Trading position (short-term; our opinion): Short positions (with a stop-loss order at $52.52 and the initial downside target at $45.80) are justified from the risk/reward perspective.

On Monday, light crude moved a bit higher as investors reacted to the Friday Baker Hughes report. As a result, light crude re-tested the lower line of trend channel. Will it withstand the buying pressure in the coming days?

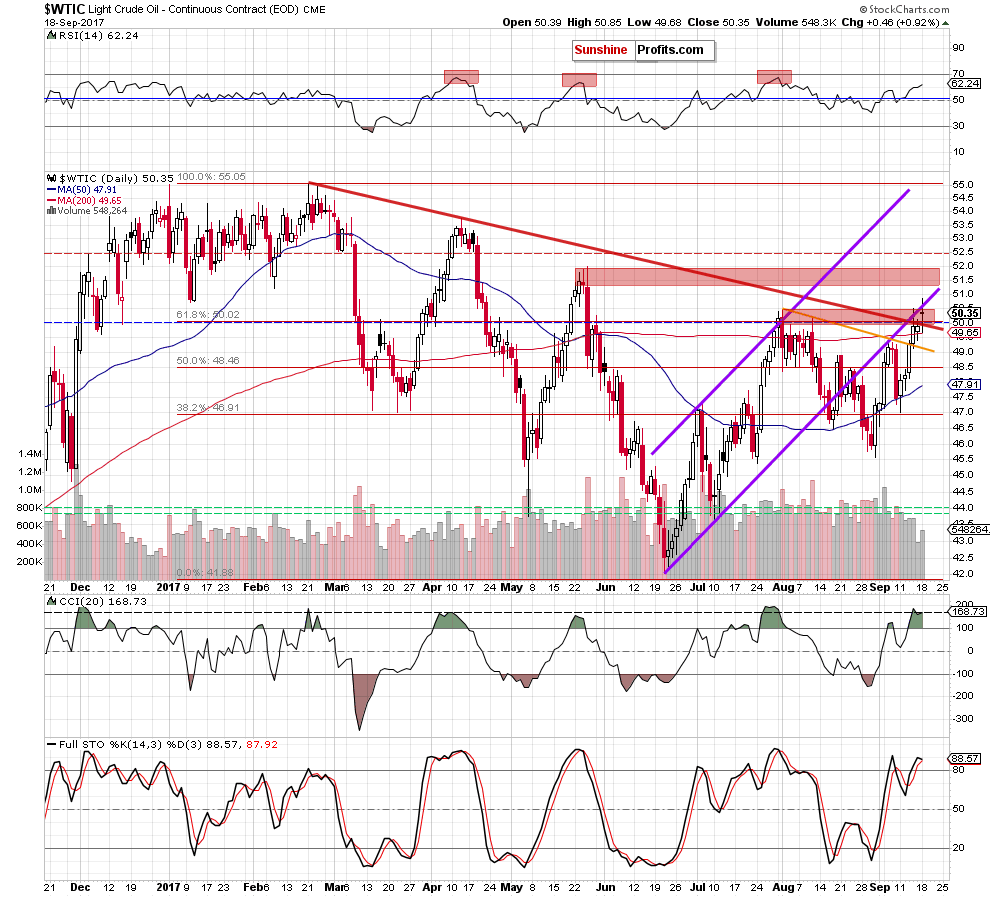

Crude Oil’s Technical Picture

Let’s take a closer look at the chart below (charts courtesy of http://stockcharts.com).

From today’s point of view, we see that crude oil extended gains and broke above the red declining resistance line, the barrier of $50, which resulted in another climb to the lower border of the purple rising trend channel.

What does it mean for black gold?

Despite the above-mentioned improvement, light crude pulled back and closed the day under this important resistance line and the August highs, invalidating the earlier tiny breakout above these levels. Such price action looks like another verification of the breakdown below the trend channel (similar to what we saw earlier this month), which is a negative development.

Additionally, recent increases materialized on smaller volume than earlier declines, which increases the probability of reversal and lower prices of black gold in the very near future.

This scenario is also reinforced by the current position of the daily indicators – they are overbought and close to generating sell signals, which suggest that the space for gains is limited and the return of the oil bear is only a matter of time.

Summing up, short positions continue to be justified from the risk/reward perspective as crude oil verified the earlier breakdown under the lower border of the purple rising trend channel once again, signaling that reversal and lower prices of black gold are just around the corner.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $52.52 and the initial downside target at $45.80) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts