Trading position (short-term; our opinion): Short position with a stop-loss order at $57.86 and the initial downside target at $51.16 is justified from the risk/reward perspective.

Oil bulls have given up yesterday's early gains and finished the day lower. The decreasing volatility and volume of recent days tells us that a bigger move is going to be afoot shortly. Could it be today's upswing? Is it a real deal, or a fake one? Let's examine the technical situation objectively...

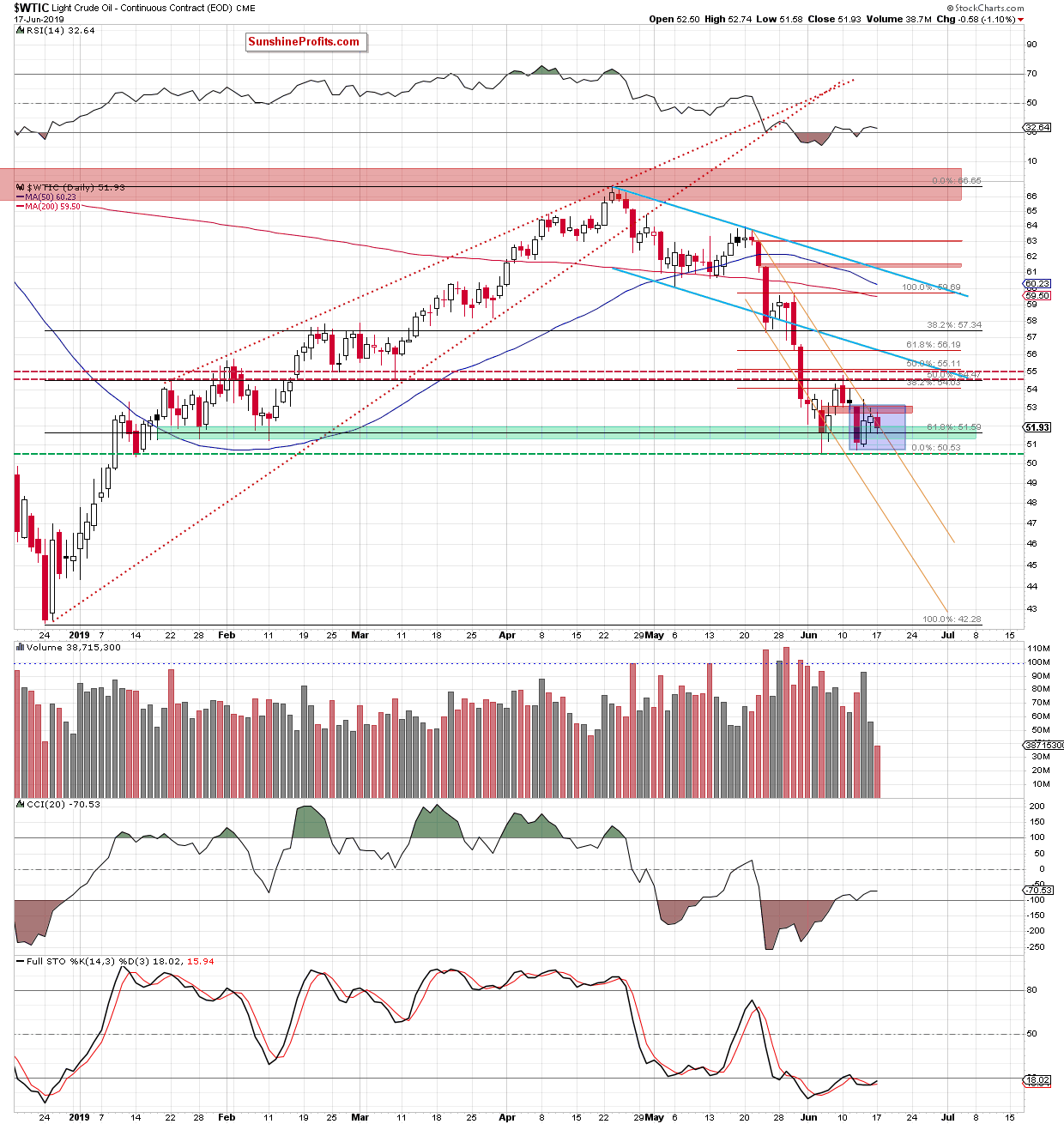

We'll start by taking a closer look at the chart below (charts courtesy of http://stockcharts.com and www.stooq.com ).

Yesterday, crude oil moved a bit higher after the market open, breaking above the upper border of the declining orange trend channel. This move has brought about a test of the red gap, yet the bulls proved no match for their opponents and black gold reversed back into the trend channel.

This way, the earlier tiny breakout above the formation has been invalidated. This increases the likelihood of further deterioration down the road. A bigger downside move will be however more reliable only if crude oil breaks below the lower border of the blue consolidation.

We also see volume getting smaller day by day. Such a decreasing volume is a harbinger of a consolidation approaching its end. A break out of it follows eventually, and as it can be a false one, getting additional price and volume confirmation is advisable. Which way is this break more likely to be?

In search of answers, let's take a look at today's crude oil futures chart just below.

Earlier today, the oil futures have moved both lower and higher. At the moment of writing these words, they're near their daily highs (over $53.00). This was the bullish side of the coin. The bearish one is that even now, black gold trades below the red gap. And as long as this gap remains open, lower oil prices remain probable.

Summing up, despite today's upswing so far, oil is still trading well below the 38.2% Fibonacci retracement and the red gap remains open. Oil is in a short-term consolidation marked by a decreasing volume, which means that a sizable move can be expected shortly. At a minimum, one more downswing remains likely. This is supported by the weekly chart analysis - black gold closed the week below the 200-week moving average and the weekly indicators are on sell signals. The short position remains justified from the risk/reward point of view.

Trading position (short-term; our opinion): Short position with a stop-loss order at $57.86 and the initial downside target at $51.16 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist