Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

The beginning of the week took crude oil to a fresh November low. Are there any technical factors that could support oil bulls in the coming days?

Let’s take a look at the charts below (charts courtesy of http://stockcharts.com).

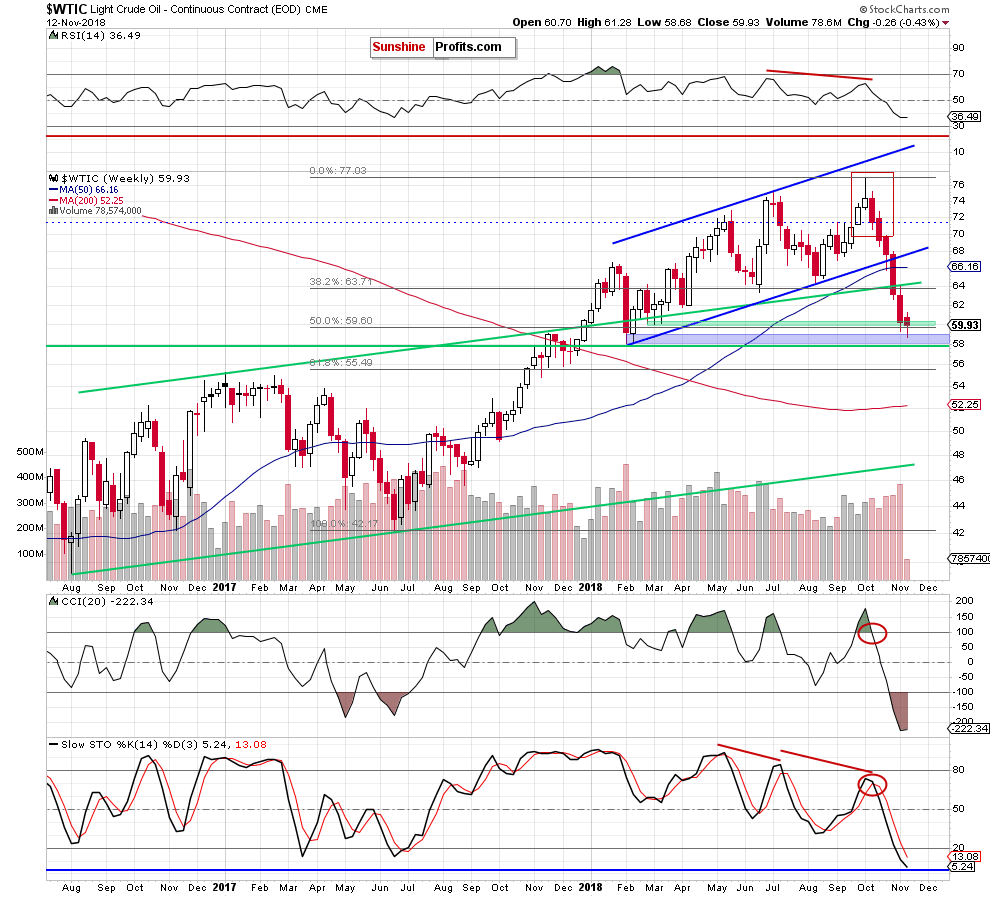

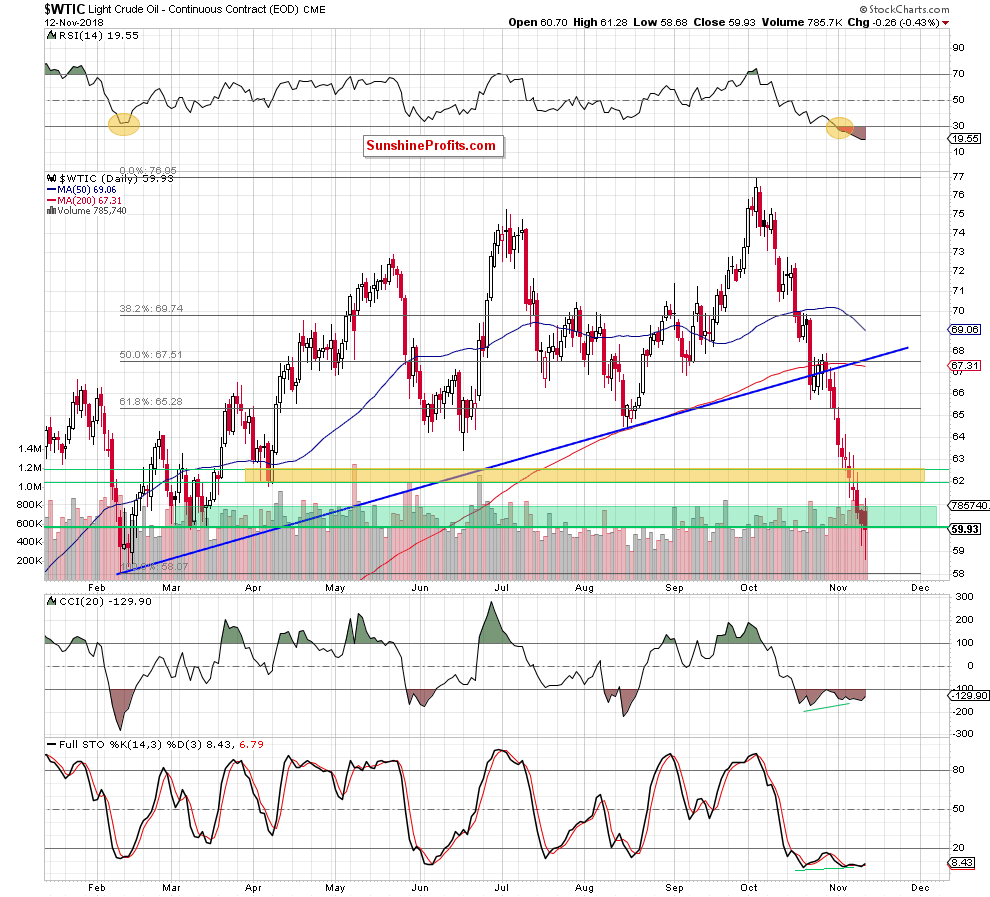

Looking at the above charts, we see that oil bears managed to hit a fresh low during yesterday’s session. Although the commodity rebounded before the session closure, the sellers managed to finish the day under the March low, which increases the probability that we’ll see a test of the blue support area (marked on the weekly chart) created by the February lows in the very near future.

What could happen if this support is broken? It seems that in the case of a such bearish scenario, the sellers could take the price of black even to the next support area around $55-$55.49, which is created by the 61.8% Fibonacci retracement and the early 2017 peaks.

Trading position (short-term; our opinion): none positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts