Trading position (short-term; our opinion): Short positions with a stop-loss order at $69.70 and the downside target at $56.50 are justified from the risk/reward perspective.

On Friday, crude oil dropped to the lowest level since almost two months, making the sellers’ short positions even more profitable. Will this lucky streak continue in the following days? Analyzing the charts, we found several elements on which bears should keep an eye on.

Let's take a closer look at the chart below (charts courtesy of http://stockcharts.com).

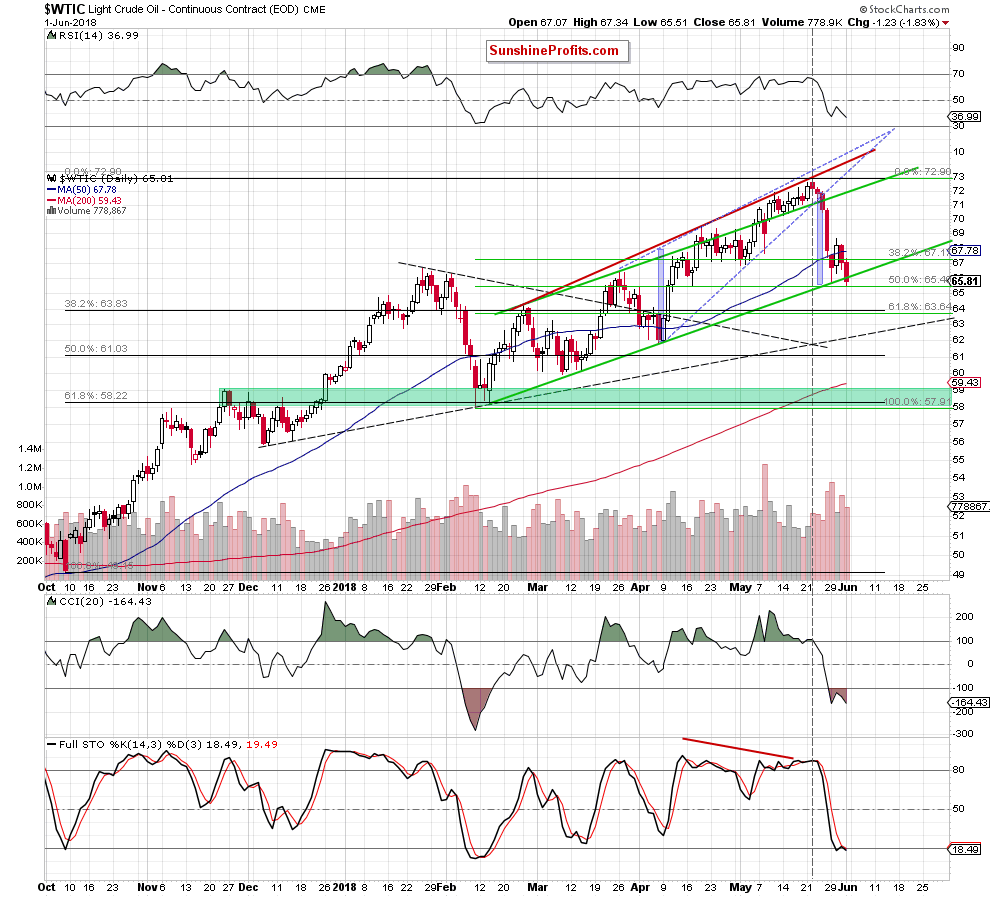

Looking at the daily chart, we see that crude oil extended losses on Friday, which was in line with our earlier assumptions (you could read about them in our last week’s alerts). Thanks to this price action our short positions have become even more profitable, but the main question that many people are going through right now is how much more money one can make?

Unfortunately, we do not have a crystal ball that would answer this question with 100% certainty, but we know what we can do to protect our profits regardless of the upcoming developments. What do we mean by that? You'll find out soon, but before that happens, let's take a closer look at the Friday’s price action from the technical point of view.

What does Friday’s decline mean for black gold?

Let's start with the factors that can be used by oil bears. Thanks to the Friday’s move, light crude slipped under the lower border of the medium-term green rising trend channel and closed the day below it, which is a solid bearish development.

Additionally, although the CCI and the Stochastic Oscillator are overbought, there are no buy signals, which could encourage oil bulls to act. This suggests that (at least) one more move to the downside is likely (nevertheless, we think that oil bears should keep an eye on them in the coming days).

How low could crude oil go?

In our opinion, if the commodity closes today’s session under the 50% Fibonacci retracement (based on the February-May upward move) and the mid-April low, we could see a decline to around $63.65. Why? Because there are two important Fibonacci retracement there: the 61.8% retracement based on the February-May upward move and the 38.2% retracement based on the entire October 2017-May 2018 increases, which together could encourage oil bulls to fight.

And speaking about the bulls… as you see on the above chart, the recent decline took the commodity to the area, where the size of the downward move corresponds to he height of the blue rising wedge (marked with blue dashed lines), which could decrease the selling pressure in the very near future (it is important to observe the shape of the next daily candlesticks to interpret their pronunciation well).

This scenario is also reinforced by the volume, which accompanied Friday’s decline (more about this issue we wrote in our last commentary on crude oil). As you see, it was smaller than day earlier, which suggests that it’s worth to keep an eye on it in the coming days. If it declines once again, we’ll consider closing part of our short positions. Nevertheless, before it happens, let our profits grow.

Finishing today’s alert, it’s time to solve the mystery: what can we do to protect our profits regardless of the upcoming developments? The answer is quite simple - lower the stop loss level. Thanks to this action we will be sure that even if we do not squeeze everything from our short position, we will not lose money and protect our capital.

Summing up, the outlook for the crude oil remains bearish and it seems that we’ll see even lower prices in the coming week. In other words, we think that the profits from the current short position will increase further. Nevertheless, we decided to lower the stop-loss level to make sure that your capital will increase (the new stop-loss order protects very small profits right now).

Trading position (short-term; our opinion): Short positions with a new stop-loss order at $69.70 and the downside target at $56.50 are justified from the risk/reward perspective. As always, we’ll keep you - our subscribers - informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts