Trading position (short-term; our opinion): Short positions (with a stop-loss order at $52.52 and the initial downside target at $45.80) are justified from the risk/reward perspective.

On Friday, crude oil gained 0.22% and closed the previous week above the barrier of $50 for the first time since mid-May. But will the rally continue?

Crude Oil’s Technical Picture

Let’s take a closer look at the charts below and try to find out (charts courtesy of http://stockcharts.com).

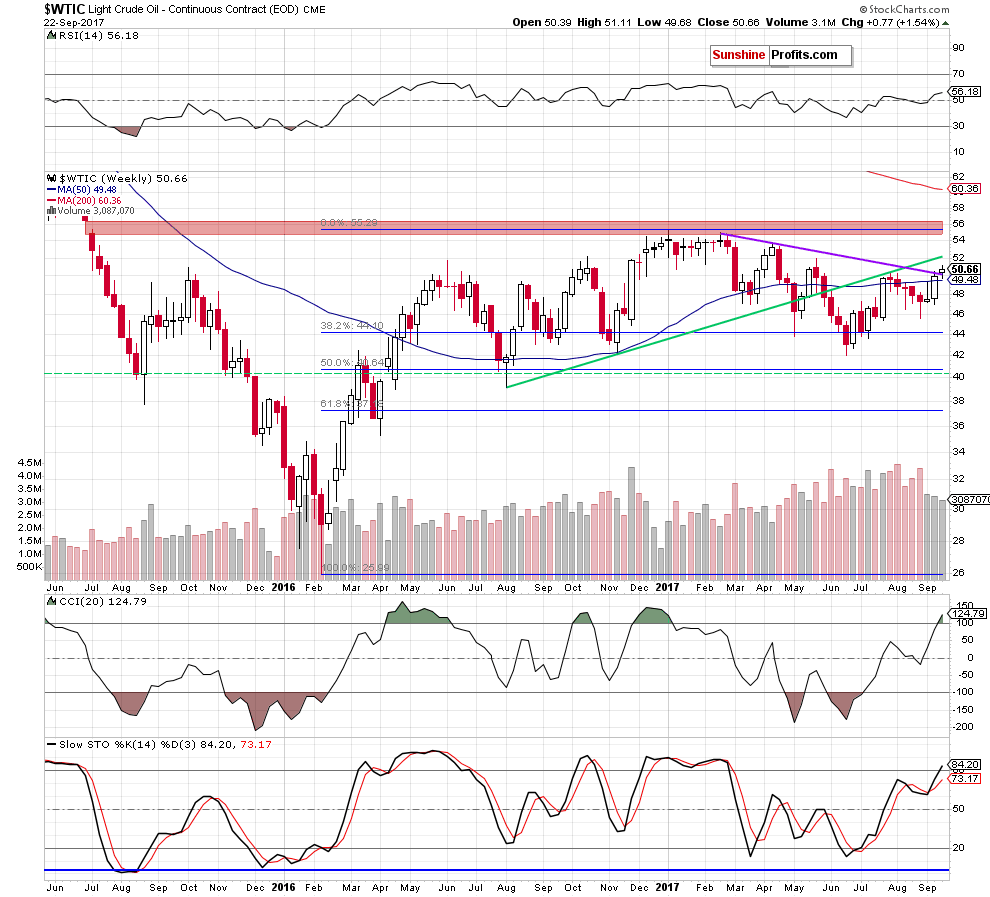

Looking at the weekly chart, we see that crude oil closed the previous week above the purple declining resistance line for the first time in 2017, which is a positive event. Nevertheless, when we take a closer look at the size of volume, we see that it is decreasing from week to week, which does not confirm the strength of oil bulls.

Additionally, crude oil is still trading under important short-term resistances.

