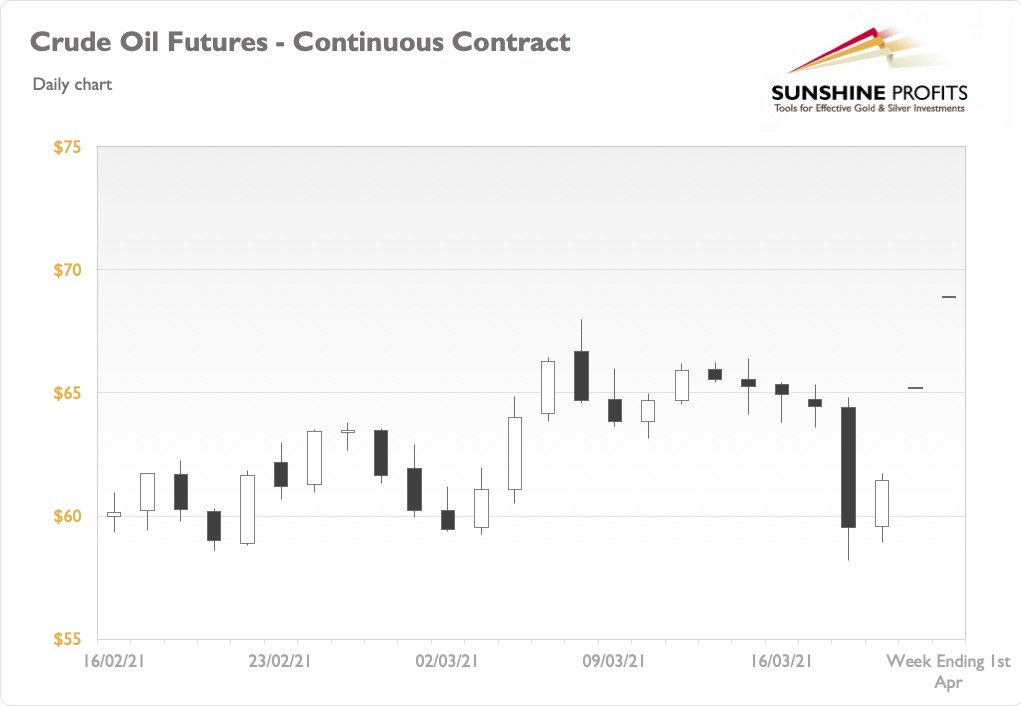

Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Move from the sidelines to long positions and enter between $60-62 with $57.79 as stop-loss and $69.83 as initial price target. Upcoming days can have a 1-2% downswing and it will be a good opportunity to buy on dips.

Saudi Aramco’s financial results paint an optimistic picture. Despite a 44.4% yearly reduction in net profits in 2020, Saudi Aramco made a profit of $49bn. Most importantly, it will pay a dividend of $74bn to shareholders which it hopes to make up by higher profits in 2021, due to higher prices and lower costs stemming from operational efficiency. The company is also betting on strong demand from Asia, especially China, and has declared China to be the priority for oil supply for the next 50 years! This can also be interpreted as a move to scale down China’s oil purchase from Iran.

On the demand side, the Energy Information Administration (EIA) projects that U.S. jet fuel consumption won’t increase as quickly as air travel demand. This is because in 2020, many older planes may not return to service due to their age or because they were converted to dedicated freighters to offset the loss in passenger aircraft belly freight capacity. The EIA projects that newer, more efficient aircraft will replace these retired and converted ones, thus further accelerating the improvement in passenger aircraft efficiency.

Geopolitical situations are also not hinting towards any improvement in stability. The recent exchange of personal statements by the U.S. and Russian Presidents further worsened the trust between the two countries. On other hand, there is a higher risk in oil logistics disruptions, due to the revival of the Quadrilateral Security Dialogue (QUAD) where the U.S., Japan, Australia and India are developing a security pact to counter China militarily and diplomatically in the South China Sea. There are also concerns over an increase in drone and missile attacks on the Kingdom of Saudi Arabia’s oil refining facilities. On March 18, a drone strike sparked a fire at a Riyadh oil refinery, which is the second major assault this month on Saudi energy facilities and has been claimed by an Iranian-aligned group.

An interesting event to watch out for next week will be the OPEC+ meeting’s potential revisions to its output policy in May, especially over concerns of sluggish demand and the IEA’s comments that supply is plentiful. I think prices may experience a rise in the coming two weeks, as shown in the chart above.

To summarize, the recent fall in crude can be attributed to an overcorrection and profit taking by most oil industry watchers, hence there is wider expectation of a price increase in coming days. This is the time when one can potentially enter long positions for the short term and look for an opportunity to enter at slight dips. For the long term, as and when more demand comes online, we will witness higher price points in the oil market.

As always, we’ll keep you, our subscribers well informed.

Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Move from the sidelines to long positions and enter between $60-62 with $57.79 as stop-loss and $69.83 as initial price target. Upcoming days can have a 1-2% downswing and it will be a good opportunity to buy on dips.

Thank you.

Nishant Jain, MBA, CPSM

Oil Trading Strategist