Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Henry Hub Natural Gas No new position justified from a risk/reward point of view.

- RBOB Gasoline No new position justified from a risk/reward point of view.

- WTI Crude Oil No new position justified from a risk/reward point of view.

- Brent Crude Oil No new position justified from a risk/reward point of view.

Regarding risk management, it is always best to define your strategy according to your own risk profile. For some guidance on trade management, read one of my articles on that topic.

After the weekend, crude oil prices moved away from their lowest in twelve months. The cold snap that boosts energy demand is taking precedence over concerns about global growth.

Supply and Demand

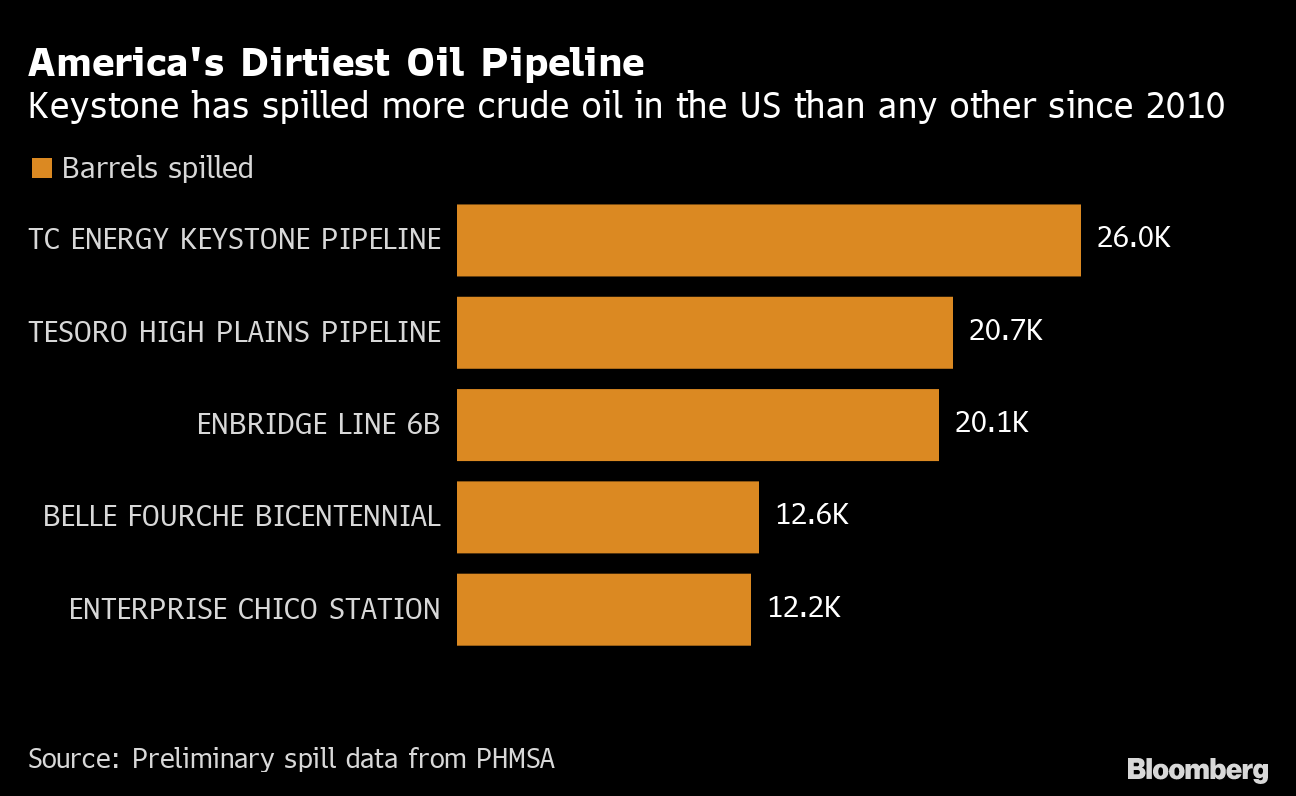

WTI crude oil is trading near the $75 mark on the NYMEX after testing its $70 support level yesterday. Keystone, one of the main pipelines operated by TC Energy that can carry about 0.6 million barrels from Alberta (Canada) to the US, has been undergoing maintenance since Wednesday after a critical leak was detected in Kansas.

(Source: Bloomberg)

On the other hand, the easing of COVID restrictions in China and Hong Kong gives hope for a rebound in the economy. According to Goldman Sachs in a report published on Sunday (Dec 11), the reopening in China could push crude oil prices up by $15. A jump in both domestic and international flights in China is to be noticed. Similarly, the removal of a three-day monitoring period for arrivals in Hong Kong marks a shift in health restrictive policies.

Weather

Another element capable of restoring momentum to the market is the degraded weather conditions in the northern hemisphere – also likely to fuel demand.

Firstly, in Europe, a mass of cold air from the Arctic brought temperatures down several degrees below seasonal averages. Secondly, in the United States, a cold front will sweep through much of the East, with negative temperatures forecast in Chicago, Cleveland, and Indianapolis.

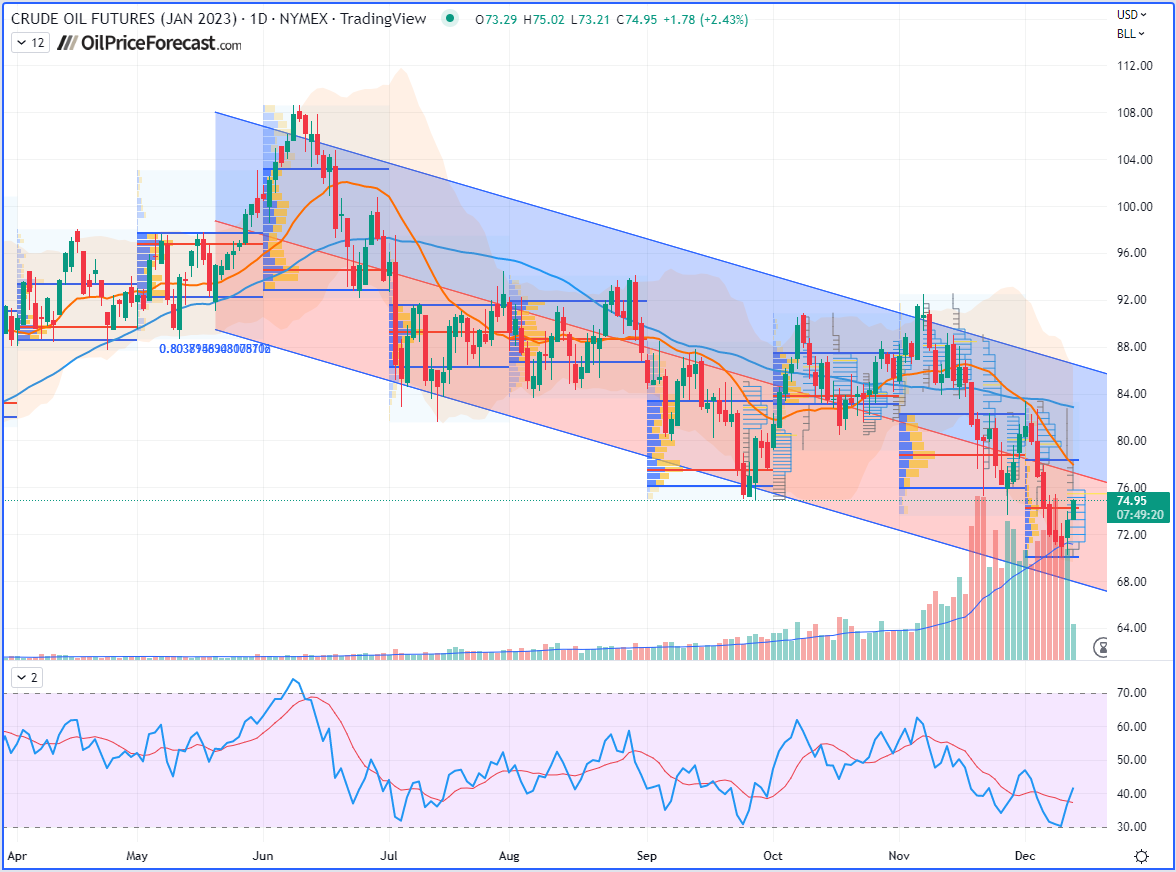

Technical Charts

WTI Crude Oil (CLF23) Futures (January contract, daily chart)

WTI Crude Oil (CLF23) Futures (January contract, 4H chart)

RBOB Gasoline (RBF23) Futures (January contract, daily chart)

Brent Crude Oil (BRNG23) Futures (February contract, daily chart) – Contract for Difference (CFD) UKOIL

Have a nice day!

As always, we’ll keep you, our subscribers well informed.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist