Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Henry Hub Natural Gas No new position justified from a risk/reward point of view.

- RBOB Gasoline No new position justified from a risk/reward point of view.

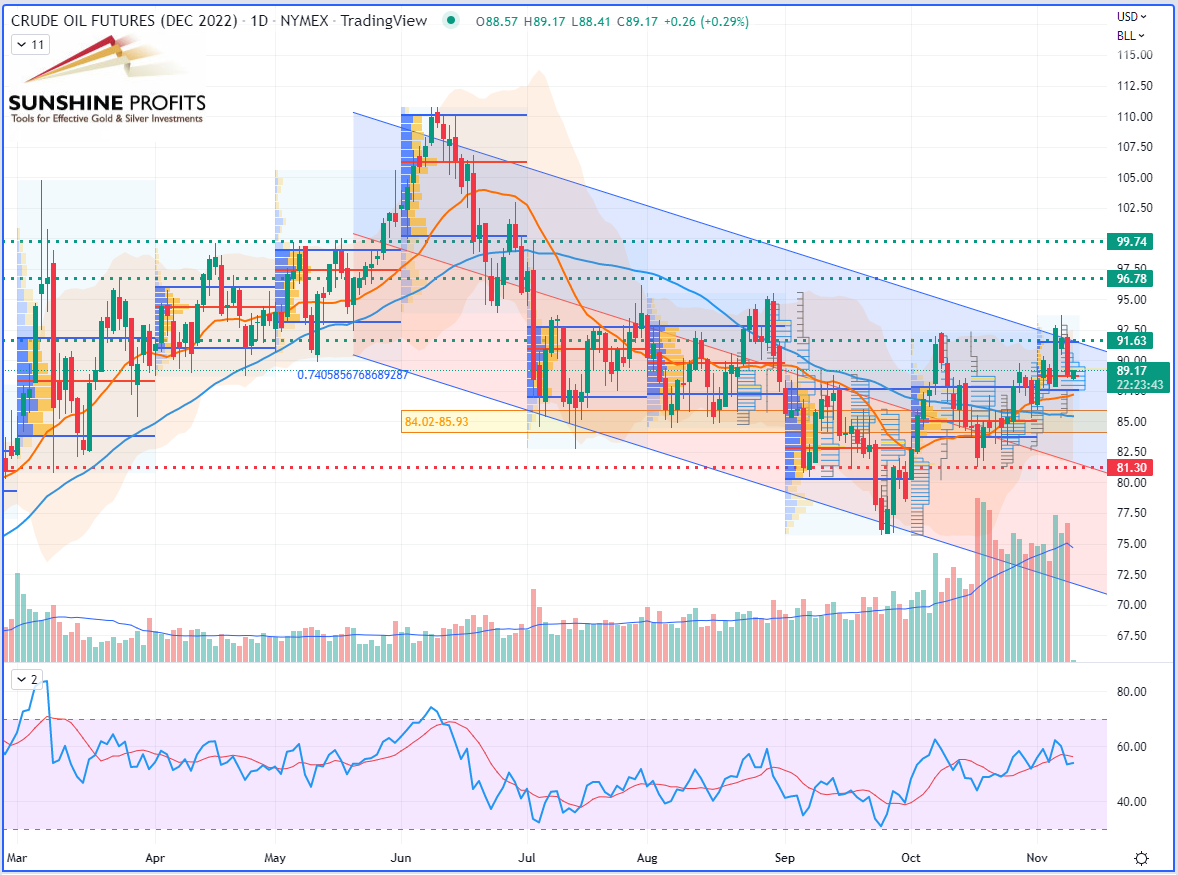

- WTI Crude Oil [CLZ2022] Long around the 84.02-85.93 area (yellow band) with stop at 81.30 and targets at 91.63, 96.78 & 99.74.

- Brent Crude Oil No new position justified from a risk/reward point of view.

Regarding risk management, it is always best to define your strategy according to your own risk profile. For some guidance on trade management, read one of my articles on that topic.

For some guidance on risk management in a more dynamic dimension, while managing multiple contracts, I invite you to read an article I wrote on how to spread risk for a trade.

WTI Crude Oil (CLZ22) Futures (December contract, daily chart)

WTI Crude Oil (CLZ22) Futures (December contract, daily chart)

By extending above the previous swing high (from October), black gold is now switching from a bearish to a new bullish trend, as its previous high was just taken over in the pre-open US trading session.

Therefore, this could be the right time to switch our market bias into an overall uptrend, thereby getting ready to go long.

At the time being, some may want to play the breakout above October’s high. My only concern with this approach is that the black gold market could face a potentially strong resistance very soon, around the next swing high from August.

Thus, I would rather get ready to enter on the next correction into the support zone, where crude oil may find a rebounding floor, prior to extend further gains.

By doing so, the risk management would appear more beneficial on a risk-to-reward point of view, with a stop located at the previous swing low from October.

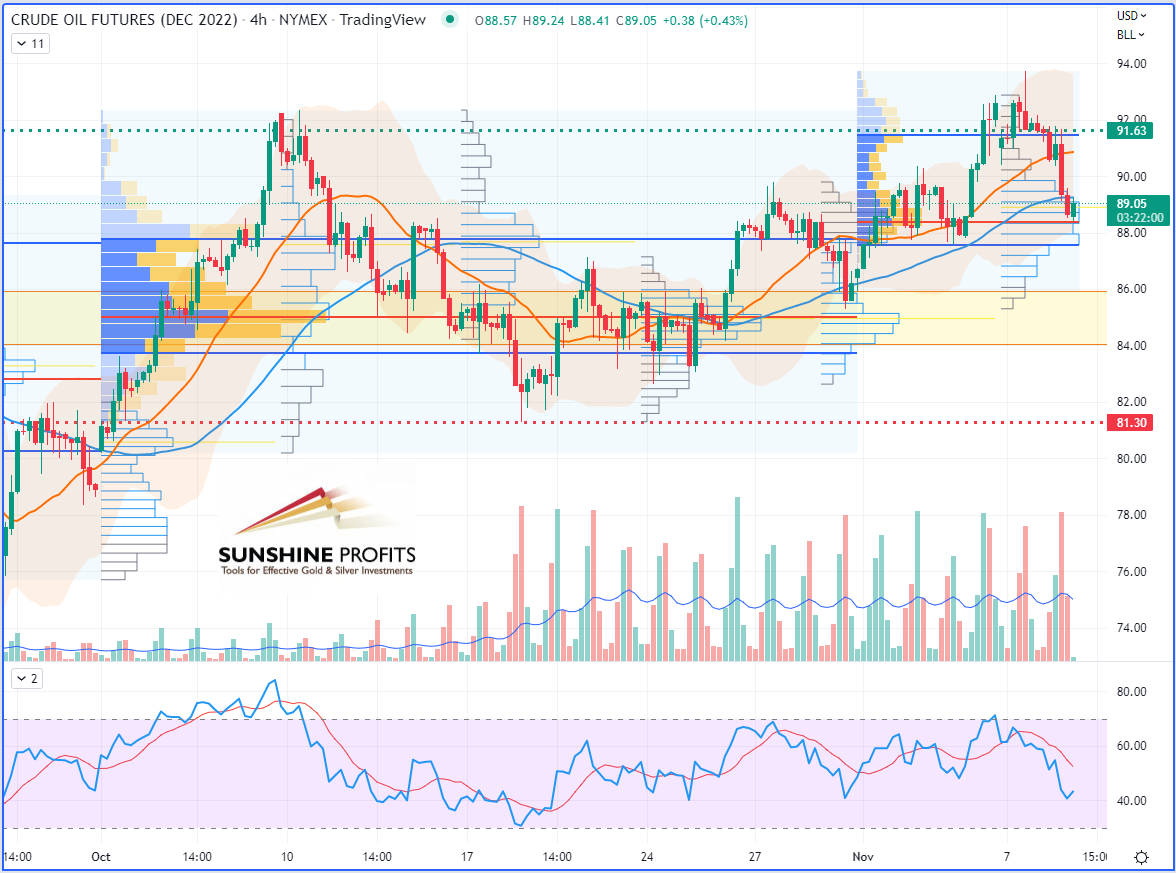

WTI Crude Oil (CLZ22) Futures (December contract, 4H chart)

WTI Crude Oil (CLZ22) Futures (December contract, 4H chart)

Less than a month from now – on December 5 – an embargo on maritime exports of Russian crude oil to the European Union will come into force, as I explained in my last article.

As a result, global oil supply is expected to tighten significantly, with Russia being the world’s largest exporter of oil and fuels.

Therefore, energy markets are bracing for turbulence, as they may face a new storm of volatility.

On the macroeconomic view, the US Dollar Currency Index – still weakening against a basket of major currencies – starts looking down from the balcony to revisit some lower floors:

US Dollar Curency Index – 2021-2022 (zoomed out)

US Dollar Curency Index – 2021-2022 (zoomed out)

While currently moving slightly outside the lower band of the 2022 regression channel, its previous swing low from October has just been taken over as the DXY is now progressing within a newly forming downward regression channel starting from the end of the last quarter.

US Dollar Currency Index (DXY) CFD (daily chart) for 2022 (zoomed in)

US Dollar Currency Index (DXY) CFD (daily chart) for 2022 (zoomed in)

Let’s zoom into a 4H chart to get a larger picture:

US Dollar Currency Index (DXY) CFD (4H chart)

US Dollar Currency Index (DXY) CFD (4H chart)

Here is the big picture for the WTI Crude Oil chart, after zooming out over the weekly timeframe:

WTI Crude Oil (CL) Futures (Continuous, weekly chart)

WTI Crude Oil (CL) Futures (Continuous, weekly chart)

The long-term structure looks rather bullish for the black gold – with an upward trend that could be triggered as the greenback may start to explore lower floors.

At the moment, if we consider the past two sessions this week alone, both assets are correlated rather positively (both falling at the same time).

But this short-term correlation may start to turn negative if we see further weakening on the US dollar, which would have the effect of propelling commodities, starting with energy. But gold can also benefit from this, as investors may switch to the yellow metal as a new safe-haven.

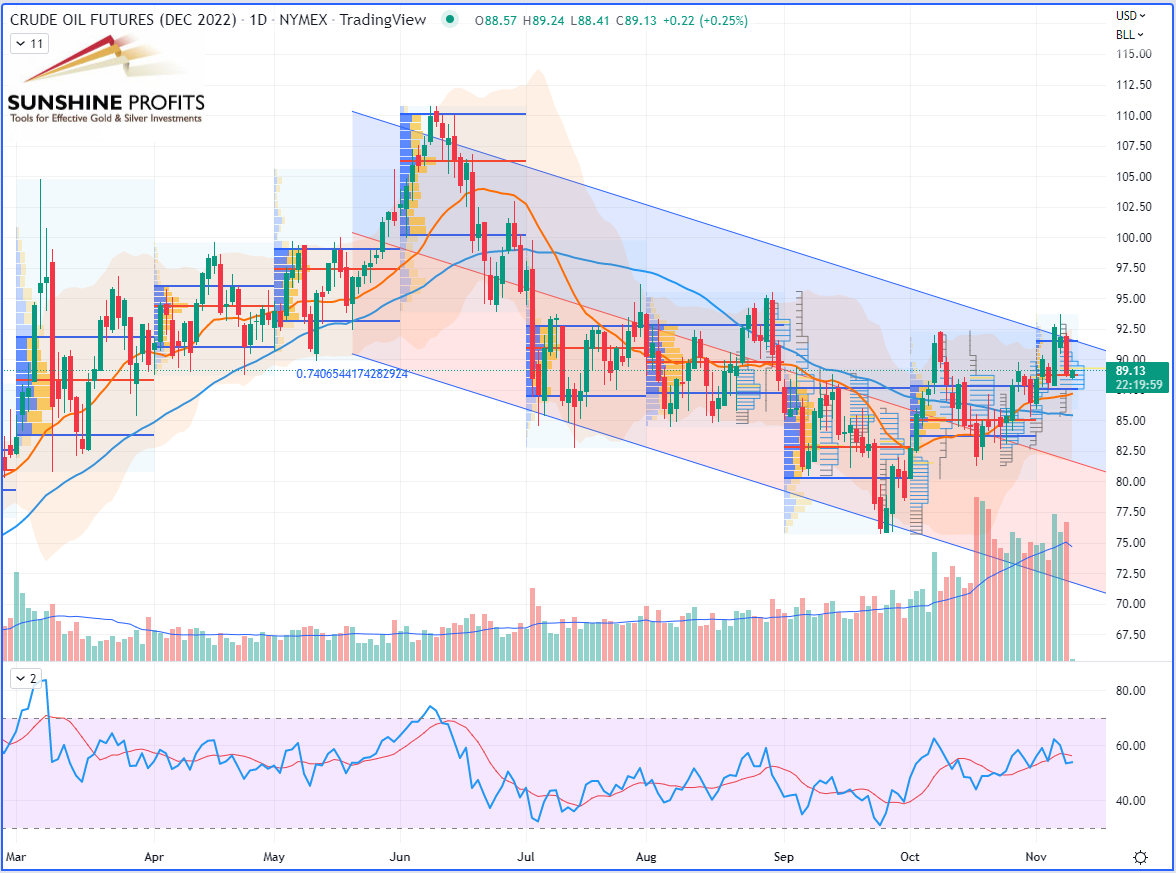

WTI Crude Oil (CLZ22) Futures (December contract, daily chart)

WTI Crude Oil (CLZ22) Futures (December contract, daily chart)

If oil prices fell on Tuesday (Nov 8th), it was mainly because they were weighed down by disappointing indicators in China and a resurgence of the epidemic which threatens demand in the country, one of the engines of global demand.

Demand in China – the country that imports the most crude in the world and also the second consumer of oil (after the United States) – is particularly unstable since the health authorities assured that the strict zero-Covid health policy would continue to be applied.

Moreover, as financial market players are increasingly concerned about the state of the global economy, the latest commercial data from China, which also highlighted a significant slowdown, seems to have proven them right.

WTI Crude Oil (CLZ22) Futures (December contract, 4H chart)

WTI Crude Oil (CLZ22) Futures (December contract, 4H chart)

This is the scenario I’m expecting will play itself out. Now, please tell me about yours!

As always, I’ll keep you well informed.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist