Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

Crude oil continues to trade in practically the same price range, and the forces that make it likely to decline haven't changed since. This means that we have practically nothing new to report in today's analysis - our Friday's points remain valid also today.

We realize that the situation in crude oil is boring and might be discouraging, but please note that it doesn't mean that nothing interesting will happen in the future. Conversely, the periods of very low volatility tend to precede periods with high volatility.

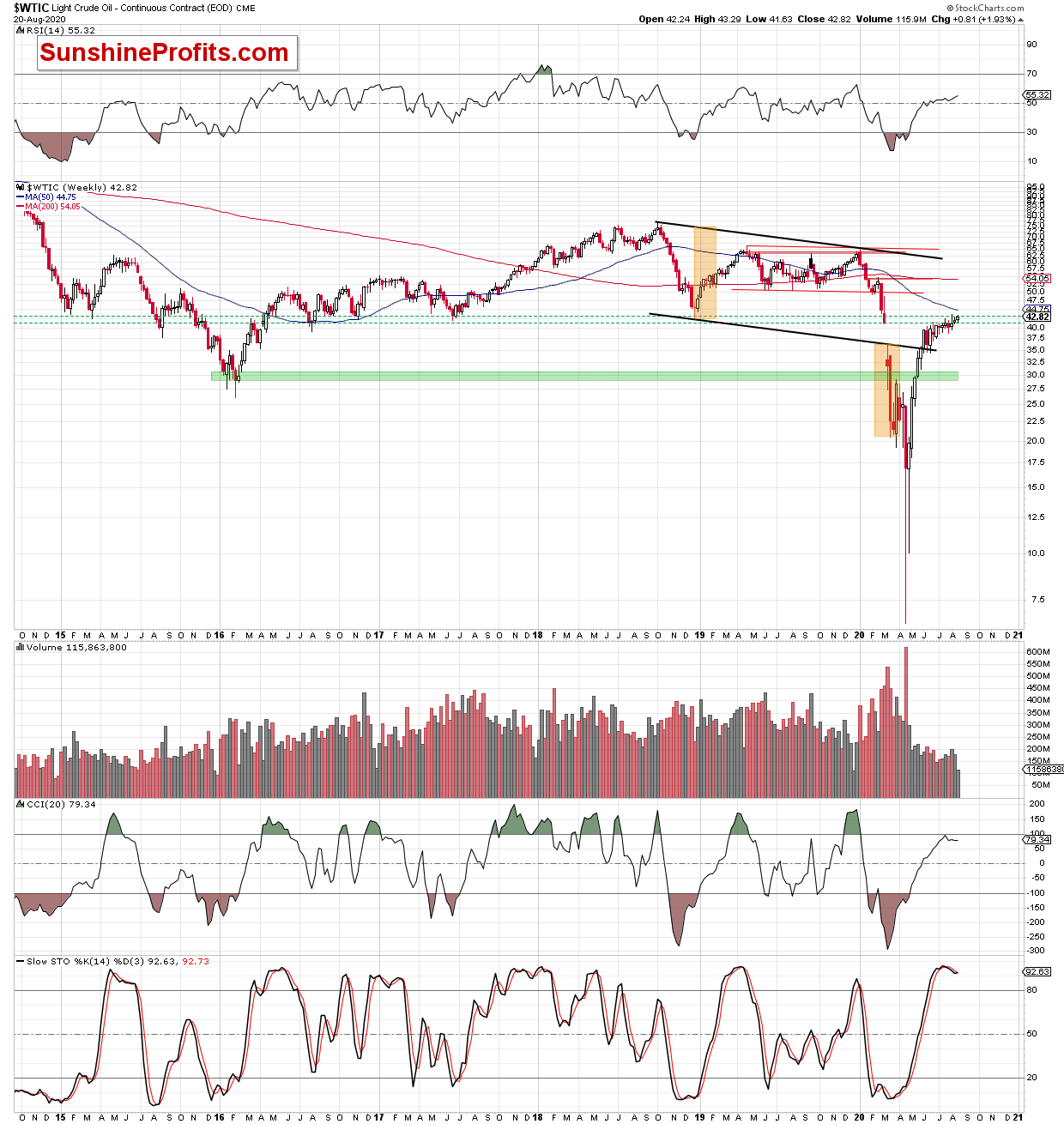

As the general stock market invalidated its breakout recently and the USD Index invalidated its breakdown, it seems that crude oil will soon get the bearish push similar to the one it did in the first quarter of the year. This, plus the technical indications present on the crude oil chart make the outlook bearish and we think that our short positions in the black gold remain justified from the risk to reward point of view.

Crude oil remains trading below the horizontal resistance level provided by the previous lows, and the long-term sell signal from the Stochastic indicator remains in place.

Summing up, the short-term outlook for crude oil is bearish based on both the technical indications and on the indications from the general stock market and the USD Index.

As always, we'll keep you - our subscribers - informed.

Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

In case of the futures contracts that are more distant than the current contract, we think that adding the premium (difference between the July and other contracts) to both: stop-loss and initial target prices is justified.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager