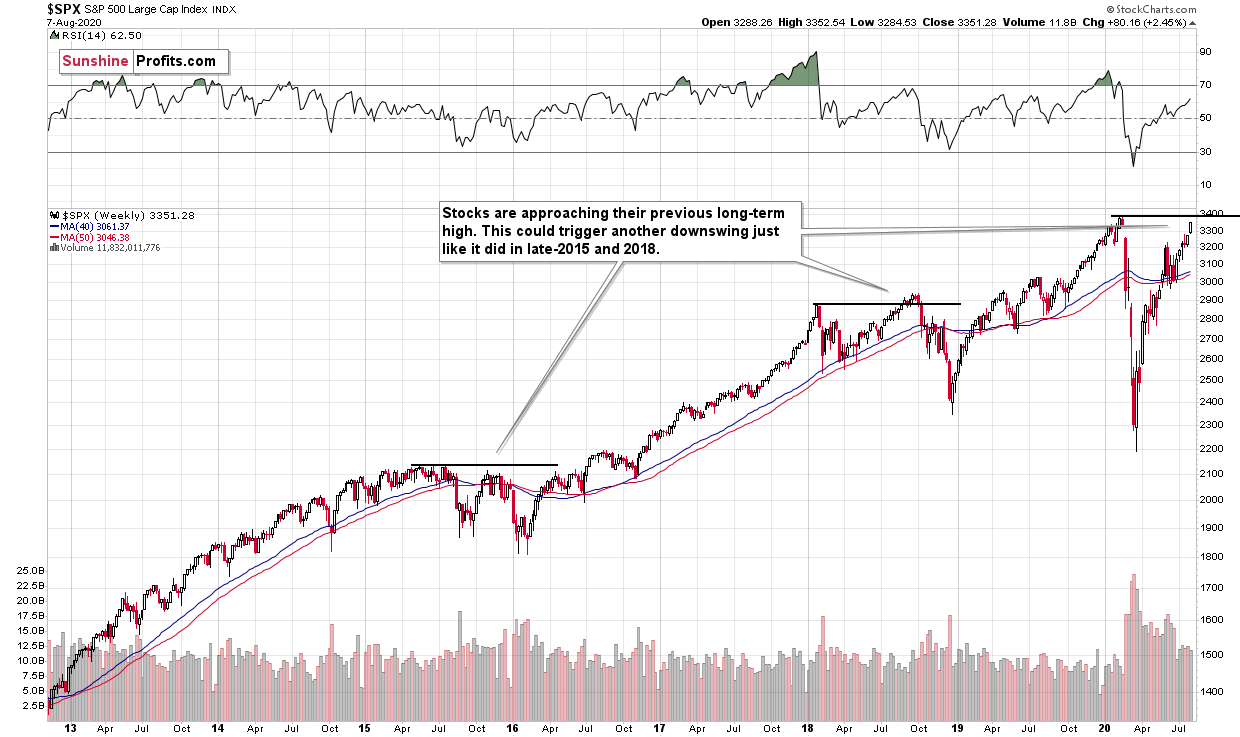

The S&P 500 is approaching its previous 2020 high. Given the economic background, I find this performance unfounded. But the markets can stick to a certain emotional trend for longer than many investors can remain logical, which would fit the above picture.

Back in 2015, stocks topped below their previous highs, and in 2018 they topped a bit above them, so the proximity to the previous is far from being a precise sell signal. It does indicate, that the stock market is likely vulnerable to sell signals coming from other markets and that this emotional rally could end rather sooner than later.

Consequently, crude oil could get the bearish trigger shortly.

As you can see on the above chart, the S&P 500 futures are already very close to the previous 2020 high. A move to this level, or - even better - a small breakout that is then invalidated, could be the perfect trigger for a slide in crude oil's price

Summing up, the short-term outlook for crude oil is bearish based on both the technical indications and on the rapidly increasing Covid-19 cases in the U.S., and we see signs that the bigger decline is likely to finally start.

As always, we'll keep you - our subscribers - informed.

Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

In case of the futures contracts that are more distant than the current contract, we think that adding the premium (difference between the July and other contracts) to both: stop-loss and initial target prices is justified.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager