Trading position (short-term; our opinion): Half of the short position (with the stop-loss order at $77.23 and the next downside target at $69.20) is justified from the risk/reward perspective.

On Tuesday, crude oil wavered between small gains and losses, but finally finished the day 0.20% above the Monday’s closure. Can this improvement be considered as the success of oil bulls?

In our opinion, it can’t. Why? Let’s take a look at the daily chart below (charts courtesy of http://stockcharts.com) to find out.

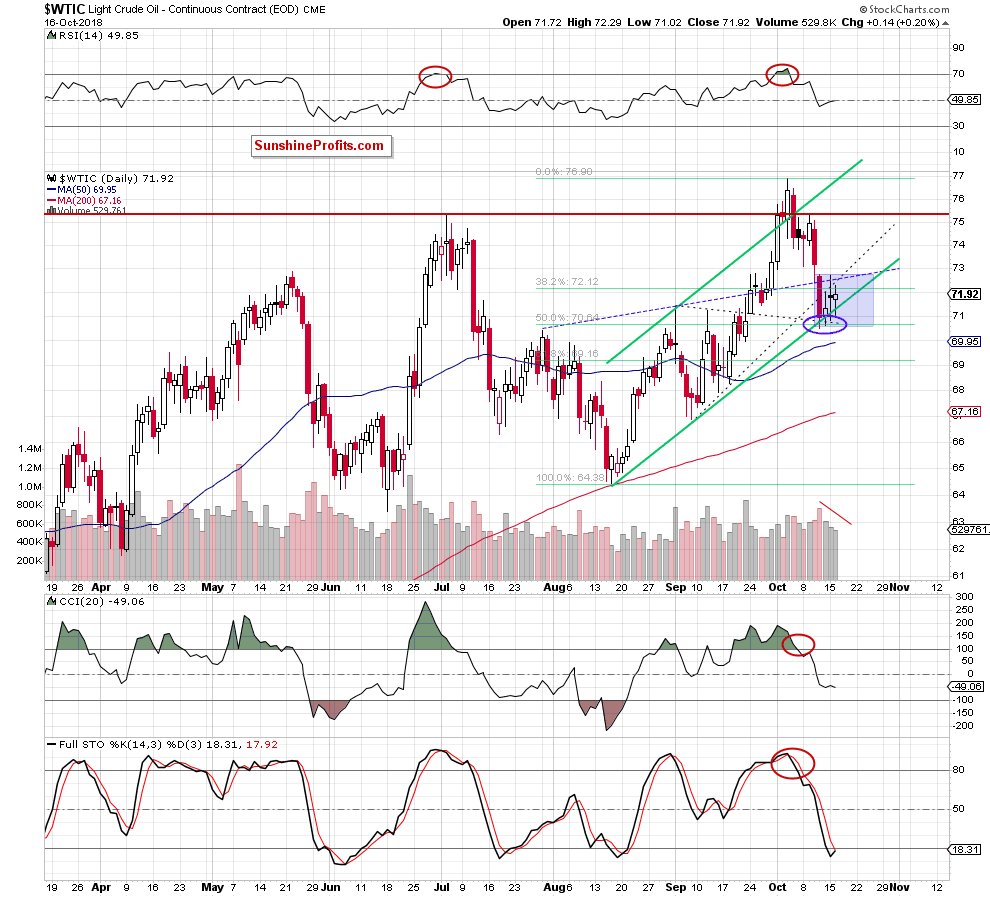

Looking at the above chart, we see that yesterday's session was nothing more than a repetition of what we saw on Monday. After the market’s open crude oil re-tested the nearest supports and then rebounded almost reaching the first resistance line.

Nevertheless, this time, there was no breaking above it (not to mention the test of the higher resistances), which we can read as a manifestation of oil bulls’ weakness.

Additionally, the volume that accompanied yesterday’s upswing was smaller than day earlier, which shows that the buyers' involvement in the next northward moves is getting smaller from session to session.

Such price action doesn’t bode well for higher prices of black gold in the coming days – especially when we factor in the sell signals generated by the daily indicators and pro-bearish signs about which we wrote yesterday:

(…) if we focus on “the forest” and not only on “a single tree” (in other words, on the entire short-term picture and not only on Monday’s session), we’ll see that oil bears still have more technical factors on their side.

What do we mean by that?

Firstly, the long-term picture and seen on the monthly chart invalidation of the earlier breakouts above the upper border of the green rising wedge, the upper line of the red resistance zone, and the 38.2% Fibonacci retracement (more about this situation we wrote in our Friday’s alert).

Secondly, the medium-term picture and the pro-bearish evening star (you could read more about this issue in our yesterday’s commentary on crude oil).

Thirdly, the short-term developments, which continue to suggest lower prices of the commodity in the coming days: two unsuccessful attempts to go higher during recent sessions, which look like a verification of the earlier breakdowns, the sell signals generated by the indicators and decreasing volume during last upswings.

Summing up, we continue to believe that (at least) one more downswing is still ahead of us. Nevertheless, another bigger decline will be more likely and reliable if the price of the commodity drops below the lower line of the blue consolidation (which will also be synonymous with a decrease below the lower border of the green rising trend channel and the 50% Fibonacci retracement).

If we see such price action, we’ll probably significantly increase short positions. As always, we’ll keep you - our subscribers - informed should anything change.

Trading position (short-term; our opinion): Half of the short position (with the stop-loss order at $77.23 and the next downside target at $69.20) is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts