Trading position (short-term; our opinion): Short position with a stop-loss order at $59.72 and the initial downside target at $55.30 is justified from the risk/reward perspective.

Oil has been trading slightly higher over a few recent sessions. As the Fed indicated yesterday it's not embarking on an easing cycle, the policy move means a cold shower for global growth prospects. Black gold has reacted accordingly, leading us straight into a new trading decision.

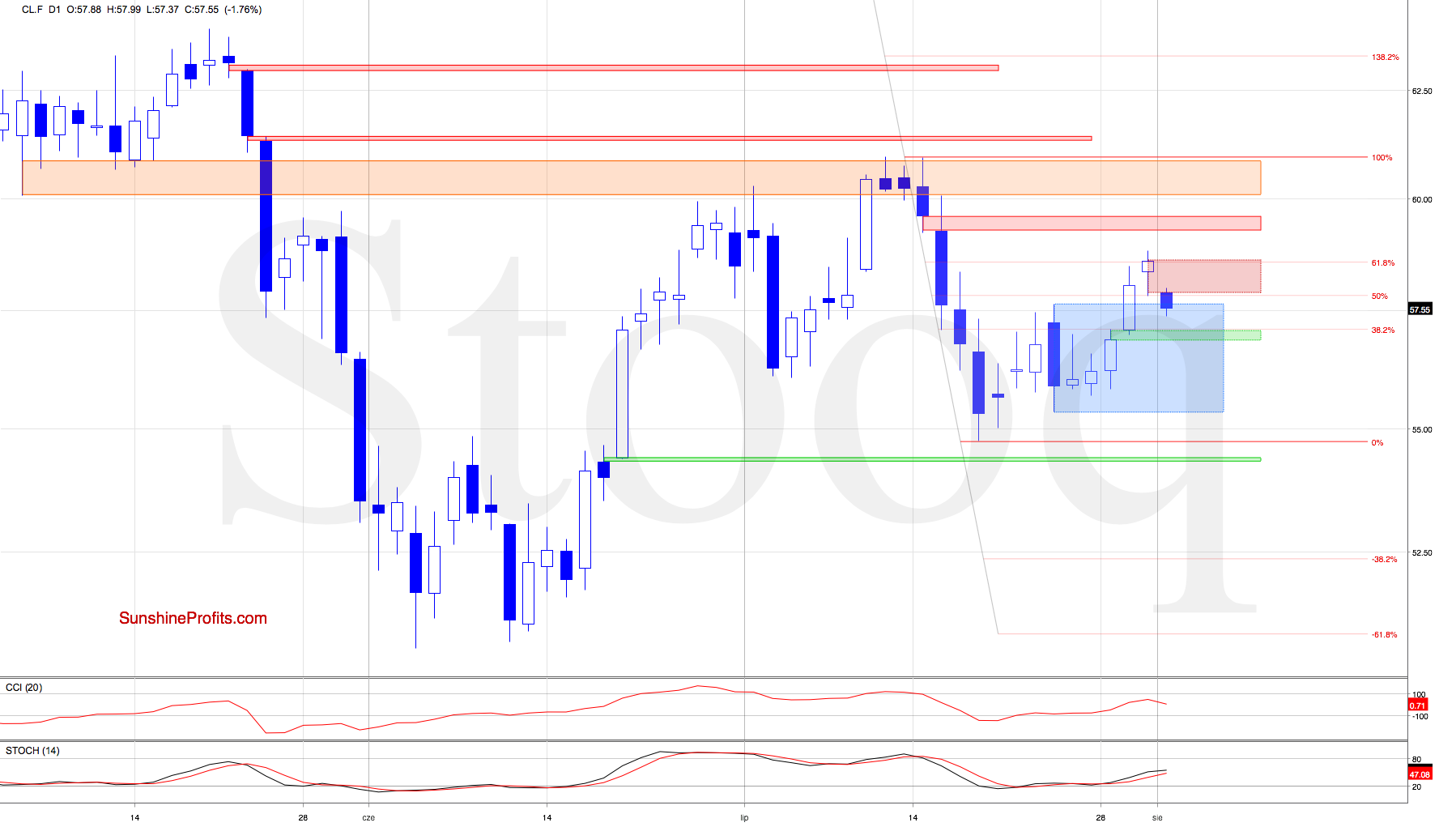

Let's take a closer look at the chart below (chart courtesy of www.stooq.com ).

Crude oil futures invalidated the earlier tiny breakout above the 61.8% Fibonacci retracement and finished yesterday below it. This bearish development encouraged the sellers to act earlier today, resulting in a red gap.

Today's drop means that the futures closed Tuesday's green gap, and came back into the blue consolidation as the earlier breakout above its upper border has been invalidated. This increases the likelihood of further deterioration and a test of the lower border of the consolidation.

Taking all the above into account, reopening short positions is justified from the risk/reward perspective at the moment. All details below.

Summing up, as crude oil has invalidated several recent bullish developments, and its price has reverted into the blue consolidation, another downside move is probable. Opening short positions is therefore warranted.

Trading position (short-term; our opinion): Short position with a stop-loss order at $59.72 and the initial downside target at $55.30 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist