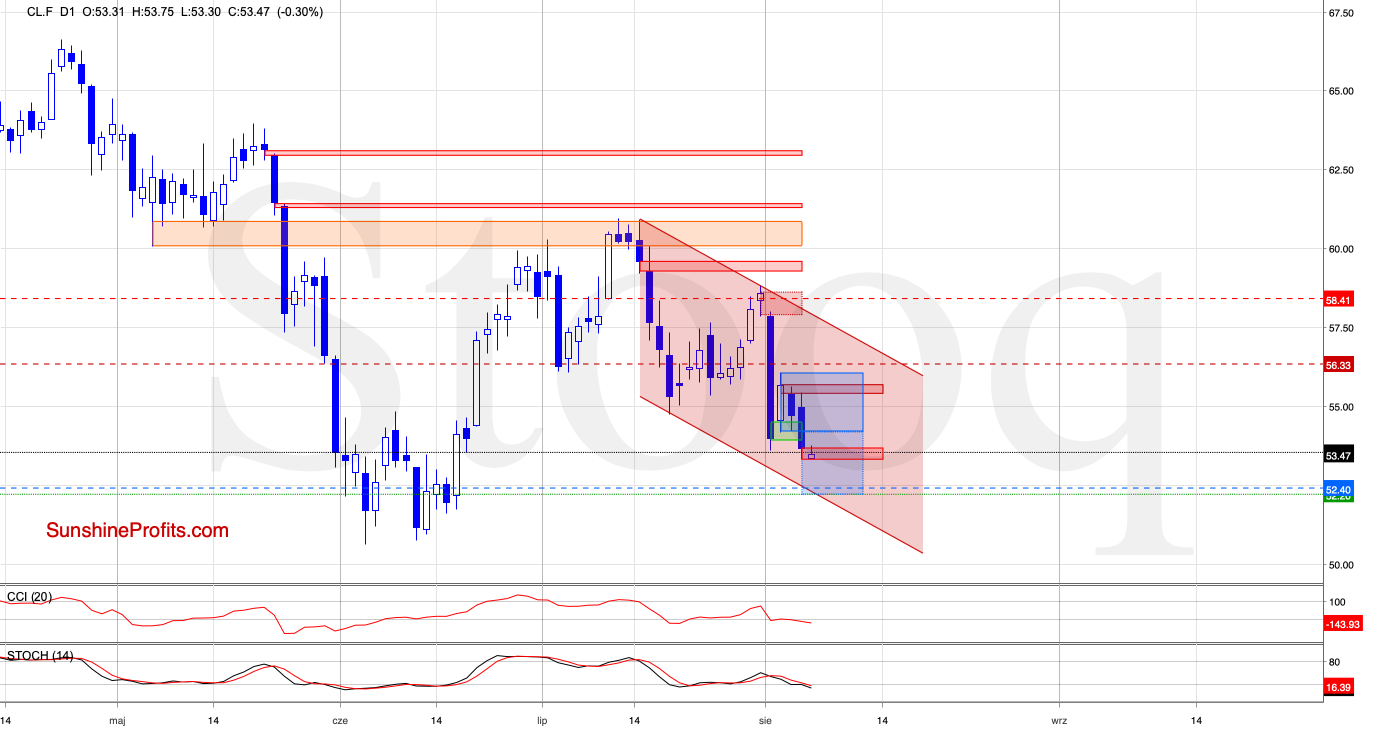

Trading position (short-term; our opinion): profitable short position with a fresh stop-loss order at $56.33 and the next downside target at $52.40 is justified from the risk/reward perspective.

Oil waved goodbye to the recent consolidation, and took forcefully to the downside. Its plunging unabated, piercing the $52.00 mark as we speak. Which areas do the bears have in their sights, and can we expect a meaningful rebound from there? Let's take a closer look.

The daily chart below says it all (chart courtesy of www.stooq.com ).

We wrote these words in our yesterday's Alert:

(...) let's keep in mind that the bulls didn't manage to push the futures even to the 38.2% Fibonacci retracement. This and the volume comparison coupled with the Stochastics' sell signal suggest that another attempt to move lower may be just around the corner.

The first downside target for the bears will be around $53.50, where the June 19 low is. However, if it is broken, the sellers could test the lower border of the red declining trend channel in the coming week (currently at around $53).

Crude oil futures have extended losses during yesterday's session, closing Friday's green gap in the process. This bearish development triggered further deterioration earlier today, with the futures hitting a fresh July low. This has made our short position even more profitable.

Yesterday's decline also means that the futures broke below the lower border of the blue consolidation, further encouraging the sellers. Taking this fact into account, we could see a decline to around $52.20, where the size of the downward move would correspond to the height of the formation.

This area also marks the lower border of the declining red trend channel, increasing the probability that the sellers will test it in the following days.

As crude oil futures opened Wednesday with a red gap and the daily indicators are on their sell signals, another attempt to move lower may be just around the corner. The short position (as a reminder we opened it on August 1, 2019) continues to be justified from the risk/reward perspective. And indeed, oil is trading well below $52.00 currently.

Taking into account recent chart developments, we decided to update our stop-loss order and lower our downside target. All details below.

Summing up, we didn't have to wait too long for the bears to reassert themselves. The combined downswings of yesterday and today have amply powered through the recent consolidation, leading us to update the profitable open trade parameters. The bulls' weakness, higher volume on the downswing and the Stochastics' sell signal mean that the short position remains justified.

Trading position (short-term; our opinion): Profitable short position with a fresh stop-loss order at $56.33 (we lowered it to protect some of our profits) and the next downside target at $52.40 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist