Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

Crude oil continues to trade above $40 and it even moved a bit higher in today’s pre-market trading. But focusing on this intraday volatility carries one big risk – missing the big picture. That’s what I’d like to emphasize today. To clarify, I don’t mean the likely broad bottom in the USD Index or the topping stock market (which I described yesterday). Yes, both are likely to contribute to crude oil’s decline in the following weeks, but the big – technical - picture in crude oil itself is telling us a lot.

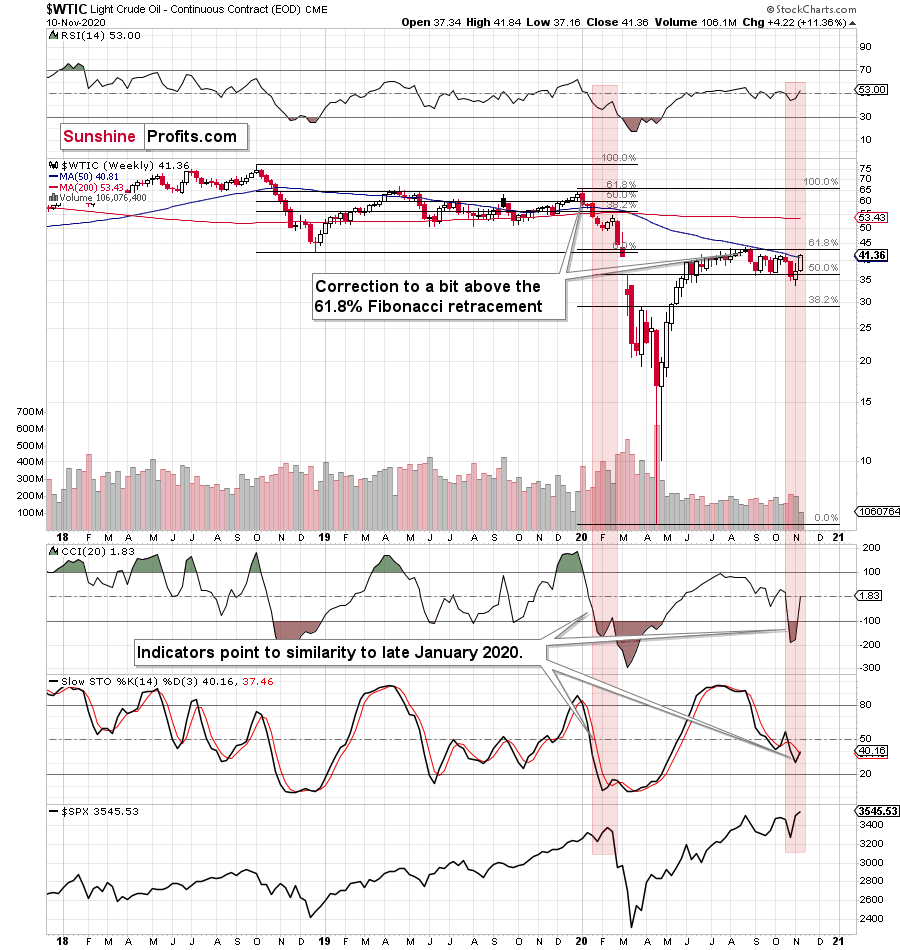

The price of the black gold is currently in the second week of its corrective upswing. The correction that we saw in early 2020 and that preceded the biggest plunge in decades took exactly two weeks as well.

Yes, the price moves are more volatile at this time, but back in February there were no elections in the U.S. and there was no sudden news regarding the possible Covid-19 vaccine over the weekend. It’s relatively normal that the volatility is bigger this time.

Of course, just noticing that the counter-trend rally took two weeks and we are now in the second week of correction is not enough to make the analogy particularly relevant. However, that’s not the only thing that points to this similarity.

The Stochastic indicator just flashed a tiny buy signal, and the CCI indicator just moved back up from the oversold levels. These are both events that took place right before the end of the corrective upswing in February.

And what did the general stock market do in February? It topped, slightly above its previous high. What did it do this week? Exactly the same thing! It moved above the previous high and invalidated this move before the day was over. The RSI is relatively close to the middle of its trading range, so while it’s not very similar, it’s not different enough to invalidate the analogy either.

During the first week of the corrective upswing in February, the volume that we saw was a bit lower than what we had seen on the previous week, when crude oil had declined. We saw the same thing recently. The current week is not over, so we don’t have the volume for it yet, but the previous week’s upswing was accompanied by volume that was a bit lower than the volume on which crude oil had declined on the previous week.

The history tends to rhyme, not necessarily to repeat itself to the letter, and the current situation in crude oil definitely seems to rhyme with what we saw earlier this year, right before the big price decline. We realize that it’s tiring to wait for crude oil to finally move in a profound way, but given what happened earlier in 2020, it seems that the wait will be well worth it.

To summarize, for the upcoming weeks, the outlook for crude oil remains bearish. If crude oil is able to keep yesterday’s strength for longer, the above might change, but for the time being, the bearish outlook remains intact.

As always, we’ll keep you, our subscribers well informed.

Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

In the future contracts that are more distant than the current contract, we think adding the premium (the difference between the July and other contracts) to both: stop-loss and initial target prices is justified.

Thank you.

Przemyslaw Radomski, CFA

Editor-in-chief