Trading position (short-term; our opinion): Order to enter small (50% of the regular size of the position) speculative short position at $66.78 with a stop-loss order at $70.22 and the initial downside target at $60.12 is justified from the risk/reward perspective.

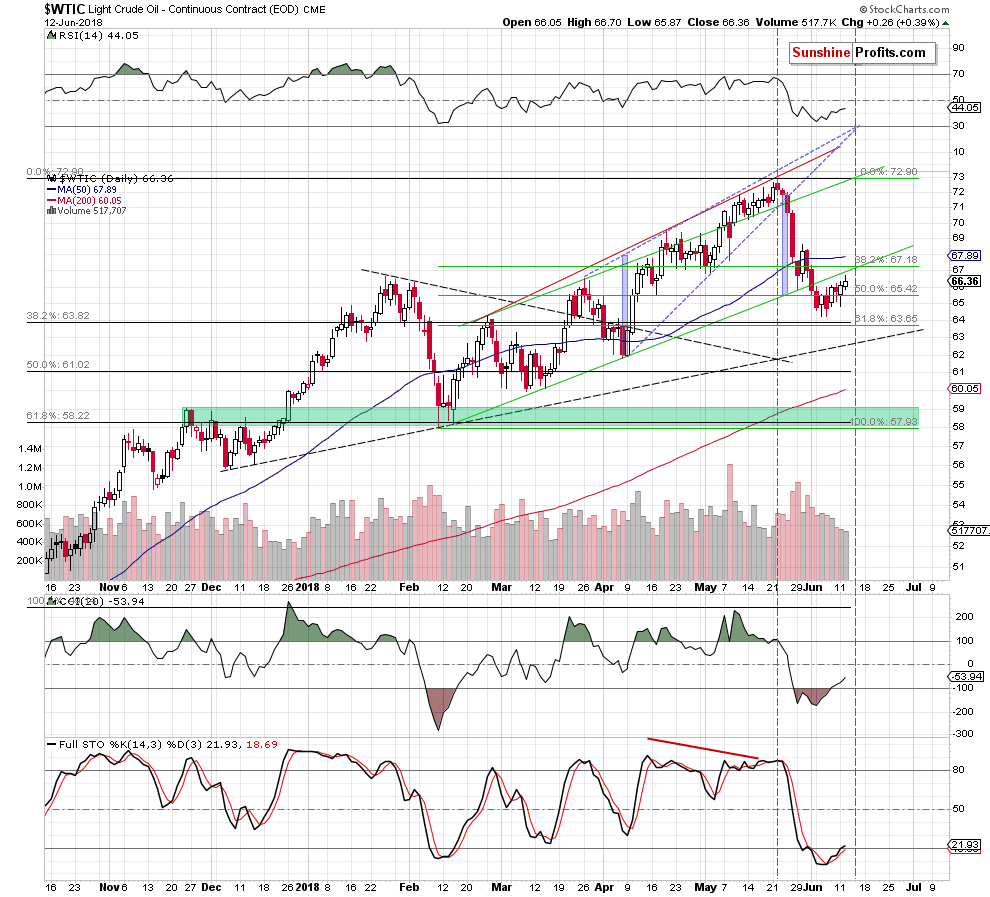

In the last few Oil Trading Alerts we focused on the big picture and the context for the current pause. In today’s analysis, we’ll do something different. We’ll focus on the short term and we’ll make the first step in establishing a new trading position. Let’s move right to the short-term chart which includes all the details.

Before you ask, the long-term picture didn’t change, so if you’d like to review it, please feel free to read yesterday’s Alert. Having said that, let’s move right to the chart.

First of all, the price of crude oil has almost reached the lower border of its previous rising trend channel, which was our target for this very short-term rally. Secondly, yesterday’s upswing was accompanied by low and declining volume, which means that a bigger decline is just around the corner and that the current move higher is just a pause.

But, this doesn’t necessarily imply that the top is already in. It could be a couple of days away based on the apex of the rising triangle that we marked with blue, dashed lines. It’s more of a wedge than a triangle, but the implications remain the same. The moment at which the lines cross is likely to be a reversal, and thus we are likely to see one shortly – either today or tomorrow. Since the rising green line was almost reached, it seems quite likely that crude oil will make another attempt to move to it.

Since we saw several bearish confirmations in light of small daily upswings on low and declining volume, it seems justified to schedule opening a short position right away, without waiting for a specific confirmation. Naturally, if we see the latter, we’ll likely increase the size of the position.

Summing up, we saw several bearish signs and it seems justified from the risk to reward point of view to place an order to enter a speculative short position that would be triggered once crude oil moves higher.

Trading position (short-term; our opinion): Order to enter small (50% of the regular size of the position) speculative short position at $66.78 with a stop-loss order at $70.22 and the initial downside target at $60.12 is justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts