Trading position (short-term; our opinion): Already profitable short position with a stop-loss order at $58.41 and the next downside target at $53.50 is justified from the risk/reward perspective.

The oil bulls defended the support successfully yesterday, and managed to take oil higher earlier today. With some of their gains gone by now, the question is where next for oil in the current consolidation. Do the subtle technical signs favor the bulls or rather the bears? Let's find out what it means for our open position.

Let's take a closer look at the charts below (charts courtesy of http://stockcharts.com and www.stooq.com ).

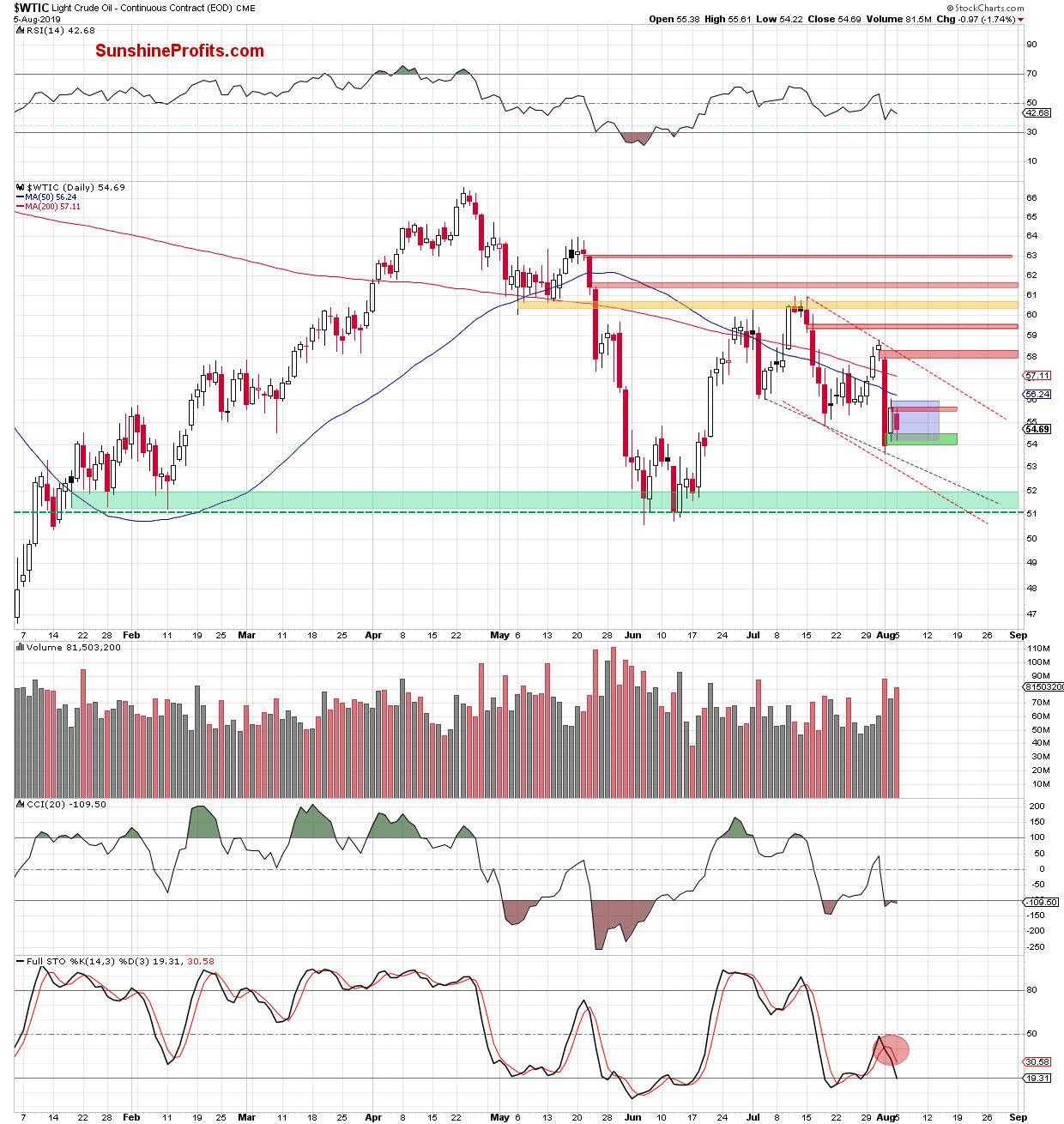

Crude oil opened yesterday's session with a bearish red gap. Although the bulls tried to close it, they failed, and a decline testing Friday's green gap followed. The bears however couldn't break below it, and black gold closed the day slightly above its upper border.

The volume of yesterday's decline increased compared to what we saw during Friday's rebound. Additionally, the sell signals of the Stochastic Oscillator remain on the cards, supporting the bears and another attempt to move lower.

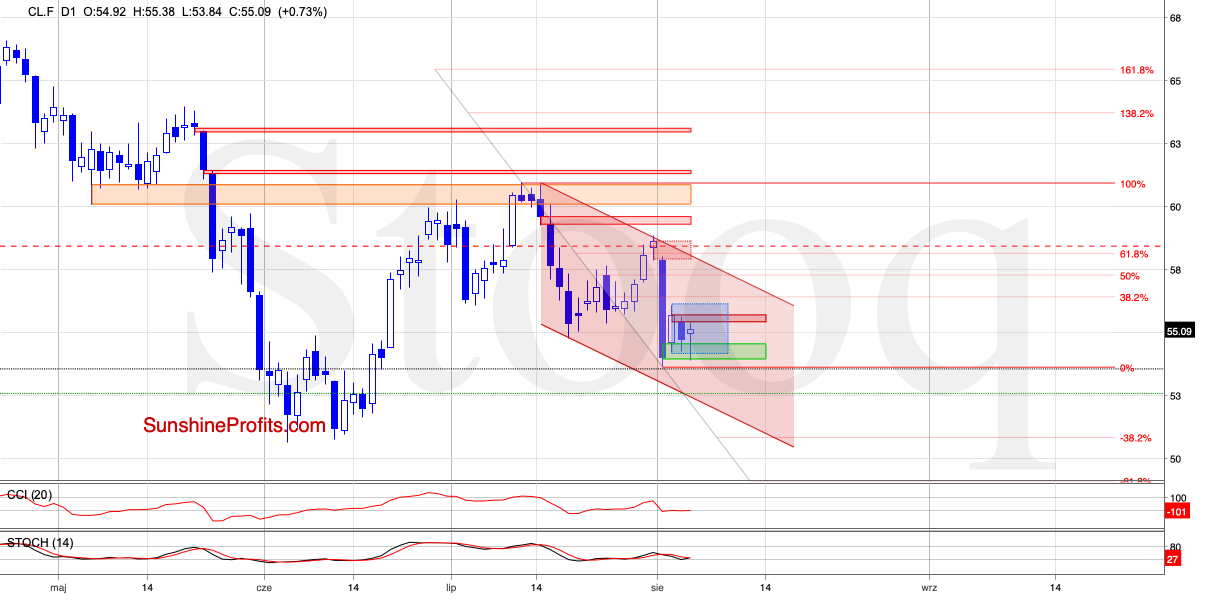

Let's check the latest action in the oil futures.

We see that crude oil futures retested the above-mentioned green gap, but the bears again couldn't make it through. The bulls didn't have much success with the red gap either - it just shows momentary indecision in the market, neither side winning this very moment.

As long as we do not see a breakout above the upper border of the blue consolidation (that would close the red gap) or a breakdown below the lower border (that would close the green gap), another bigger move is not likely to be seen. Short-lived moves in both directions should not surprise us.

Nevertheless, let's keep in mind that the bulls didn't manage to push the futures even to the 38.2% Fibonacci retracement. This and the volume comparison coupled with the Stochastics' sell signal suggest that another attempt to move lower may be just around the corner.

The first downside target for the bears will be around $53.50, where the June 19 low is. However, if it is broken, the sellers could test the lower border of the red declining trend channel in the coming week (currently at around $53).

Summing up, Friday's upswing gave way to yesterday's decline, and while neither side holds the upper hand currently, a multitude of factors continue supporting the bears. Namely, it's the bulls' weakness, higher volume on the downswing and the Stochastics' sell signal. The short position therefore remains justified.

Trading position (short-term; our opinion): Profitable short position with a stop-loss order at $58.41 and the next downside target at $53.50 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist