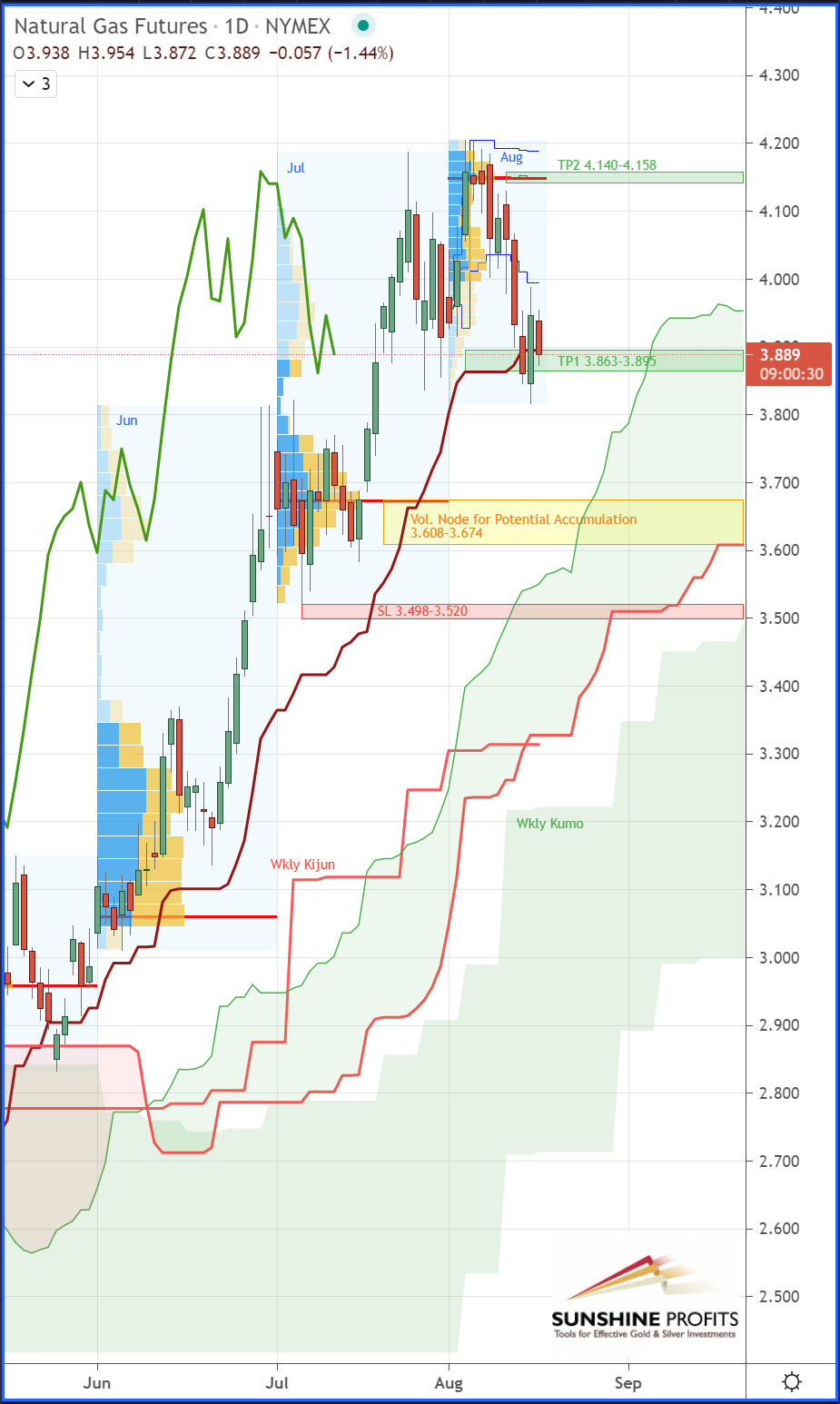

Trading position (short to long-term; our opinion; levels for natural gas’s continuous futures contract): long positions with an entry at $3.608-3.674, with a stop-loss around $3.5 and $3.863-3.895 (TP1) / $4.140-4.158 (TP2) as price targets.

NatGas reached a three-year high at $4.20 a couple of weeks ago, holding the highs for three consecutive days. Will we see a comeback to that level?

Fundamental Aspects & Weather

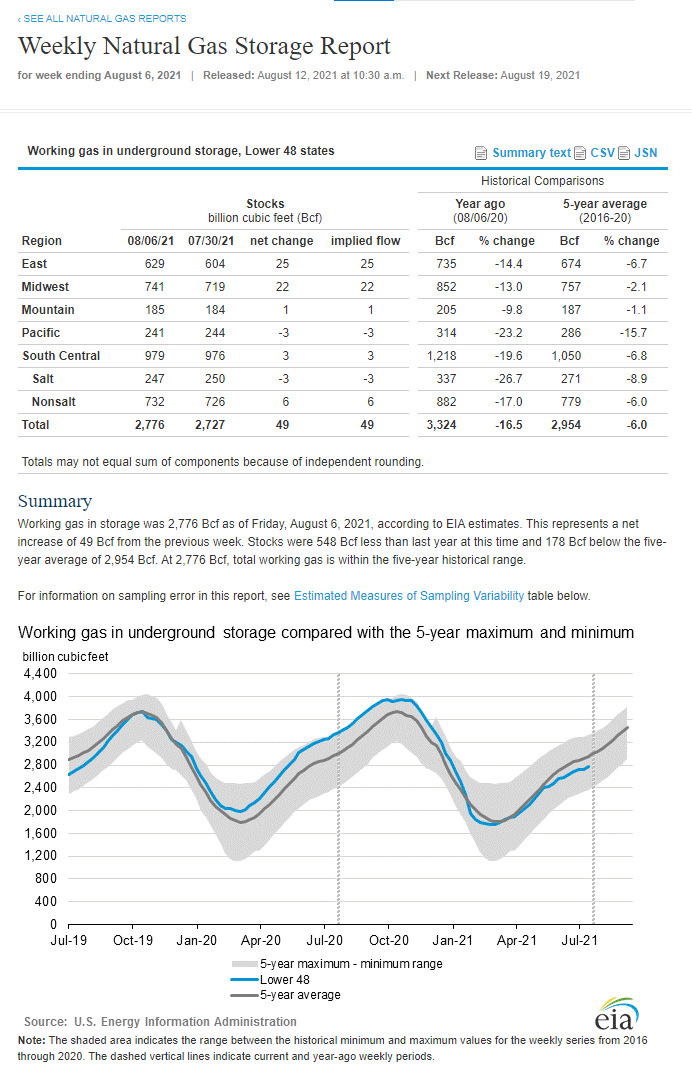

A sharp fall happened last Thursday once the EIA figures showed a net increase in gas storage of 49 Billion cubic feet (Bcf) in the first week of the month (Cf. below report):

However, approaching the end of the summer, cool temperatures will only get cooler, gradually raising demand for gas.

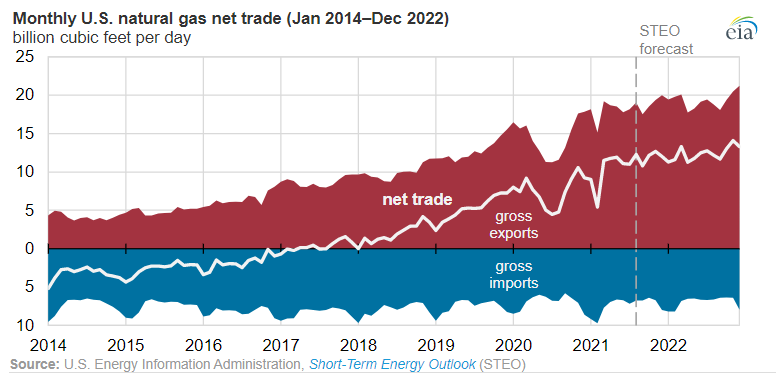

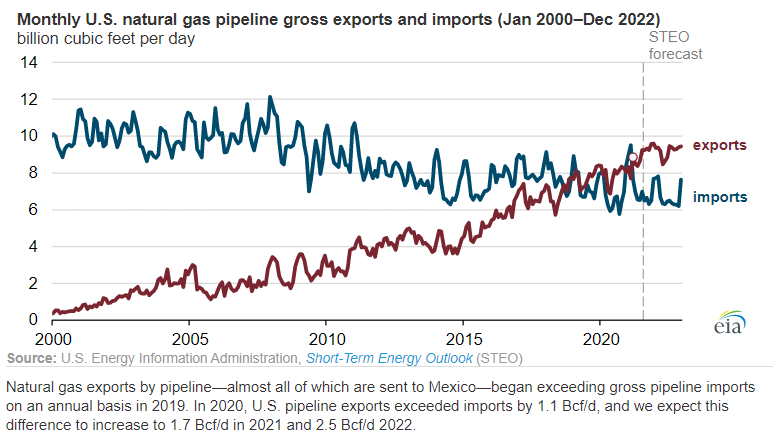

According to the recent EIA report, “U.S. natural gas net trade is growing as annual LNG exports exceed pipeline exports.” In this report, they evaluated an excess to the average of +11Bcf per day in 2021 – +50% more than in 2020. The main driver of this growth appears to be linked to the pipeline exports to Mexico.

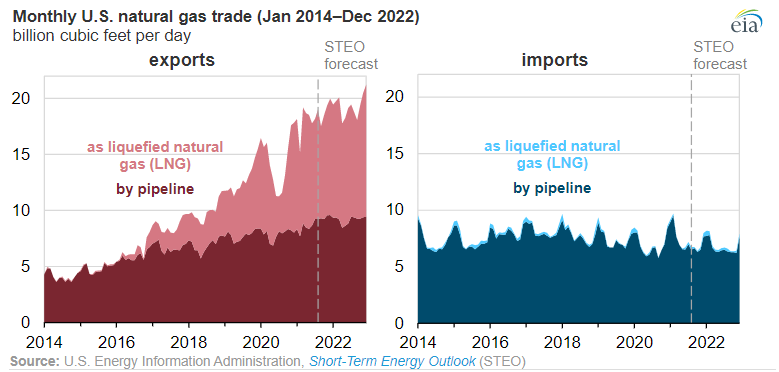

Regarding U.S. natural gas exports, they are projected to keep growing throughout 2021 and 2022 at this pace:

Last year, NatGas exports were estimated to account for 23% of total U.S. energy exports, and it was explained that both the U.S.’s additional LNG export capacities and the expansion of LNG export destinations largely contributed to boosting that growth in LNG exports.

The EIA’s projections state a yearly increase of 6% in U.S. natural gas imports (pipeline + LNG) in 2021 before a decline in 2022.

Figure 1 – Henry Hub (NG21) Natural Gas Futures (Continuous contract, daily)

Technical Analysis

This week, we are watching the market finding some support over $3.863. A firm close under that level could potentially accelerate a drop to lower levels of $3.608-3.674 where the buyers considering this a relatively fair price to enter could show up.

Given the long-term bullish trend and the recent sharp correction from last week, we could expect the market to rebound after finding some strong support provided by the bulls.

- Therefore, we could see prices end their retracement in the $3.608-3.614 area (yellow rectangle) before rallying further towards the previous support (which might turn into resistance) around $3.863-3.895 (first target labeled as TP1). It will either trigger a retake of control from the sellers or some more buying pressure driving the prices higher towards the previous highs – even to the second target (TP2), overlapping the current Volume Point of Control (VPOC) around $4.140-4.158.

- A stop loss (SL) could be placed at the previous swing low or just below July’s Volume Area (VA) around $3.5. You can also use any other measure (eg. ATR) depending on your risk profile.

In summary, gas prices are currently in an obvious correction – this could provide the buyers with a dip to (re)enter the trade with a good risk/reward ratio.

As always, we’ll keep you, our subscribers well informed.

Trading position (short to long-term; our opinion; levels for natural gas’s continuous futures contract): long positions with an entry at $3.608-3.674, with a stop-loss around $3.5 and $3.863-3.895 (TP1) / $4.140-4.158 (TP2) as price targets.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist