Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

After Friday’s drop in price, oil made some slight gains early Monday, trading below $44 a barrel. Crude was buoyed partly by drugmaker Moderna’s announcement of successful Covid-19 vaccine testing as well as the OPEC+ meeting scheduled for today, where the oil market might receive some support as the second wave of Covid-19 intensifies. Our crude analysis however, remains unchanged from last Thursday (Nov 12th). Please note that the chart and trading positions remain unchanged as well.

In last Wednesday’s (Nov 11th) analysis I elaborated on the big picture, and while my comments remain up-to-date, I’d like to draw your attention to one important detail that we saw on Wednesday.

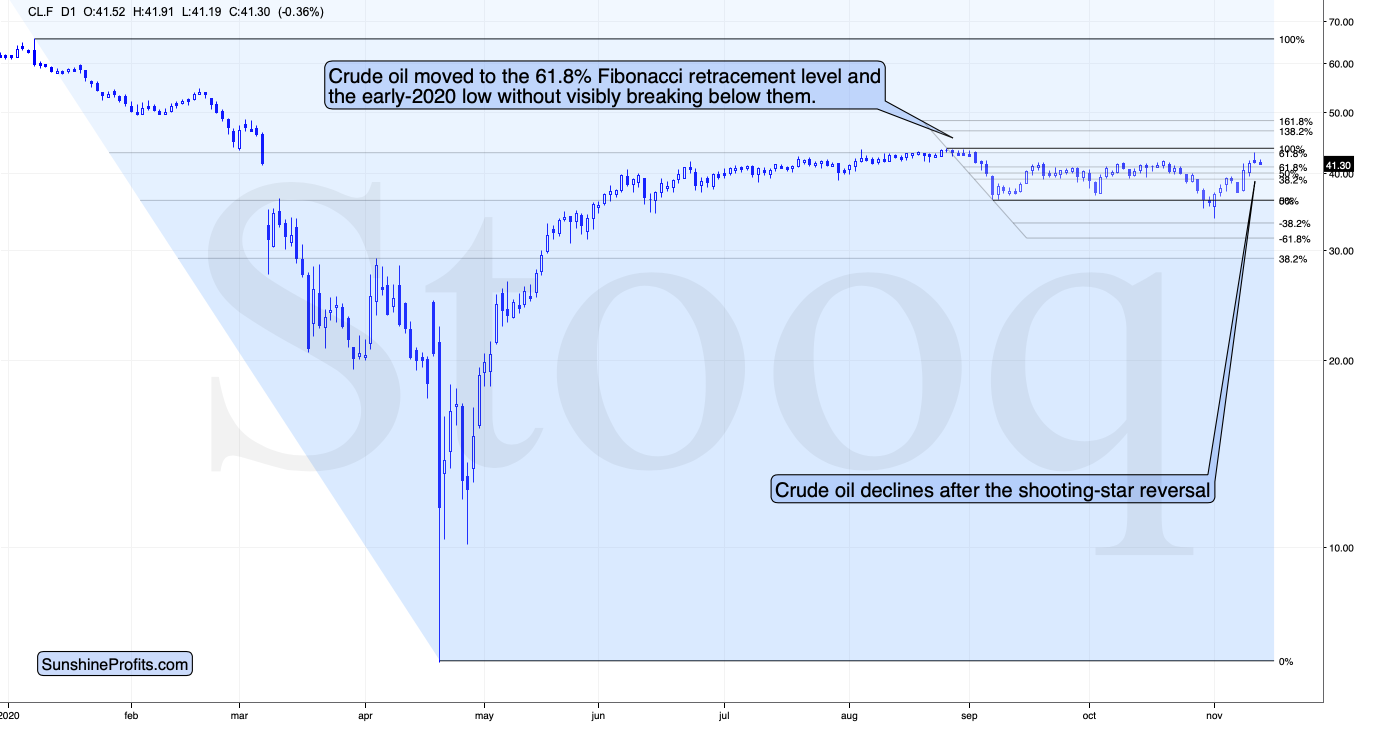

Namely, we just saw a daily reversal. It took the form of a shooting star candlestick, and it was already followed by a pre-market decline last Thursday.

This reversal took place after crude oil tried to move to the August highs – and it failed to do so.

A clear daily reversal that takes place very close to the previous high is a very bearish sign for the short term. Interestingly, it’s very similar to what we saw in the S&P 500 Index on Nov 9th. It seems likely that both market’s signals confirm each other and point to lower values in the following days/weeks.

To summarize, for the upcoming weeks, the outlook for crude oil remains bearish. If crude oil is able to keep yesterday’s strength for longer, the above might change, but for the time being, the bearish outlook remains intact.

As always, we’ll keep you, our subscribers well informed.

Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

In the future contracts that are more distant than the current contract, we think adding the premium (the difference between the July and other contracts) to both: stop-loss and initial target prices is justified.

Thank you.

Przemyslaw Radomski, CFA

Editor-in-chief