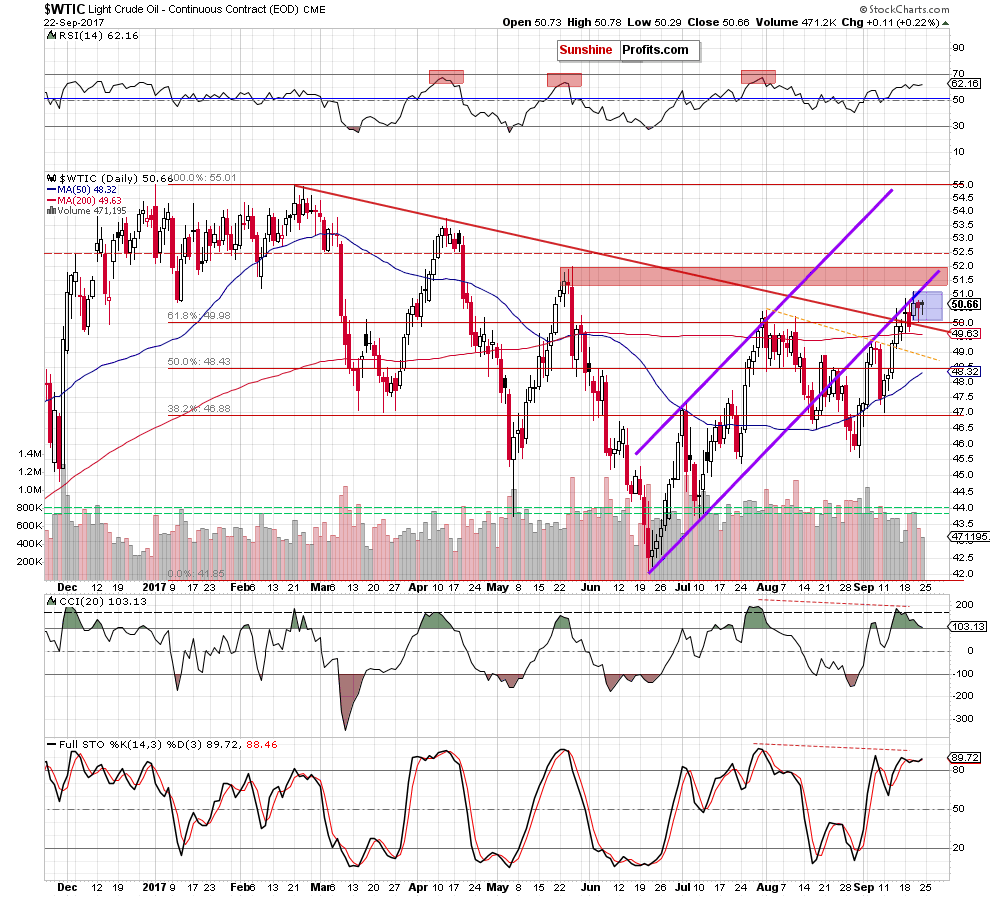

On the daily chart, we see that the overall situation in the very short-term hasn’t changed much as crude oil remains in the blue consolidation under the lower border of the purple rising trend channel and the red resistance zone created by the May peaks.

What can we expect in the coming week?

Taking into account several unsuccessful attempts to break above the lower border of the purple rising trend channel, we think that oil bulls are losing strength. Additionally, the current position of the daily indicators (the CCI and the Stochastic Oscillator are very close to generating sell signals) and another decline in volume during upswing suggest that lower prices of the commodity are just around the corner.

Therefore, if crude oil moves lower from current levels, the initial downside target for oil bears will be around $47, where the mid-September low is.

Finishing today’s alert please keep in mind that although light crude moved a bit higher on Friday, members of the OPEC and other major producers didn’t reach a decision to extend the production-cut agreement beyond March 2018, which could affect negatively the price of crude oil in the coming week(s).

Summing up, short positions continue to be justified from the risk/reward perspective as crude oil is still trading under the lower border of the purple rising trend channel, which suggesting that oil bulls are not strong enough to invalidate the earlier breakdown and push the price of light crude higher. This show of their weakness increases the probability of another move to the downside in the coming days.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $52.52 and the initial downside target at $45.80) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts