Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

The bullish momentum in crude oil continued also yesterday. While the bulls have dealt with some obstacles, there are quite a few both remaining and new ones. We invite you to a thorough examination of the prospects for black gold as they stand right now.

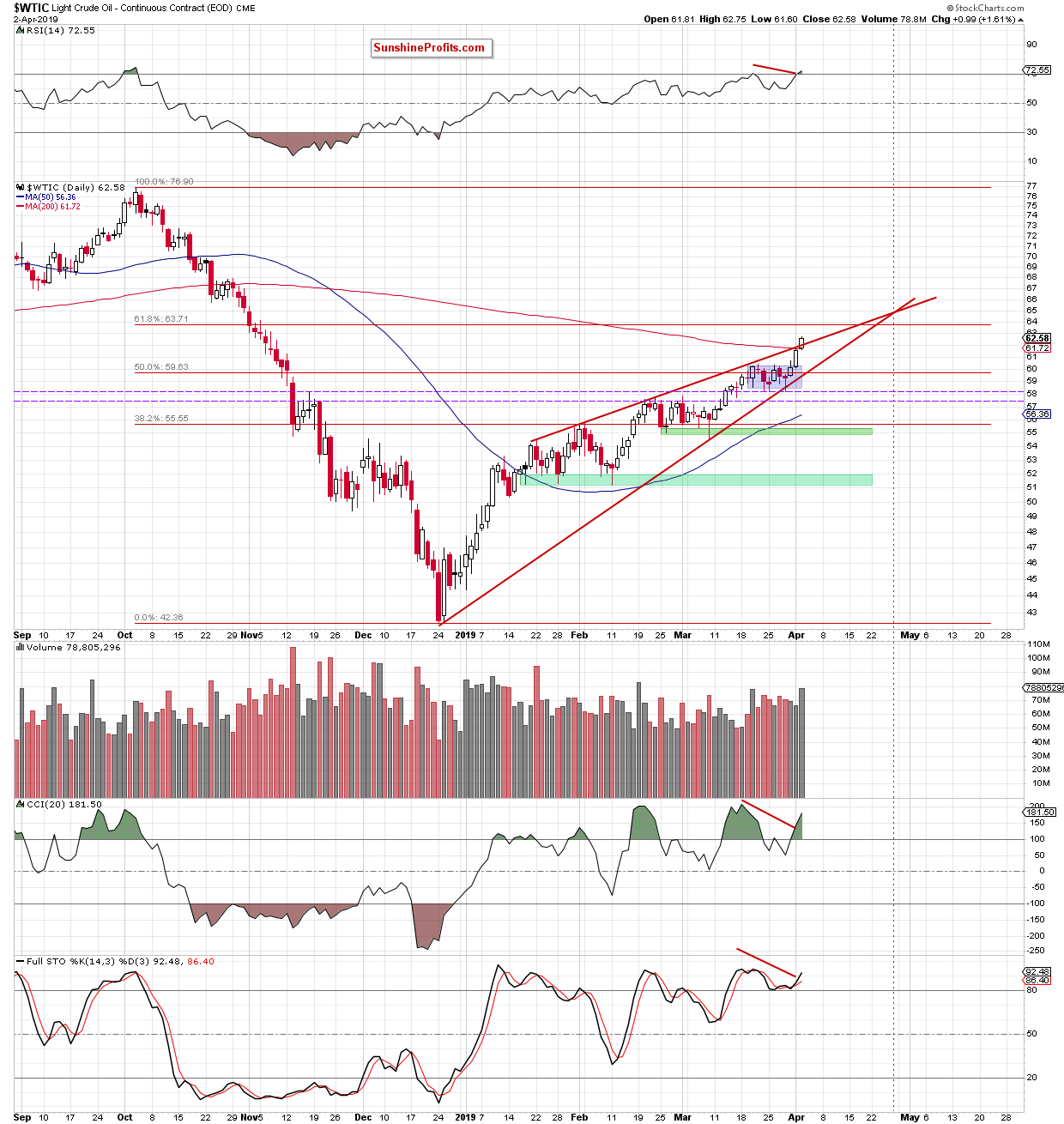

Let’s start with the daily chart below (charts courtesy of http://stockcharts.com).

The highlight of yesterday’s session was the breakout above the upper border of the red rising wedge and the 200-day moving average. Although this is a bullish development, the breakdown is not confirmed yet and bearish divergences between daily indicators and the price of black gold remain on the cards. This keeps the doubts about further oil rally alive.

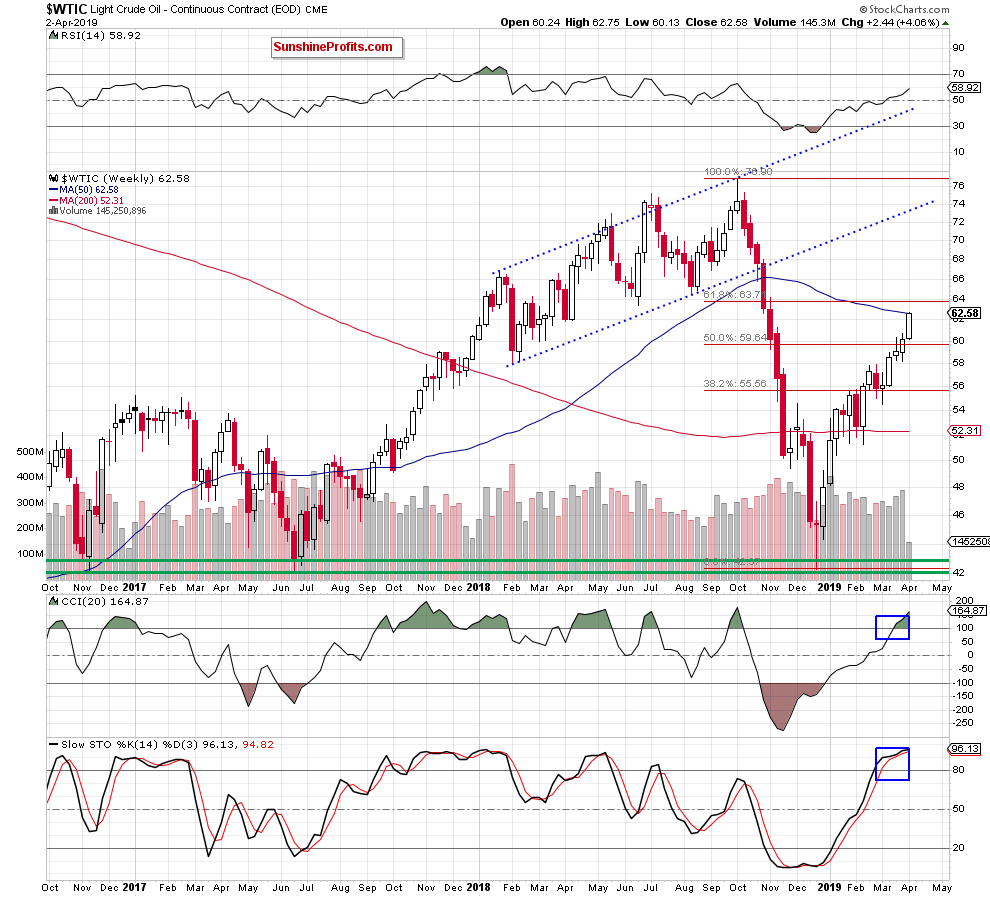

Additionally, the commodity reached the 50-week moving average as seen on the weekly chart below. The weekly indicators remain in their overbought areas, increasing the probability of reversal in the coming days.

Before finishing today’s Alert, there’s one thing worth mentioning. There’s the 61.8% Fibonacci retracement based on the entire 2018-2019 downward move not far from current levels. It serves as an additional resistance and could encourage the sellers to act in a very near future.

Trading position (short-term; our opinion): No position is justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist